Hamilton Lane: Private Markets are Dull

Fundraising from Allianz, SL Green, Nuveen and AXA

👋 Hey, Nick here. A big welcome to the new subscribers from Deutsche Credit Capital Partners, MA Financial, and Citi. This is the 143rd edition of my weekly newsletter. If someone forwarded this to you, you can subscribe here and read my previous articles here.

📕 Reads of the Week

Do we have the right people, partnerships, and relationships that give us a leg up in originating and structuring the best deals, so we don’t have to reach for risk to deliver the right return?

Oaktree’s Armen Panossian on the Alt Goes Mainstream podcast

Market Updates

Europe is facing a housing shortage, and AB CarVal can help. Link

KKR: The Upper Mid-Market is Differentiated. Link

Invesco’s 2026 Market Outlook. Link

Mubadala reinforces its confidence in private credit, its top-performing asset class for the past three years.

Speaking at the Milken conference in Abu Dhabi, the deputy group CEO dismissed concerns about structural weaknesses. He said performance hinges on diversification and disciplined risk construction, not on whether the sector faces an impending downturn.

Mubadala has built a $20 billion portfolio with the likes of Apollo, Carlyle, and KKR.

👉 [Learn more here]

Bank of England to Carry Out Private Markets Stress Testing.

According to the BoE, the resilience of private markets to a severe downturn has not yet been tested in their current form.

The BoE will now work with leading managers such as Blackstone, Ares, Apollo, and Carlyle to carry out internal stress tests.

The tests will aim to:

understand how banks and non-banks would respond to a global downturn.

analyse how banks and non-banks interact at a system level.

Assess whether these interactions can amplify stress and pose risks to UK financial stability.

The bank will work collaboratively with firms to build that system-wide understanding together.

