Apollo: Nobody knows what "Private Credit" means.

In an effort to clear things up, Apollo has shared a 125-page deck defining “private credit.”

👋 Hey, Nick here. A big welcome to the new subscribers from Goldman Sachs, EIG Partners, Elliott, and Cresta. This is the 144th edition of my weekly newsletter. If someone forwarded this to you, you can subscribe here and read my previous articles here.

There’s a lot of content this week. If you’re short of time, I’d recommend the Apollo slides (Link) + the Bonus Material (Link).

The railroads were a bubble, and they transformed America.

Electricity was a bubble, and it transformed America.

The broadband build-out of the late 1990s was a bubble that transformed America.

I am not rooting for a bubble, and quite the contrary, I hope that the US economy doesn’t experience another recession for many years. But given the amount of debt now flowing into AI data center construction, I think it’s unlikely that AI will be the first transformative technology that isn’t overbuilt and doesn’t incur a brief painful correction

📕 Reads of the Week

Market Updates

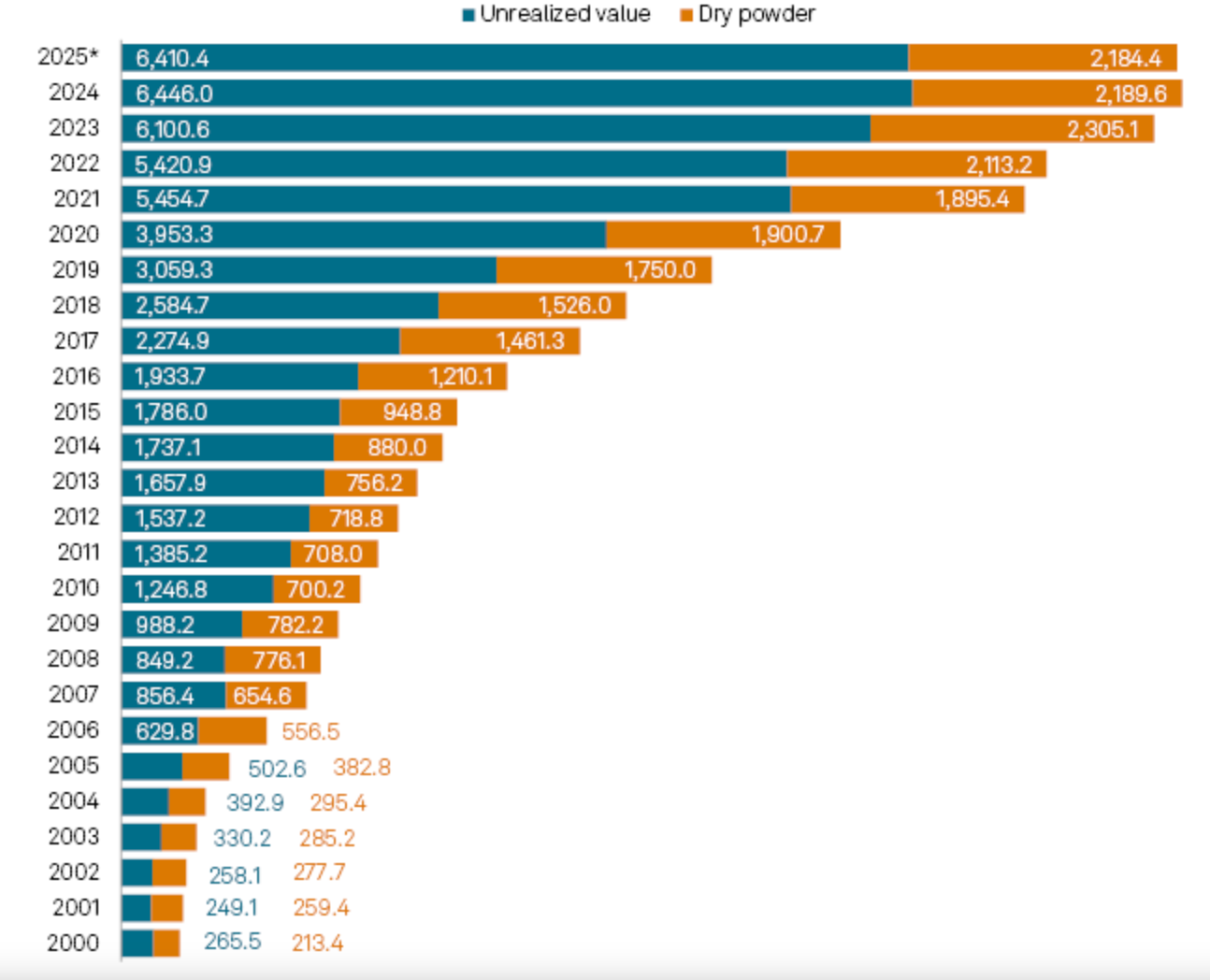

Private equity dry powder recedes from all-time highs amid slow fundraising

👉 [Learn more here]

