Apollo is back in the ETF Arena.

👋 Hey, Nick here.

Apollo is back in the Arena, partnering with State Street on another private credit ETF. Unlike a Chamath SPAC, this will still be around in five years. (NOT INVESTMENT ADVICE…Obviously)

Bloomberg published three hit pieces on the filing. I won’t be linking because I respect your intelligence.

Here’s a summary of the new short-duration ETF and why it’s interesting:

Key features

These features are the same as the first ETF, PRIV.

Private credit allocation: 10–35%, sourced directly by Apollo

Liquidity & Valuations: Apollo provides daily, firm, executable bids on the private credit holdings

What’s different:

Duration: Targets 1–3 year loans, whereas PRIV focuses on 4–8 year loans.

Why I think it’s interesting.

Apollo will have access to the world’s third-largest ETF provider. This distribution channel will only be available to a select group of scaled managers. BlackRock, the largest ETF provider, will use HPS, and Vanguard (The second largest) has partnered with Blackstone.

State Street’s average ETF has $8 to 10 billion of AUM. These two ETFs alone could provide Apollo with an additional $7 billion of capital. While small in the context of Apollo’s platform, it’s an early move in what could become a repeatable playbook.

“Seventy-three percent of bonds in the world trade at a yield of less than 5%. There is only beta in public credit markets.” Link

And if you’re doubting my credibility, fair enough. Here’s why Marc Rowan, Jonathan Gray, Marc Lipschultz, and Scott Nuttall think it’s interesting. Link

A special welcome to the new subscribers from Goldman Sachs, Northern Bank, and PGIM Private Capital. It’s great to have you. Reach out and say hi. This is the 116th edition of my weekly newsletter. You can read my previous articles here and subscribe here

📕 Reads of the Week

Blackstone vs. BlackRock: The Greatest Wall Street Frenemy Story Ever Told. Link

Proskauer’s Private Credit Default Index. Link

Blue Owl: The growth and durability of software lending. Link

🎧 Riding the European Wave: How Pemberton plans to grow from $30 to $100 Billion. Link

🎧 Ares partners, Keith Ashton and David Ells, explore the accelerating role of insurance capital in asset-based finance. Link

Brookfield and GATX partnered to acquire a $4.4 billion portfolio of US rail operating lease assets from Wells Fargo. Link

India’s real estate and construction conglomerate, Shapoorji, closed a $3.4 billion and a 19.75% yield, record private credit deal. Investors reportedly include Ares, Cerberus, and Davidson Kempner. Link

🏦 Partnerships of the Week

HSBC Asset Management plans to invest $4 billion of its own capital into private credit funds, as part of its strategy to build a $50 billion credit platform within five years. More here

Apollo is partnering with JPMorgan Chase, Goldman Sachs, and Citigroup. The partnership will allow the banks to either purchase investment-grade private loans originated by Apollo or broker and price these assets for third-party buyers. The extra liquidity will also enable Apollo to originate larger loans at a faster pace. More here

Vertis Capital Partners, a UK-based alternative manager, announced a partnership with DunPort, an Ireland-based credit manager. Vertis will also take a minority stake in DunPort. DunPort will work closely with Vertis and its affiliate, Henry Costa Partners, a specialist merchant bank, to accelerate institutional fundraising and provide fundraising solutions to channel capital from insurance companies. Link

📊 Why Apollo Is Focusing on Large-Cap Credit

Apollo believes that larger corporate borrowers have consistently demonstrated stronger fundamentals and greater resilience compared to smaller issuers. In the current environment, these advantages are only becoming more pronounced.

Here are 4 reasons why Apollo is focusing on large-cap companies. Read the full report here.

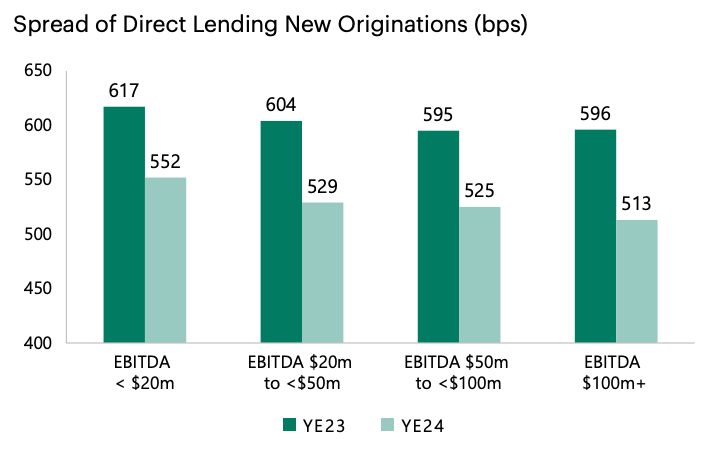

Loans to Smaller Companies only offer 20-40bps of additional spread

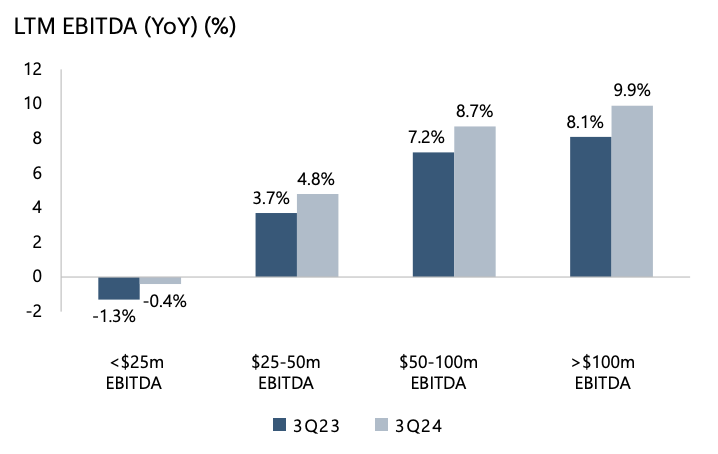

Large-cap companies are exhibiting stronger EBITDA growth

Smaller firms are disproportionately impacted by higher borrowing costs, which divert cash flow away from areas that would otherwise support business health and growth.

Instead, a growing share of operating cash flow is allocated toward interest expense.

“Higher-for-longer” rates are impacting smaller issuers more severely

The elevated rate environment becomes a structural drag for smaller issuers, potentially suppressing reinvestment, weakening credit metrics, and heightening the risk of distress. Apollo believes the downside risks are increasingly skewed toward these smaller-cap companies, which are less equipped to absorb sustained rate pressure

Dollar-weighted defaults have recently been less severe

The result is a widening gap in default expectations, reinforcing the importance of credit selection. In a more uncertain credit market, Apollo continues to believe that large-cap borrowers with the balance sheet strength, pricing power, and operational flexibility will weather uncertainty and deliver durable cash flow.

Read the full report here.

💰Fundraising News

Mavik Capital Management, a New York-based real estate manager, held a first close of $350 million for its Real Estate Special Opportunities VS2 fund. The fund will target stressed, distressed, and special-situation real estate investments within the US middle market. It will focus on opportunities ranging from $10 million to $50 million. Mavik is targeting a final close of $515 million. More here

La Trobe Financial, an Australia-based alternative manager, launched its La Trobe Private Credit Fund. The ASX-listed Fund will provide investors with exposure to a portfolio of Australian Real Estate private credit and U.S. mid-market corporate private credit. It targets monthly distributions with a benchmark of RBA Official Cash Rate + 3.25% p.a.. La Trobe hopes to raise between $100 million and $300 million. More here

This newsletter is for educational or entertainment purposes only. It should not be taken as investment advice.