Let's Wrap-up 2025

👋 Hey, Nick here. A big welcome to the new subscribers from Ares, Carlyle and Newmarket Capital. This is the 145th edition of my weekly newsletter. If someone forwarded this to you, you can subscribe here and read my previous articles here.

This week’s a wrap-up of 2025. Unfortunately, some managers took the “wrap” theme a little too literally, so I’ve posted their music videos for your amusement.

If we don’t speak before the New Year, Happy Holidays, and thank you for subscribing.

I hope you’ve enjoyed this year of Credit Crunch as much as I did.

Looking forward to 2026.

Nick

📕 The Holiday Videos are Back

Blackstone’s Holiday Video

Apollo’s Holiday Video

😐 The Crowd’s Narrative for 2025

Spreads are tight (don’t worry, we still have a premium to liquid credit)

Defaults are within historical norms (Can we stop treating one messy credit as proof the whole market’s broken?)

M&A is coming back (We’re told M&A helps spreads. We’re choosing to be emotionally available to that idea.)

We’re partnering with banks, insurers, and traditional asset managers more than ever (The good news: we have capital. The bad news: everyone else has it too.)

Commercial Real Estate lending is back (We’re even financing the banks so they can go back to the office.)

ABF is 🚀 (New entrants are underwriting vibes, particularly in consumer and factoring.)

AI is 🚀 (We hope we won’t be holding the keys if there’s any overbuild. 🤞)

We’re growing in Europe (And possibly Asia, depending on how many flights we take and how many deals survive IC.)

📈 More Than the Talking Points

We’ve lived through generally good times in the last 16 years. The coming period is likely to be more “interesting,” as errors that were made in those good times come to light.

Recent credit events have probably chastened lenders and investors, putting them on alert. Thus, they’re likely to incorporate a re-elevated level of prudence in their decisions in the coming months and perhaps years…

There’s nothing wrong with the plumbing.

Howard Marks (Read here)

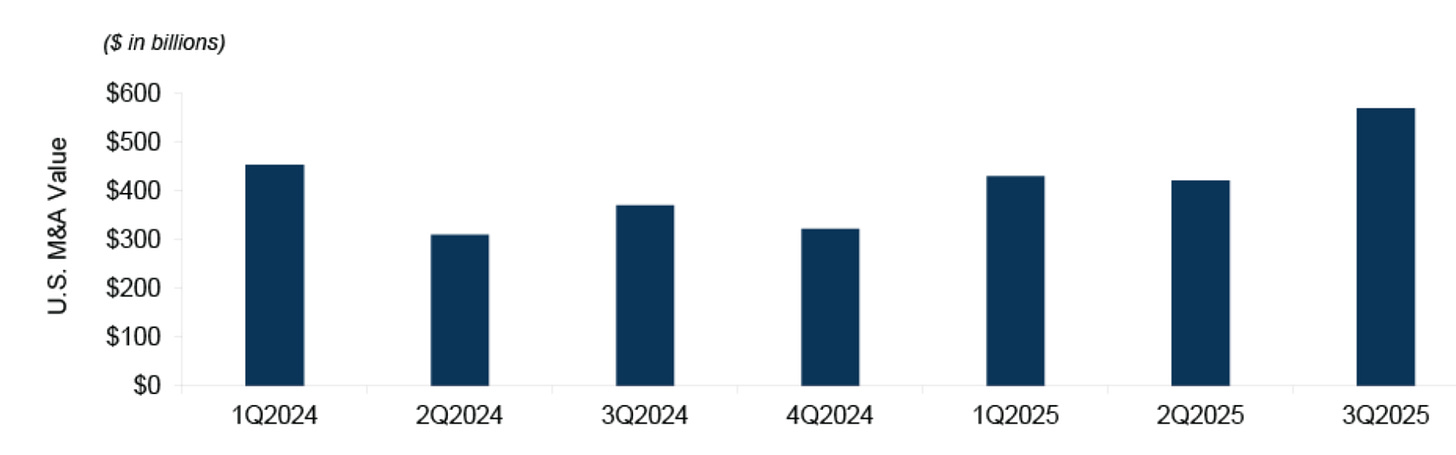

US M.A is Showing Signs of a Revival

👉 [Read Oaktree’s December letter here]