KKR: Focus Under the Hood, Not on the Headlines. Link

Alternative Credit Council’s Financing the Economy 2025. Link

Manager Updates

🎧 KKR is looking to Europe and Japan for yield as US debt spreads grind tighter. Link

BCRED redemptions rise 3x vs 2024. Link

Apollo is restructuring its hybrid capital team out of its private equity division, underlining the firm’s strategic pivot toward private credit. Link

Partnership Updates

If you want evidence behind Marc Rowan’s comments on how private credit is evolving, here are three examples from this week alone.

Retail & Wealth: Invesco and LGT Capital Partners announced a partnership to expand access to private markets for U.S. wealth and retirement investors. More here

Insurance: SAF Group, the Canadian private credit manager, has partnered with American Life & Security Corp to launch a ~$1.5 billion reinsurance vehicle. More here

Traditional Asset Management: OHA announced that its partnership with T. Rowe Price contributed meaningfully towards its $17.7 billion fundraise Senior Private Lending Fund. More here

The correction in CRE asset values over the past 18 months has created a particularly attractive opportunity set for real estate lenders.

Investors can lend on a secured basis against an asset that has repriced down by as much as 20%, and still receive a 5%–6.5% yield on low to moderately levered (<65% loan-to-value) commercial mortgage loans.

For a moderately levered (<75% loan-to-value) commercial mortgage loan, yields are as much as 9%–10%, often supported by back-leverage on 70%–75% of the debt stack.

📚 Apollo: Nobody knows what “Private Credit” means.

We are living through the ‘mediazation’ of financial markets, and Apollo is frustrated because no one knows what private credit actually means.

In an effort to clear things up, Apollo has put together a 125-page deck defining “private credit.”

The full deck is worth sharing, but you can see some of my highlights below.

