Apollo on Maturities: One of the Largest Opportunities in Private Credit History

Fundraising from Ares, Blackstone, Colbeck, Centerbridge, Dunport Capital and more

👋 Hey, Nick here. A special welcome to the new subscribers from Oliver Wyman, BBAM, and Hudson Cove. It’s great to have you. Reach out and say hi. This is the 97th edition of my weekly newsletter. Each week, I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here.

📕 Reads of the week

Goldman Sachs Announces Creation of Capital Solutions Group. Link

Ardian Raises Record $30 billion for Largest-ever Secondaries Platform. Link

Asia Private Credit Funding Hits Eight-Year Low. Link

📆 Event of the Week - European Private Credit Conference

on Direct Lending

Join over 500 delegates at the 2nd Annual European Private Credit Conference on Direct Lending this January 2025 at the Landmark Hotel in London. 🇬🇧 Register here.

👫 Partnerships of the week

Apollo and Standard Chartered announced a $3 billion partnership to support and accelerate financing for infrastructure, clean transition, and renewable energy. Origination will primarily be undertaken by Apterra, an Apollo-owned platform. Standard Chartered has acquired a minority stake in Apterra. Link

Ramirez Asset Management, a New York-based asset manager, acquired Avenue Capital’s $500 million Private Credit strategy team Link

Italy’s Generali will Acquire US Credit Firm MGG for $320 Million. MGG provides senior secured loans and structured capital solutions to US mid-market businesses. It has over $6 billion under management and has deployed ~$10 billion since its inception in 2014. Link

Stonepeak, a New York-based alternative manager, completed its acquisition of Boundary Street Capital. Boundary Street targets lower middle market borrowers in the digital infrastructure and technology services sector. Link

🧗Apollo’s Maturity Wall Opportunity

Apollo published its 2025 Private Credit outlook. Below is a summary of Apollo’s views on the upcoming maturity wall. You can read the full report here

In March 2024, the OECD cautioned investors about the looming maturity wall. At the end of 2022, nearly $700 billion of debt was set to mature before 2025 across the US high yield and leveraged loan markets.

Today, that figure sits below $100 billion and most issuers successfully rolled their maturities. This follows a now familiar pattern in credit markets. Investors fixate on an upcoming maturity wall only to see it addressed by refinancing activity in the capital markets.

Apollo expects investors will soon focus on the upcoming 2026-2027 maturity wall

The 2026-2027 maturity wall is a direct result of the record-shattering PE dealmaking in 2021-2022

PE deal-making hit $1.2 trillion and $915 billion in 2021 and 2022, respectively—twice the average annual pace over the five years preceding the pandemic. High yield and leveraged loan issuance in 2021 rose to $465 billion and $615 billion, respectively, the most on record and nearly 50% of sub-investment grade debt issued that year was sponsor-backed.

Over $620 billion of high yield loans will mature in 26-27.

Apollo has seen some notable differences in how the 2024/2025 cohort of maturities were digested.

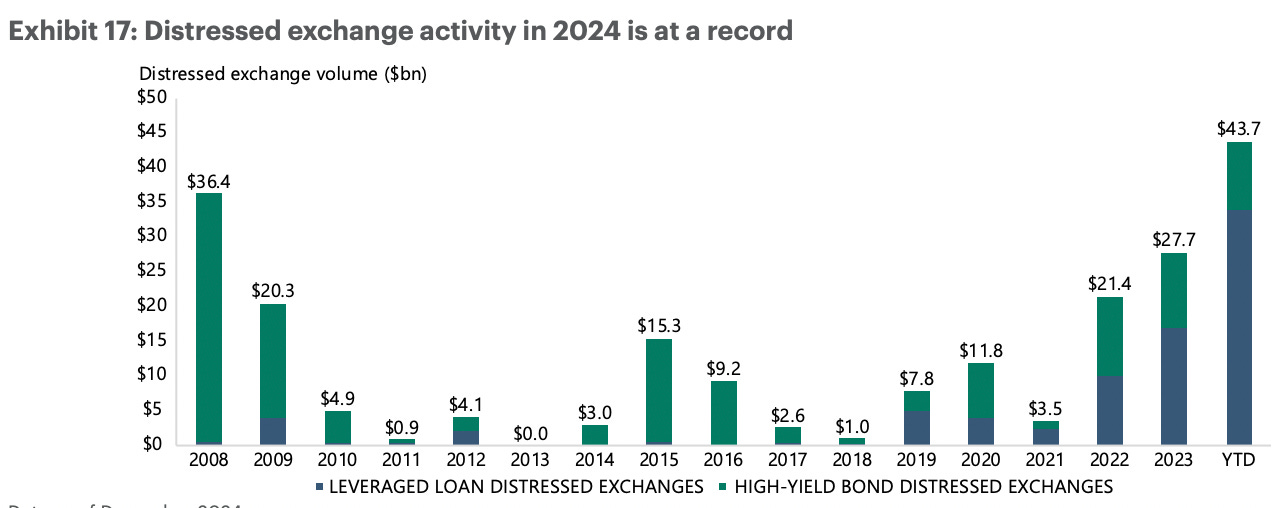

Distressed debt exchange activity has set a new annual record

Many companies have looked beyond the syndicated markets for refinancing alternatives. Private credit along with out-of-court distressed exchanges, has played a key role in addressing these maturities for more levered borrowers unable to access the broadly syndicated markets

