Inside Brookfield's Next Phase

The Five-Year Path to Double its Earnings

👋 Hey, Nick here. A big welcome to the new subscribers from Ardian, Golub, and StreetCred PR. This is the 136th edition of my weekly newsletter. If someone forwarded this to you, you can subscribe here, and read my previous articles here.

📕 Reads of the Week

When you see one cockroach, there are probably more.

Everyone should be forewarned on this one.

I put [First Brands] in the same category, and there are a couple of other ones out that I’ve seen that I put in a similar category.

There clearly was, in my opinion, fraud involved in a bunch of these things. But that doesn’t mean we can’t improve our procedures.

Jamie Dimon on Tricolor (Source: Q3 Earnings Transcript)

1) Celebrating 35 Years of Memos with Howard Marks

Congratulations to Howard on 35 years of Memos.

👉 [Read The Best of Howard’s memos here]

2) Covenant Lite with the best BDC post I’ve read this year

Public BDCs have spent less than 10% of their time trading 20% below book value in twenty years of data. But that is where they find themselves trading today.

So, what is going on?

Covenant Lite analyses four potential causes:

Fear that Tricolor and First Brands Bankruptcies Foreshadow More Private Credit Losses

Institutional Underownership

Capital Flows to Private/Nontraded BDC

Interest Rate Pivot and NII Headwinds

👉 [Read more here]

3) Ares Global Credit Monitor - Third Quarter 2025

Day-to-day uncertainty and big headlines are likely to continue over the next quarter.

But, broader activity across credit and equity markets has picked up globally, with all major markets now open for business and even IPOs coming back to life after a long period of anemic activity.

Concerns that markets are priced to perfection and that bumps in the road could derail activity are a valid consideration.

The medium-term outlook looks clearer for now and is an improvement over the second quarter.

👉 [Read more here]

4) Other Notable Reads

Blue Owl on the outlook for private credit. Link

JPMorgan Eyes SRT Deal Tied to $2 Billion of Private Jet Loans. The potential size of the SRT could be about $250 million, equivalent to around 12.5% of the total loan pool. JPMorgan has also held preliminary inquiries with investors to gauge appetite for an SRT tied to loans used to purchase artwork. Link

Meta is set to seal a $30 billion finance package for its data center site in rural Louisiana. Meta and Blue Owl will split ownership of the Hyperion data center site. Morgan Stanley arranged more than $27 billion debt. Link

“I guess [Jamie Dimon’s] saying there might be a lot more cockroaches at JPMorgan” Marc Lipschultz at CAIS Summit. Link

📊 Brookfield Corporation’s 2025 Investor Day

Brookfield held its 2025 Investor Day a few weeks ago.

One thing that’s become obvious. The biggest managers have scaled massively over the last 20 years. (See my previous summaries for Apollo, Blue Owl, BlackRock, KKR, and Ares)

One thing I’m questioning?

How do I get a job in “strategy” at one of these managers? Is the brief to Ctrl+C the industry-standard “double in five years” slide and Ctrl+V our logo? (See Blue Owl, Apollo, BlackRock, and below)

Below are my highlights, 👉 [Watch the full presentation here]

