Marblegate’s Brutal Middle Market Thesis. The Free Money Era Is Over.

Fundraising from 17Capital, ACRE, Avila, Third Point and Abrdn

👋 Hey, Nick here. A big welcome to the new subscribers from Joele Frank, Corten Real Estate, and Park Cities Management. This is the 124th edition of my weekly newsletter. If someone forwarded this to you, you can subscribe here and read my previous articles here.

📕 Reads of the Week

“The decision you have to make as a business owner is, ‘Do you wanna do what everybody’s doing or do you wanna pivot?'” Brookfield reduces its allocation to private credit. Link

Does Private Credit Offer an Illiquidity Premium? Aviva analysed over 2,000 investment-grade private debt deals to compare their spreads against public benchmarks. Link

Private credit managers are laying the groundwork to access the $12 trillion U.S. retirement market. KKR, Blackstone, and Blue Owl have already established partnerships with 401(k) providers. Link

Following the same playbook, Goldman Sachs has announced a new partnership to access 401(k) assets (see below).

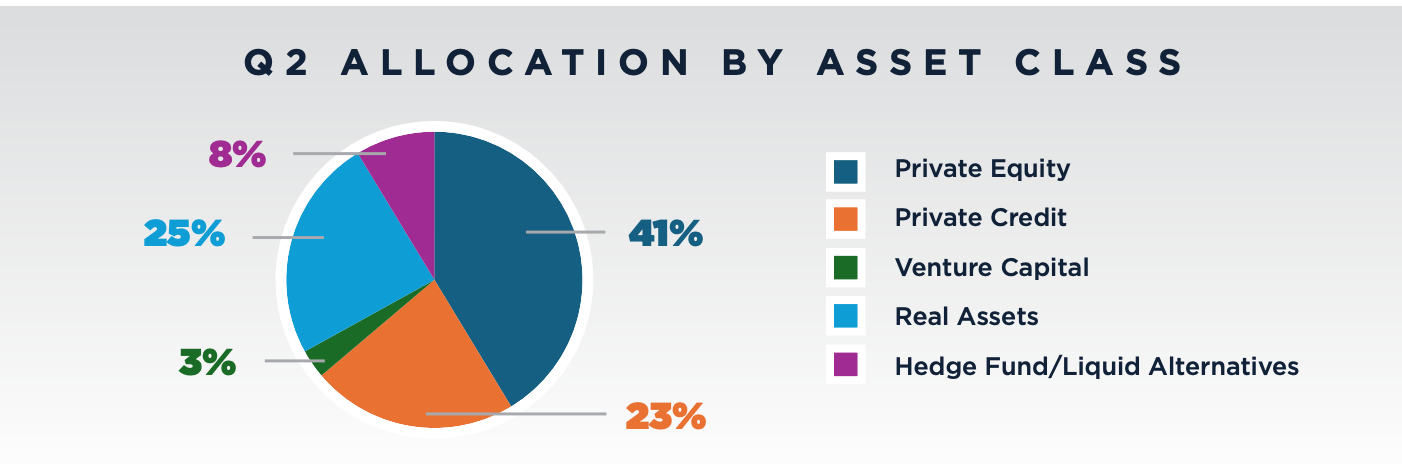

US Public Pension funds deployed ~$14.8 billion into private credit in Q2 2025, Up 13% QoQ and accounting for nearly a quarter of total allocations. Opportunistic credit captured the lion’s share of allocations. Read the Dakota Quarterly Public Pension Allocations Report here.

GIC unveils its “Devil’s Advocate” chatbot designed to highlight how AI is changing the way the Singapore state investor does deals. About an hour after uploading data and background materials on a proposed investment, the bot spits out a detailed summary of the key issues and examples of questions an investment committee member might ask before giving it a green light. Link

xAI is looking for $12 billion to expand its data center infrastructure. Link

Today’s ABF opportunity is too big to ignore. KKR’s ABF Primer. Link

📊 Marblegate’s Brutal Middle Market Thesis. The Free Money Era Is Over.

I’ve spent a lot of time writing about the rise of opportunistic and distressed funds this year.

I’ve also spent a lot of time wondering,

“Where is this money going to be deployed?”

Marblegate just published the most direct answer I’ve seen.

And it’s not pretty.