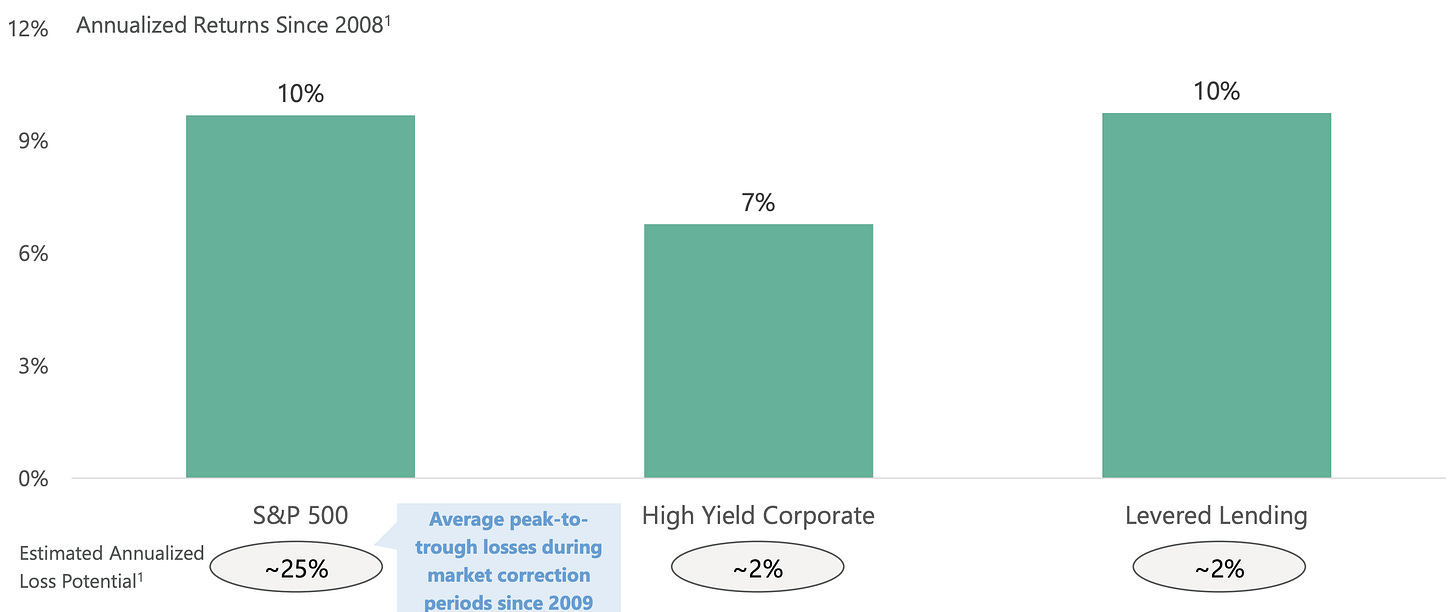

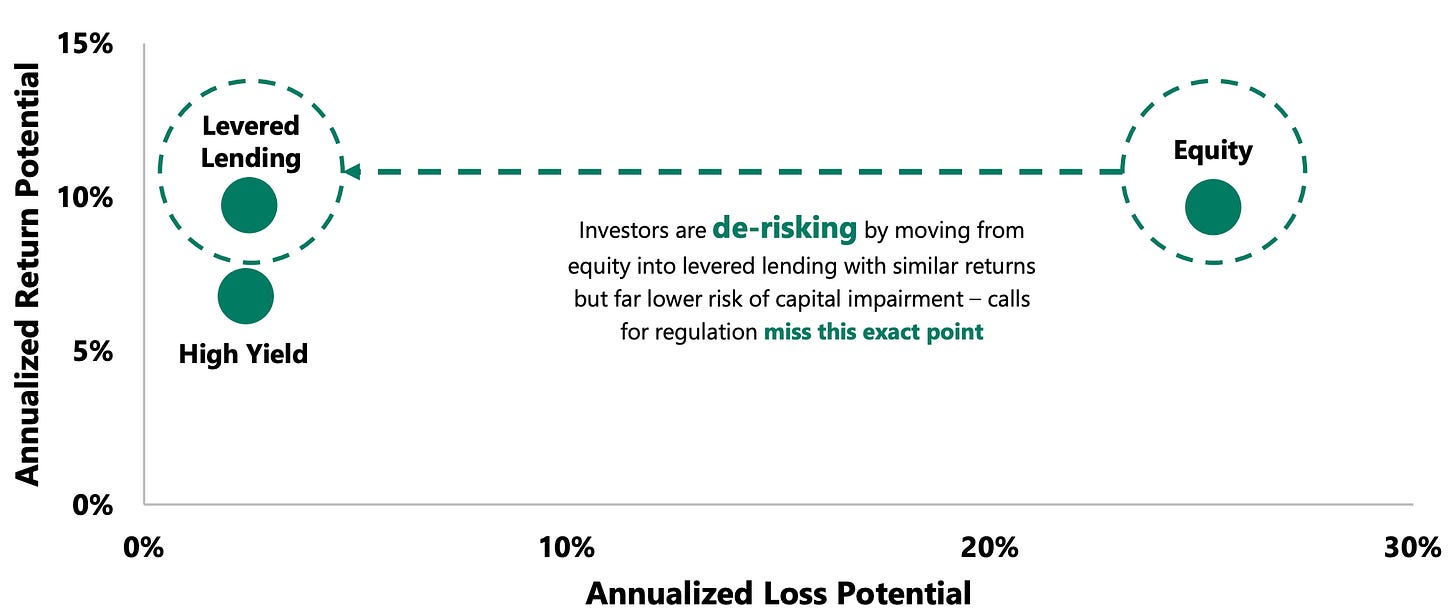

Investors are Selling High-Priced Equity and Moving into Levered Lending: Lower Risk, Similar Returns

Let’s start from the investor's point of view.

If you have an opportunity to move your money out of a high-priced equity market that is concentrated around seven stocks and earn roughly long-term equity returns for first lien risk, that is a de-risking trade for investors.

And when people say, well, there’s risk in private credit, of course, there’s risk in private credit, direct lending. We’re lending to BB companies.

Some number of these companies will default, but it’s a fraction of the risk of equity, and it’s a fraction of the risk of public high yield.

People are not moving their money out of their Treasury portfolio and into direct lending. They’re moving it out of equity.

And so, what the market broadly does not understand is that this is a de-risking trade for the market. This de-risking trade is going to continue, particularly around equity volatility, so long as private credit returns are good.

