Ares Believes Private Credit Has Room to Grow

Fundraisings from KSL Capital Partners, Crayhill Capital, Sculptor Capital, Atempo Growth and InCred.

👋 Hey, Nick here. A special welcome to the new subscribers from Akin, Structural Capital, and Wells Fargo. It’s great to have you. Reach out and say hi. This is the 110th edition of my weekly newsletter. You can read my previous articles here and subscribe here

📕 Reads of the Week

Canadian and Danish pension funds are rethinking their US private market allocations. Link

Most takes on private credit ETFs are empty narratives. Covenant Lite just posted an ETF piece that’s worth your time. Link

MSCI and Moody's Launch Independent Risk Assessments for Private Credit. The combination of Moody’s flagship risk modeling with MSCI’s universe of private credit investment data will produce proprietary third-party risk assessments available at the underlying company and facility level using transparent metrics. More here

Blackstone is set to launch its fifth perpetual flagship, BMACX, on May 1. The Blackstone Private Multi-Asset Credit and Income Fund will initially be launched to the RIA channel. It will also allow daily subscriptions, unlike Blackstone’s existing perpetuals, which only allow monthly sales. Link

🎧 Coller Capital: First-Time GP Users Are the Secondary Market’s New Growth Engine. Why 2024 was a high-water mark year for the secondaries market. Link

Brookfield: Why Private Real Estate Lending Is Compelling Now. Link

FS Investments: U.S. middle market faces less disruption from global supply chains. Link

🏦 Partnerships of the Week

Blackstone, Wellington, and Vanguard announced a strategic alliance to transform how investors access private market opportunities. The three firms will collaborate on developing simplified multi-asset investment solutions that seamlessly integrate public and private markets as well as active and index strategies. More here

Nick’s Notes: If this sounds familiar, it’s because BlackRock announced a similar product three weeks ago. Link

Ares and Barings announced a $2.4 billion partnership with Coller Capital. The fund will invest in private credit and private equity secondaries. Barings Portfolio Finance acted as the Lead lender, with Coller Capital and Ares providing the credit enhancement. This is Coller Capital’s fifth and largest structured solution since 2020. More here

Generali Investments and Partners Group are teaming up to launch a private credit secondaries fund. The fund aims to raise around $1 billion. More here

🌳 Ares Believes Private Credit Has Room to Grow

I wrote about the phenomenal rise in opportunistic credit funds a few weeks ago (Link). In Q1 alone, these funds raised more than twice what they did in Q1 24. If you’re looking for deeper insights behind this trend, I’d recommend reading Ares’ presentation on the current state of private credit. Three charts in particular stand out. Read the full report here

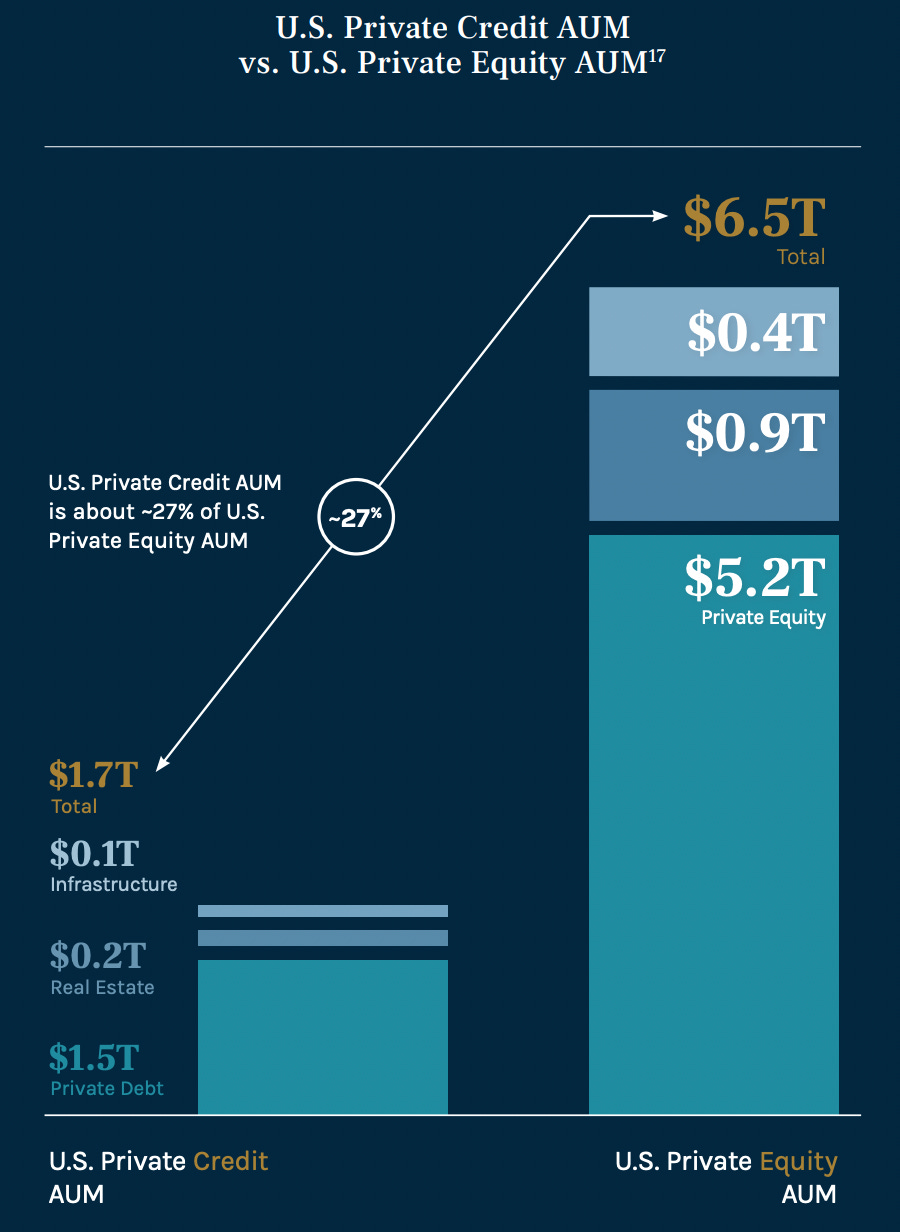

The Private Credit Market Is a Fraction of the Private Equity Market

Despite significant fundraising in Private Credit, its AUM remains a fraction of Private Equity.

