It's time to buy

Fundraisings from Blue Torch Capital, KKR, Comvest Partners and Gemcorp Capital.

👋 Hey, Nick here. If you’re new, this is the 57th edition of my weekly newsletter. Each week I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here. Scroll to the bottom, if you’re here for the fundraising news.

📚 Reads of the week

Brookfield is in talks to buy a majority stake in Castlelake More here

Blue Owl launches Real Estate Finance strategy with the acquisition of Prima Capital Advisors More here

Blackrock acquires $600 million of infrastructure debt from Santander. More here

Barclays is worried about PIK More here

💬 Quote of the Week

Jack Farley- Forward Guidance (Quote)

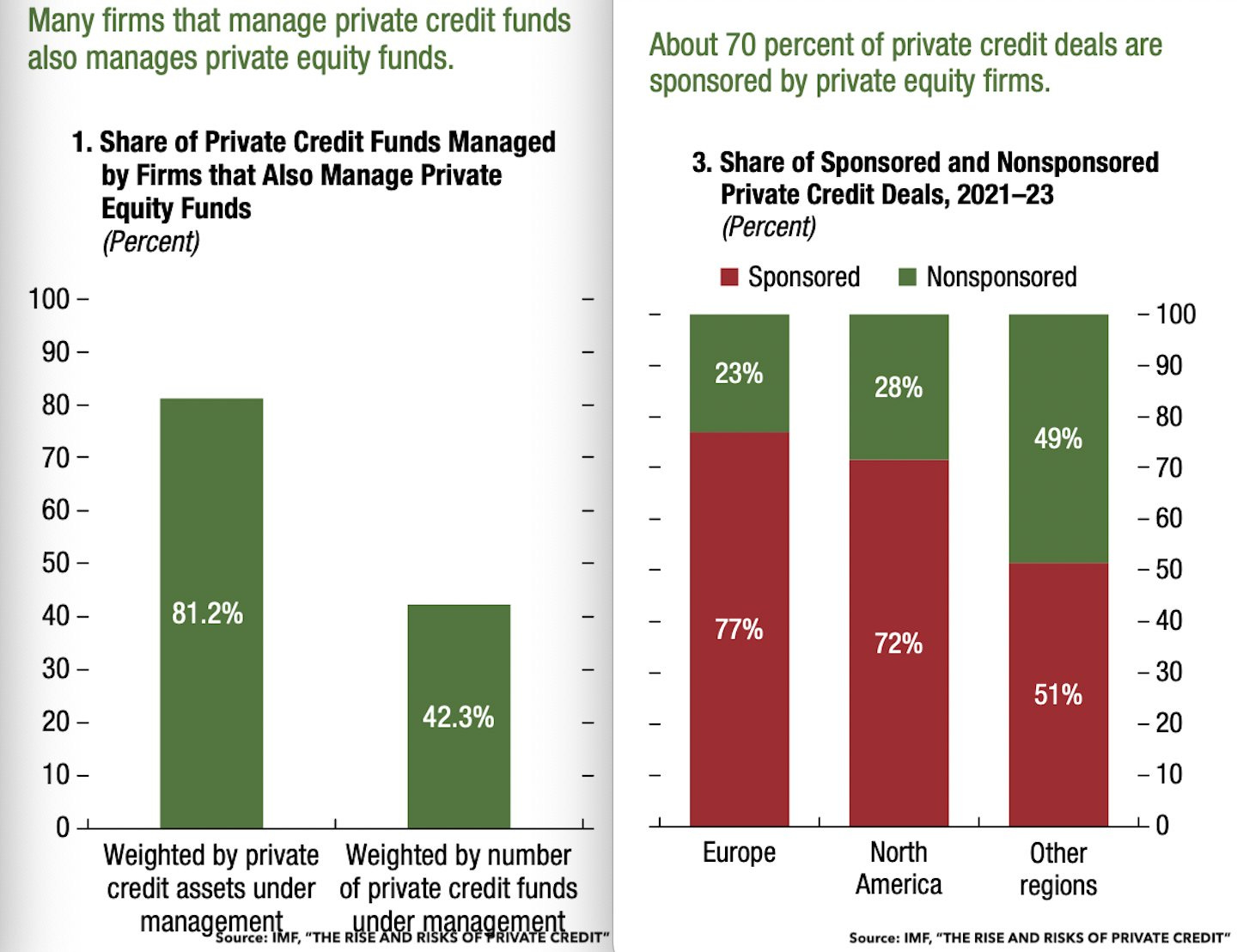

81% of private credit assets are managed by firms that also manage private equity funds

and

72% of private credit deals (in North America) are sponsored by private equity firms

borrowing from Peter to dividend recap Paul??

