KKR Believes Capital Light Companies are Outperforming

Fundraising from Oaktree, KKR, AEA and Enko Capital

👋 Hey, Nick here. A big welcome to the new subscribers from Blackrock, TowerBrook Golub, and HPS. This is the 137th edition of my weekly newsletter. If someone forwarded this to you, you can subscribe here, and read my previous articles here.

📕 Reads of the Week

1) Capital Light Companies are Breaking Out

KKR held an ABL update for its investors. Below is one of the more notable slides which argues the case for companies offloading balance sheet assets.

The synopsis is that if you compared the returns of Capital Intensive companies and Non Capital Intensive then the Non Intensive outperform by nearly 10x.

Arguably with software being Non Intensive, the chart would look the same if you compared the Mag 7 to the S&P 493.

Despite this, if you’d like to learn more about KKR’s ABL strategy i’d recommend reading the full deck.

👉 [Read more here]

2) Sixth Street: Private Credit Returns Will Disappoint

Josh Easterly warned Private Credit Investors to brace for smaller returns. LINK

He also brought attention to their April letter to investors, below with my favorite insights:

Sixth Street thinks about allocation of capital in three vectors.

Does the asset provide an “illiquid premium” compared to comparable liquid credit assets? This should be viewed on a loss adjusted basis. To be clear, the “illiquidity premium” is a euphemism for “can’t change your mind premium”. Given there is no readily available market for private assets (or at a price where a rational actor would transact), you can’t really change your mind.

Does the unlevered asset return provide the right return skew given the level of risk. Note, we didn’t say the right expected (i.e., average) return. Given the distribution of losses, does the asset have the right unlevered return (as measured in “IRR”) and M-o-M/Return on Invested Capital (as nobody has figured out how to actually eat “IRR”).

Finally, and where we think the sector may have lost its way, does the asset level return (post expected losses) exceed your cost of capital/equity. This is a relatively easy calculation (as previously outlined earlier in this letter)

3) Ares tops European Private Credit League Tables

9fin published its European private credit deal rankings for Q3 25. Ares tops the tables with nearly double the number of deals of its nearest

