Blackstone: Real Estate Enters the Next Phase of the Cycle

Fundraising includes Churchill's $16 billion Senior Loan Strategy

👋 Hey, Nick here. A big welcome to the new subscribers from Bain Capital, Jefferies, and CIBC. This is the 150th edition of my weekly newsletter. If someone forwarded this to you, you can subscribe here and read my previous articles here.

We’re starting 2026 with the kind of deal activity the market’s been hoping to see

📕 Reads of the Week

Deals of the Week

EQT is acquiring Coller Capital for $3.2 billion. The transaction shows the strategic importance of secondaries, a market that grew 41% in 2025, and is expected to more than double by 2030.

CVC is acquiring Marathon for up to $1.2 billion. The transaction significantly expands CVC’s access to the large and fast-growing US market. It will increase CVC Credit’s Fee-Paying AuM €61 billion. It also helps CVC close in on its plan to deliver double-digit growth in FPAUM to €200bn by 2028.

👉 [More here]

Manager Updates

Blackstone’s Michael Zawadzki on How Private Credit Got so Big

👉 [Listen here]

PGIM announced an expansion into private credit secondaries, with plans to deploy up to $1 billion over the next two years into the asset class. It will focus on sourcing opportunities in direct lending as well as in opportunistic credit. Link

Partners Group delivered double-digit AUM growth in 2025, increasing AuM by 14% to $185 billion. Link

BlackRock Extend Asia Credit Fund by Another Year. Link

Blackstone’s 2026 Investment Perspectives

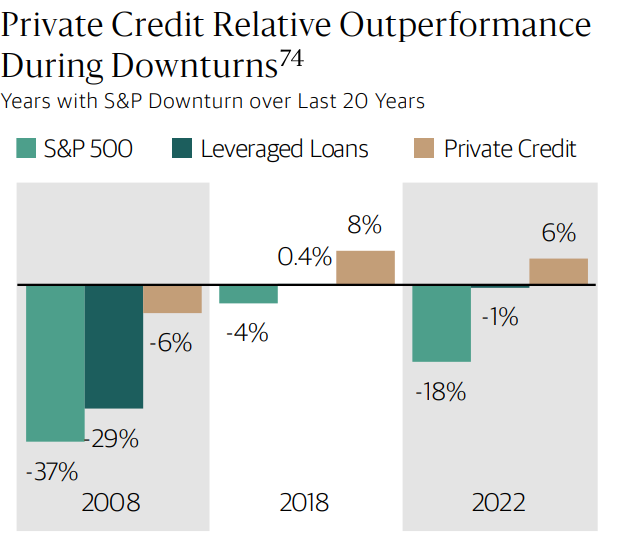

Over the past twenty years, the S&P 500 posted negative annual returns three times; in each of those periods, private credit significantly outperformed equities and leveraged loans, twice delivering positive absolute results

👉 [Read here]

Davos Updates

“We have built the capability in private credit over these last couple of years and its a significant contributor to our balance sheet. It’s one of the best performing asset classes for us. There are more headwinds in the space, but if you are with the right partner we remain quite bullish on this space.”

Khaldoon Al Mubarak, CEO of Abu Dhabi’s Mubadala Investment Co.

How Robust Is Private Credit?

Panel Featuring:

Ontario Teachers’ Pension Plan

GoldenTree Asset Management

Bain & Company Inc

S&P

“We have got about $140 billion of private credit sitting in our businesses and we aim to double that. This is a really important source of financing for our client base and they will continue to use this.”

Partnership Updates

AIG and CVC announced a partnership to allocate $2 billion to SMAs and Funds managed by CVC, with an initial $1 billion to be deployed through 2026. The SMAs will provide AIG with access to diversified private and liquid credit strategies. Link

Castlelake and LendInvest, a UK-based real estate lender, launched a new funding partnership. As part of the agreement, Castlelake will purchase up to £250 million in loans from LendInvest. The arrangement increases LendInvest’s capacity for larger, more complex loans – including the ability to fund individual projects up to £15m – while simultaneously unlocking a greater capability in regulated bridging loans and other areas such as Development Exit financing. Link

Partners Group and Barings closed a $365 million investment in Partners Group Private Loans, an evergreen private credit vehicle focused on direct lending opportunities globally. Barings Portfolio Finance provided the entirety of the investment‑grade rated loans,

Blackstone: Real Estate Enters the Next Phase of the Cycle

Commercial real estate is moving into a new part of the cycle, creating what we believe is one of the most attractive entry points for investors in recent years.

