Why Fund Structure Drives Direct Lending Returns

Fundraising from Bridge Investment, Viola, Ares and Breakwall

👋 Hey, Nick here. A big welcome to the new subscribers from Beach Point, Aksia, and Blue Owl. This is the 138th edition of my weekly newsletter. If someone forwarded this to you, you can subscribe here, and read my previous articles here.

📕 Reads of the Week

1) Is Fund Structure the Secret Sauce in Direct Lending?

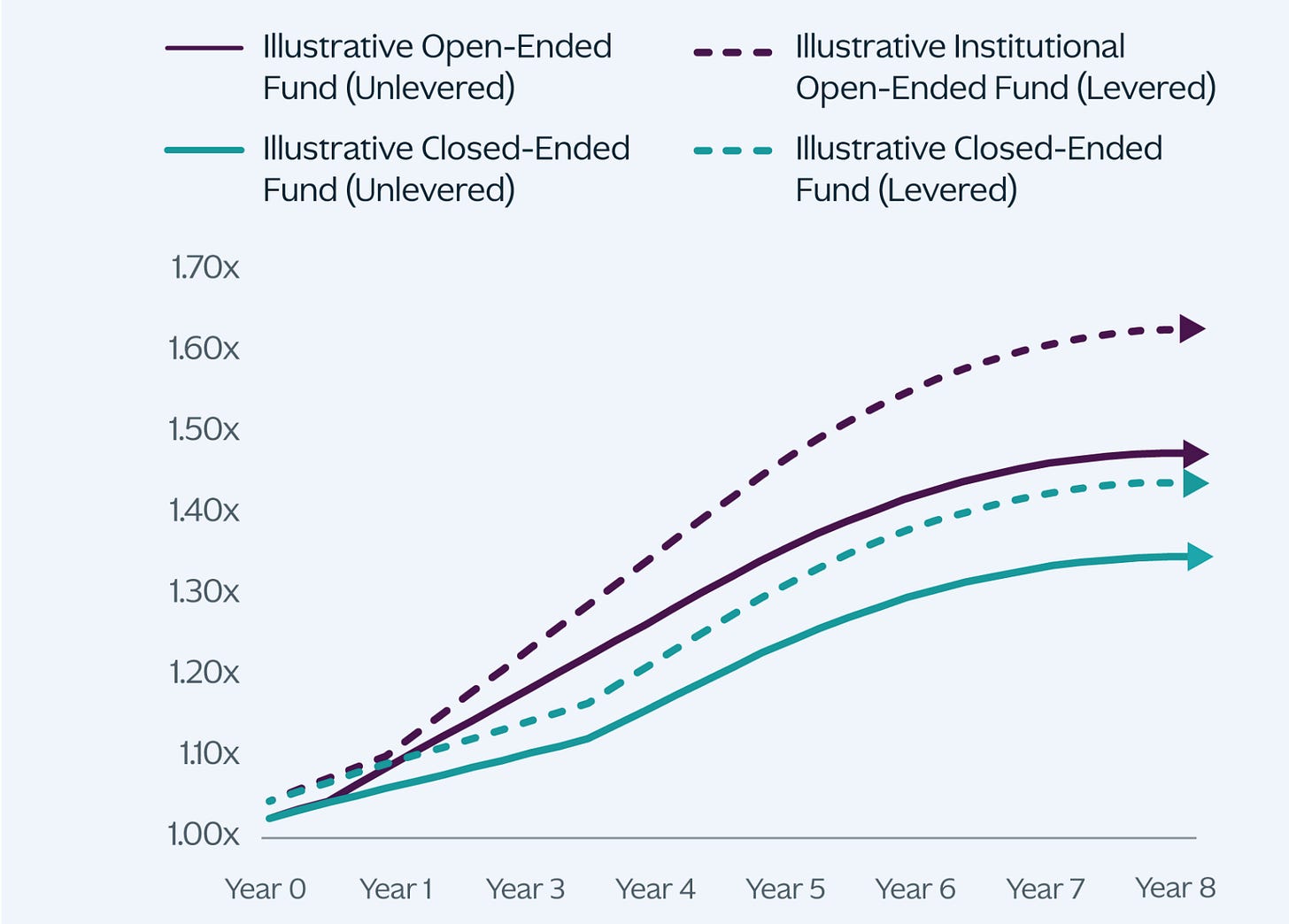

Historically, direct lending was only offered via traditional drawdown structures.