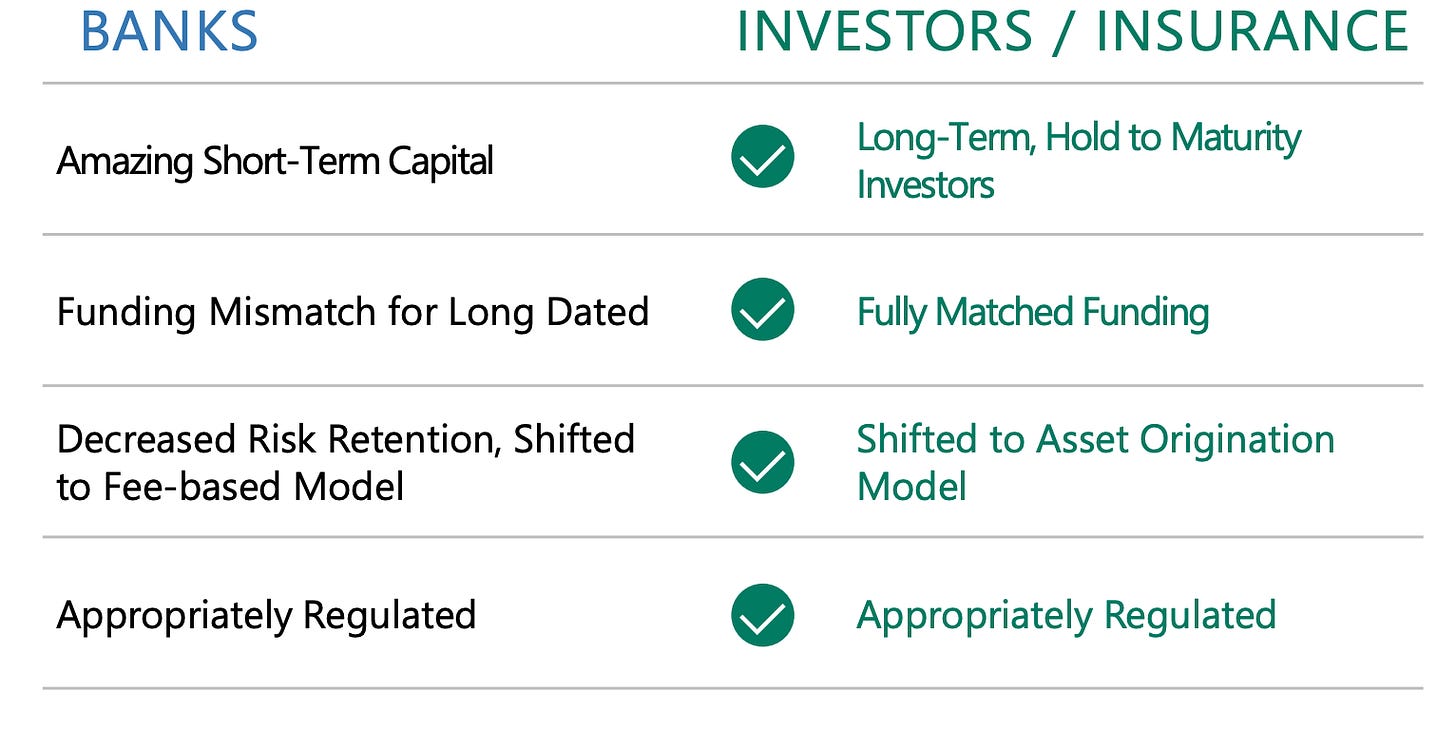

Almost Everything We are Building Today (Infrastructure, Energy, Data Centers, Manufacturing) is Long-Term

The demand for capital from this global industrial renaissance is just off the charts.

If Microsoft wants to borrow, the cheapest place for Microsoft to borrow is on its balance sheet, drive-by deals, low spreads, any amount, any day.

That’s not what’s happening now.

When you’re doing data center deals, or you’re doing power deals, or you’re building a new defense plant, manufacturing, or infrastructure, these are project finance deals.

Project finance does not generally go to the bond market. When you’re talking about project finance in the broadest sense, if it’s short-dated, you’re going to the banking system. The banking system is by far the most efficient place to execute.

If you want something long-dated, you’re generally coming to the private market. And what’s happened is the scale of what we’re doing is just off the charts.

Relative to the size of the private market, we’re seeing this massive need for capital that is mostly investment grade, that is mostly secured, that is mostly project-focused. This capital ends up as a credit derivative of investment-grade balance sheets.