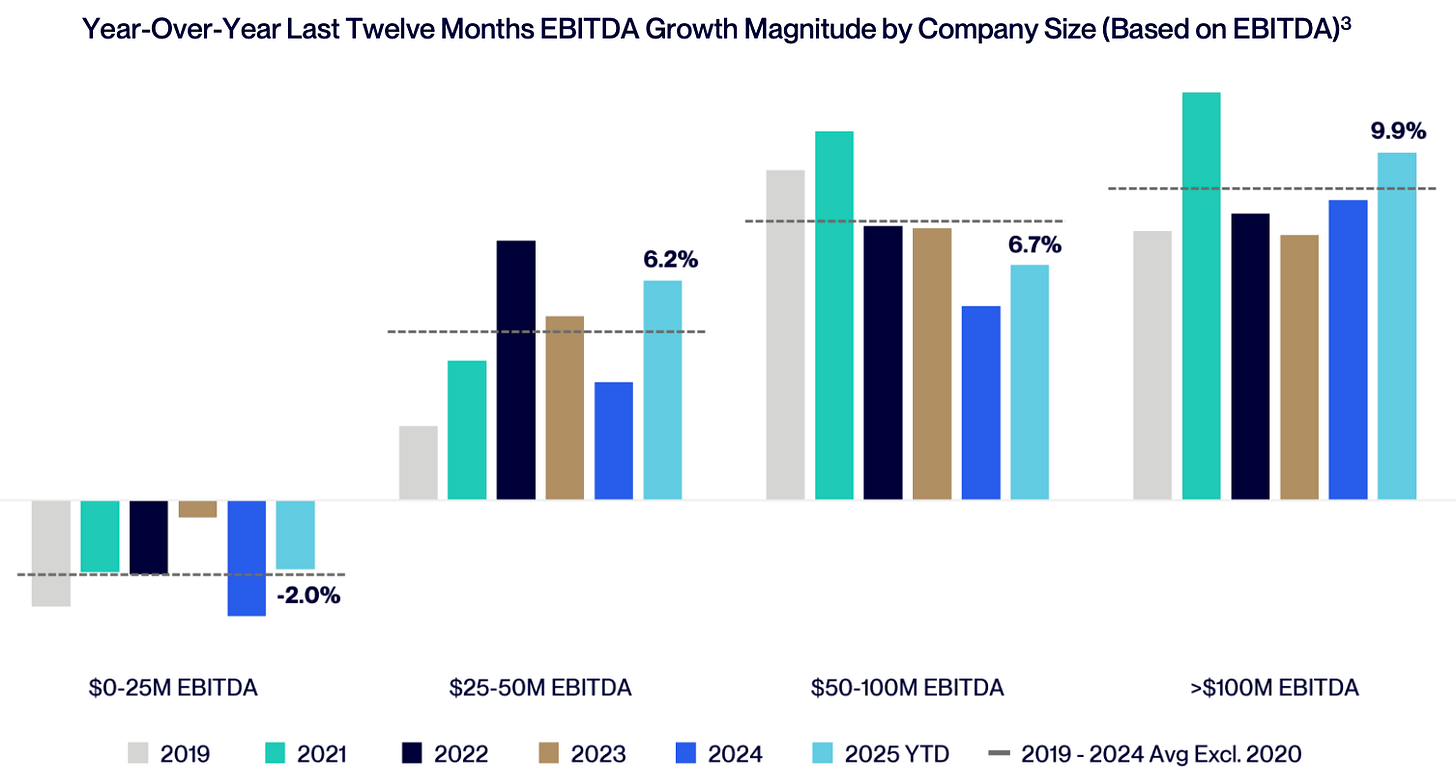

Deepening Dispersion

BlackRock sees widening dispersion within private credit, particularly in the lower mid-market.

They showed the same graph last year.

👉 [Read BlackRock’s Outlook here]

HPS has ‘independently’ arrived at the same opinion

We see the most pressure within smaller companies, which we believe have a limited margin for error navigating macroeconomic shocks. Companies with less than $25 million of EBITDA are experiencing meaningfully higher covenant defaults, compared to companies at the upper end of the market, reinforcing our view that experienced private credit managers with scale that invest in larger companies are best positioned during challenging macroeconomic environments.

