Why Brookfield Sees No Risk of Overbuilding AI Infrastructure

Fundraising from Brinley Partners, OrbiMed, Aperture Investors and Keppel

👋 Hey, Nick here. A big welcome to the new subscribers from Partners Group, Castlelake, and RBS International. This is the 126th edition of my weekly newsletter. If someone forwarded this to you, you can subscribe here and read my previous articles here.

📕 Reads of the Week

Is the U.S. Still Special? Oaktree thinks so. Link

Apollo on America’s retirement problem in four charts. Link

How private credit's 5 largest managers are positioning themselves for success. Link

The chief investment officer of Arrow Global hits back at the FT. Link

How might Trump’s 401(k) executive order change the market structure of retirement savings? Link

Private credit giants are the most likely bidders for HSBC’s $40 billion Australian retail loan business. Link

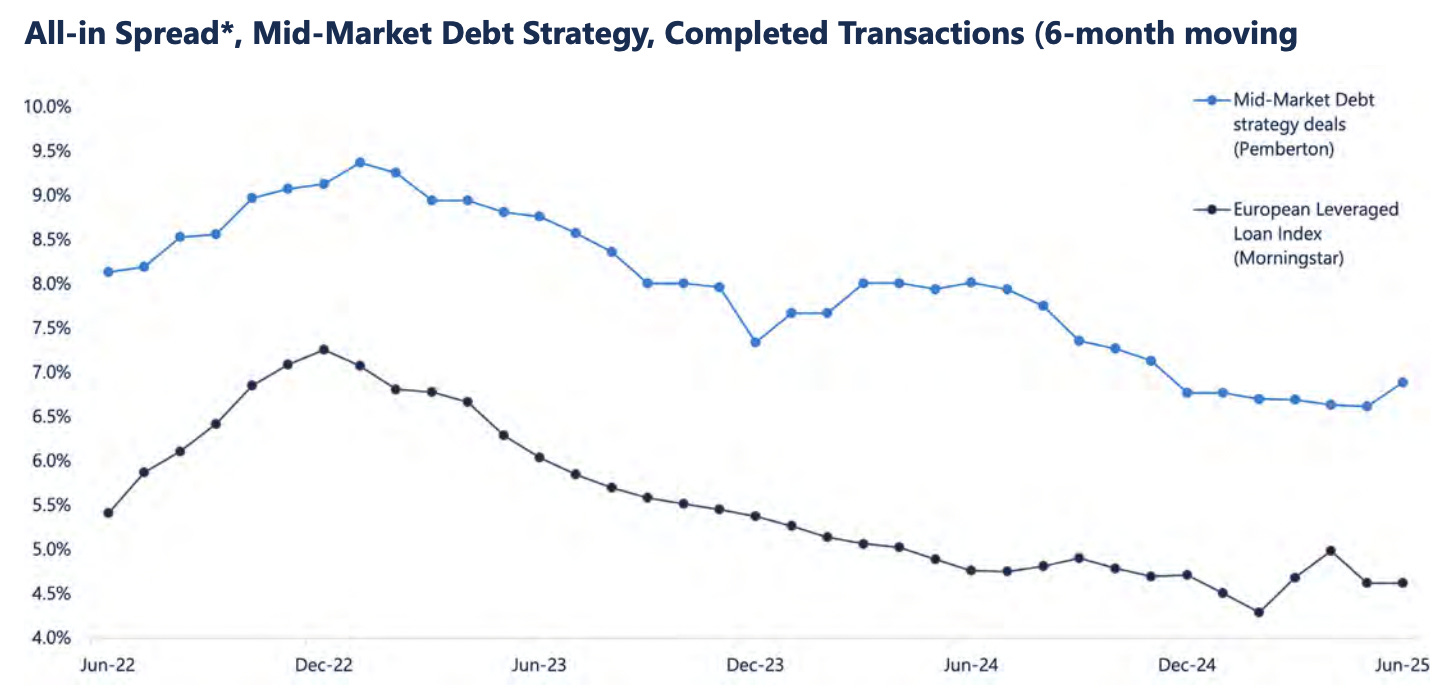

Pemberton’s H1 2025 European Private Credit Review. Link

🏭 Why Brookfield Sees No Risk of Overbuilding AI Infrastructure

“AI is becoming commercial and functional in a greater number of use cases. More efficiency in AI is going to drive more demand for AI. We see very little chance of overbuilding at this point.”

