Ares: There’s No Private Credit Bubble

Fundraising from Thoma Bravo, Francisco Partners, Guggenheim Investments and Arcano Partners

👋 Hey, Nick here. A special welcome to the new subscribers from Francisco Partners, TD Securities, and Claret Capital. It’s great to have you. Reach out and say hi. This is the 98th edition of my weekly newsletter. Each week, I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here.

📕 Reads of the week

Mubadala says that private credit has been the best-performing asset class over the last three years. Link

Private Credit is helping pre-IPO software companies amid the IPO market lull. Link

A good friend of mine recently started his own Substack - CovenantLite, you should subscribe. Start with his Introduction to Litigation Finance. Link

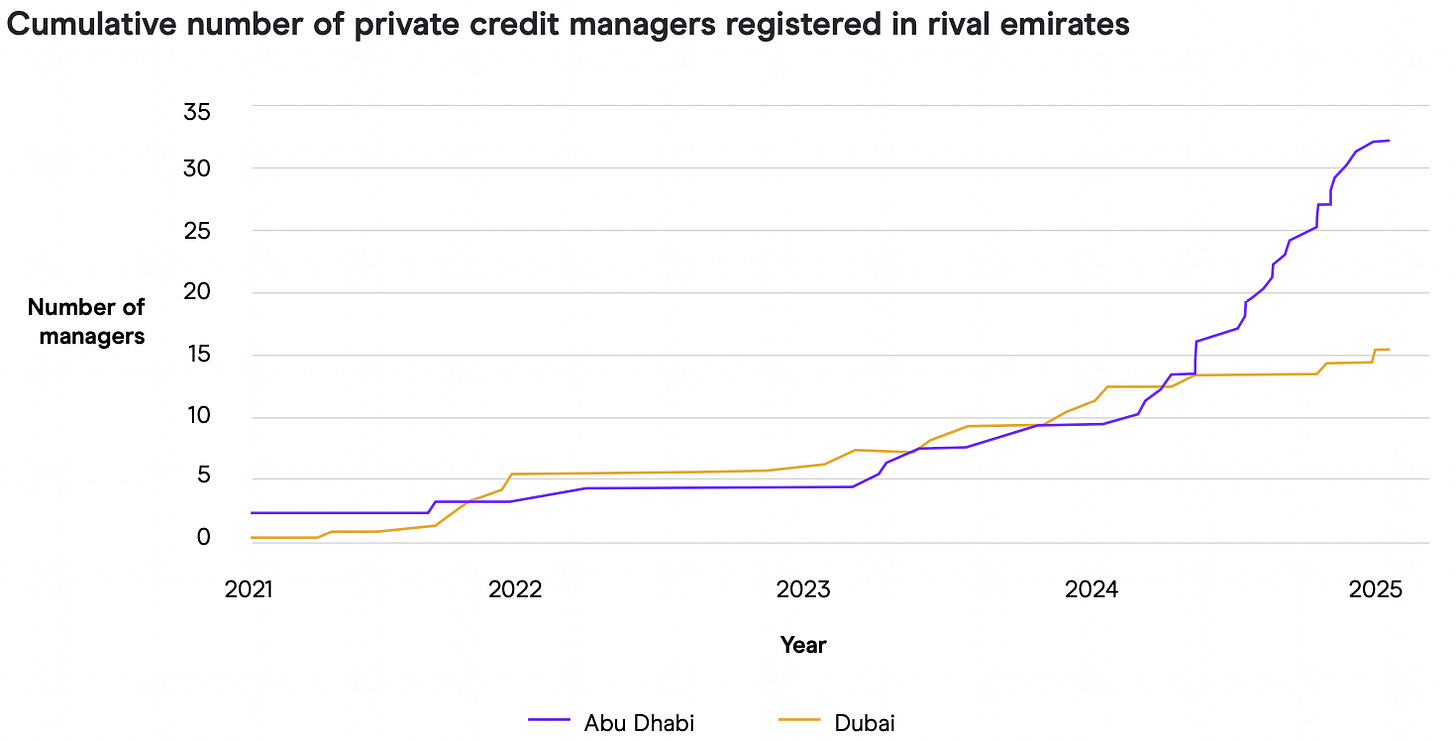

With Intelligence Private Credit Outlook 2025 is one of the best this year. The report includes several non-consensus ideas that deserve a closer look. See below its data on growth in the Middle East. Link

