Inside Q3’s Tight Spreads and the Flight to Europe

Fundraising from Investec, Castelake and Monroe

👋 Hey, Nick here. A big welcome to the new subscribers from Allianz, MUFG and Lazard. This is the 142nd edition of my weekly newsletter. If someone forwarded this to you, you can subscribe here and read my previous articles here.

📕 Reads of the Week

Direct lending has become more of a beta strategy.

It’s mostly a return the market gives you, and you’re unlikely to do much better or much worse.

Buffett talks about the fact that he used to be able to buy dollars for 50 cents. You can’t do that if there are 700 highly motivated private credit managers competing against you and everybody has a computer and complete information.

Market Updates

Houlihan Lokey - U.S. Private Credit Market Update. **Recommended** Link

Benefit Street Partners - Looser covenants and PIK toggles make private credit a great home for the upper middle market. Large Cap borrowers are 10x more likely to have PIK toggles. Link

Building the case for Europe

Pemberton - The tilt towards Europe is starting to show. (Europe continues to outperform US vs last year)

Pemberton sees three major explanations for this nascent trend:

Relative value: Europe’s relatively immature private credit market has fewer scale players, and net returns are generally 100 bps higher than in the US.

Diversification: Investors with concentrated exposure to the US are increasingly diversifying their risks.

Europe’s consolidation: The European mid-market is inherently fragmented across distinct national economies. This provides an opportunity for buy-and-build strategies across multiple sectors to achieve pan-European scale. As this consolidation trend plays out, it should continue to drive material additional demand for private credit.

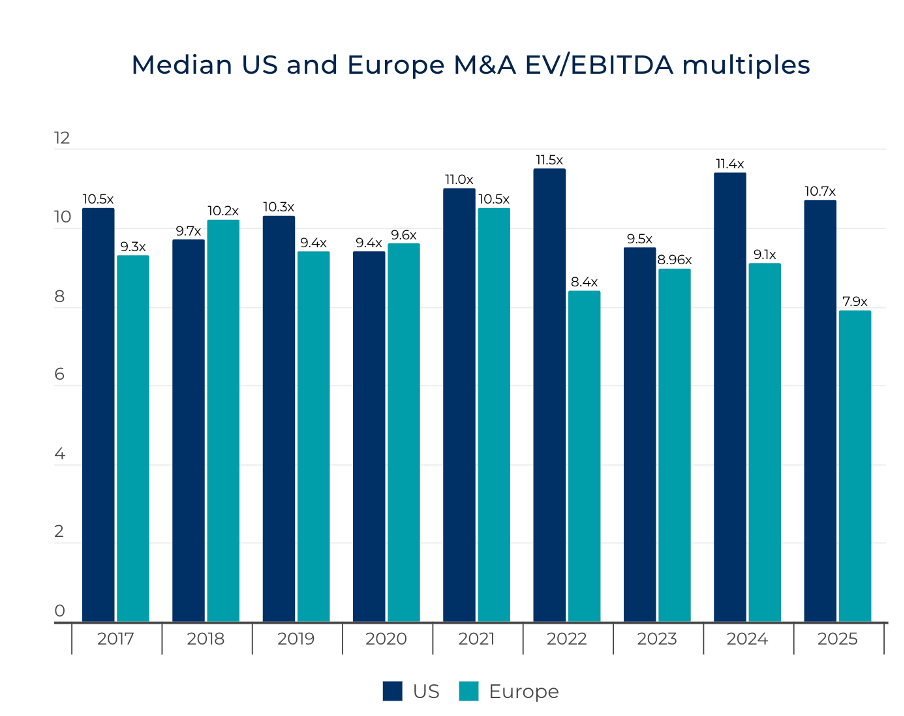

HarbourVest - Europe’s Lower EV/EBITDA multiples and a fragmented corporate landscape offer a fertile ground for investors

The Solution to Private Equity’s Liquidity Dilemma?

Pemberton is now offering GP-led, LP-elective NAV loans.

The solution is designed to replicate the benefits of NAV loans and continuation vehicles in one structure.

How it works

The GP consults with LPs to identify those seeking liquidity.

Those LPs and the GP recapitalise their fund commitments via a NAV loan raised at an SPV ‘above’ the fund.

Pemberton provides a further NAV loan at the fund level for growth capital.

Key Benefits for LPs

All upside is retained by existing investors with fresh capital provided for growth, if required.