However, the rise of business development companies and other liquid vehicles has provided credit investors with additional options.

KKR believes gross returns can be improved by either

(a) increasing asset level yields, which comes with a commensurate increase in risk profile, or

(b) optimizing for faster and more complete deployment with consistent, diversified exposure to the asset class.

KKR believes the latter is a far better answer for investors, particularly when net returns can be enhanced through more efficient investment structures and improved fee schedules.

👉 [Learn more here]

2) Small Ratings Firms are Taking Market Share

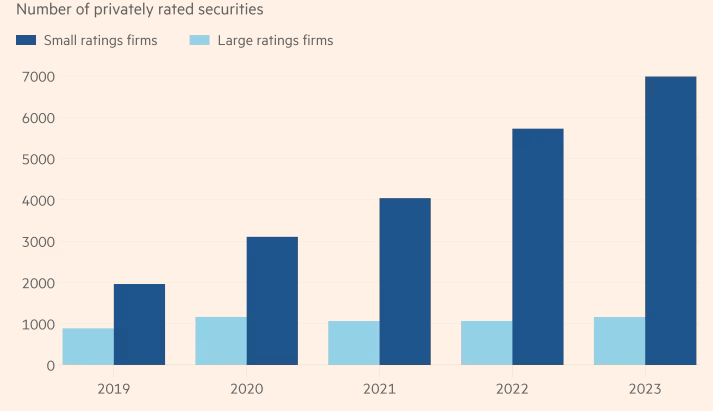

The FT’s latest article on private credit ratings makes for dramatic reading. That said, a few points stood out:

The number of insurance securities rated by Moody’s, S&P, and Fitch has been largely flat in recent years. In contrast, the number of deals rated by smaller providers has grown rapidly.

US life insurers have been among the biggest buyers of this debt.

The National Association of Insurance Commissioners believes ratings from small providers were, on average, three notches higher than its ratings.

An analysis by Absolute Strategy Research found that US life insurers would need an additional $30bn to $35bn of capital to maintain their regulatory buffers, if private letter ratings were moved in line with the NAIC’s designations.

👉 [Read more here]

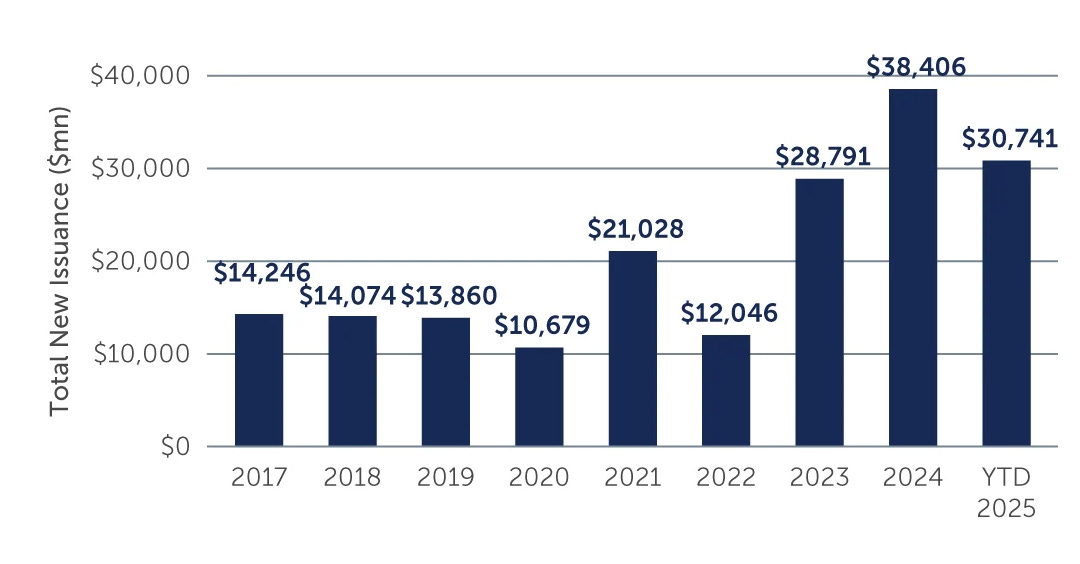

3) Private Credit CLO Issuance is on the Rise

U.S. CLO supply exceeded $150 billion in the quarter, the busiest on record.