📊 BDC’s Debt to Equity ratios have doubled since 2008

If you’re questioning why this matters, Warren Buffet has a great summary of LTCM’s leverage:

The whole LTCM is really fascinating because if you take Larry Hillenbrand, Eric Rosenfeld, John Meriwether and the two Nobel prize winners. If you take the 16 of them, they have about as high an IQ as any 16 people working together in one business in the country, including Microsoft. An incredible amount of intellect in one room. Now you combine that with the fact that those people had extensive experience in the field they were operating in. These were not a bunch of guys who had made their money selling men’s clothing and all of a sudden went into the securities business. They had in aggregate, the 16, had 300 or 400 years of experience doing exactly what they were doing and then you throw in the third factor that most of them had most of their very substantial net worth’s in the businesses. Hundreds and hundreds of millions of their own money up (at risk), super high intellect and working in a field that they knew. Essentially they went broke. That to me is absolutely fascinating.

If I ever write a book it will be called, Why Smart People Do Dumb Things. My partner says it should be autobiographical. But this might be an interesting illustration. They are perfectly decent guys. I respect them and they helped me out when I had problems at Salomon. They are not bad people at all.

But to make money they didn’t have and didn’t need, they risked what they did have and what they did need.

That is just plain foolish; it doesn’t matter what your IQ is. If you risk something that is important to you for something that is unimportant to you it just doesn’t make sense. I don’t care if the odds you succeed are 99 to 1 or 1000 to 1 that you succeed. If you hand me a gun with a million chambers with one bullet in a chamber and put it up to your temple and I am paid to pull the trigger, it doesn’t matter how much I would be paid. I would not pull the trigger. You can name any sum you want, but it doesn’t do anything for me on the upside and I think the downside is fairly clear. Yet people do it financially very much without thinking.

There was a lousy book with a great title written by Walter Gutman—You Only Have to Get Rich Once. Now that seems pretty fundamental. If you have $100 million at the beginning of the year and you will make 10% if you are unleveraged and 20% if you are leveraged 99 times out of a 100, what difference if at the end of the year, you have $110 million or $120 million? It makes no difference. If you die at the end of the year, the guy who makes up the story may make a typo, he may have said 110 even though you had a 120. You have gained nothing at all. It makes absolutely no difference. But to make money they didn’t have and didn’t need, they risked what they did have and what they did need difference to your family or anybody else.

The downside, especially if you are managing other people’s money, is not only losing all your money, but it is disgrace, humiliation and facing friends whose money you have lost. Yet 16 guys with very high IQs entered into that game. I think it is madness. It is produced by an over reliance to some extent on things.

I urge you. We basically never borrow money. I never borrowed money even when I had $10,000 basically, what difference did it make. I was having fun as I went along it didn’t matter whether I had $10,000 or $100,000 or $1,000,000.

(Source)

💰Fundraising news

Blue Torch Capital, a New York-based private credit investment firm, closed its $2.3 billion Credit Opportunities Fund III. The fund lends to middle market companies that require capital support for growth, acquisitions, operational challenges, and financial hurdles. Blue Torch platform has deployed $8.2 billion across 127 portfolio companies since inception. More here

KKR is reportedly raising $2 billion for an evergreen US direct lending fund. The fund was launched in March 2023 to focus on upper middle market companies. KKR’s direct lending strategy has raised more than $10 billion over the last 12 months. More here

Comvest Partners, a Florida-based investment manager, is launching its flagship Credit Partners VII fund. The fund lends senior secured loans to North American mid-market businesses. Comvest can lend up to $250 million per transaction and supports both sponsored and non-sponsored companies. Comvest presented at TRSL’s February Board meeting for a $100 million commitment. Comvest’s prior Direct Lending fund closed in July 2023 at $2 billion. More here and here

Gemcorp Capital, a London-based emerging markets asset manager, is launching an Abu Dhabi office. Gemcorp manages around $1.2bn and already operates a representative office in neighboring Dubai. More here