Building a Case for Non-Sponsored Mid-Market Lending in Europe

Where to Find 150bps of Excess Return in European Private Credit

👋 Hey, Nick here. A big welcome to the new subscribers from Golub, Prudential and Victory Park. This is the 141st edition of my weekly newsletter. If someone forwarded this to you, you can subscribe here and read my previous articles here.

📕 Reads of the Week

Manager Updates

Blue Owl Cancels BDC Merger. Read Covenant Lite’s analysis if you want something more substantive than the headline-driven hit pieces.

CVC expands into credit secondaries. The strategy leverages CVC’s established network and $17 billion of Secondaries AuM. It will invest across geographies, fund vintages, and transactions.

Partnership of the Week - ICG x Amundi

If you’re watching what BlackRock is doing and you’re in traditional asset management, you’re looking to figure out how you get private market exposure.

Marc Rowan - Apollo Q3 Earnings.

Another Marc Rowan prediction comes true. Amundi, one of Europe’s leading traditional asset managers, and ICG, one of Europe’s leading private markets asset managers, announced a long-term strategic partnership comprising several components:

Amundi will be the exclusive global distributor in the wealth channel for ICG’s evergreen and similar products. ICG will be Amundi’s exclusive provider for those products to Amundi’s distribution business.

Amundi to acquire a 9.9% economic stake in ICG.

White papers

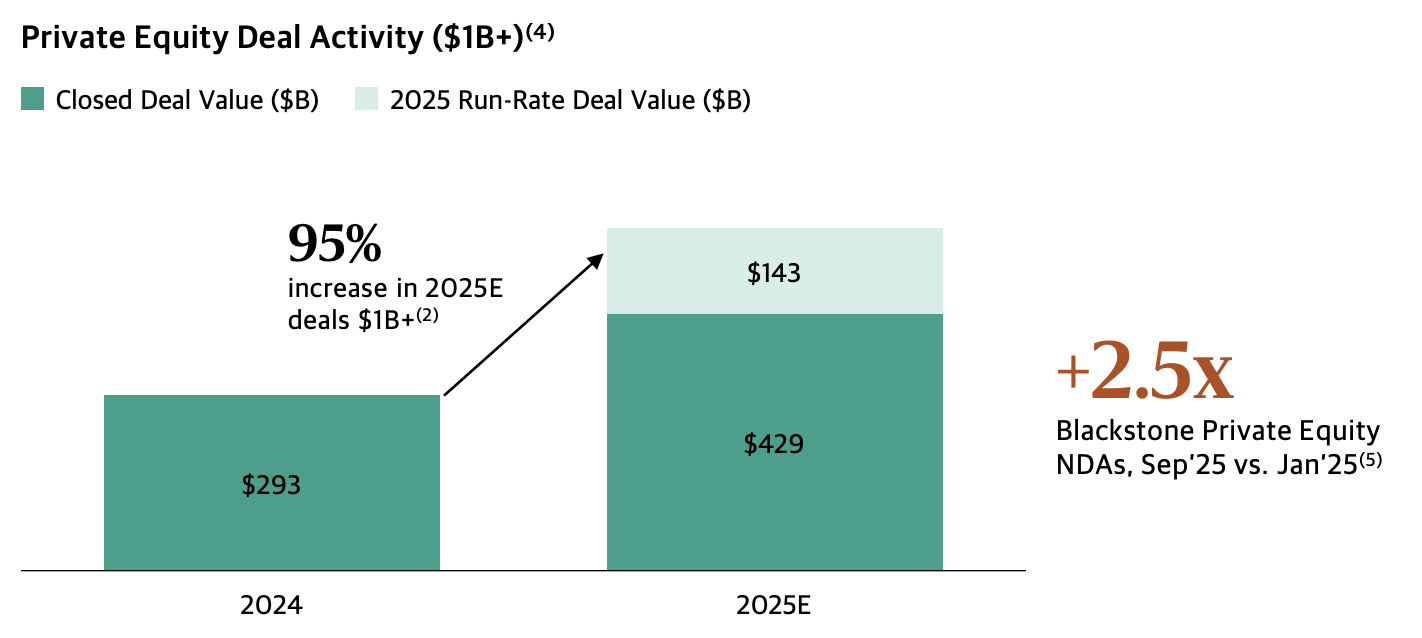

Blackstone Thinks The Deal Dam is Breaking.

Large-scale private equity exits, or those over $1 billion, are on pace to increase 2.3x versus 2024 levels. These transactions are disproportionately benefiting large managers as over 75% of all exits YTD have been in these scaled deals.