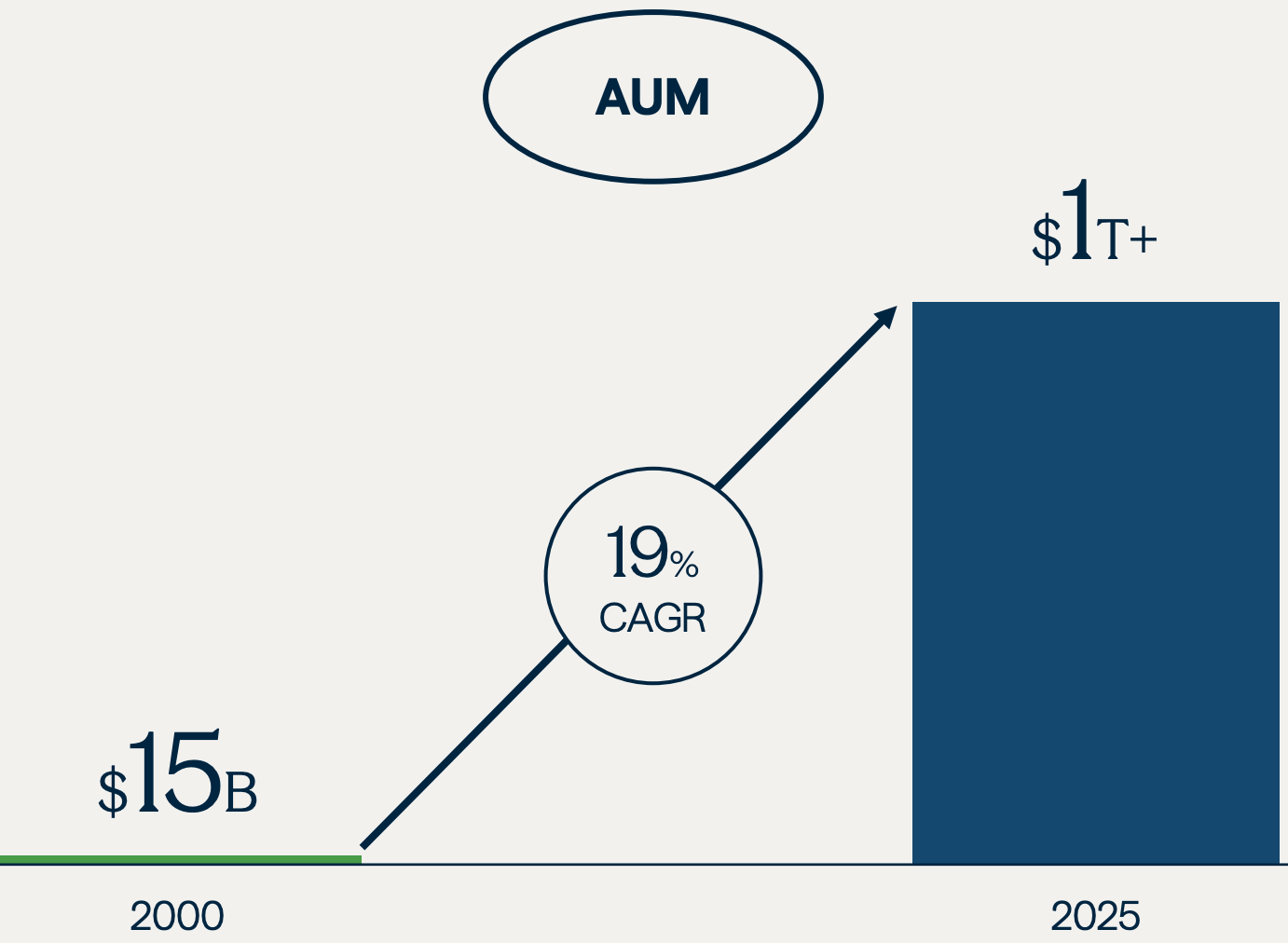

Brookfield has demonstrated its ability to scale

Having scaled AUM from $15 billion to $1 trillion over the last 25 years, Brookfield shared its playbook for achieving this success:

Identify secular trends.

Create products that serve its clients.

Attract capital at scale.

It will use this playbook to double its earnings over the next five years.

1) Three secular trends driving Brookfield’s 5-year plan

Financing AI factories could be Brookfield’s largest business within the next 10 years.

An aging population means that US retirement accounts will grow from $40 billion today to over $100 trillion by 2040. This trend is consistent across all Western markets.

The real estate recovery is here. Everybody’s back at work, and retail supply remains constrained.