If you need a reason to launch an opportunistic fund, Marblegate handed it over.

Below are my key highlights, but you should read the full report here.

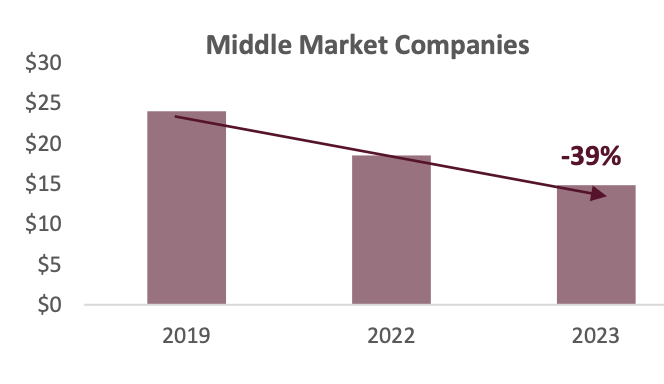

The middle market struggles with the persistent erosion of earnings power

Average EBITDA for middle market companies plummeted 39% from 2019 to 2023.

This dramatic decline for middle-market companies reflects a combination of higher input costs, decreasing efficiency, and limited pricing power.

Average Middle Market EBITDA ($million)

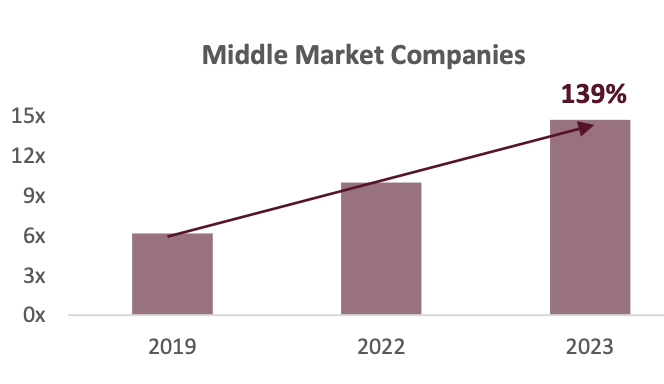

Financial leverage has exploded

As earnings and margins shrank, the average private middle-market company’s liabilities surged 45%

At these current leverage ratios, the average middle market company is likely to violate or already be breaching covenants.

Average Leverage (Total Liabilities to EBITDA)

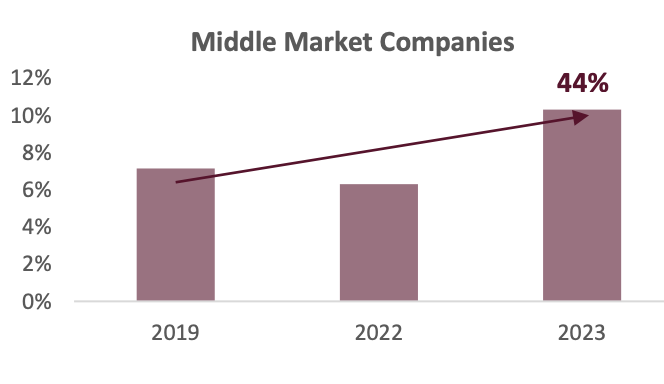

Debt costs have surged

Floating-rate bank debt has increased borrowing costs to over 10%.

Implied Average Rate on Debt

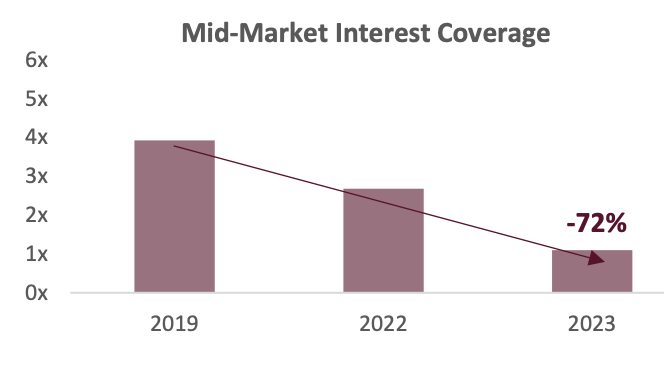

The average company cannot pay its bills without restructuring its debt

Plunging profitability and rising liabilities prove to be a toxic combination, especially while interest rates remain high.