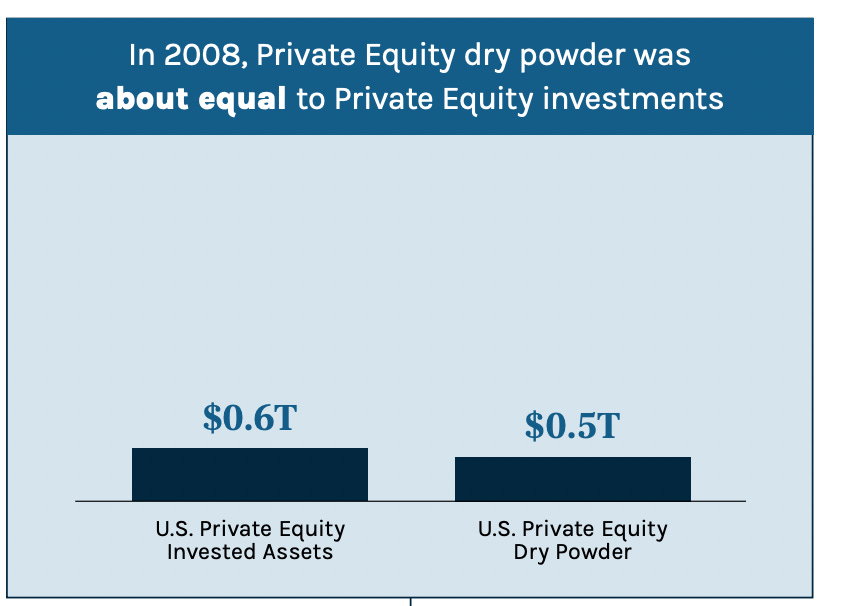

U.S. Private Equity (2008)

In 2008, Private Equity sponsors could offset existing portfolio issues by simply deploying their large relative supply of new capital into an attractive environment

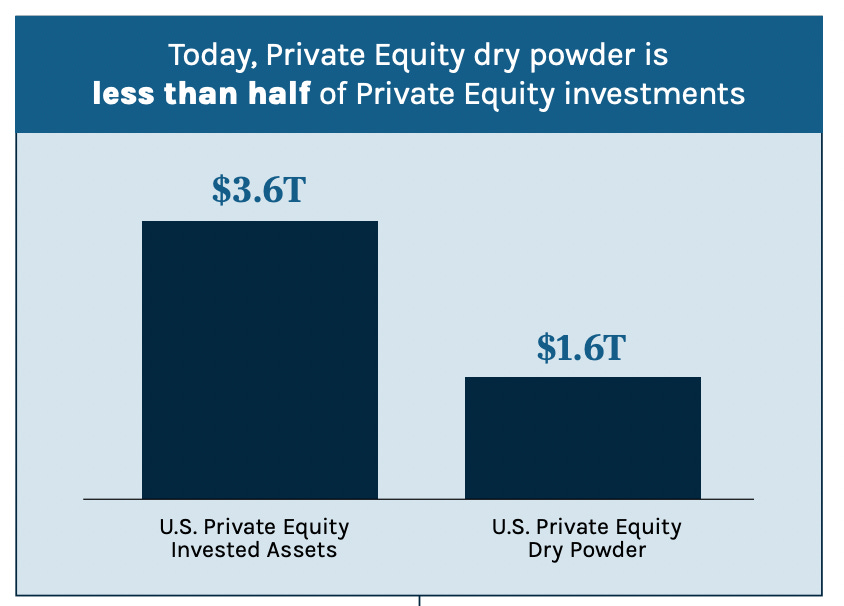

U.S. Private Equity Today

Today, the large amount of invested assets relative to dry powder means that sponsors may not be able to outgrow portfolio issues, but instead are focused on supporting and improving existing portfolio companies

Read the full report here

💰Fundraising News

KSL Capital Partners, a Colorado-based manager, closed its $1.4 billion Tactical Opportunities II Fund. KSL specializes in travel and leisure investing and focuses on five primary sectors: hospitality, recreation, clubs, real estate, and travel services. KSL’s "Tac Opps" team provides solutions that fall outside its traditional equity and credit mandates. More here

Crayhill Capital Management, a New York-based asset manager, closed its $1.3 billion Principal Strategies Fund III. The fund will provide capital to specialty finance platforms and other asset-heavy companies across sectors, including residential housing, energy, commercial real estate, media, and digital infrastructure. More here

Sculptor Capital Management, a New York-based alternative manager, closed its $900 million Tactical Credit Fund. The opportunistic fund lends across corporate, asset-based, and real estate credit markets. Sculptor manages $23 billion across its global credit strategies. More here

Atempo Growth, a London-based venture debt lender, announced a first close of ~$340 million for its second fund. Atempo lends to technology companies across Europe and has invested in 32 companies from its debut fund. More here

InCred Financial Services, an India-based lender, plans to raise $174 million for a new private credit fund. The fund will lend to SMEs in India and will target an IRR of 16-17%. More here

This newsletter is for education or entertainment purposes only. It should not be taken as investment advice.