Four reasons why private credit isn’t actually a systemic risk

Fundraising from KKR, Goldman Sachs, PGIM, Hercules and HarbourVest

👋 Hey, Nick here. A big welcome to the new subscribers from Coller Capital, Brookfield and Cascade Debt. This is the 125th edition of my weekly newsletter. If someone forwarded this to you, you can subscribe here and read my previous articles here.

📕 Reads of the Week

It’s rare to see the FT speak favourably about Private Credit, so when they do, it’s worth highlighting. If you don’t have an FT subscription, email me and I’ll gift you the article.

Four reasons why private credit isn’t actually a systemic risk. Link

Two lesser-known factors behind David Swensen’s success at Yale. Link

Golub’s Q2 Middle Market Report. Private equity-backed companies see 11th consecutive quarter of earnings growth. Link

BlackRock on Growth and Venture Debt. Link

How Real Estate Debt Is Redefining Ares’ Investment Strategy. Link

KKR and PIMCO are buying Harley-Davidson’s financing services, including its existing motorcycle loan portfolio, in a deal valued at ~$5 billion. Link

How Carlyle Is Rethinking Investment-Grade Solutions. Link

Private Credit Has a ‘Real Place’ in 401(k)s, Centerbridge Says. Link

📊 Charts of the Week

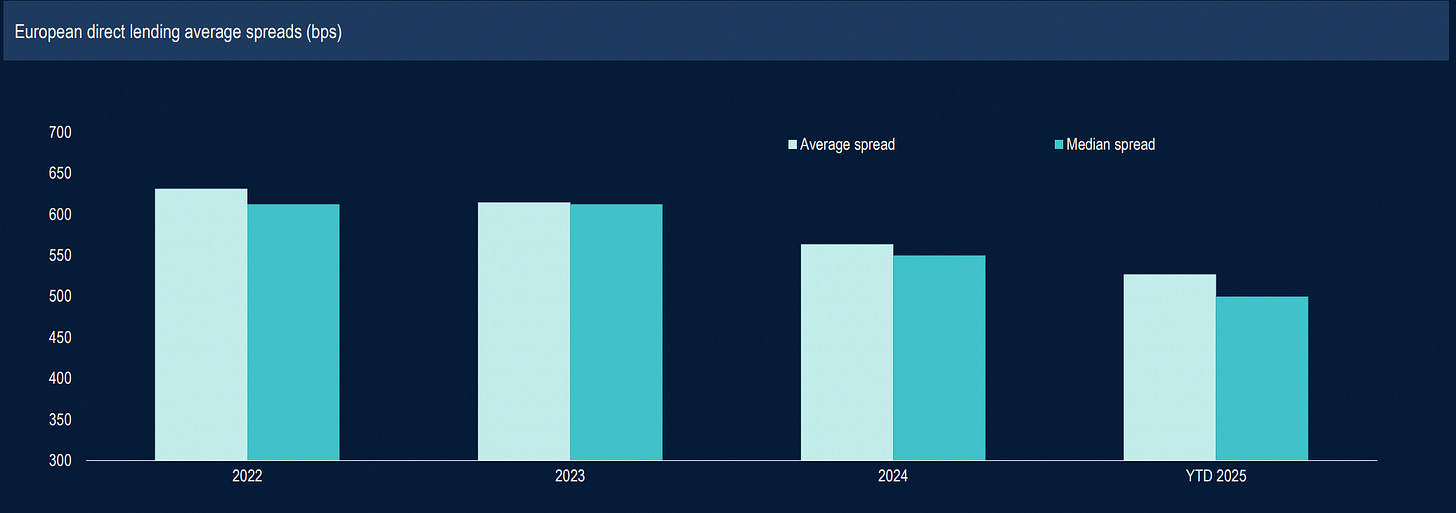

Pitchbook’s European Private Credit Monitor.