📚 Building a Case for Non-Sponsored Mid-Market Lending in Europe

Arini held the second close of its $2.3 billion Arini European Direct Lending Fund.

The four charts below outline why it’s concentrating on the European mid-market and, more specifically, non-sponsored core mid-market opportunities.

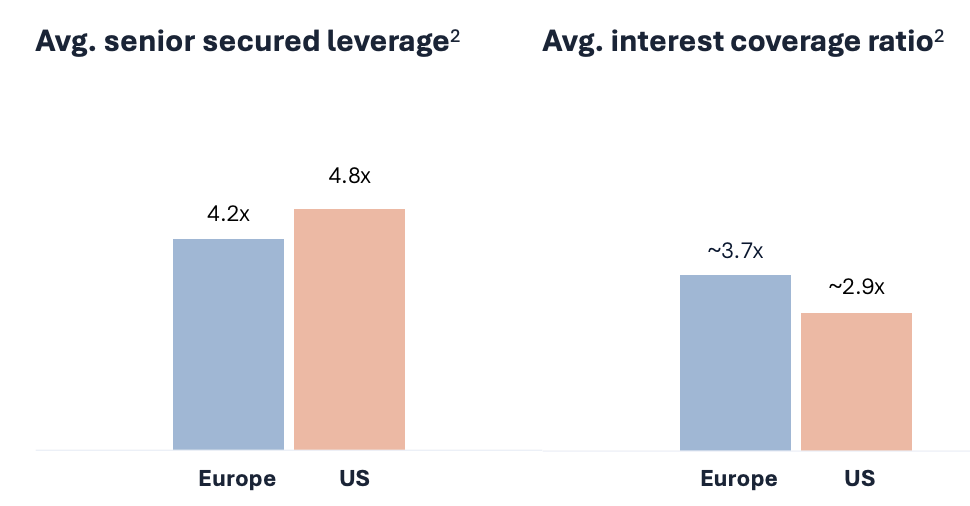

European direct lending has a 50bps excess spread relative to the US

Spread premium driven by structural differences between Europe and the US, including a more fragmented market with multiple legal systems and regulatory regimes

More conservative leverage and interest coverage ratios in Europe

Market participants might attribute this to an assumed greater proportion of TMT and healthcare deals in the US, sectors often associated with higher leverage. But the European direct lending market has similar or greater exposure to TMT and healthcare relative to US direct lending

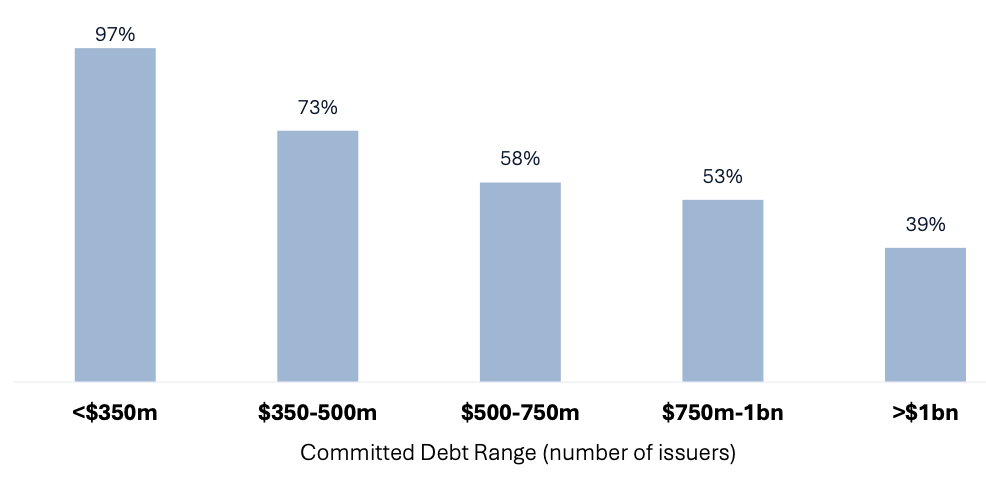

Leverage levels in the core middle market are typically ~1x lower than larger deals in the upper middle market

A materially larger proportion of core middle market transactions include maintenance covenants, with a far greater percentage of market participants in Europe requiring tighter documentation.

Non-sponsor deals have ~150bps+ of excess spread

Spread premium driven by (a) difficulty originating non-sponsor deals and (b) increased diligence effort given the inability to rely on a sponsor’s diligence.