Notably, roughly 70% of that supply came from repricings, reflecting a market focused on optimizing existing structures rather than expanding through new issuance.

Private Credit CLOs have rapidly gained acceptance, with U.S. private credit CLOs accounting for roughly 16% of overall issuance and on track to outperform 2024.

👉 [Read more here]

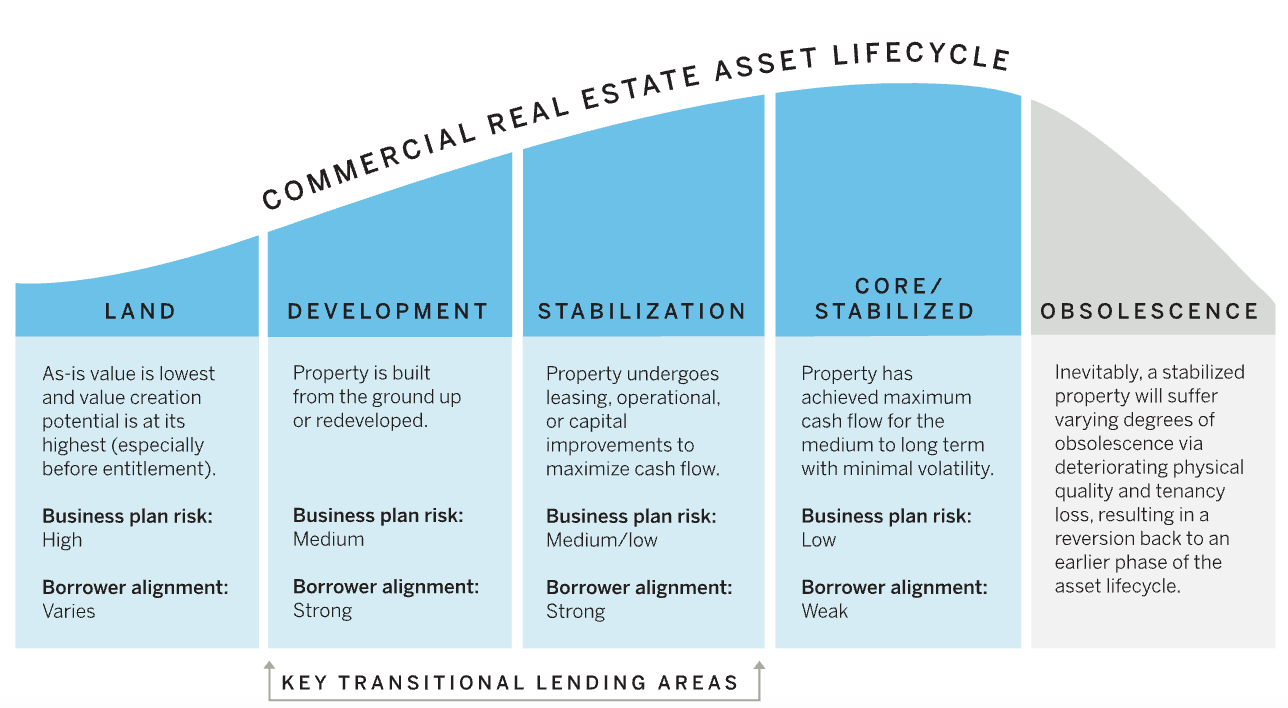

4) Wellington’s Deep Dive on CRE Transitional Lending

Transitional CRE lenders typically provide senior secured loans to CRE for the purposes of upgrading, leasing, and/or reprogramming.