European Direct lending deal spreads continue to tighten. Median spreads of 500 bps are more than 100bps lower than in 2022. Link

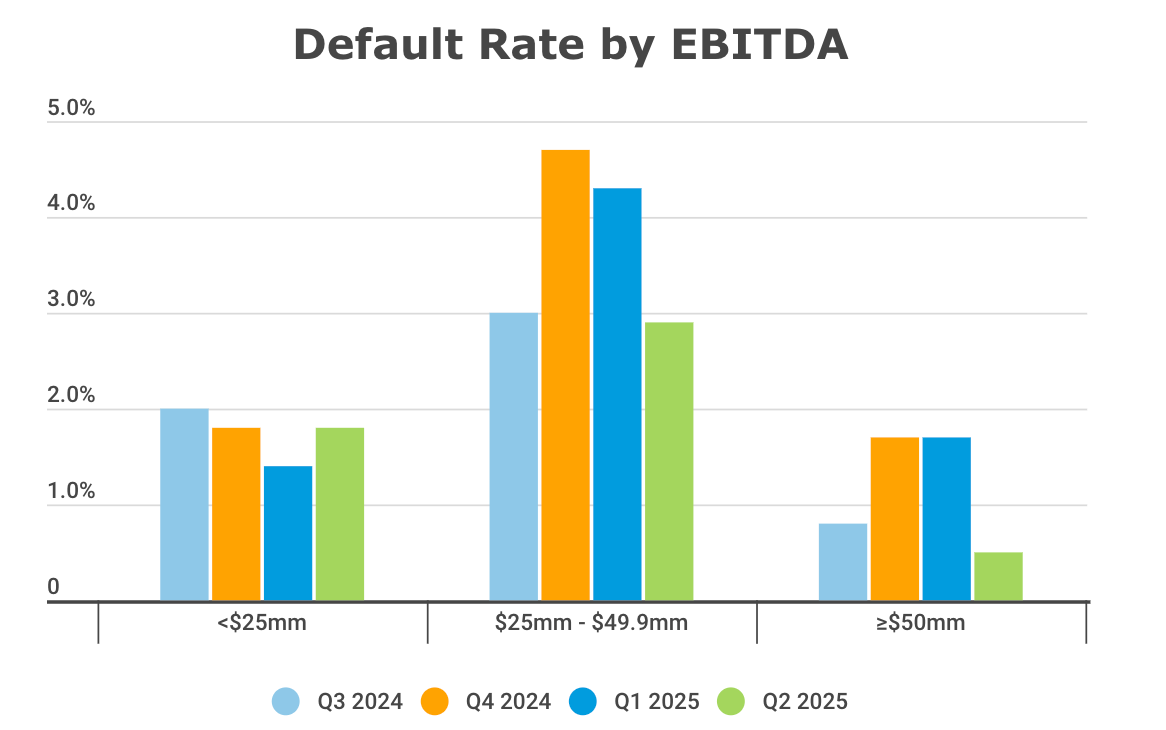

Proskauer’s Private Credit Default Index

Q2 2025 saw a default rate of 1.76%, a notable decline from 2.42% in Q1 and 2.67% in Q4 2024. Link