Leading Corporates Choose Private Investment Grade Credit

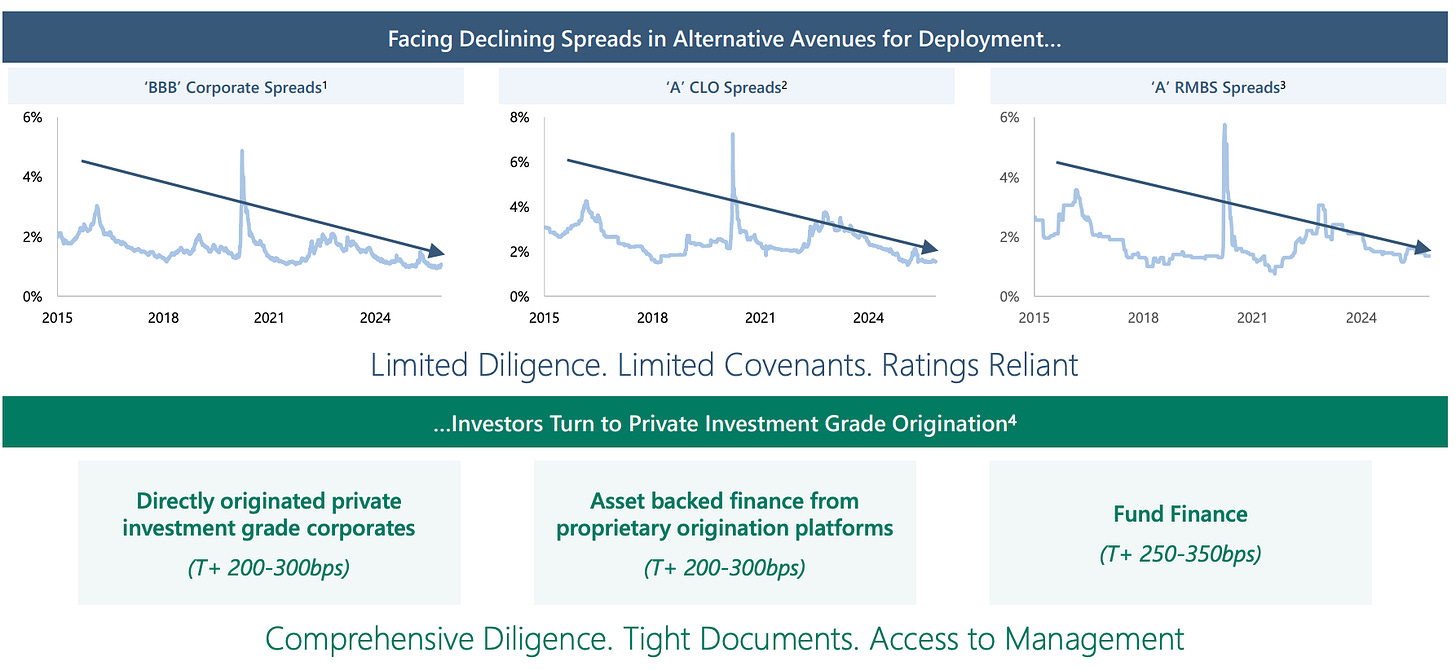

Why Do Investors Choose Private Investment Grade Over Public Investment Grade?

Why Do Issuers Choose Private Investment Grade Over Public Investment Grade?

*** BONUS MATERIAL ***

Marc Rowan expanded on this deck at the Goldman Sachs Financial Services Conference.

Two of his comments stood out to me.

👉 [See the full transcript here ]

Lending to Data Centers: The Principal vs. Agent Problem

Data centers are attractive, but as a credit investor, you should focus on getting leased and repaid. Not on guessing what the world looks like at lease renewal.

There’s a difference between a principal’s mindset and an agent’s mindset.

If you are an agent, you are originating anything to do with AI and data today. You have 100% confidence that you can distribute the risk.

If you have a principal’s mindset and you’re going to own the asset for a long period of time, you look at everything through a different lens.

So, if you now drill into the notion of AI data centers, what are we really talking about? Anywhere we go in the world for heavy users of compute, you ask them, what do they need to move faster? And the answer is always the same, more compute. When are they going to get more compute? No time soon, because there are natural limits. There are energy limits, there are regulatory limits, and there are zoning limits. (And everything else..)

What does that tell you as a credit investor? It tells me that the risk I’m prepared to take is lease-up risk. The risk I’m not prepared to take is renewal risk.

The chart of experts’ projections of energy usage in 2030 is like a child throwing darts. If the experts have no idea of energy use, much less chip use, compute, the impact of quantum, do I really want to, with my credit hat on, take renewal risk? No.