Liability management exercises move mainstream

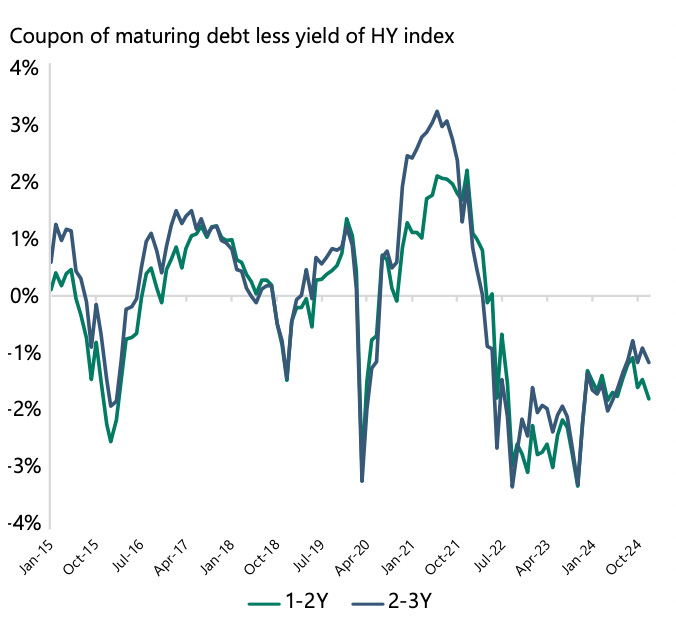

With yields still meaningfully higher than their 2021 lows, the coupon of high yield maturing debt is 1%-2% lower relative to the high yield index.

The cost of refinancing upcoming bond maturities will be meaningfully higher.

The precedent set by the explosion of out-of-court maturity extension activity and structured private credit solutions may serve as a tailwind for the broader adoption of these deal structures.

Maturing high yield debt is at the highest in nearly a decade.

Providing companies with solutions to address this maturity cliff could represent one of the largest private credit opportunities in the history of the sub-investment grade market.

Its magnitude will be partially dictated by the state of the capital markets over the next few years. Companies will start thinking about their refinancing strategies for 2026 and 2027 as 2025 unfolds.

You can read the full report here

💰Fundraising News

Ares announced the final close of its $17.6 billion Ares Capital Europe VI. The fund is the largest direct-lending fund in Europe, ahead of ICG's €15.2 billion fund. The fund lends to European companies in defensive industries with EBITDA over €10 million. Since its inception, the European Direct Lending business has lent over €70 billion to nearly 380 companies. More here and here

Blackstone is set to reach $1.5 billion for its European private credit fund, ECRED. Launched in 2022, ECRED strives to match the success of Blackstone's $54 billion US fund, BCRED. It has been launched in seven European countries and has partnered with ING, BNP, UniCredit, and Banca Generali. The fund has invested in 115 companies across 36 sectors. The portfolio has a median EBITDA of €109 million, an average closing LTV of 39%, and an average interest coverage ratio of 1.9x. More here and here

Colbeck Capital Management, a New York-based private credit firm, closed its $700 million Strategic Lending Fund III. The fund lends senior secured loans to unsponsored, asset-heavy, and cash-flow-generating middle-market companies undergoing transition. The fund’s final close brings Colbeck’s invested and committed capital to $3 billion. More here

DunPort Capital Management, a Dublin-based alternative manager, announced a first close of $207 million for its Willow Corporate Credit DAC fund. Willow targets SMEs in the UK, Ireland, and Benelux with earnings between €1 million and €10 million. The fund has a final close target of €500 million. More here

MA Financial, an Australia-based alternative manager, raised $107 million for its first listed investment trust, MA Credit Income Trust. The fund offers investors access to MA Financial’s flagship private credit strategies and targets a return of the RBA Cash Rate + 4.25% (~8.6%). Investors benefit from exposure to an AUD $3.7 billion portfolio of 165 private credit investments, diversified across lending strategies and geographies. More here

Arini, a London-based credit manager, raised $314 million for its inaugural closed-opportunities fund. The strategy will focus on European credit markets. More here

Centerbridge raised $775 million from LACERA. Centerbridge will manage a credit strategy for LACERA structured as a dedicated managed account. More here

Siguler Guff & Company raised $500 million from LACERA. Siguler Guff will manage a credit strategy for LACERA structured as a dedicated managed account. More here

This newsletter is for education or entertainment purposes only. It should not be taken as investment advice.