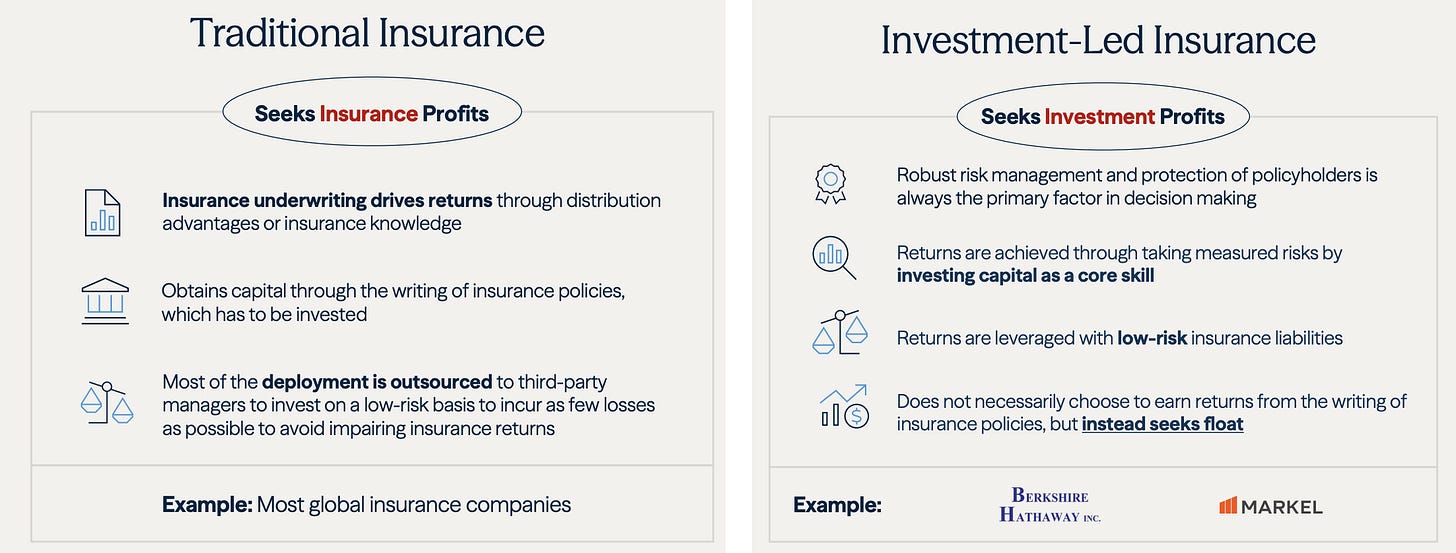

2) Brookfield Wealth Solutions will be a fully integrated, investment-led insurance organization

“What does investment-led insurance organization mean?”

“Traditional insurance underwrites insurance, and tries to make money by underwriting insurance. It takes the float it gets, and it gives it to managers, and tries to not lose money.

Make profit out of insurance, don’t lose money on float, equals profitability of your insurance company.

Investment-led insurance turns that upside down. We have extremely strong risk management.

We try to achieve returns out of investments. We try not to lose money on insurance.

Insurance companies are good at what they do. They underwrite insurance. They’re trying to make profits.

Investment-led insurance is the exact opposite of that, and that’s what we’re trying to do with the business.

Many of the things we do are long-tailed assets, which match long-term liabilities. Our long duration investing matches that float.

Our model is designed to maximize capital efficiency, and enhance returns without taking any more risk on the asset management side.

Bringing it together, investing in operating capabilities with wealth flows are a significant portion of the next future of Brookfield Corporation

3) The building blocks are now in place to double earnings over the next five years

Brookfield has built leading origination platforms in the U.S., in Canada, in the UK, and is focused on expanding further into Asia.

They expect these highly cash-generative businesses to generate $53 billion of free cash flow over the next five years.

They also plan to scale insurance assets to $350 billion over the next five years.

👉 [Watch the full presentation here]

📊 Partnerships of the week

Brookfield x Oaktree

Brookfield has acquired the remaing 26% of Oaktree shares for total consideration of $3 billion.

The shares will be subject to two-year and five-year lock-ups.

The acquisition further cements the partnership, which has helped Oaktree increase its AuM by 75% since it began.

Howard Marks and Bruce Karsh continue their involvement at senior levels of the business.

Robert O’Leary and Armen Panossian, Co-CEOs of Oaktree, will also become Co-CEOs of Brookfield’s credit business.

👉 [Read more here]

Barings x Principal Asset Management

Principal will allocate up to $1 billion in investment-grade portfolio finance originated by Barings.

👉 [Read more here]

💰Fundraising News

Bain Capital Credit launched a new BDC, Bain Capital Private Credit. The fund will be available to investors in 33 states and will invest in US middle-market senior secured, floating-rate loans. It will also invest in select junior capital investments to enhance yield. More here

Plexus Capital, a North Carolina-based manager, closed its $1 billion Fund VII. The structured capital strategy invests debt accompanied by equity ownership in profitable companies with $10 – $100 million of revenue and $2 – $12 million of EBITDA. The fund sources deals from independent sponsors, search funds, private equity groups, and management teams. More here

CBC Group, Asia’s largest healthcare-dedicated asset management firm, closed its $500 million R-Bridge Healthcare Fund II. The fund finances biotech, biopharma, medical technology, and healthcare services companies with non-dilutive financing, backed by Asia-sourced healthcare royalty interests or through a range of alternative financing structures. The fundraise represents one of the largest private credit funds focused on healthcare raised to date for an Asia-based firm. More here

Janus Henderson, a London-based asset manager, announced a first close of its $300 million Shariah-compliant direct lending vehicle, Janus Henderson MENA Private Credit Fund IV. The fund is expected to make 10 to 12 investments of $15 million to $50 million throughout its eight-year life. The final close is scheduled for mid-2026. More here

SaaS Capital, an Ohio-based debt lender, closed its $100 million Fund V. The fund lends to “Subscription AI and Software” businesses focusing on B2B companies with at least $3 million in annualized recurring revenue. More here

This newsletter is for educational or entertainment purposes only. It should not be taken as investment advice.

The Ares Global Credit Monitor highlights are reassuring - markets being open for business across all regions is a positiv development. Their perspective on the medium-term outlook improving from Q2 makes sense given the stabilization in rates and equity market activity. Interesting contrast with the Brookfield content - both firms scaling aggressively but taking different paths with insurance vs. direct origination platforms.