Compelling Entry Point

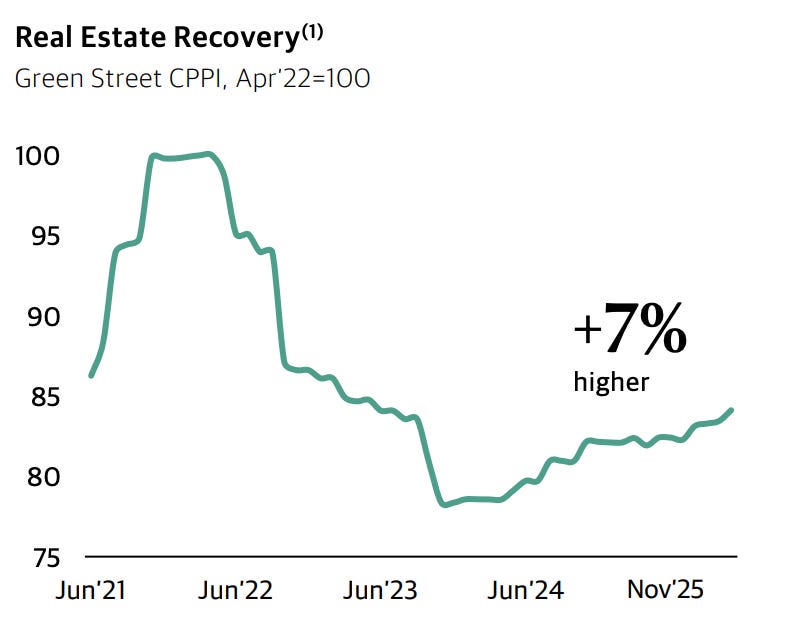

Real estate values peaked in 2022 before declining over the following two years, weighed down by rising base rates and persistent challenges in the office sector

By early 2024, we began to see clear signs that values were stabilizing.

Today, real estate remains very attractively priced on a relative basis: values are only 7% above their trough, compared to equities and fixed income, which are hovering near peak levels.

Post-Downturn Playbook

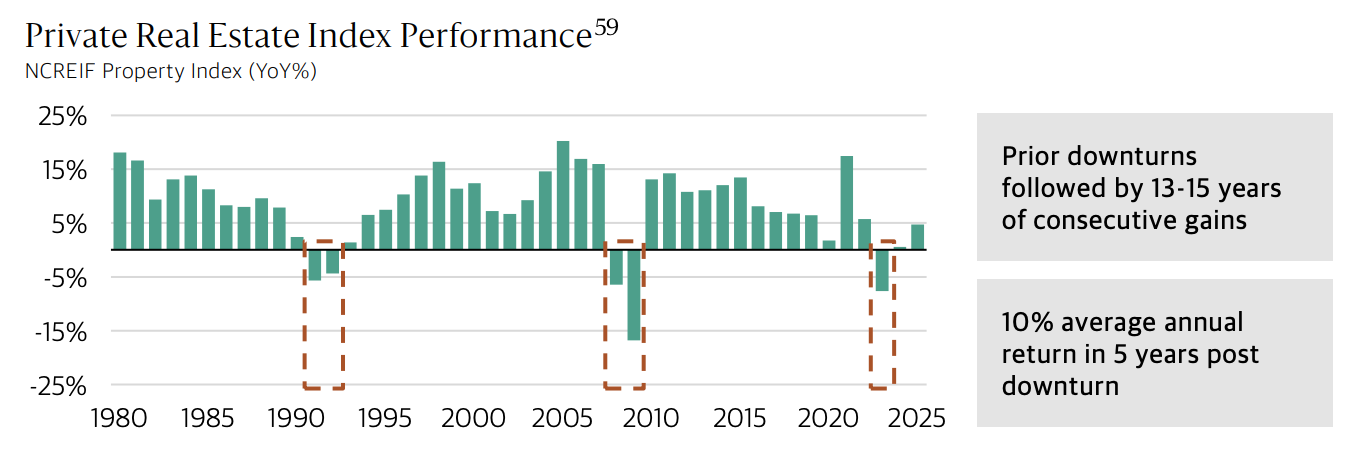

In the prior two downturns private real estate delivered double -digit average annual returns over the following five years as fundamentals and capital markets recovered.

There are a couple of reasons we believe today is a compelling moment to be deploying capital into real estate.

