Mubadala Calls Out 2021 Valuations

Fundraisings from Synergy Capital, Granite Asia, DunPort and Zagga

👋 Hey, Nick here. A special welcome to the new subscribers from Trinity Capital, Terra Cap, and ThinCats. It’s great to have you. Reach out and say hi. This is the 114th edition of my weekly newsletter. You can read my previous articles here and subscribe here

“If you’re sitting in a 2021 vintage private credit fund and it’s marked at par.

You’re mistaken.”

Oscar Fahlgren, CIO and global head of private equity at Mubadala Capital. Link

📕 Reads of the Week

Mubadala also announced that its private credit portfolio grew to US$20 billion in 2024. Link

Milken 2025: What Leading Credit Investors Are Saying About Asset-Based Finance. Link

Milken 2025: Alternatives are a Pillar of Multi-Asset Management. Link

WhiteHorse Capital: Taking the Temperature of Healthcare Lending. Link

Blackstone launched its Multi-Asset Credit Fund, BMACX. The fund invests across various credit assets, including corporate credit, asset-based and real estate credit, structured credit, and liquid credit. US investors can invest in the fund through their registered investment advisers. The fund offers ticker execution with daily subscriptions, quarterly liquidity, and low investment minimums. More here

Clearlake launched Clearlake Credit following the acquisition of MV Credit. Clearlake Credit represents over $57 billion in liquid and illiquid credit. Link

Goldman Sachs led a record €6.5B direct-lending loan for Adevinta. The deal comes with a €1.7 billion upsize, and the existing €4.8 billion loan has been repriced by 100 bps to E+475 with a 99 OID. Link

🏦 Partnerships of the Week

Monroe Capital, Sumitomo Mitsui Banking Corporation (SMBC), and MA Financial announced a partnership to invest $1.7 billion in senior secured loans to U.S. middle market borrowers. More here

BlackRock is collaborating with Singapore-headquartered digital wealth platform Syfe. Clients of Syfe, one of Asia Pacific’s largest digital investment platforms with $10bn in assets, will gain access to BlackRock’s US middle market direct lending strategy. BlackRock will provide exclusivity in Singapore for this particular strategy with Syfe for a limited period. More here

📈Charts of the week

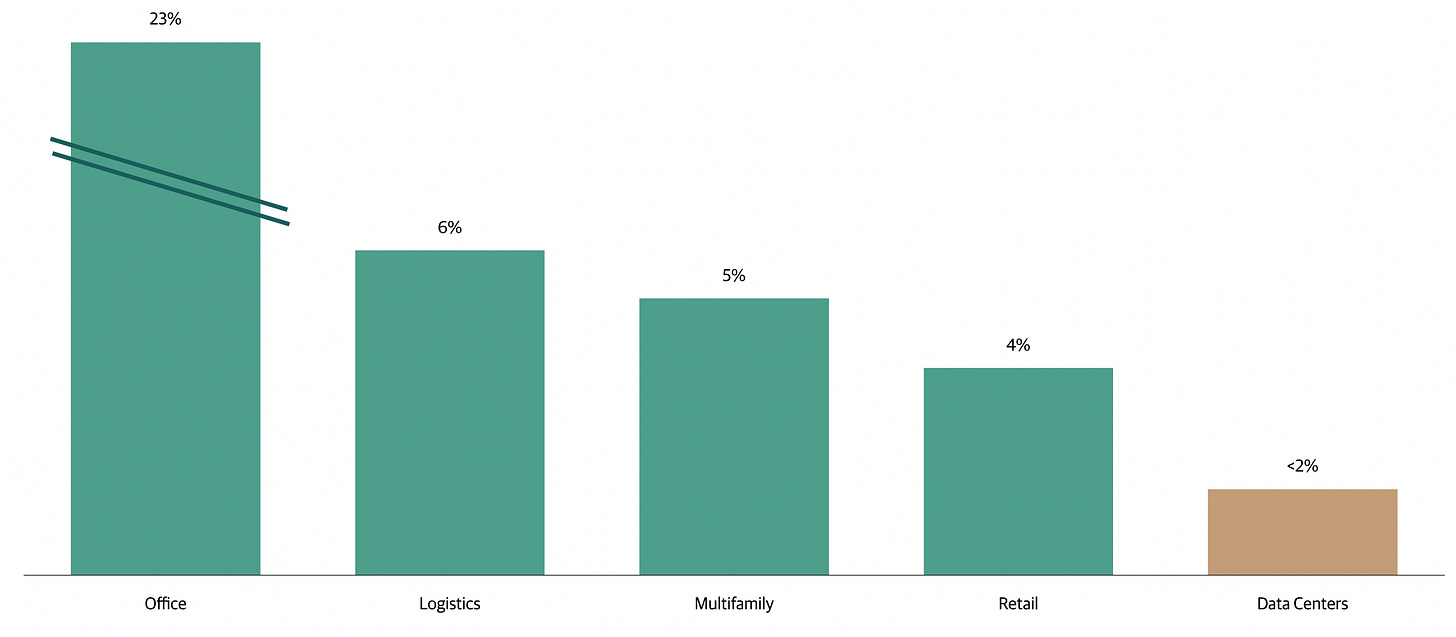

Data center vacancy is lower than other asset class

Blackstone creates the case for investing in data centers. Link

Private Credit Might Be the Hardest Path for Emerging Managers

Buyouts magazine surveyed 107 LPs to create its latest emerging market report. Link

BDC non-accruals show a mixed bag of borrower stress

Bloomberg reports on BDC’s latest earnings. Link

💰Fundraising News

Synergy Capital, a Dubai-based manager, announced a first close of $715 million for its third opportunistic fund. The fund focuses on industrials, metals, and power sectors globally. It invests across the capital structure with a typical investment size between $20 million and $50 million. More here

Granite Asia, a Singapore-based investment manager, announced a first close of $250 million for its inaugural private credit vehicle, Libra Hybrid Capital Fund. The fund lends senior secured loans to businesses across Asia-Pacific. Granite Asia are targeting a final close of $500 million. More here

DunPort Capital Management, a Dublin-based private credit manager, announced its $120 million co-investment vehicle with the British Business Bank. The fund lends to companies with less than £100 million that are wholly or predominantly based, headquartered, or operating in the UK. More here

Zagga, an Australian alternative real estate investment manager, launched its debut private credit fund. The fund will invest directly in quality prime commercial real estate across Australia's east coast. More here

This newsletter is for educational or entertainment purposes only. It should not be taken as investment advice.