This is now the bifurcation of how you think about AI and data.

And so, let’s make sure we’re looking at this through the right lens. Credit is credit, and the best you can do is get paid back. Therefore, it is not a great place to speculate on renewal. There’s plenty to do without taking renewal risk.

Equity has the volatility of upside and the chance of losing everything. And, yes, you can lose it all, and prices are high, and I think there will be both great fortunes made and lost in the equity of data centers.

The Evolution of Private Credit

We had one buyer of private assets for almost 40 years.

That buyer was the alternative bucket of our institutional clients. And when something’s an alternative, you want really high rates of return. You want to watch it closely. You don’t want it to be that concentrated. And that sustained the entirety of our industry for almost 40 years.

Then, we got the second thing called retail and wealth, and that is now going to double the size of the market.

Then, we got a third thing called insurance companies. People watched what we did and understood that the ability to own certain types of private assets inside of an insurance company made sense.

Then, we got a fourth market, which is institutions looking at their debt and equity bucket, understanding that private no longer meant alternative, that private was just private and could be investment grade or not.

Then, we got a fifth market accelerated by BlackRock’s purchase of HPS and Preqin, which are traditional asset managers who are looking for the next thing because active management has not been a great market, very difficult to sustain performance in active management, and they are hoping that the blend of public and private will help produce returns that beat indices.

And then, I think we’re going to get a sixth market already indicated by the executive order in 401(k).

Private credit will be limited by origination.

Over the short term, fundraising is really important. Over the medium term, private credit will not be limited by capital.

Private credit will be limited by our capacity to originate risk that is worth originating.

We as an industry cannot originate enough to serve all six channels. We are heading for a world where there is more demand for quality private assets than there is supply of quality private assets.

We will have some amount of pricing power so long as we originate good risk. We will have to be very careful not to abuse that pricing power because we will want to work with people who are partners over cycles and who are easy to serve.

In the institutional market, we will have fewer clients in five years than we have today. And those clients will be larger. They will be more partner-like.

In the retail market, we will end up in a position where the big wealth firms probably don’t sell individual products. They sell blended products of multiple exposures.

👉 [See the full transcript here ]

💰Fundraising News

Direct Lending

Oak Hill Advisors, the New York alternative manager, announced the final close of its $17.7 billion Senior Private Lending Fund. The fund will capitalize on the growing opportunity for direct lending to larger companies, focusing on first lien and unitranche loans to companies with EBITDA greater than $75 million. It is OHA’s largest flagship fundraise in our history. More here

TPG raised $6.2 billion for its third Credit Solutions Fund. The strategy will lend to both public and private companies, targeting high single-digit to low double-digit returns. The fund will lend against specific assets, business carve-outs, and unencumbered collateral. More here

Infrastructure

Eiffel Investment Group, a Paris-based asset manager, announced a final close of $1.4 billion for its third vintage of the energy transition infrastructure debt strategy, Eiffel Energy Transition III. The fund provides short-term debt to green energy assets. The strategy has backed more than 5,000 green energy production assets (solar, wind, biomass, biogas, hydroelectricity, cogeneration, and energy efficiency) representing a carbon-free electricity production capacity of more than 15 GW. More here

APAC

SeaTown, the Singaporean manager backed by Temasek, raised $900 million for its third private credit fund. The fund lends to corporates in the Asia-Pacific region and targets mid-teens returns. SeaTown is targeting a fund size similar to its previous private credit vintages, which closed on $1.2 and $1.3 billion. More here

SC Lowy, the South East Asian manager, raised $417 million for its Strategic Investments IV fund. The manager focuses on primary direct lending to companies and projects with limited access to traditional financing. More here

Granite Asia, a Singapore-based investment manager, announced a first close of $350 million for its inaugural private credit vehicle, Libra Hybrid Capital Fund. The fund lends senior secured loans to businesses across Asia-Pacific. Granite Asia is targeting a final close of $500 million. More here

This newsletter is for educational and entertainment purposes only. It should not be taken as investment advice.

Great summary, thanks

As someone who spends most of my time doing bottom-up work on individual companies, I think there’s a big shift happening. A lot of long-term capital, sovereign wealth funds, insurers, pensions, is quietly allocating more toward private, investment-grade credit.

At the same time, public markets have become more concentrated in a handful of large names, while many sizeable businesses remain private. In my opinion, private credit is seen as a relatively steady way for institutions to diversify and access long-duration cash flows.

I’m paying close attention to where patient capital is going.

Great overview and summary