Charts of the Week

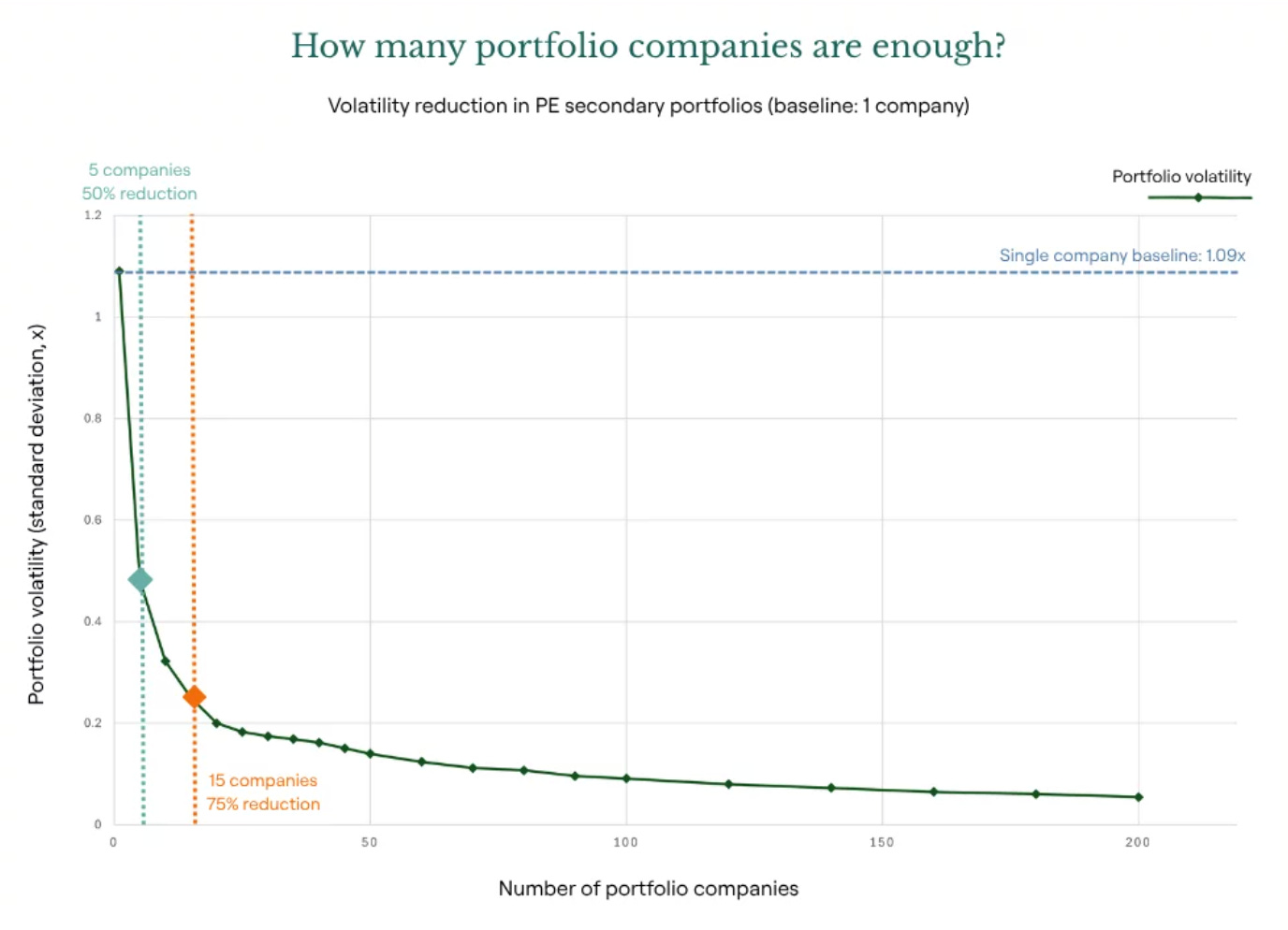

How many portfolio companies are enough?

Coller Capital says 50 [Learn more here]

Blue Owl’s pillars of defense within asset-based finance

Partnership of the Week - Carlyle, GSAM <> Willow Wealth

Willow Wealth partnered with Carlyle and Goldman Sachs Asset Management to allow its 500,000 members to directly invest in private credit.

📚 Hamilton Lane thinks private markets are dull

Hamilton Lane has published yet another compelling market update.

If you’re short on time, here are the key highlights, but the full report is well worth a read. Link

If you missed its overview earlier in the year, I’d also recommend you read it here.

Deals purchased in 2021 and 2022 are being held at valuations that aren’t currently clearing.

BUT these assets are performing, and multiples have continued to increase.

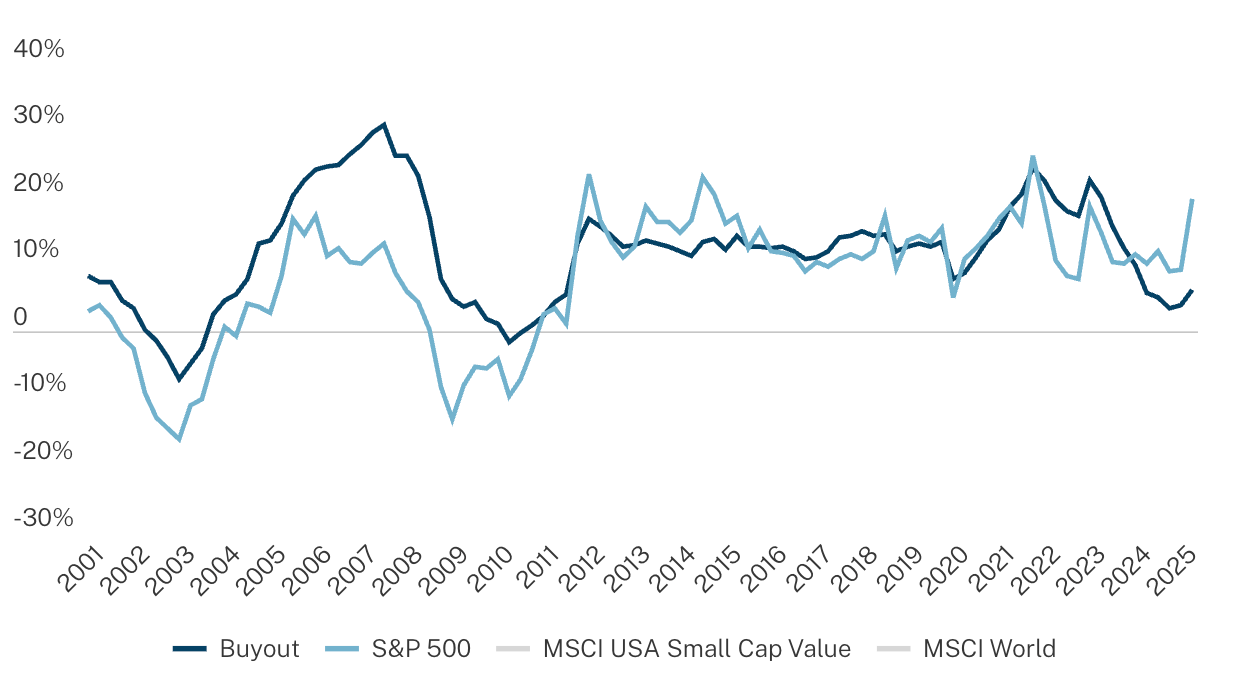

Private equity is underperforming every public index Hamilton Lane uses.

This is NOT unprecedented.

But Private equity needs to get its act together and return to outperformance.