Connor Teskey, President of Brookfield Asset Management

Brookfield is the latest manager to weigh in on the AI infrastructure buildout. Below is my summary. You should read the full report here. If you missed them, here are the Ares (Link) and Blackstone (Link) whitepapers.

In 1865, economist William Jevons observed that improvements in the efficiency of coal-powered steam engines led to more, not less, coal consumption.

The same dynamic applies to modern technologies.

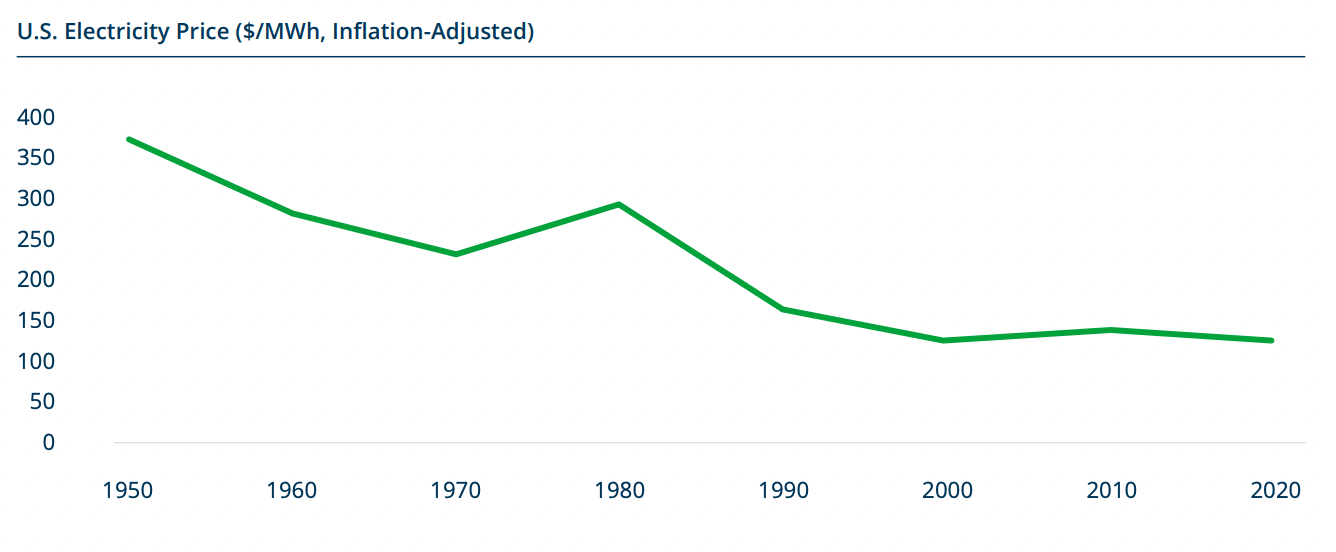

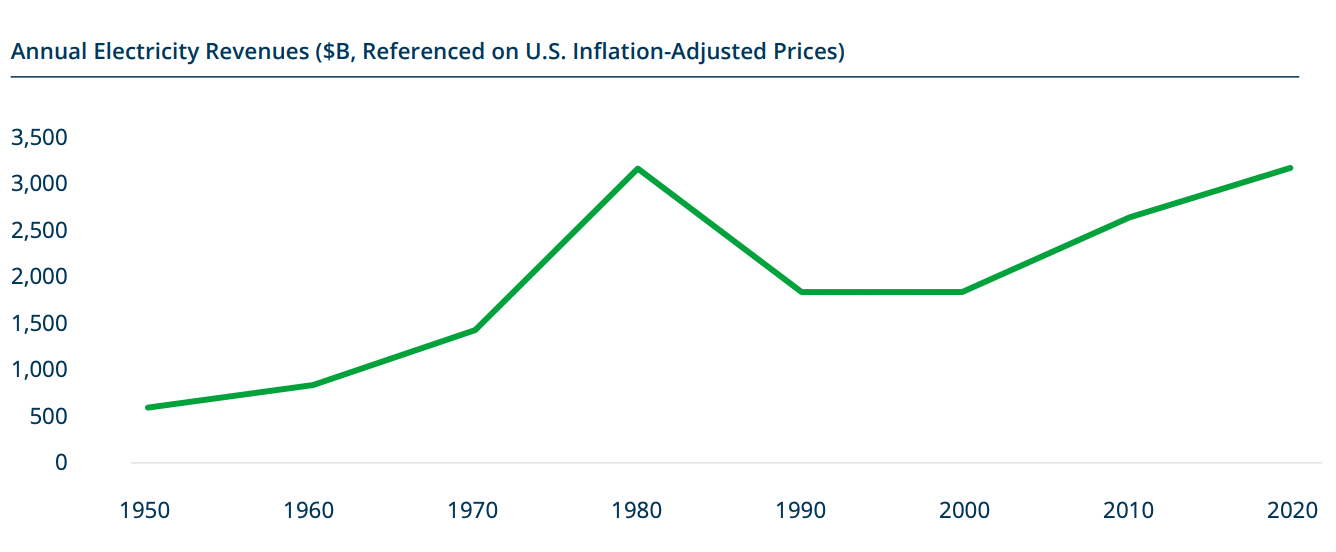

Take electricity: Over the last 70 years, the real unit price of electricity has fallen by 65% due to productivity improvements.

At the same time, total energy consumption increased by 15x, driven by more users and rising usage per user.

The net result was a 5x expansion of the global electricity market.

Brookfield expects that AI compute will ultimately resemble utility products like electricity

Since the release of ChatGPT, the marginal cost that OpenAI charged developers has fallen by 99% in just 18 months.