LP elected liquidity, which is not divisive and preserves alignment.

IRR/DPI/fees unaffected at the fund level.

Key Benefits for GPs

No new LPs required.

Removes pressure for immediate DPI.

Preserves management fee streams.

Partnership of the Week - Investec & Carlyle AlpInvest

Investec & Carlyle AlpInvest partnered to launch Investec’s inaugural European senior debt fund.

The fund was established through an innovative credit secondary transaction led by Carlyle AlpInvest, comprising of a secondary purchase of performing loans from Investec’s balance sheet to form a seed portfolio.

In addition, Carlyle AlpInvest provided significant new capital, which is available alongside this portfolio to invest in new direct lending investments.

The fund will focus on financing senior secured loans to European-sponsored and unsponsored mid-market businesses. between

It will primarily lend to companies with €3m to €50m of EBITDA that are based in the UK, Ireland, Benelux, and DACH regions.

👉 [Learn More Here]

📚 Q324 Credit Market Update.

Configure Partners published its Q324 Credit Market Update.

Below are two of my favorite insights, but you should also read the full update here. I’d highly recommend it.

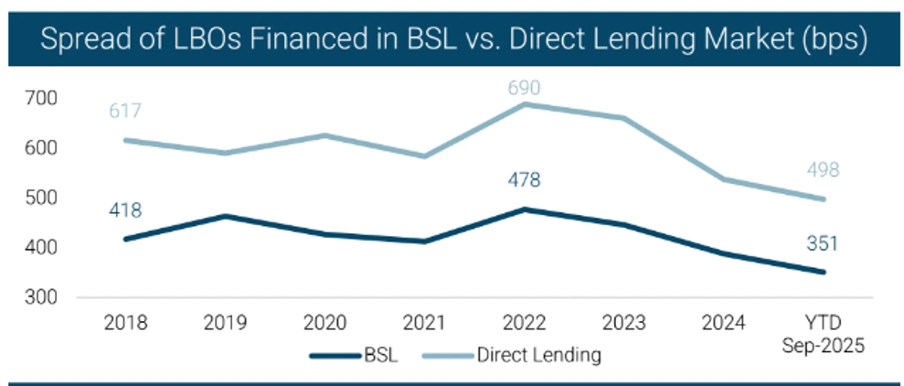

Spreads are at all-time tights

Pricing continues to compress

This is most noticeable in buyout financings where more than 50% of new issue transactions are priced below S+500.

In addition to tighter pricing, structures are becoming more flexible and borrower-friendly.

Despite this, private credit still has a 125 to 150bps premium to BSL.

The “Deal Dam” is real

M&A volumes have accelerated, and momentum is expected to continue into year-end.

The spread gap between LBO raises and refinancing transactions has largely disappeared.

Leverage is coming back

Read the full update here.

💰Fundraising News

Investec & Carlyle AlpInvest - European Senior Debt Fund - €400m

Investec & Carlyle AlpInvest partnered to launch Investec’s inaugural European senior debt fund.

The fund was established through an innovative credit secondary transaction, led by Carlyle AlpInvest, comprising of a secondary purchase of performing loans from Investec’s balance sheet to form a seed portfolio.

In addition, Carlyle AlpInvest provided significant new capital, which is available alongside this portfolio to invest in new direct lending investments.

The fund will focus on financing senior secured loans to European-sponsored and unsponsored mid-market businesses. between

It will primarily lend to companies with €3m to €50m of EBITDA and based in the UK, Ireland, Benelux, and DACH.

Castlelake - European Senior Secured Asset Backed Private Credit - €450m First Close

The fund will target loans between €20 and €75 million and will not use back leverage.

The fund will invest in real estate, consumer credit and SME finance.

Monroe Capital - PCL CLO 1 - $730.7 million

This marks the US manager’s third CLO transaction in 2025.

It is secured by a portfolio of lower and core middle-market senior secured loans.

The issued debt tranches were rated from AA through BBB.

Monroe’s CLO platform now manages over $4.5 billion in assets.

Enko Capital - African Private Credit - $30 million investment

The fund is targeting a final close of $150 million in second half of 2026, with a hard cap of $200 million.

The fund lends to growing companies in Africa.

Eurazeo - Prime Income Credit - €100 million ELTIF2.0

The evergreen fund will be distributed across the European wealth channel.

This newsletter is for educational or entertainment purposes only. It should not be taken as investment advice.

Great read, as always!