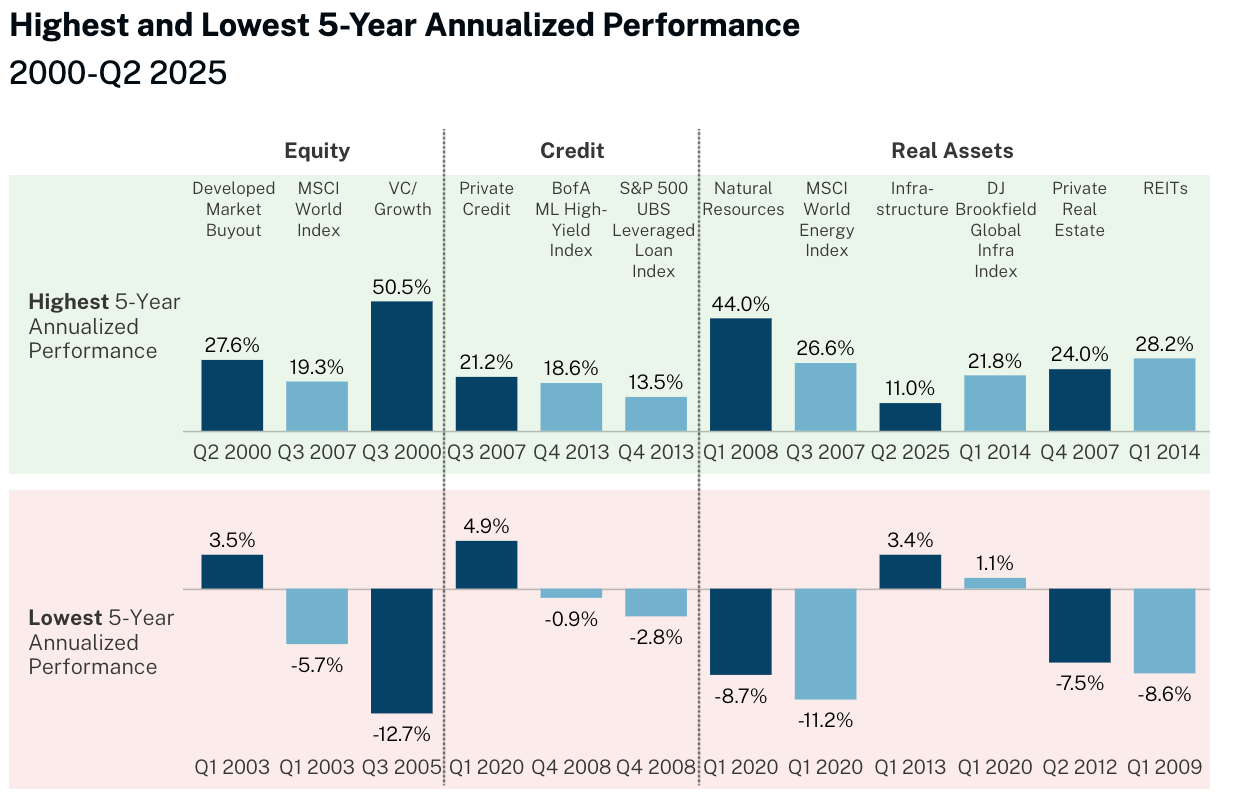

Private Credit Outperforms All Public Benchmarks

Maybe this is the most important chart in this update. We know that there is a great deal of attention paid to the risk of private markets. If risk is defined as risk of loss, it’s overstated. You really have to work hard, and incompetently, to lose money in private buyouts, credit and infrastructure. That’s a nice cushion to have. Plus, if that wasn’t enough, you aren’t giving up any upside. Your best periods in buyout and credit are better than what you get in the public markets.