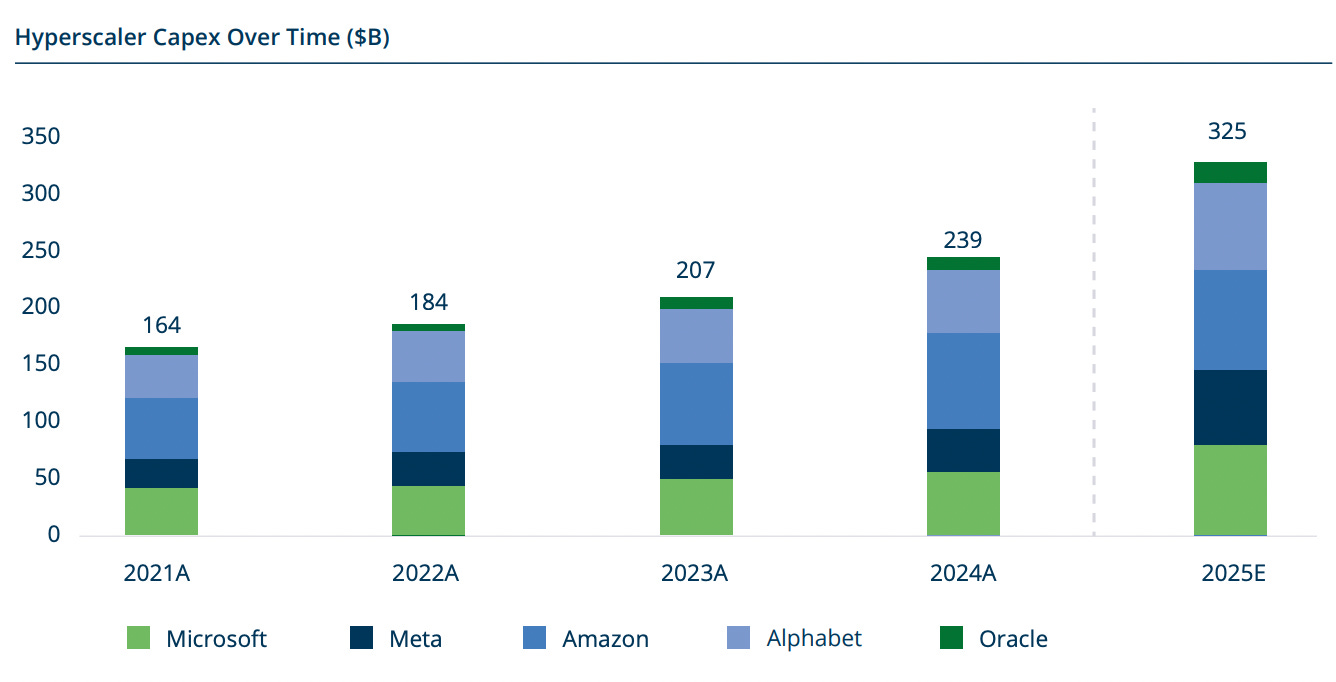

Meanwhile, Hyperscalers have doubled their capital expenditures over the last four years.