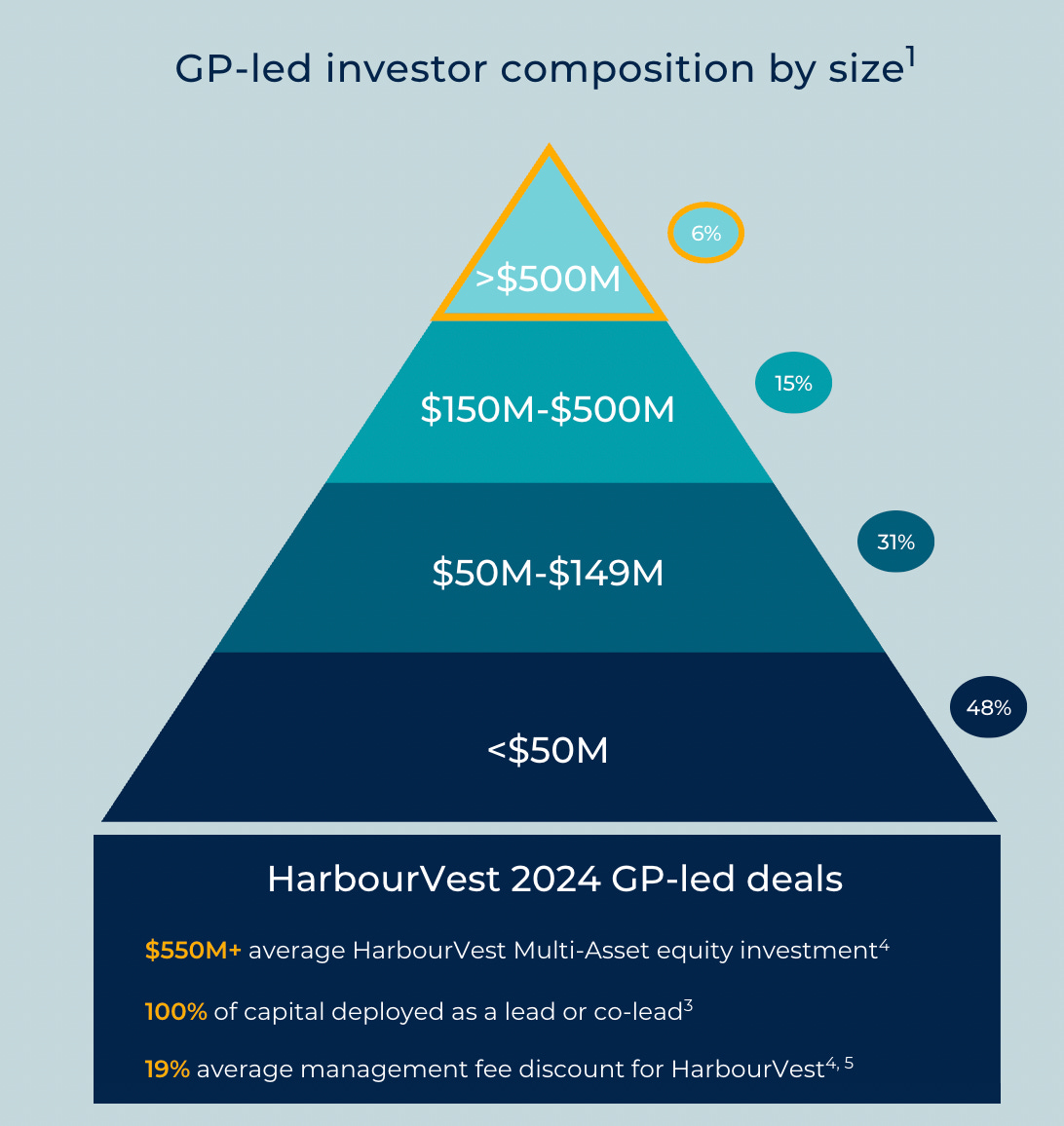

HarbourVest and The GP-Led Market: A Growing Yet Undercapitalized Segment.

The relevance of GP-led transactions as an exit path has increased, with GP-led deals rising from 5% of all PE exits in 2020 to 13% in 2024.

8 out of 10 GP-led buyers invest less than $150 million per deal.

Only 6% of buyers invest more than $50 million per deal, allowing them to negotiate critical terms such as portfolio composition, GP alignment, and economic terms. Link

