How do Sovereign Wealth Funds expect allocations to private credit to change?

Fundraising from AlbaCore Capital, Twain Private Credit, Arrow Global, SMBC, Soleus Capital.

👋 Hey, Nick here. A special welcome to the new subscribers at W. P. Carey. This is the 72nd edition of my weekly newsletter. Each week I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here.

📕Reads of the week

Fortress aims to double AUM to $100 billion as it aims to compete with Ares, Apollo and Sixth Street. Grow or become irrelevant… Link

Low Fees Help Ares Exceed $10B Private Credit Target Link

Blackstone Bets on Growth in Private Credit Business Outside US Link

Private Credit Funds Identify Latin America as the Next Frontier Link

How private equity tangled banks in a web of debt Link

📝 Invesco Sovereign Asset Management Study

Invesco gathered insights from 140 senior investment professionals, representing 83 sovereign wealth funds and 57 central banks. Together, these organisations oversee approximately US$22 trillion in assets under management. Below are my three favorite insights. You can read the full report here

How do you expect your allocation to private credit to change next year?

(% of respondents)

Private credit is now a widely adopted strategy among sovereign wealth funds, with 56% of respondents participating through fund investments. The role of private credit in investment strategies looks set to grow, with two-thirds of sovereign wealth funds planning to increase their allocations to private credit in the coming year.

What is the appeal of private credit for your fund?

(% of respondents)

The growing interest in private credit can be attributed to several key factors. Chief among these is the asset class’s potential for diversification from traditional fixed income sectors.

Where does the increased allocation to private credit come from?

(% of respondents)

The sources of these additional allocations vary, with sovereign wealth funds primarily reallocating capital from fixed income, public equities and private equity.

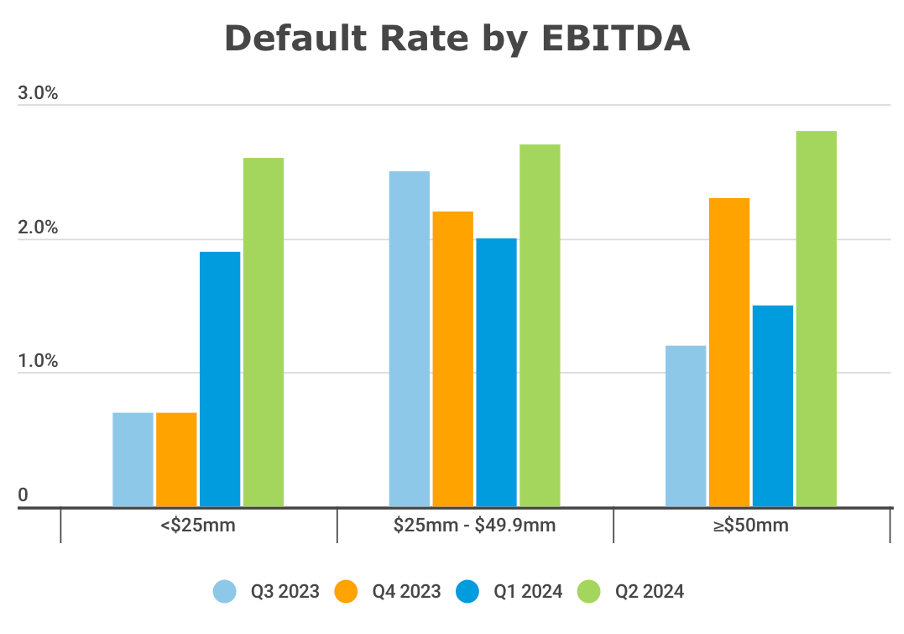

📊Private Credit Defaults Increase

Proskauer, published its Private Credit Default Index. You can read the full report here

The overall default rate increased for the third consecutive quarter default to 2.71% in Q2 2024. The index, which includes 922 active loans representing approximately $150.7 billion in principal of senior-secured and unitranche loans in the United States.

This is the third consecutive quarter in which defaults have risen. The rates in Q1 2024, Q4 2023 and Q3 2023 were 1.84%, 1.60% and 1.41%, respectively.

💰Fundraising news

AlbaCore Capital LLP, a London-based credit manager, is reportedly raising $2.2 billion for a new senior direct-lending strategy. The fund will finance European leveraged buyouts with senior secured loans. AlbaCore manages about $9.4 billion of assets and has traditionally focused on higher-yielding debt such as capital solutions and opportunistic credit. More here

Twain Private Credit, a Mississippi-based investment manager, launched its Truman Fund. The fund will lend to small businesses in Mississippi and neighboring states–such as Oklahoma, Arkansas, Alabama, and Georgia. The fund is a Small Business Investment Company. More here and more about SBICs here

Arrow Global, a UK-based asset manager, raised $400 million for its European Real Estate Lending strategy from the Abu Dhabi Investment Authority. The strategy finances real estate investors and developers throughout the lifecycle of their projects. Arrow Global lent over €1.2 billion in 2023 which, to date, has funded the development of more than 18,000 units, spanning more than 11,000,000 square feet of real estate. More here and more from Arrow’s real estate team here

SMBC, the Japanese bank, raised ~$500 million for its maiden private credit fund. The fund will provide senior secured loans to sponsored middle-market businesses in Europe. It will invest alongside SMBC Group’s balance sheet-driven private credit funds including its joint venture with Park Square Capital. The European Middle Market Credit Fund was established through a secondary purchase of a strip of investments held on SMBC Group’s balance sheet, which forms a seed portfolio of high-quality, performing loans, alongside a primary capital commitment. The deal was led by Pantheon’s private credit secondaries business. More here

Soleus Capital, a Connecticut-based life sciences specialist, is raising $250 - $300 million for its first credit fund. Like its other funds, the manager will focus on companies primarily in biotech, medtech, diagnostics, and genomics. The fund will lend senior secured loans, asset-backed financing, and senior convertible securities to small and midsize companies. Most of the investments will be in U.S.-based commercial-stage companies, both privately held and publicly traded. More here

This newsletter is for education or entertainment purposes only. It should not be taken as investment advice.