Life Insurance M&A Surpasses $150 Billion

Fundraisings from DWS, Ares, Kayne Anderson, Nuveen, Lioncrest and Locust Point.

👋 Hey, Nick here. A special welcome to the new subscribers from Goldman Sachs, Blackstone, and Northwest Bank. It’s great to have you. Reach out and say hi. This is the 119th edition of my weekly newsletter. You can read my previous articles here and subscribe here

📕 Reads of the Week

If you’re going to listen to anything this week. I’d listen to this podcast with John Zito. It’s an honest view on how John sees the private credit market today and what it takes to become a leading alternative manager. Link

Lessons From Private Credit’s Fallen Stars. Covenant Lite posts another great post on what can go wrong in private credit. Link

AustralianSuper is set to enter European mid-market corporate lending. The fund is selecting GPs and plans to invest late this year or early next year. Link

Apollo commits to £4.5 billion to finance a UK nuclear power Ssation. Link

BlackRock Report: Nearly one-third of family offices intend to increase their allocations to private credit. Link

Avellinia Capital partners with British Business Bank to fund UK FinTech lenders. Link

📊 Charts of the Week

Summer’s here, and the insights have taken a holiday. Instead of wasting your time with fluff, here are four charts worth a glance before your first coffee.

Life Insurance M&A Surpasses $150 Billion

Major Deals include:

2019 - Apollo takes a $2 billion stake in Athene

2020 - KKR acquires a $5 billion majority ownership stake in Global Atlantic

2021 - Entities managed by Blackstone acquire Everlake for $3 billion

2021 - Apollo purchases the remainder of Athene for $7 billion

2021 - Blackstone acquires 9.9% of Corebridge for $2 billion

2021 - Brookfield acquires American National for $5 billion

2022 - Blackstone acquires a $3 billion interest in Resolution Life

2023 - Brookfield acquires American Equity for $4 billion.

Read Moody’s Special Report Here

The Direct Lending Illiquidity Premium Is Still Robust

KKR published a primer on “What Role Can Private Credit Play in Individual Investors’ Portfolios?” Read the full report here

Spread to Maturity, Direct Lending vs. BSL Single B, Basis Points

Most investors expect an increase in the volume of private credit GP-led secondary transactions.

Testament to the fact that as private credit continues its growth trajectory, investor interest in secondaries is rising. As more private credit funds approach the mid-to-late stages of their lifecycle, sponsors can tap into Continuation Vehicles or other GP-led structures to retain assets while providing liquidity.

Read Coller Capital’s Global Private Capital Barometer here.