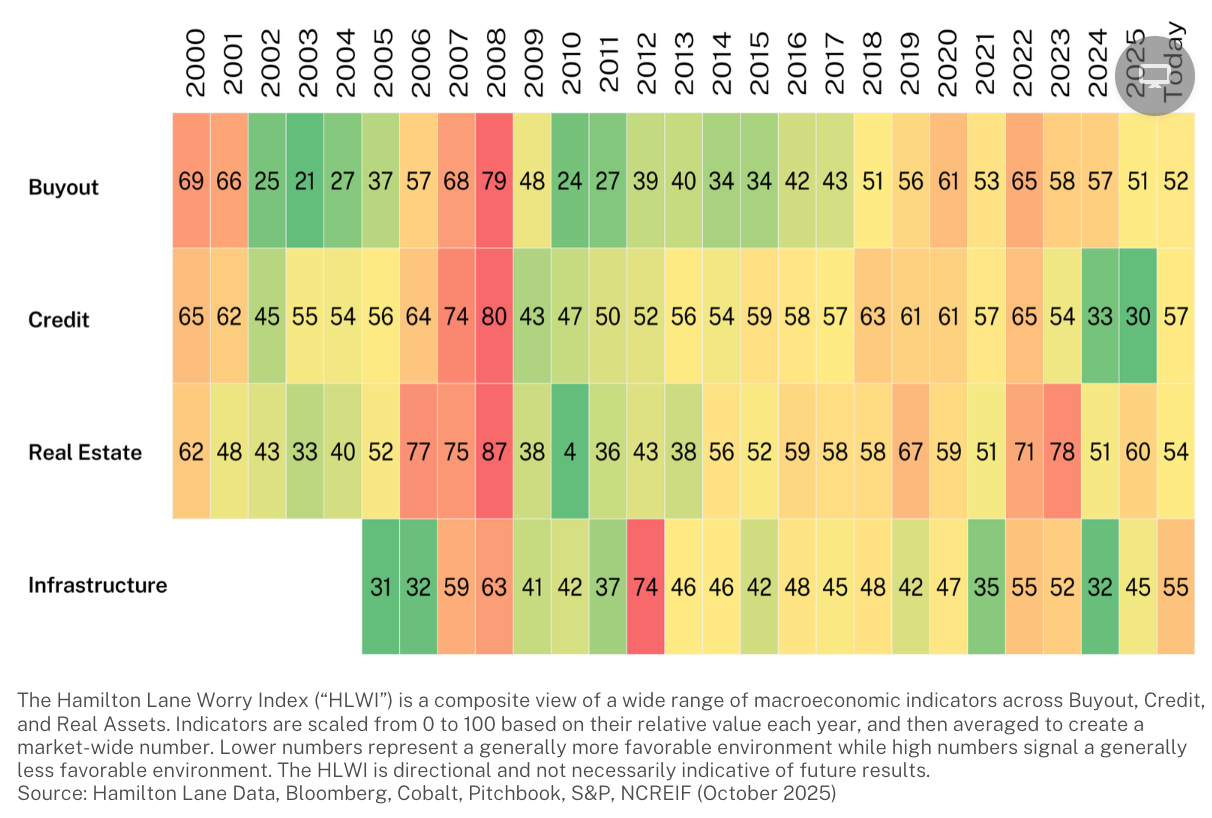

The Hamilton Lane Worry Index

The Hamilton Lane Worry Index is a composite of Hamilton Lane’s sentiment indicators.

Higher Numbers = More Worry

We know you are reading all sorts of stuff on the public markets. What are they telling you? Valuations are stretched. Market sentiment is bullish. Everything is screaming red.

That doesn’t mean it will go down, but how would you feel if our sentiment indicators had us here telling you, “Yikes, all our boxes are flaming red!” You’d be worried.

Boring is good here. You are looking at private markets that are dull and investable. No extreme behavior, no particularly worrying indicators.

The thrill is gone... for now. Boring is your friend.

💰Fundraising News

Allianz Global Investors announced a first close of $1.4 billion for its second private debt secondaries fund. The fund will invest in senior direct lending opportunities, complemented by opportunistic positions. It will build a diversified portfolio across managers and sectors, targeting the US, Europe, and Asia. More here

SL Green Realty Corp, Manhattan’s largest office landlord, closed its $1.3 billion Opportunistic Debt Fund. The Fund targets high-quality assets in New York City. It will originate new loans and/or purchase existing loans, loan portfolios, and controlling CMBS securities. More here

Nuveen, a US-based manager, closed its $650 million U.S. Strategic Debt Fund. The fund focuses on commercial real estate across the United States. It finances senior loans secured against transitional real estate properties requiring physical, operational, or financial restructuring. The current portfolio is diversified across multifamily (60%) and industrial (40%) properties in 16 markets nationwide. More here

AXA announced a first close of $340 million for its Infrastructure Resilience Development Fund. The fund will be managed by GIP and is a partnership with the Insurance Development Forum. It will invest in small to medium-sized commercial infrastructure projects across Latin America, Asia, and Africa, and aims to build a portfolio of resilient infrastructure assets, including clean water and water management, waste management, energy, transportation, hospitals, digital infrastructure, and other vital assets. More here

DMI Alternatives, an India-based manager backed by MUFG, raised $120 million for its first private credit fund. The fund will invest in sectors that benefit from long-term growth trends driving India’s economic expansion, including health care, technology, and financial services. More here

Wentworth, an Australian real estate private equity firm, launched its private credit platform. The fund will focus on transitional lending to performing real estate in Australia and New Zealand, targeting double-digit returns for investors. The platform’s typical deal size will be between ~$15 and $60 million. More here

This newsletter is for educational and entertainment purposes only. It should not be taken as investment advice.

Hi all, Sorry, I realise the Hamilton Lane and Blue Owl links were wrong in the email. These have been corrected on Substack. Sorry about this.