Lenders can expect to receive low-to-mid-teens levered yields for extending credit in this profile

Transitional lending takes on the risk of business plan execution (i.e., value creation). But when structured correctly, these loans can maintain robust alignment with the borrower even when execution doesn’t go according to plan.

From Wellington’s perspective, the key to navigating CRE as an asset class is knowing where the best relative value is at any point in the cycle.

👉 [See where Wellington sees relative value here]

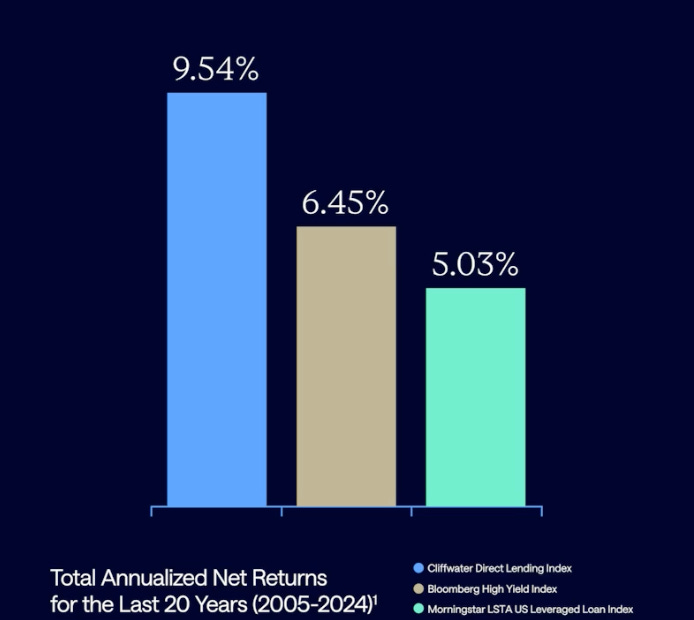

5) How has the direct lending market performed over the last 20 years?

The past two decades of investing have been defined by volatility.

During that time, the loss rate for direct lending loans is just slightly over 1%

The direct lending market has delivered a return over that 20-year period that’s been well in excess of both the high-yield and leverage loan markets

It’s stayed pretty consistent year to year, at least a 150 basis points to 200 basis points spread.

If you look at the S&P 500’s returns over the last 20 years and compare it to the direct lending market, you’d actually find that they’re just about the same.How has the direct lending market performed over the last 20 years?