Collapsing Construction

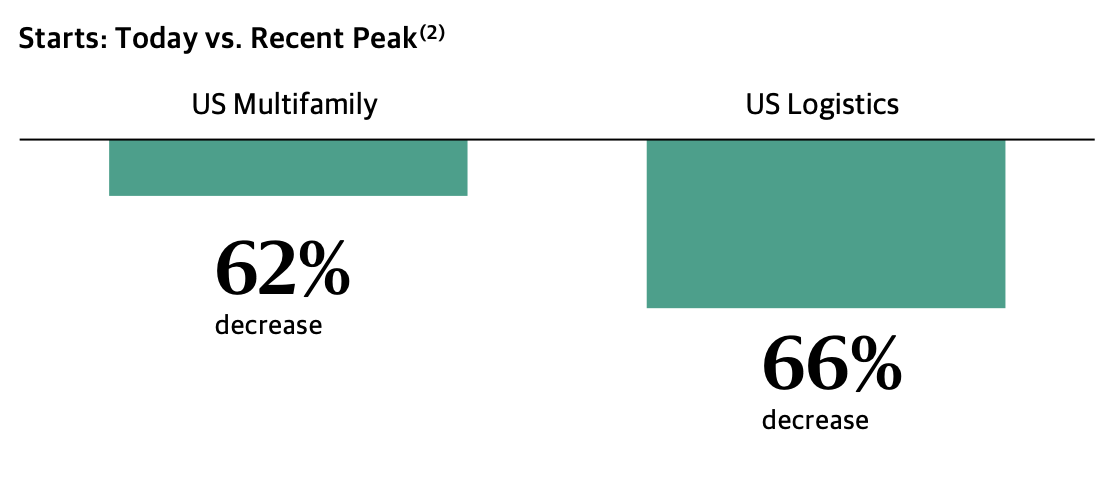

Blackstone is seeing a dramatic decline in new supply across virtually every sector globally, down 60%+ across our major US sectors.

This is the #1 reason we are bullish on real estate today: lower supply generally leads to stronger rent growth and higher values.

Capital Markets Are Strengthening

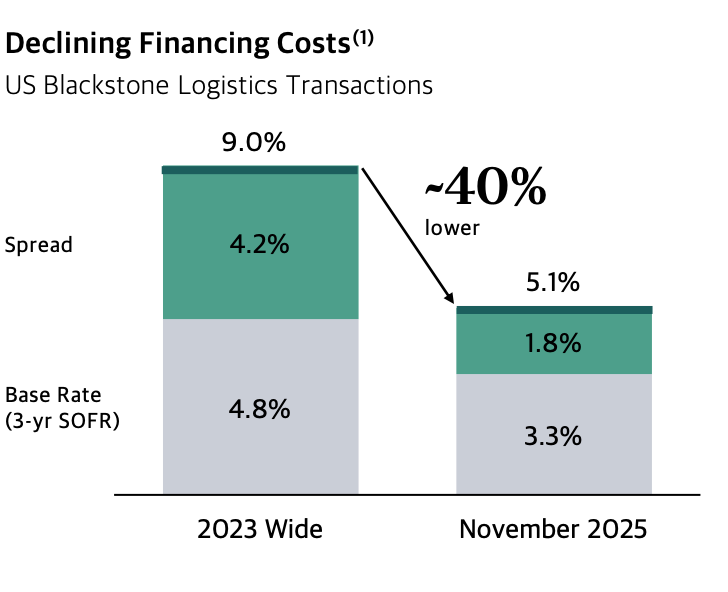

Real estate values are heavily dependent on debt financing, and the debt market is rapidly improving. The overall cost of debt capital has declined ~40% from the peak in 2023.

Blackstone is seeing improved financing translate into more bidders showing up to buy assets, and we expect this to continue.

With both long- and short-term interest rates declining, real estate’s biggest headwind in recent years is becoming a tailwind. Declining rates have historically led to significant outperformance for real estate.

So, Where Are We Focused on Deploying Capital in the US?

💰Fundraising News

Churchill Asset Management, the U.S. affiliate of Nuveen, raised over $16 billion for its flagship senior loan strategy. Churchill’s senior lending strategy lends first lien and unitranche financing to sponsored U.S. middle market companies. More here

Crescent Capital, a Los Angeles-head quartered manager, closed its $3.2 billion private credit continuation vehicle. Crescent Credit Solutions VII will acquire a portfolio of performing sponsor-backed loans and other equity interests from Crescent Mezzanine Partners VII, a 2016-vintage fund. The transaction was led by Pantheon and is the largest credit continuation vehicle transaction in the private credit secondaries market to date. More here

Twin Brook Capital Partners $3 billion continuation vehicle led by Coller Capital previously held this record. More here

PGIM announced an expansion into private credit secondaries, with plans to deploy up to $1 billion over the next two years into the asset class. It will focus on sourcing opportunities in direct lending as well as in opportunistic credit. More here

Dolomite Capital, a London-based credit manager, launched following a spin-off from Taconic Capital Advisors. The firm focuses on on complex mid-market European opportunistic credit opportunities and is supported by $200 million in seed capital from Stable Asset Management for a new evergreen fund. More here

Lendable, a London-based emerging markets lender, confirmed the the first close of its two new blended-finance funds: Lendable MSME Fintech Credit Fund 2 (LMFCF2) and Lendable Transportation and Energy Fund (LTEF), raising more than US$300 million and on track for final close in excess of US$500 million. More here

CIBC Asset Management, the subsidiary of the Canadian bank, launched its Diversified Private Credit Fund. The institutional open-ended solution offers access to a portfolio of senior secured, floating-rate loans sourced through CIBC’s origination network. Leveraging CIBC’s established bank lending platform, the Fund provides exposure to direct and specialty lending, including asset based lending in real estate and infrastructure. Link

This newsletter is for educational and entertainment purposes only. It should not be taken as investment advice.