🎧 Centerbridge Bets on Consumer Credit. “You had the worst performance on record in 2021/22 for many consumer sectors, but it’s always post-blow up that we want to be there originating,” Aaron Fink on Bloomberg’s latest Credit Edge podcast. Link

M&G Investments: “Why should insurers invest in direct lending?” TLDR: The floating rate and sub-investment grade nature of direct lending means it is unlikely to form part of an insurer’s core portfolio composition. However, compared to other asset classes (EMD, private equity, or hedge funds), the Solvency II spread risk capital insurers have to hold against direct lending assets is attractive. Link

Apollo’s latest marketing content would make Steven Spielberg proud. See its video on Apollo Real Estate Credit. Link

🏦 Bank Partnerships this Week

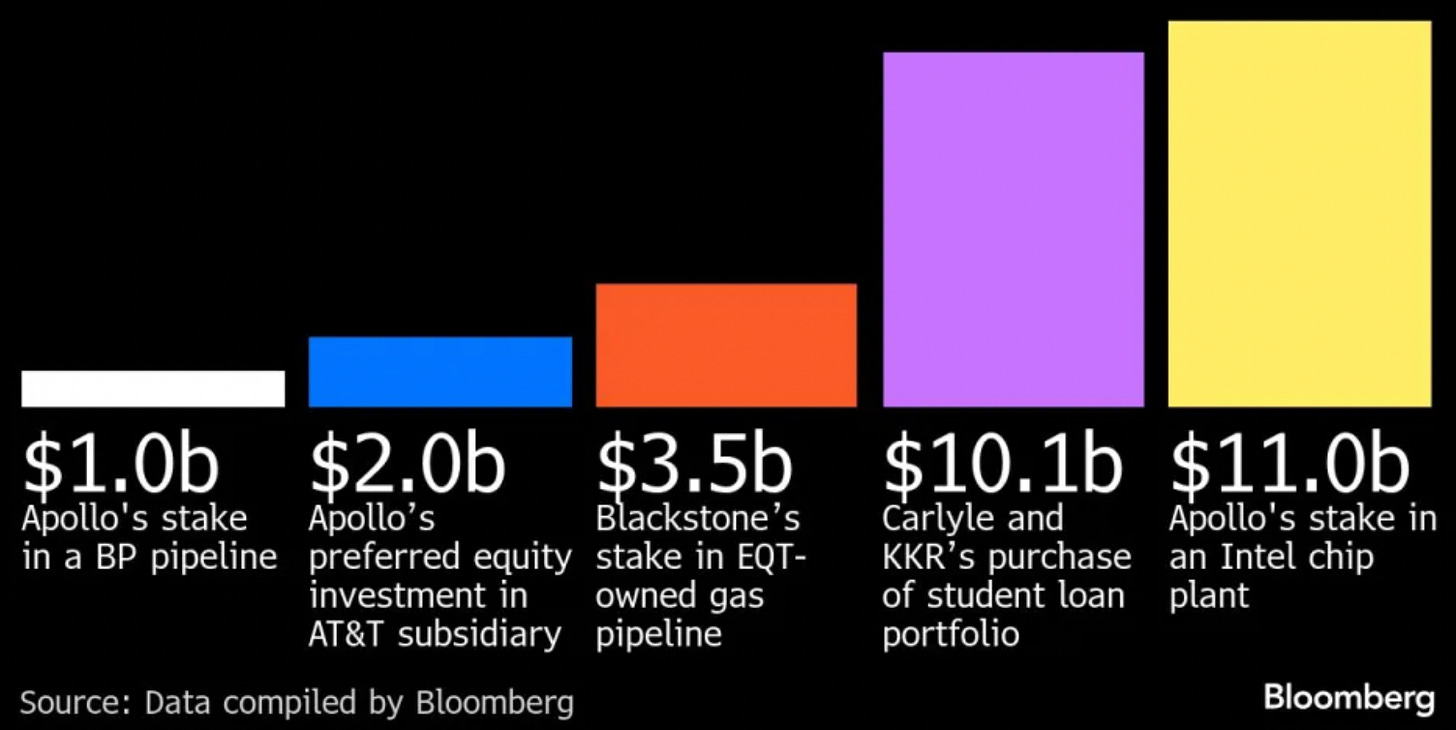

Bloomberg shows how bank partnerships have helped private credit move into investment-grade lending Link

