3 Reasons Ares’ Latest In the Gaps Is Required Reading for Your Credit Team

Fundraising from Claret Capital Partners, Park Square, Pemberton, Cottonwood...

👋 Hey, Nick here. A quick personal update. Last week, we announced the second close of Claret Capital’s fourth fund. The close takes our AUM to over $1 billion, and it feels like we’re just getting started. Nothing much changes on our side. It’s the same unglamorous, heads-down work. I’ll share the occasional update as we move along, but feel free to message me if you’d like to learn more.

A big welcome to the new subscribers from Mercer, Extension Fund, and Prosperity Asset Management. This is the 131st edition of my weekly newsletter. If someone forwarded this to you, you can subscribe here and read my previous articles here.

📕 Reads of the Week

Jon Gray’s career advice to new analysts. Link

WisdomTree launched a new tokenized fund focusing on private credit. The new fund tracks a basket of 35 publicly traded closed-end funds, business development companies, and real estate investment trusts. The fund has a minimum investment of just $25 and offers two-day redemption. Link

A day in the life of asset-based finance. Link

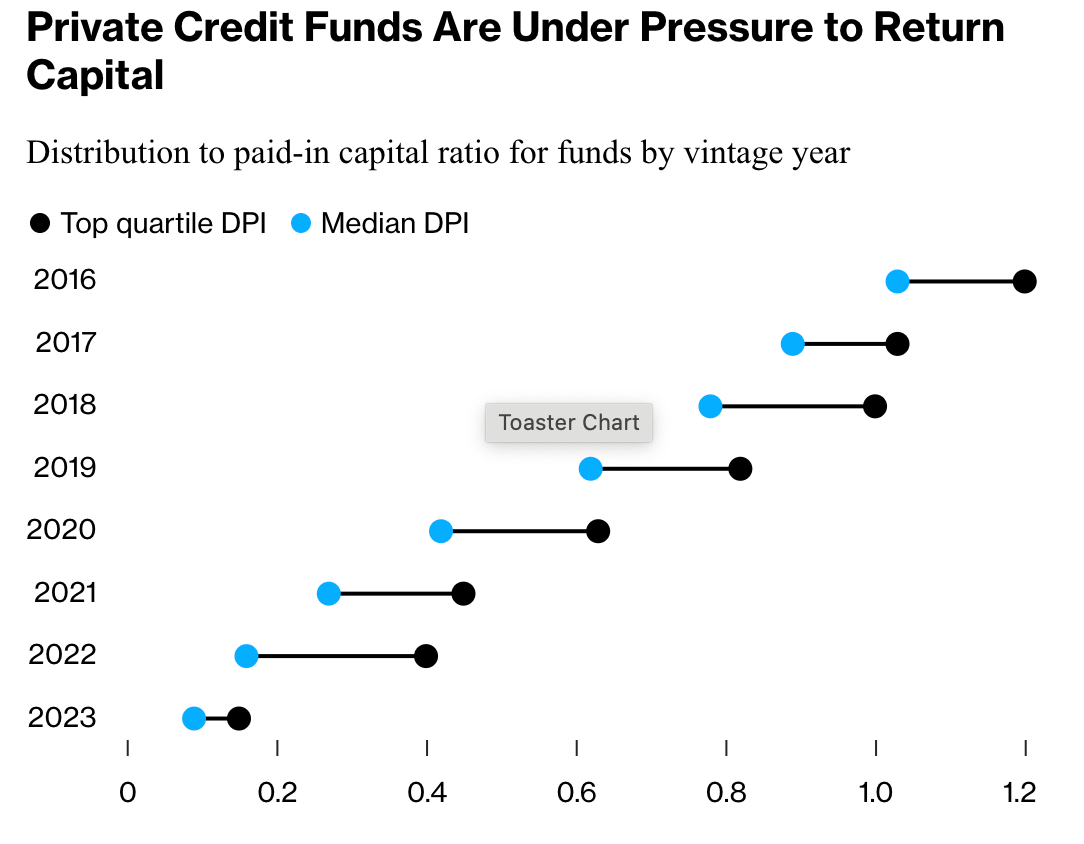

Private credit funds are under pressure to return capital. Funds formed in 2016 reported a median DPI above 1. However, subsequent vintages are still well below that target. Funds formed in 2020 or later show a median DPI of less than 0.6. Link

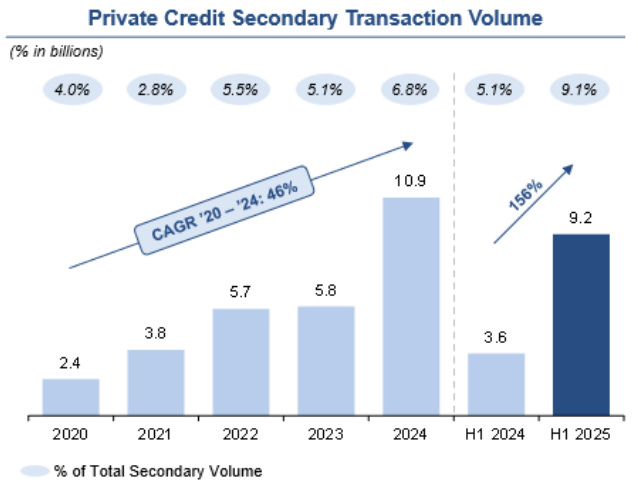

In support of the above, Evercore thinks credit secondaries have hit a growth inflection point. Link

📊 3 Reasons Ares’ Latest In the Gaps Is Required Reading for Your Credit Team

What is elementary, worldly wisdom? Well, the first rule is that you can’t really know anything if you just remember isolated facts and try and bang ’em back.