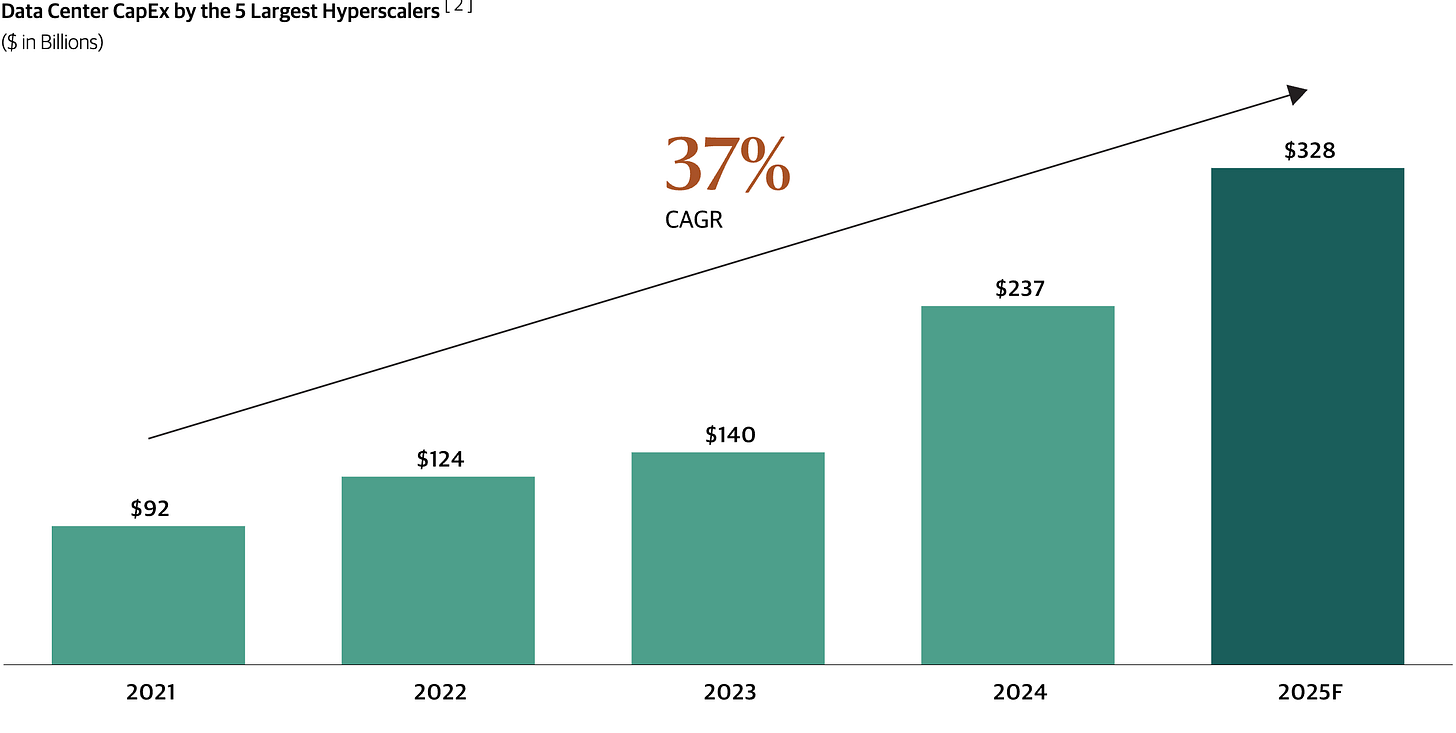

The largest technology companies are projected to spend over $2 trillion on data centers over the next five to seven years.

Read Blackstone’s update on infrastructure investing here.

💰Fundraising News

DWS, a German asset manager, is raising $2.3 billion for its second European direct lending fund. The fund focuses on European mid-market companies and is expected to launch fundraising in autumn. Link

Kayne Anderson Real Estate, a Los Angeles-based manager, closed its $1.7 billion Opportunistic Real Estate Debt Fund II. The Fund will opportunistically invest in commercial real estate debt investments and secondary market transactions. In the last 24 months, the platform has deployed more than $3.9 billion, with $2.2 billion deployed in the last 12 months alone. More here

Nuveen, a Chicago-based asset manager, announced a second close of ~$430 million for its Australian commercial real estate debt strategy. The fund invests in institutional senior and junior loans secured by prime real estate in Australia. Preferred sectors for the strategy are industrial / logistics and residential, with a selective approach to retail, office and alternatives across major cities in Australia. Total AUM is expected to exceed A$1 billion, including capital approved for co-investments. More here

Lioncrest Ventures, an Arizona-based Venture Capital firm, launched its $100 million multi-strategy platform spanning both equity and credit funds. The credit fund will be managed by Prospeq. Prospeq typically lends $500k to $2 million loans to early stage software companies. More here and here

Locust Point Capital, a Miami-based credit firm, announced a final closed of $668 million for its third Fund. Fund III will execute the firm’s core strategy, providing structured credit solutions to experienced owner-operators of seniors housing communities across the United States. Locust Point targets sub-$50 million transactions. The successful raise marks a 56% increase over the firm’s $428 million predecessor. More here

Pride Capital Partners, an Amsterdam-based credit manage, announced a first close of ~$175 million for its third Fund. Pride lends to non-sponsored, scalable software and IT companies across the Benelux, DACH, and Nordics. More here

Ares launched its first ELTIF, the Ares European Strategic Income ELTIF Fund. The semi-liquid perpetual fund will provide European individual investors access to Ares’ leading European Direct Lending strategy. Link

This newsletter is for educational or entertainment purposes only. It should not be taken as investment advice.