But managers have increasingly been directly lending to companies, causing banks to question their long-term role as “gatekeeping toll collectors”. The FT highlights that banks such as Goldman Sachs, trade at a steep valuation discount to Blackstone, Apollo, and their peers. Link

The FT believes other banks will follow in Goldman’s footsteps and reorganize to maintain their fee schedules and relevance. Link

This transition is easier said than done. Deutsche Bank’s asset management company, DWS, is among newcomers struggling to “attract sizable commitments from investors”. Link

Banks are also being much more aggressive in getting some market share back. Ardonagh and Dechra Pharmaceuticals are two recent examples. Link

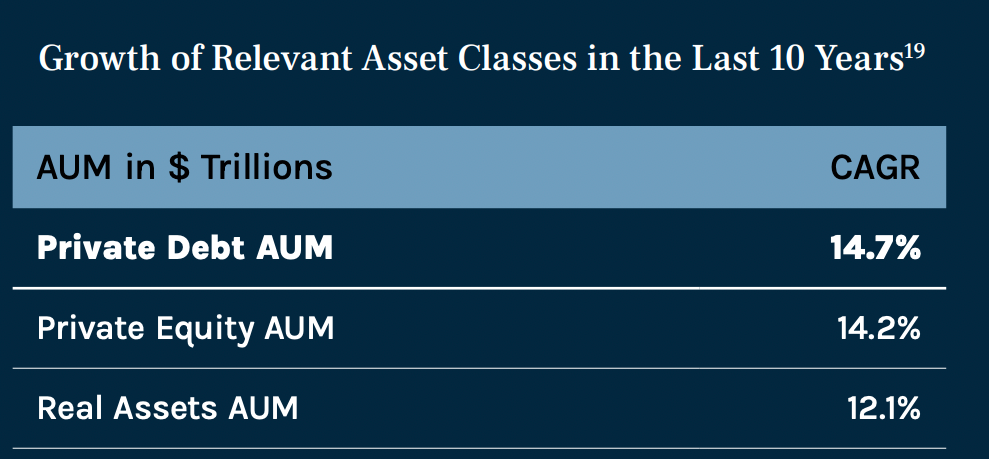

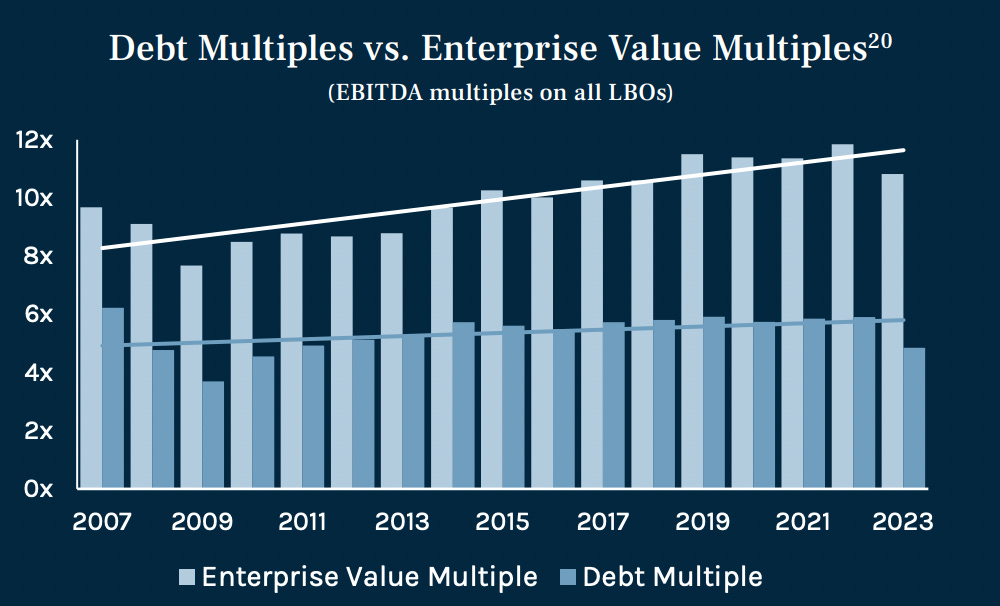

🫧 Ares Says There’s No Private Credit Bubble

Ares published a report on the history and current state of private credit. Feel free to share it with your banking buddies. Read the full report here

Private Debt AUM has grown in line with related private markets

Private credit multiples are below historic averages

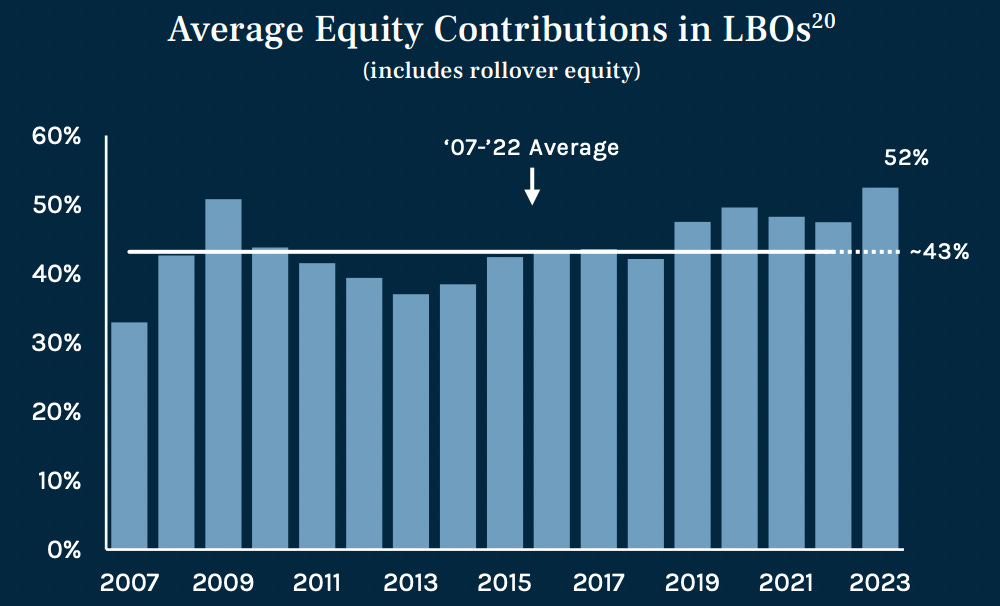

LBO equity contributions are above long-term averages

Spreads remain within historic ranges

Read the full report here

💰Fundraising News

