Howard Marks on Cockroaches in the Coal Mine

Fundraising from Greystar, D.E. Shaw and Point72

👋 Hey, Nick here. A big welcome to the new subscribers from Altavair, HarbourVest and Invesco. This is the 139th edition of my weekly newsletter. If someone forwarded this to you, you can subscribe here, and read my previous articles here.

📕 Reads of the Week

Warrent Buffett is “going quiet.”

Market Updates

Deepdives

Interviews

Apollo on What’s Driving the Shift in Portfolio Construction

Partnerships

Apollo formed its first South Korean partnership, teaming up with KB Securities, to pursue private credit opportunities in one of Asia’s fastest-growing alternative lending markets.

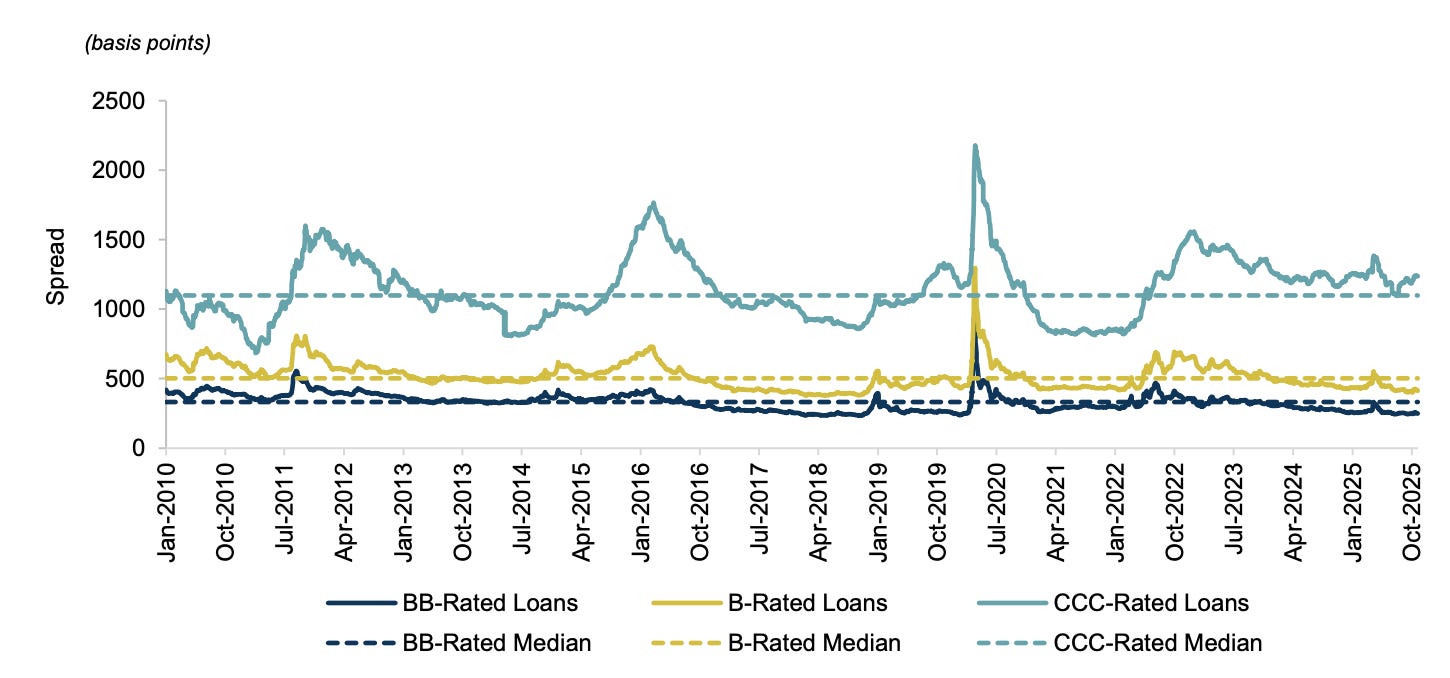

The credit market remains bifurcated by quality

CCC-rated loans are trading outside their historical average, with an average spread in excess of 1,200 bps.

When dispersion is this dramatic, fundamental, bottom-up credit selection is especially critical.

👉 [Learn more here]