👉 [Read HPS’s Thoughts on Private Credit]

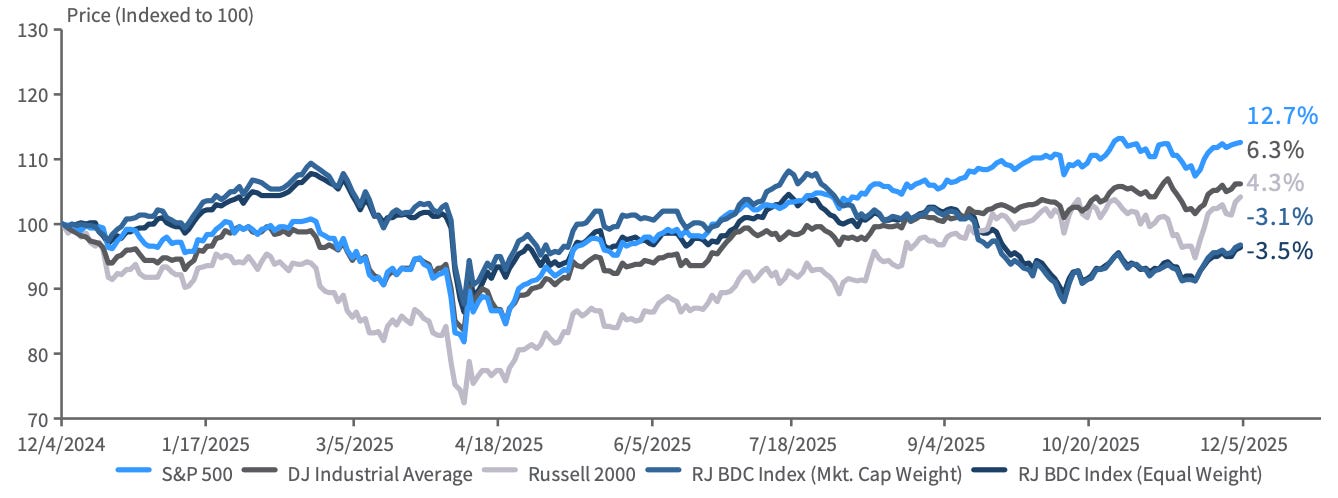

BDCs Underperformed in 2025

The underperformance got more airtime than it deserved.

👉 [Read Raymond James’ December Update Here]

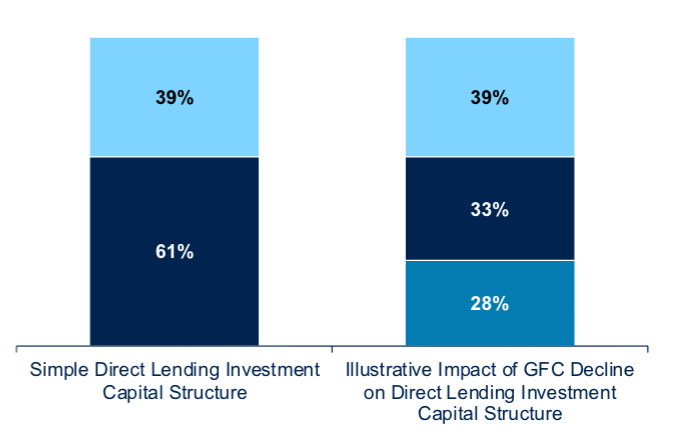

Moderate LTVs Still Provide Meaningful Protection

During the 2008-2009 GFC, the Cambridge Associates Private Equity Index experienced a 28% peak-to-trough valuation decline.

Blue Owl highlights that its loans are generally senior with a weighted average loan-to-value of 39%.

Borrowers would therefore need to lose more than 60% of their value before Blue Owl experiences potential principal loss.

👉 [Read Blue Owl’s Update Here]