The impact of interest rate hikes took an additional toll in 2023, pushing middle market companies’ average interest coverage ratio down to an alarming 1.0x.

A large and growing group of companies is nearing insolvency.

Nearly 25% of the companies analyzed already had a coverage ratio below 1x.

With base rates remaining stubbornly high and labor and input prices elevated, this cohort of companies with less than 1x coverage will likely increase in the coming quarters, leading to a wave of restructurings..

A company’s finances are generally a reflection of its management’s decisions.

Ballooning leverage and weak interest coverage are as much a product of the size of a company’s indebtedness as it is management’s ability to effectively generate revenue and manage costs.

After decades of free money where many decisions carried no cost, these same decisions – staffing, CAPEX, technology – today, carry ever higher costs and with them greater consequences.

Many middle market companies lack the skill or experience to manage in such an environment..

Right-sizing financial liabilities in the absence of improving the operational performance will simply not be enough to save many good companies.

Financial restructuring alone is the equivalent of being far from shore with a flotation device but without the skill or stamina to swim – in the absence of outside intervention, survival remains highly uncertain.

During this period of grinding dissolution, investors who can address the unique financial and operational challenges facing middle market companies will find attractive investment opportunities among critical links in larger supply chains or among leaders in niche industries that often go overlooked.

Read the full report here.

🏦 Partnership of the Week

Carlyle signed a $250 million forward-flow partnership with FarmOp Capital to finance U.S. farm operating loans. This partnership, through Carlyle’s asset-backed finance platform, will boost FarmOp’s capacity to lend to independent row-crop farmers across the country. More here

Goldman Sachs’ Private Credit Collective Investment Trust has been included in Great Gray’s Panorix Target Date Series (Panorix), a retirement-focused investment solution developed by Great Gray in collaboration with leading institutional managers.

Hayfin announced its partnership with Mubadala and AXA IM Prime. As part of the agreement, each firm will acquire a minority interest from Arctos Partners. The partnership will support Hayfin's growth in European private credit, with the firm managing €31 billion in AUM. More here

This announcement comes less than 6 months after British Columbia Investment completed the sale of its majority stake in Hayfin to Arctos Partners. Link

💰Fundraising News

17Capital, a London-based NAV finance specialist, announced the final close of $5.5 billion for its Strategic Lending Fund 6. The fund provides non-dilutive capital to private equity managers for GP commitments, franchise growth, and succession plans, targeting US and European deals. It has already deployed $2.5bn across 10 investments and was backed by global pension funds, insurers, and sovereign wealth funds. More here

ACRE, a US private real estate manager, closed its $1 billion ACRE Credit Fund II. The fund focuses on first mortgages with flexibility to provide mezzanine debt, preferred equity, and construction loans. It typically lends $25 million to $125 million per transaction and aims to originate first mortgages around 60-65 percent loan-to-value. More here

Avila Real Estate Capital, a New York-based real estate lender, held a $700 million final close for its inaugural debt fund. The fund focuses exclusively on lending to the U.S. homebuilding sector, providing acquisition, development, and construction mortgages. More here

Third Point, a New York-based alternative investment manager, secured a first close of $400 million for its first dedicated, rated structured private credit fund for insurance companies. Third Point Insurance Solutions Fund I will target U.S. middle-market opportunities for consistent income and strong returns, with further products expected later in 2025. More here

abrdn, an Aberdeen-based asset manager, raised $310 million for its Global Fund Finance Fund. The fund provides subscription lines and fund finance solutions for private equity and credit funds, focusing on mid-market funds. More here

Goldman Sachs announced the launch of a private credit collective investment trust for defined contribution retirement plans. The GS Private Credit CIT will provide 401(k) and similar plans access to GSAM-managed private credit, including North American and European direct lending. More here

VERT, a Brazilian asset manager with ~$8 billion of AUM, launched its $130 million blockchain-based platform for structured credit. By leveraging blockchain technology, VERT’s platform transforms receivables and loan repayments from agribusinesses into investment-grade products, reducing issuance costs and accelerating capital access for small rural producers. More here

This newsletter is for educational or entertainment purposes only. It should not be taken as investment advice.