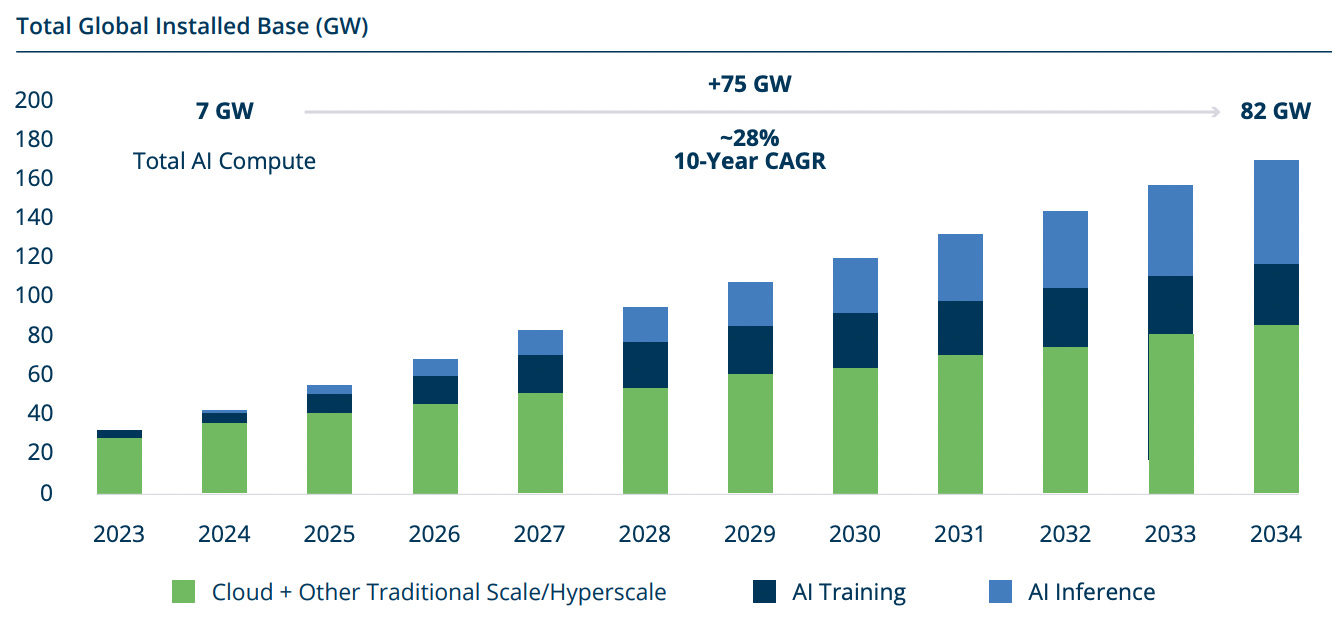

Brookfield expects AI factories will double their power capacity this year alone.