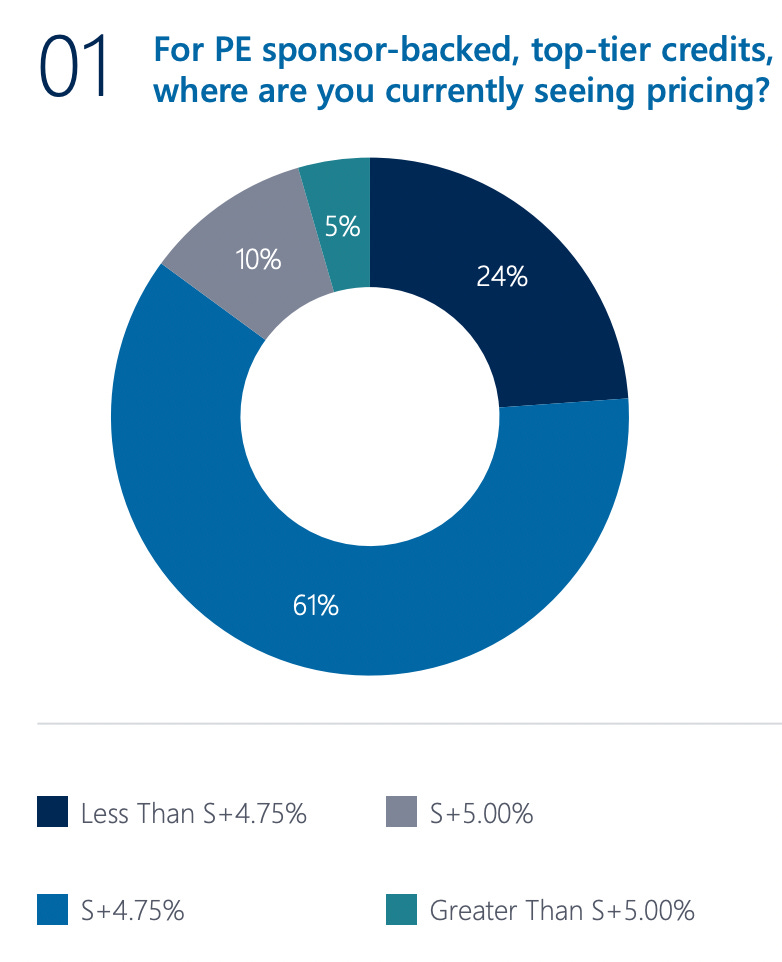

Houlihan Lokey’s U.S. Private Credit July Update

Conditions continue to favor borrowers, and pricing continues to compress. An increasing share of transactions are priced inside of S+500. Link

🏦 Partnership of the Week

Eldridge has partnered with Fifth Third Bancorp. Fifth Third will refer lending opportunities that fall outside its traditional credit box to Eldridge. In return, Fifth Third will earn fees tied to origination and may provide ancillary services such as revolving credit facilities, treasury management, and payments infrastructure, executives from both firms confirmed. The two parties anticipate originating $2 billion to $3 billion in private credit transactions over the next two to three years. More here

Antares, a Chicago-based alt manager, announced its partnership with Ascot Group, a global specialty (re)insurance company. Antares will serve as the exclusive private credit asset manager for Ascot Group. More here

💰Fundraising News

KKR closed its $5.6 billion Asset-Based Finance Partners Fund II. The strategy focuses on four key themes: Consumer/Mortgage Finance, Commercial Finance, Hard Assets, and Contractual Cash Flows. In addition, KKR’s multi-sector approach offers flexibility to invest across a range of industries, including aviation, real estate, automotive finance, mortgages, royalties, and equipment leasing, among others. More here

Goldman Sachs Alternatives has raised more than $6 billion for its evergreen European private credit strategy. The strategy invests predominantly in cash-pay, floating-rate loans to companies located primarily in Europe. It aims to build a stable portfolio by employing a “buy-and-hold” strategy. More here

PGIM, the asset management arm of Prudential Financial, closed its $4.2 billion Senior Loan Opportunities II fund, making it one of the largest middle-market direct lending fundraises this year. The fund will finance middle-market companies across North America, Europe, and Australia. It can invest in both sponsored and non-sponsored companies. More here

Hercules Capital, a California-based venture debt lender, announced a first close of its Growth Lending Fund IV. Since its inception, Hercules has committed over $22.0 billion to more than 680 portfolio companies. More here

Tacora Capital, a Texas-based venture debt fund, raised $685 million for its second fund. Unlike traditional venture debt, Tacora focuses primarily on asset-based lending to venture-backed businesses. The fund lends against loans, leases, invoices, purchase orders, receivables, and a little bit of equipment. It typically lends between $10 and $40 million per transaction. Fund I closed at $350 million, raising $250 million from Peter Thiel and the remainder from five other investors that included one large endowment and one large foundation. More here and here

HarbourVest Partners, a Boston-based investment manager, is the latest secondaries manager to launch a dedicated private credit strategy. A July 2 regulatory filing in Luxembourg shows that the firm has established HarbourVest Senior Credit Secondaries, its first private credit secondaries vehicle. More here

S3 Capital, a New York–based real estate credit manager, has raised $730 million for its LB Real Estate Credit Fund III. S3 Capital is a US-focused construction and bridge lender. The firm aims to originate senior secured, s at 55-65 percent loan-to-value in growing and established US markets. More here

Flow Capital Partners, a Hong Kong-based private lender, launched a $125 million Asia-focused credit fund. FCP, known for providing private credit to Chinese property developers, is now broadening its sector focus to include areas such as renewable energy, in line with shifting regional credit demand. More here

This newsletter is for educational or entertainment purposes only. It should not be taken as investment advice.