💰Fundraising News

Direct Lending

Neuberger Berman - Private Debt V - $7.3 billion

The Fund aims to invest in senior secured, first-lien, and unitranche loans to sponsored companies in North America.

Launched in 2013, Neuberger’s private debt business manages $24.3 billion across evergreen and closed-end funds; leads or co-leads 98% of originated loans; and has the capacity to commit over $800 million per transaction.

Client capital dedicated to the strategy has increased by more than 81% in the past two years.

Arini -European Direct Lending Fund - $2.3 billion Second Close

The fund is a partnership between Arini and Lazard and leverages Lazard’s advisory network for deal origination and Arini’s credit underwriting experience.

It focuses on financing mid-market companies across Europe

Ascertis Credit - Fund IV - $520 million First Close

Ascertis, an India-based manager, is targeting a $1 billion fund size.

The fund will lend to high-growth businesses across India and Singapore-Southeast Asia.

Ascertis Credit has deployed over $1.5 billion across its previous funds

Credit Opportunities

Arrow Global - European Credit Opportunities - $3.1 billion

Arrow focuses on opportunistic credit investments within its core European markets.

The strategy targets a range of distressed and special situations, including:

Performing and non-performing credit portfolios

Bankruptcy situations

Secured collaterals

KKR - Asia Credit Opportunities Fund II - $2 billion Target

KKR is targeting a $2 billion final close in December.

The fund, which started fundraising in January 2024, is a performing credit fund aiming to deploy capital for deals yielding low-to-mid-teens.

Monomoy - Credit Opportunities Fund III - $500 Million

Monomoy, a New York-based manager, invests in the senior secured debt of North American middle-market companies.

Monomoy targets businesses in the industrial, distribution, and consumer sectors.

Monomoy’s Credit Team leverages its private equity strategy to identify and manage investments.

Real Estate

Arrow Global - Arrow Lending Opportunities - $1.7 billion

The real estate lending strategy provides development loans, bridge loans, and term mortgages secured against residential property.

The fund received a $400 million commitment from a wholly owned subsidiary of the Abu Dhabi Investment Authority.

Specialist

Viola Credit - European Growth Lending Fund - $350 Million

The fund lends to European Technology Companies.

It aims to invest in up to 50 sponsor-backed companies in Western Europe and the UK, with a focus on sectors including Enterprise SaaS, Vertical AI, FinTech, Cleantech, and HealthTech.

It targets Venture Capital-backed companies post Series A and typically lends between $5 million and $50 million per transaction.

Pearl Diver Capital - Aquanaut (SRT) Fund - $1.5 billion Target

The London-based manager announced the first closing for its open-ended global interval fund providing institutional investors with scalable access to global Significant/Synthetic Risk Transfer (SRT) and financial institution capital relief transactions.

The fund will focus on corporate loan portfolios originated by leading global banks across Europe, the UK, and select international markets.

Overflow

Interviews

Fortress Investment Group co-CEO Drew McKnight talks about leaning into AI-related services. Link

You can be big believers in AI.

But you can also question the investment returns that will be yielded through these investments. Link

Centerbridge Partners managing principal Jeff Aronson tells Bloomberg to step back and take a breath. Link

When people come down and take a breath, they will realise the world isn’t going to end. Link

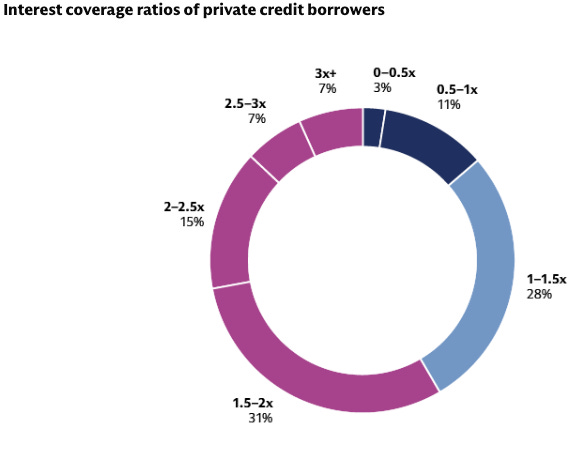

GSAM Talks About Private Credit’s Pressure Points

When rates peaked at ~5% above pre-2022 levels, a loan underwritten at 5.5x EBITDA would have faced an additional 25-30 cents in interest payments for every $1 of EBITDA at underwriting.