They also expect a 10-fold increase over the next decade.

Supplying reliable power has become a top priority, as AI workloads consume far more electricity than traditional IT.

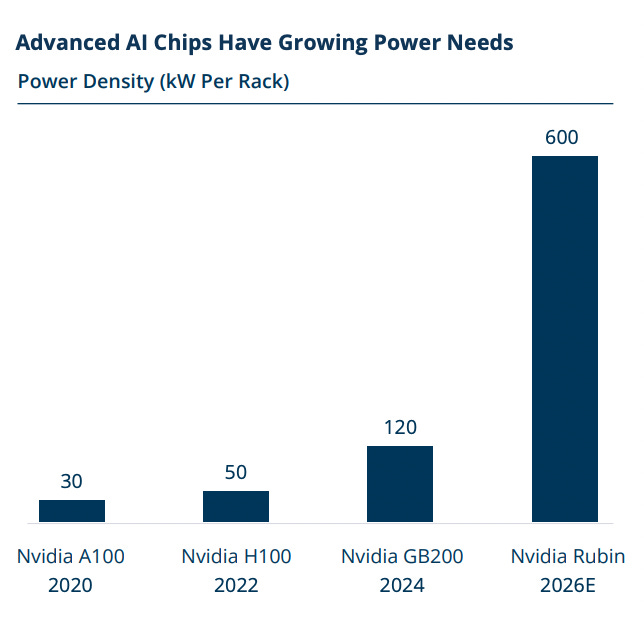

The power density of AI chips is 10x higher than that of typical servers and this is expected to rise another 5–10x in the coming years.

An Nvidia Rubin rack is about the size of your fridge, which is comforting until you realize it uses the same amount of electricity as 500 US homes.

The energy sector is facing unprecedented pressure.

And opportunity.

Brookfield forecasts that the power generation and transmission buildout could represent over $0.5 trillion in capital over the next decade.

If you’re not excited yet, read Brookfield’s full piece to learn more.

🏦 Partnership of the Week

Manulife announced it will acquire 75% of Comvest Credit Partners for $937.5 million in upfront consideration. As part of the agreement, Manulife will align its US$3.7 billion Senior Credit team with Comvest, creating a leading US$18.4 billion private credit asset management platform. Manulife intends to co-brand the new platform as Manulife | Comvest. More here

💰Fundraising News

Brinley Partners, a New York-based private credit firm, secured a $4 billion commitment from a leading U.S. insurance company. Brinley focuses on companies in the middle-market and large-cap space. The capital will fund Brinley’s inaugural CLO. Brinley’s first flagship fund, Brinley Private Debt Fund I LP, closed with ~$3 billion in 2021, inclusive of leverage. More here

OrbiMed, a New York-based healthcare investor, raised $1.9 billion for its OrbiMed Royalty and Credit Opportunities Fund V. Consistent with its predecessors, Fund V will invest in growth-oriented healthcare companies, with a focus on non-dilutive credit and royalty-based financing. OrbiMed expects to partner with healthcare companies across many sectors, including biopharmaceuticals, medical devices, diagnostics, and technology-enabled healthcare services. More here

Aperture Investors, a US-based alternative asset manager, is launching a $1 billion asset-backed finance strategy. The strategy, seeded by Generali Investments, will focus initially on North American asset-based lending, with a planned expansion into Europe. Target assets include consumer, commercial, and esoteric credit exposures, such as credit card receivables, installment and auto loans, small business lending, and royalty streams. More here

Keppel, a Singapore-based asset manager, is targeting up to $1 billion for its third private credit fund. The fund lends to Asia Pacific-based companies. It invests across a wide range of real asset sectors, focusing on defensive infrastructure-like operating businesses. This includes renewable energy, transportation, telecommunications, logistics, and social infrastructure. More here

This newsletter is for educational or entertainment purposes only. It should not be taken as investment advice.