Thoma Bravo closed its $3.6 billion Credit Fund III. Thoma Bravo Credit lends senior secured loans to established, mission-critical enterprise software companies. The platform targets sponsor-backed companies and leverages Thoma Bravo’s sector expertise in enterprise software. Since its inception in 2017, the platform has invested over $8.0 billion across approximately 100 transactions. Fund III has already invested over $1.0 billion across 20 investments. More here

Francisco Partners, a San Francisco-based manager, closed its $3.3 billion Credit Partners III Fund. The fund finances technology-driven businesses using a spectrum of capital solutions, ranging from traditional credit financings to flexible growth structures. The fund works alongside FP’s Flagship Private Equity fund which closed its $13.5 billion Fund VII in 2022. More here and here

Guggenheim Investments, a New York-based manager, raised $400 million for its private debt strategy. The transaction was led by Allianz Global Investors. A group of funds managed by StepStone co-underwrote the transaction. Investors can access diversified portfolios across borrowers, sectors, and vintage. More here

Arcano Partners, a Spanish asset manager, announced a first close of ~$100 million for its second private debt fund. The fund lends to Spanish SMEs committed to sustainability. It expects to make at least 20 investments, with an average ticket size of €5 million to €15 million per investment. More here

This newsletter is for education or entertainment purposes only. It should not be taken as investment advice.