If the facts don’t hang together on a latticework of theory, you don’t have them in a usable form.

You’ve got to have models in your head. And you’ve got to array your experience—both vicarious and direct—on this latticework of models.

💡 Most “thought pieces” are glorified sales pitches filled with one-sided facts and generic fluff. In the Gaps is the exception. The Ares Alternative Credit Team continues to produce content that challenges my worldview and forces me to update my mental models.

If you read one thing this week, make it this. 👉 (Read it here) Below are three of my favorite extracts:

Generalization Errors

Generalization errors are insidious because they can catch the unwary investor too focused on the big picture and not enough on the details.

We think the risk of generalization errors is reaching peak levels in many parts of consumer credit today. And no wonder! There is broad disagreement, even conflicting signals, at the big picture, generalized level. Depending on who you talk to, or what you read, the consumer is either doing great or awful…

With a U.S. consumer credit market over $18 trillion in size today, any one transaction represents a small ladleful out of that ocean of possible credit.

The risk and performance characteristics of that ladle’s worth of credit can either be highly representative or highly idiosyncratic – clean and clear or full of stinging jellyfish.

Therein lies the critical nature of deal selection. In a very real way, and despite the inconsistencies, each of the above headlines is true. Each is true not of the entire consumer credit ocean, but of the particular ladlefuls of water behind those contradictory headlines.

Everybody and Their Cat

We know what you’re thinking: you want to hear that cat’s pitch because you think it might actually be better than some of the other ABF manager meetings you’ve taken recently.

Undeniably, ABF has become a very big area of focus for investors. With TAM estimates approaching $30 trillion, investors perceive a large market to which many feel relatively underallocated. That has created a siren song for managers with existing ABF capabilities. It has also inspired other managers to develop ABF capabilities to capitalize on what they perceive to be a potential AUM growth opportunity…

The greatest misperception of all, however, is that the entrance of new funds into this market has made it a crowded environment for everyone. With a total asset market that has been estimated to exceed $30 trillion, the entrance of a new fund here or there is akin to a small drop of water within an ocean of ABF opportunities. It’s not that meaningful.

Bubbles 🛁

Bubbles always form at the nexus of the most liquid markets (e.g., public equity, fixed income, etc.) and leverage. Leverage is the soap that is added to liquidity, allowing bubbles to form.

Once combined, the mixture needs only some air for the bubbles to form. The air is confidence.

History has shown that this is a pattern that repeats in every economic cycle. It is the undefeated champion against unwary investors. You can underwrite risk to levels of third-decimal precision, but if you fail to account for cycles – be they economic, industrial or asset class – you are performing the science of investing without understanding the art of it.

The goal is to be Leonardo DaVinci capturing both the science and the art of investing.

Once again, read the full newsletter here. Thanks to Joel Holsinger and the rest of the Ares Alternative Credit team for publishing this.

💰Fundraising News

Claret Capital, a London-based venture debt lender, announced a second close of ~$410 million for its fourth fund. The fund invests across technology, life sciences, and climate tech. Claret has deployed over €1.2 billion to more than 190 companies since its inception. More here

Park Square, a London-based private credit manager, closed its $2.8 billion Fund V. PSCP V is the fifth vintage of Park Square’s junior capital strategy. It supports market-leading, stable businesses across Europe and North America, with a strong emphasis on partnerships with private equity sponsors. The fund expects to make 30 to 40 total investments across Business Services, Software, Healthcare, and high-margin Industrial companies. More here

Pemberton Asset Management, a London-based private credit manager, announced a final close of $1.7 billion for its first NAV Financing fund. Pemberton’s NAV Financing strategy provides loans to private equity sponsors, secured against a pool of underlying portfolio companies. The loans are typically used to support value-accretive bolt-on acquisitions and additional platform investments. More here

Cottonwood, a Los Angeles-based private real estate investment firm, closed a $1 billion special situations fund. The fund has already invested in a residential tower at 262 Fifth Ave. in Manhattan, a mixed-use development in Austin, and a redevelopment site that currently hosts the Viper Room, a storied nightclub in West Hollywood, California. More here

Atempo Growth, a London-based venture debt lender, announced a second close of $470 million for its second fund. The fund lends to European high-growth technology companies and focuses on companies from Series A to Pre-IPO. More here

State Street Investment Management launched the State Street Short Duration IG Public & Private Credit ETF. The fund will invest in IG public and private credit. The fund is a partnership with Apollo who will source private credit loans. Private Credit will generally range between 10 and 35% of the Fund’s portfolio. More here

Oak Hill Advisors, a London-based credit manager, has secured a significant commitment from a wholly owned subsidiary of ADIA for its European special situations strategy. OHA has deployed €7 billion in European private and special situations opportunities since its inception. More here

Aperture Investors, a New York-based alternative manager, is reportedly launching a $1 billion ABF fund. The fund will focus on asset-based finance deals in North America to start, but expects to expand into Europe over time. More here

This newsletter is for educational or entertainment purposes only. It should not be taken as investment advice.

In the Gaps is a great recommendation!