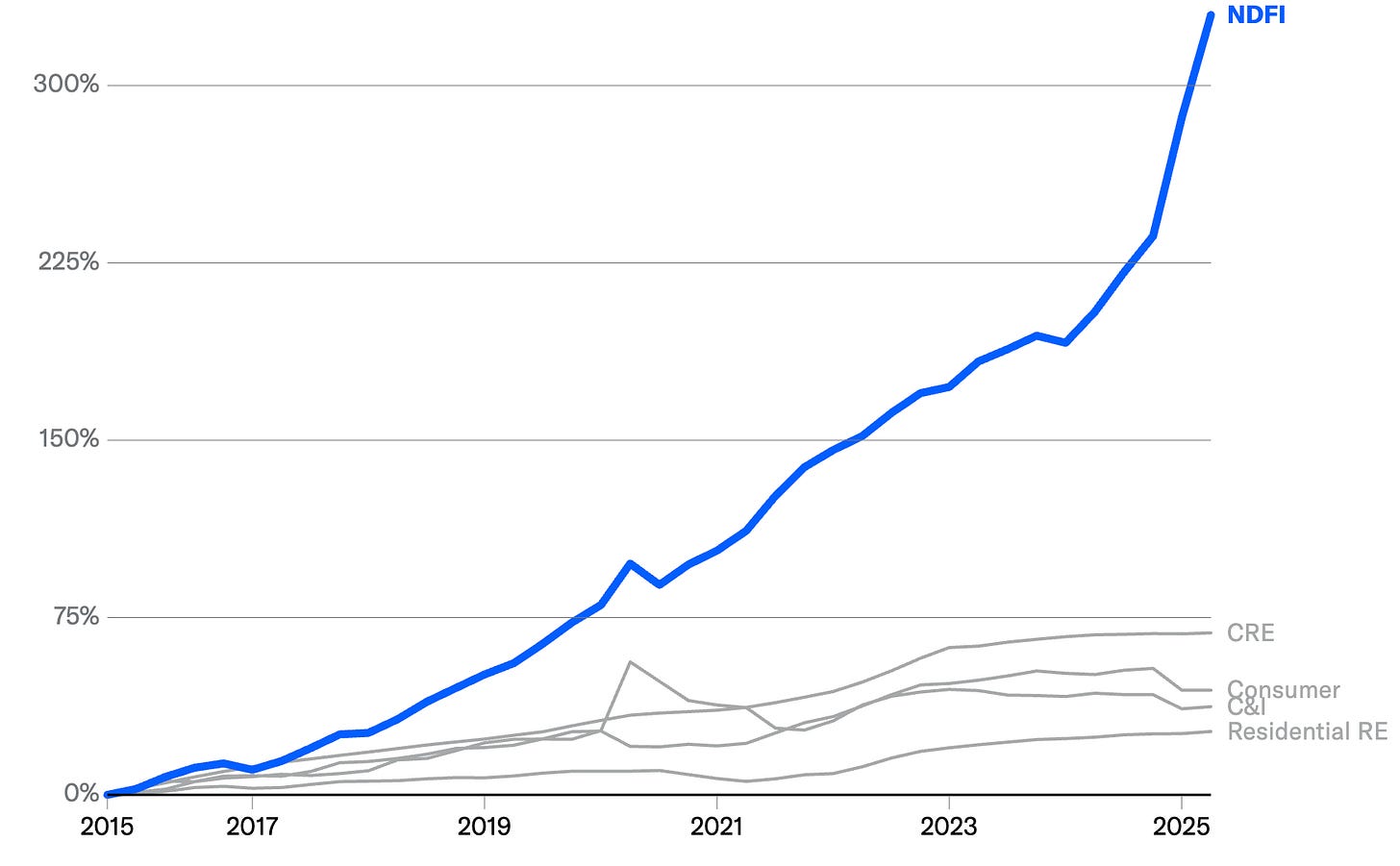

4) Non Depository Financial Institutions are driving US Bank loand Growth

Moody’s published its report on banks lending to non-depository financial institutions.

It highlights that NDFIs are driving loan growth at US banks outpacing all other bank lending activities since 2016

In aggregate, US banks have lent nearly $300 billion to private credit providers and a further $285 billion to private equity funds as of June 2025.

👉 [Read more here]

5) Other Notable Reads

Pemberton, Blue Owl and Hayfin are taking over struggling telecoms supplier Netceed through a debt-for-equity swap. Netceed, which is controlled by private equity firm Cinven, will also gain access to €70 million as part of the agreement. Link

Nuveen and Arcmont launched a private credit offering to qualified individual investors in Europe and Asia. Link

Despite all these positive developments, over the past several weeks, there’s been a significant external focus on the implications of certain credit defaults in the market. These events have been erroneously linked to the traditional private credit market as a result of misunderstandings and misinformation.

Stephen Schwarzman calls out “misunderstandings and misinformation” Link

🗣️ The Best of Howard Marks

I’ve been jumping puddles trying to earn my keep so this week’s post is light on analysis. I have however had the chance to reread the best of Howard Marks’ letters and below with a few of my favorite quotes and links

Long-term investment success is best achieved through a string of consistently good returns and an absence of poor years, rather than by aiming for brilliant successes, getting there in some years and flopping in others.

Buying at a fair price doesn’t generate alpha – it’s buying at an unreasonably low one that does. Thus, accessing a bargain requires cooperation from someone who’ll sell at a price that’s irrationally low.

Unconventional behavior is the only route to superior investment results, although it’s far from sure to work. To engage in it, you have to dare to be different, dare to be wrong, and dare to look wrong for a while even when you’re right. This isn’t easy, and that’s why not everyone can take the steps needed for investment superiority.

💰Fundraising News

Oaktree announced a first close of $2.4 billion for its Evergreen Direct Lending Fund. The fund will primarily make senior secured loans to sponsor-backed, middle-market U.S. borrowers. It will also lend to large-cap and non-sponsor-backed borrowers in the U.S. and Europe on a selective basis. It charges no incentive fees, only management fees. The fund is available to both insurance and non-insurance investors and in both levered and unlevered versions. It also benefits from ratings assigned by two global agencies. More here

KKR launched Galaxy Container Solutions, a marine container leasing and financing platform. Galaxy will be owned by KKR-managed credit funds, which are committing $500 million. Galaxy will provide a full suite of container leasing and financing solutions to shipping companies around the world. More here

AEA Private Debt closed its $550 million credit continuation vehicle. The continuation vehicle was established to acquire a portfolio of senior secured loans from AEA Private Debt’s 2016 vintage direct lending fund, AEA Middle Market Debt Fund III, primarily consisting of loans to sponsor-backed U.S. middle market companies. The transaction was led by Carlyle AlpInvest. More here

Enko Capital, an Africa-focused asset manager, announced a first close of $100 million for its flagship private credit fund. The Fund provides US dollar-denominated loans to mid-market companies across Sub-Saharan Africa, focusing on established, cash-generating businesses in non-cyclical sectors such as agriculture, telecommunications, manufacturing, renewable energy, and financial services. The fund has a target of US$150 million at final close, with a hard cap of US$200 million. More here

Appian Capital Advisory, a UK-based private equity firm, has launched a $1 billion fund focused on developing critical minerals and metals projects in emerging markets. The fund finances responsible mining projects that are essential for energy access and industrial growth. It will invest in equity, credit and royalties, targeting high-impact projects in emerging markets. More here

This newsletter is for educational or entertainment purposes only. It should not be taken as investment advice.