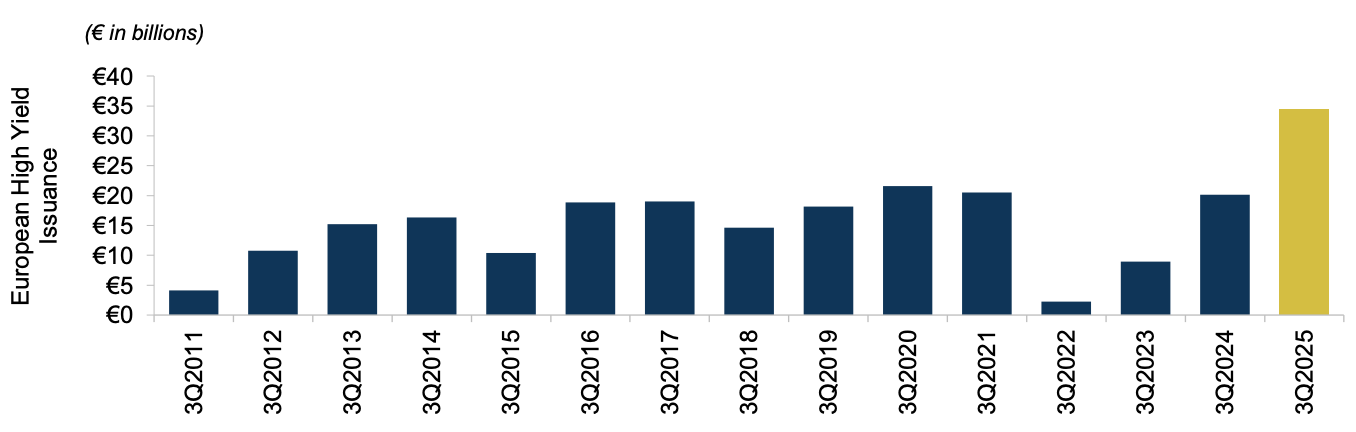

Q3 Was a Record for European High Yield Issuance

The third quarter saw record European CLO activity, as robust demand for liabilities helped AAA-rated spreads compress back below 130 basis points for tier-one managers.

Senior loans also finished September at record issuance levels for the year-to-date period.

Direct lending activity has been strong, with over €30bn of volume so far this year, exceeding the level for the same period in 2024.

👉 [Learn more here]

📚 Howard Marks on Cockroaches in the Coal Mine

With the media absorbed by “bubble” narratives, Howard brings the discussion back to fundamentals. Below are my favorite sections, but I’d highly recommend that you read the memo in full (here).

Defaults are a normal part of life in sub-investment grade investing.

The truth is that there are always defaults... Over my 47 years in the high yield bond market, more than 2% of all bonds by value have defaulted in a typical year, and many more during crises.

If you apply that percentage to the number of sub-investment grade issuers, which runs in the thousands, it shouldn’t come as a surprise if there are a few dozen defaults in a normal year…

It’s just a reminder that the yield spreads people care about so much are there for a reason: because sub-investment grade debt entails credit risk

Good times usually lead to a lowering of lending standards, giving rise to elevated defaults and an occasional fraud.

Security prices fluctuate much more than do the intrinsic value and prospects of the underlying companies.

The main reason for this is the extreme volatility in the way people feel about risk.

When the economy is humming, companies are reporting growing earnings, security prices are rising, and profits are piling up, people say things like: “Risk is my friend.”

Charlie Munger and I used to enjoy talking about the economist John Kenneth Galbraith.

One [concept] I haven’t mentioned since my memo, The Long View, is the “bezzle”.

What’s a bezzle? In short, according to Galbraith, it’s the wealth financial fraudsters or embezzlers appear to have created, which lifts the spirits of the beneficiaries up until the time they’re found out.

Charlie used to say the good times described above, in giving rise to a low level of prudence, create the necessary conditions for “a good bezzle.”

Even though money is plentiful, there are always many people who need more. Under these circumstances, the rate of embezzlement grows, the rate of discovery falls off, and the bezzle increases rapidly.

In depression, all this is reversed. Money is watched with a narrow, suspicious eye. The man who handles it is assumed to be dishonest until he proves himself otherwise. Audits are penetrating and meticulous. Commercial morality is enormously improved. The bezzle shrinks.

In heady times, rather than say, “That’s too good to be true,” people are more likely to ask, “How can I get in on that?”

A Case in Point: First Brands

Even in advance of First Brands’s bankruptcy filing, Oaktree’s research turned up the following red flags:

only six years of operating history but already $5 billion of annual sales

controlled by an individual with almost no media references or online profile

a significant litigation history, including allegations of misconduct

reported profit margins above the industry average

a large number of M&A transactions creating a web of corporate entities

In investment research, conclusions usually aren’t compellingly obvious, but instead built up from inferences and probabilities. It’s not a matter of one decisive discovery at an “aha moment” but rather the assembly of individual snippets of information into a “mosaic” that leans toward a conclusion based on what in law is called “a preponderance of the evidence.”

In detecting credit defects, the big payoff is for being early.

If you reach a negative conclusion at the same time as everyone else, the price you’ll get for your holdings is likely to be marked down to fully reflect the negatives – that’s market efficiency.

We’ve lived through generally good times in the last 16 years. The coming period is likely to be more “interesting,” as errors that were made in those good times come to light.

💰Fundraising News

Greystar - Credit Opportunities Fund II - $1.3 billion

The residential real estate manager has now raised five credit funds across fixed income and direct lending strategies.

This fund will invest in debt collateralized by for-rent residential assets.

It can also provide construction loans, finance industrial assets, and purchase securities backed by residential collateral.

The fund has already committed $1.6 billion in loans.

D. E. Shaw - Diopter Fund II - $1.3 billion final close

A New York-based investment manager with more than $65 billion in investment capital.

The strategy focuses on providing regulatory capital relief financing for banks.

These include capital relief, capital optimization, risk transfer, risk sharing, or other similar transactions.

Point 72 - $1 billion evergreen fund

The US hedge fund is in preliminary conversations to raise money next year.

This newsletter is for educational or entertainment purposes only. It should not be taken as investment advice.