Private Credit Still Matches the Opportunity

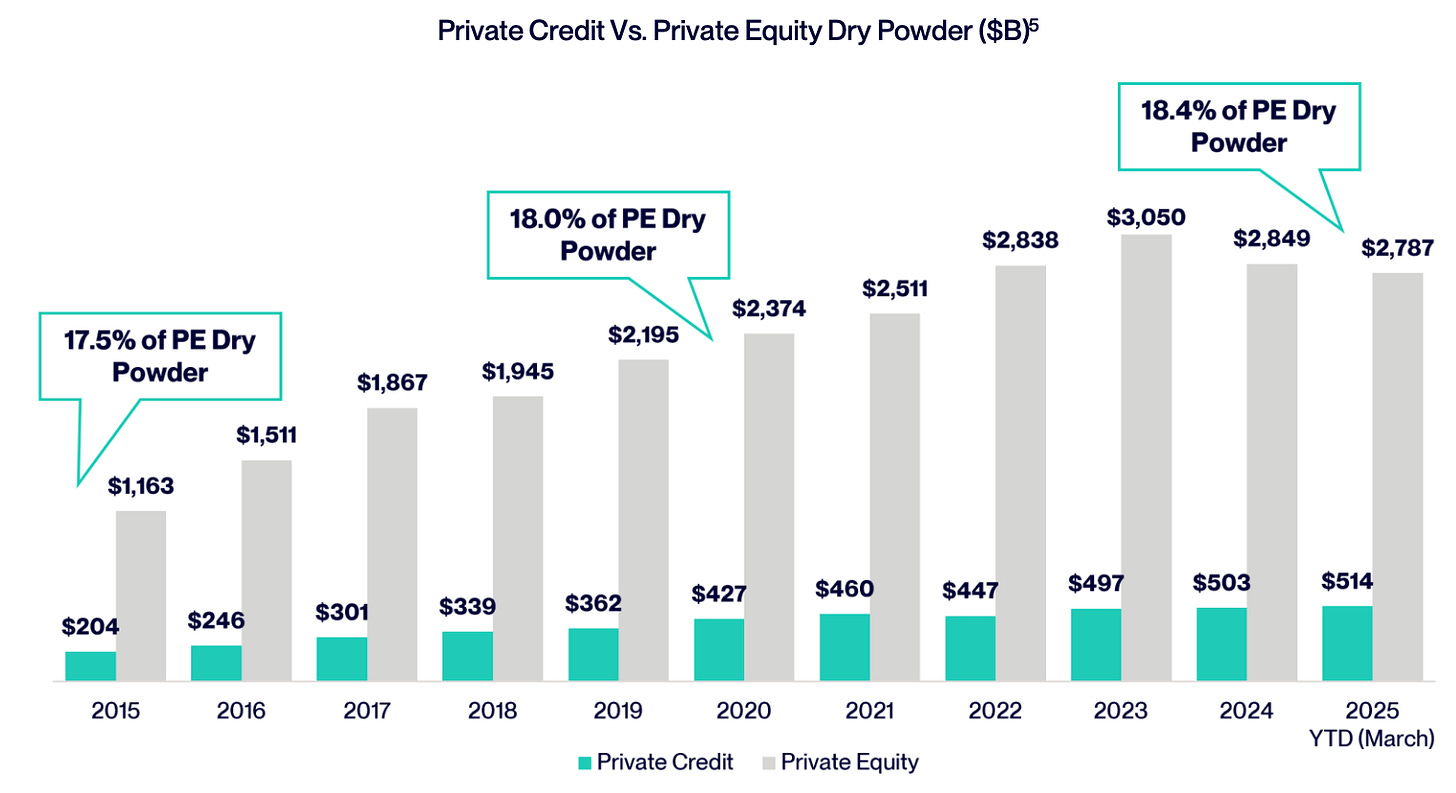

Private credit dry powder relative to private equity dry powder has remained almost unchanged over the last ten years

Underscoring the thesis that the market’s scale remains proportionate to its opportunity set.

👉 [Read HPS’s Thoughts on Private Credit]

Banks Are Powering Private Markets

Loans to non-deposit financial institutions have increased 3x since 2020.

New Entrants Need Not Apply

Five years ago, the top 20 managers raised 35% of the capital in the market; in 2024, the top 20 private credit managers raised more than 65% of the capital.

Fundraising data shows a similar trend, with new entrants accounting for just 2% of the total fundraising share in 2024.4

And the last one, because what’s a summary without mentioning AI.

👉 [Read Partner’s Group Outlook here]

💰Fundraising News

Deerpath Capital, a U.S.-based lender, raised $3.5 billion for its Deerpath Fund VII fund. The fund lends to sponsored U.S. lower middle market companies.Since its inception in 2007, Deerpath has invested more than $14 billion across over 1,200 transactions. More here

Colesco Capital, a Netherlands-based private credit specialist, has agreed with Polestar Capital and its investors to take over management of the Polestar Capital Circular Debt Fund. The fund focuses on financing the transition towards a more circular economy. The entire investment team will transfer to Colesco, maintaining continuity in the execution of the strategy. More here

HSBC Asset Management has launched a new fund for retail investors in Hong Kong. The fund will invest in both public and private credit globally and will offer investors monthly payouts. It will focus on short-duration institutional-grade private credit and asset-backed opportunities. More here

This newsletter is for educational and entertainment purposes only. It should not be taken as investment advice.

Great synopsis for the year, Nick. Particularly the HSBC HK fund. I have captured the story on Private Credit goes shopping for consumer loans over at my publication. Would invite you to take a look and would be great to hear your thoughts.

I knew of Blackstone videos, but no Apollo's. I mean...whoever wrote that script wouldn't pass a drug test for sure. I am very confused...