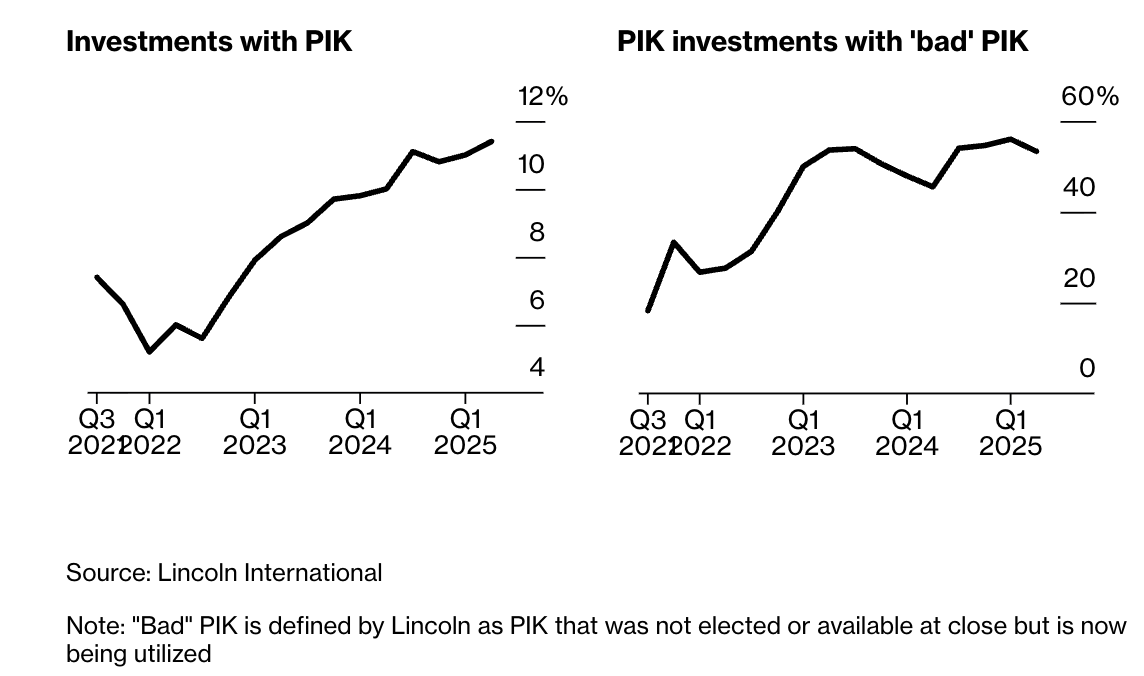

5) 60% of PIK loans are ‘bad’ PIK

The percentage of loans valued by Lincoln with some sort of PIK rose to 11.4% in the second quarter from 6% in 2022.

More than half of those had the bad version of the debt.

Lincoln believes ‘bad’ PIK is a “shadow default rate” (i.e 5.4%)

5) Other Notable Reads

Jon Gray debunks the private credit bubble. Link

Asia Pacific’s real estate credit market. Link

Apollo compares ABF and Direct Lending. Link

💰Fundraising News

Bridge Investment Group - Fund V - $2.2 billion final close

A Utah-based manager and affiliate of Apollo focused on the multifamily residential rental market.

The three-pronged strategy focuses on originating first mortgage direct loans, issuing CRE CLOs, purchasing Freddie Mac K-Series B-Pieces, and investing in other CRE-backed debt.

Viola Credit - Third Asset-Based Lending Fund - $2 Billion Final Close

An Israel-based credit manager focused on the innovation economy.

The fund will finance up to 40 sponsored FinTech and tech-enabled lenders across the U.S., U.K., Western Europe, and Australia, spanning sectors such as SME finance, payments, consumer credit, music royalties, and embedded lending.

The fund invests from $10 million to $500 million per company.

Ares - Specialty Healthcare Fund - $1.5 Billion Final Close

The inaugural Healthcare fund will finance sponsored and non-sponsored specialty healthcare companies.

It can invest across the capital structure, including first lien, second lien, mezzanine, preferred equity, and non-control equity opportunities.

The fund focuses on public and private companies worldwide, across five specialized sub-sectors: pharmaceuticals and biotechnology, medical technologies, tools and diagnostics, specialty services, and healthcare IT.

Pathlight Capital - ABL Fund IV - $1.5 billion Final Close

The Boston-based lender focuses on consumer, retail, and industrial borrowers.

The firm plans to make loans of up to $300 million.

Its loans are secured by inventory, receivables, and equipment.

SAIL Investments- An impact manager - $700 million for its second fund

The fund is currently in market, with a first close expected in 2026.

The firm provides sponsorless, senior-secured loans of $10 million to $30 million to corporates that are “delinking deforestation from major commodity supply chains”.

For the first fund, the firm identified 10 countries in Latin America, Africa, and Southeast Asia

Eiffel Investment Group – Evergreen Green Private Debt - €220m First close:

The fund consists of two subfunds, each pursuing a distinct impact-driven private credit strategy.

One finances SMEs and energy transition projects in the Benelux region.

The other provides short-term secured loans for energy infrastructure across Europe.

The solution directly contributes to increasing the renewable energy capacity installed and supports local small and mid-cap companies.

Breakwall Capital - Energy Credit Partners Fund - $125 million first close

The fund is focused on senior secured investments within the energy infrastructure, infrastructure services, and energy transition subsectors.

Breakwall’s financing efforts are expected to fill a void left by traditional financing markets and other generalist-direct lenders/

Breakwall has executed more than $1.4 billion of new deal activity/

This newsletter is for educational or entertainment purposes only. It should not be taken as investment advice.