Borrowers at the margin had little opportunity for EBITDA growth to compensate.

Companies currently struggling to service their debt (10-15% of the market) have likely missed initial operational targets and will find solvency challenging without an operational pivot.

For borrowers at the margin, or those in the “elevated but managed” category (25-30% of the market), the pressure point may emerge when loans mature or when the company is sold.

GSAM believes companies in this situation with fundamentally sound businesses will likely need to be recapitalized with hybrid or equity capital to balance capital structures.

White papers

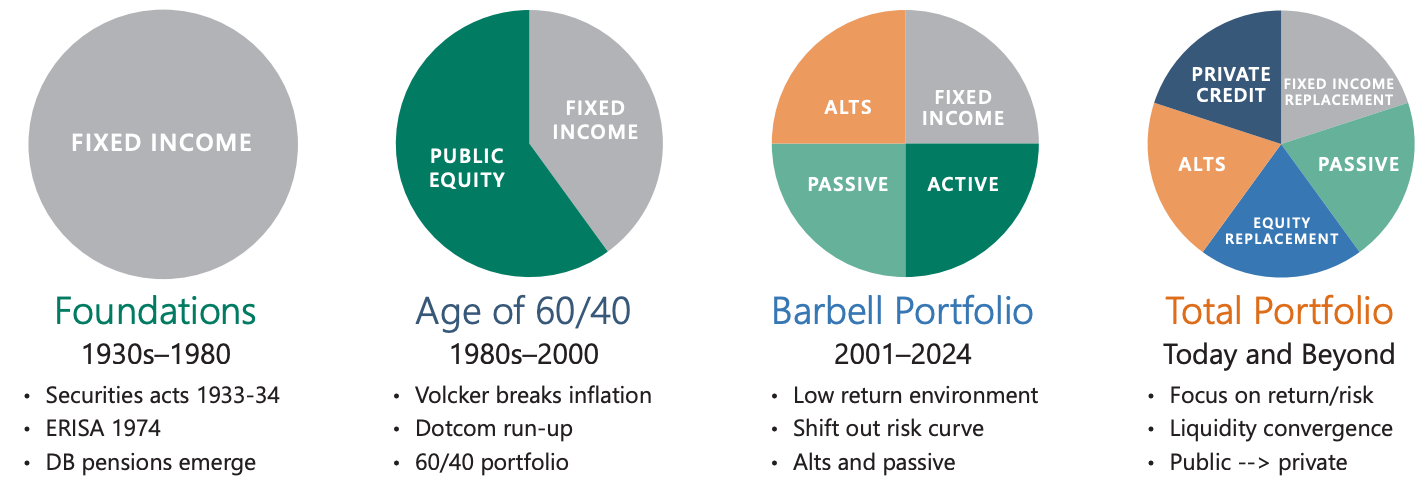

Apollo on The Evolution of Institutional Asset Allocation.

The goal of most institutional investors has not changed in decades: 7-8% total return (or 5-6% real return). What has changed is the starting point—the risk-free rate—which sets the foundation. Looking back through history, there have been four major phases of institutional investor asset allocation.

Other Partnerships

Park Square, a London-based manager, and Nomura announced a partnership to further strengthen their origination and underwriting efforts in the U.S. senior direct lending market. The partnership grants Park Square access to unitranche private credit opportunities sourced through Nomura’s U.S. Investment Banking Division, including both its differentiated Acquisition and Leveraged Finance and Advisory businesses. Nomura has committed an anchor investment of $150 million to Park Square’s inaugural dedicated U.S. senior direct lending vehicle.

Carlyle and SBI announced a partnership to support SBI’s expansion into a multi-strategy private credit business for Japanese institutional investors.

HPS and Lunate announced a partnership to launch the HPS Strategic Solutions Partners. Lunate is an investment manager with over $110 billion in assets under management and is backed by Abu Dhabi sovereign wealth fund ADQ. The Platform will invest in preferred & common equity as well as debt-related investments in sponsored and non-sponsored large corporates, primarily in the United States and Europe. Lunate will anchor the Platform with a projected long-term commitment of at least $1 billion.

Lunate has also partnered with Blue Owl, Brookfield, and Blackstone.

This newsletter is for educational or entertainment purposes only. It should not be taken as investment advice.

The 150bps premium on non sponsored deals makes sense when you think about the extra legwork required. Without a sponsor's due dilligence to lean on, lenders have to build that confidence from scratch. The question is whether more players entering this space will erode that spread premum over time.