Oaktree: Dispersion Is Back

Averages shouldn’t be relied upon.

👋 Hey, Nick here. A big welcome to the new subscribers from Hudson Cove, RBS International, and Man Group. This is the 152nd edition of my weekly newsletter. If someone forwarded this to you, you can subscribe here and read my previous articles here.

📕 Reads of the Week

Market Updates

I sat down with The Credit Clubhouse to discuss what’s happening in private credit right now.

Pitchbook: The Rise of SRT Investing. Link

JP Morgan: How should investors allocate to private credit today?

Place greater emphasis on selectivity and risk management than in the past. Reducing concentration risk, avoiding aggressive leverage structures, and maintaining diversification across vintage years.

The gap between top-quartile and bottom-quartile managers is already wide, and there is little reason to believe it will narrow. On the contrary, as weaker loans come under pressure, differences in portfolio construction and risk discipline will become more visible.

Investors should broaden beyond direct lending. Direct lending remains the core of the asset class, but it is no longer the only source of attractive risk-adjusted returns.

Muzinich: The Growth of European Markets. Link

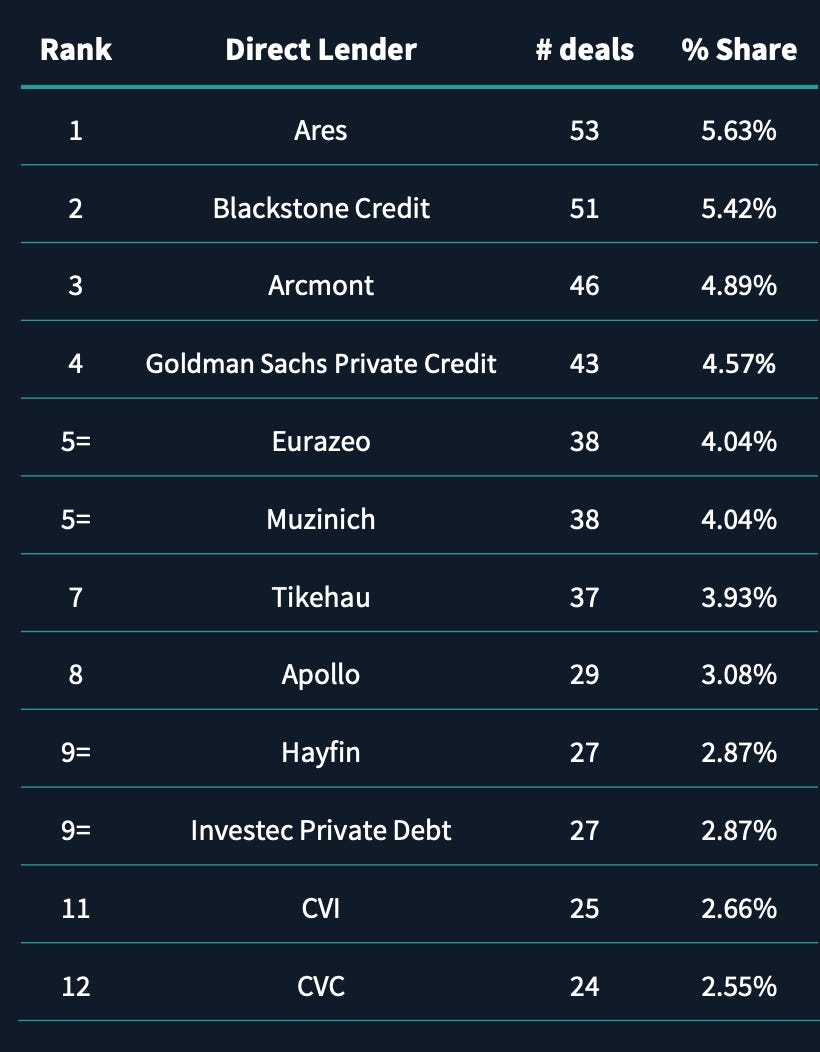

Debt Wire: European Direct Lending Rankings. European direct lending market shatters records for deployment. Link

Alternative Managers Are All Talking About Asset-Based Finance

Nearly 7 out of every 10 earnings calls mention ABF, up ~14x in five years

Manager Updates

Covenant Lite: How Ares Built Its ABF Platform. Link

**RECOMMENDED LISTEN**: Jon Gray sits down with Morgan Stanley Co‑President Dan Simkowitz to unpack two out‑of‑consensus decisions that shaped his perspective.

Dawson Partners, formerly named Whitehorse Liquidity Partners, is launching its inaugural credit secondary strategy. Link

Partnership Updates

HSBC Asset Management partnered with Admiral, a UK insurer. Admiral will make an investment in HSBC’s UK Direct Lending Fund, as part of the partnership. Link

Apollo partnered with Schroders, a $1 trillion+ UK asset manager, to develop a range of wealth and retirement investment solutions aimed at enhancing client choice and outcomes. Link

P10, a Dallas-based manager, entered into a definitive agreement to acquire Stellus Capital Management, a U.S. direct lender, for $250 million. Link

Dispersion Is Back

Oaktree’s latest report is a reminder of why we shouldn’t be looking at averages.

Here are my highlights.

We’re entering a new era of dispersion

Behind buoyant index averages are sharply bifurcated cohorts of winners and losers.

Equities are flying high but remain mostly propelled by a handful of AI superstars.

Credit appears healthy in aggregate, but there’s a notable tail of unloved names.

Economic growth looks robust but masks clear divergence in the experience of high- and low-income consumers, a phenomenon now termed the “k-shaped economy.”

These dynamics serve as a reminder that averages shouldn’t be relied upon in a sophisticated investment process.

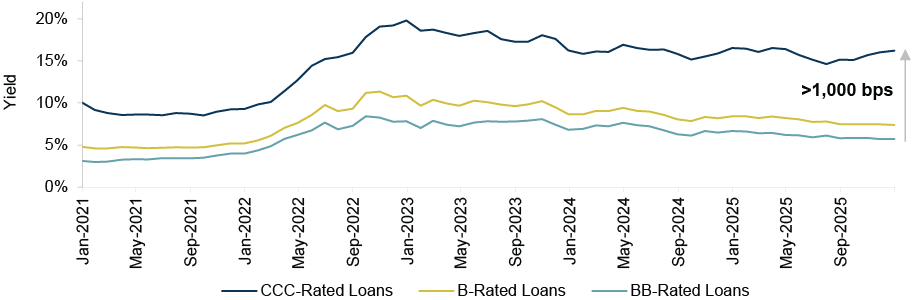

During the low-interest-rate environment of 2009-2021, credit was “bunched up,” with limited dispersion around the index spread. Now yields are much healthier, but a tougher backdrop means we’re returning to a world where mistakes are punished – and potentially capitalized on. As Howard Marks recently wrote, the next phase is set to be more “interesting.”

Mind the Spread Gap

“Tight spreads but good yields” has become the familiar refrain. While that’s broadly accurate, looking under the hood gives a more nuanced perspective.

The senior loan index currently offers a yield of 7.9%, but BB-rated loans are at 5.7% and CCCs are at 16.1%!

It’s a similar story in the high yield bond universe, where index dispersion is the highest on record.

So why are unloved names falling so far through the cracks?

Weak credit documentation has heightened fears of poor recoveries, meaning struggling names can face immediate selling pressure. The data justifies this fear. While payment default rates remain low, recoveries are well below their long-term average: the recovery rate on first-lien loans stands at 37.7% versus the 25-year average of 62.3%.9

In the case of broadly syndicated loans, the dominant buyer – CLOs – has limited appetite for stressed loans. These managed vehicles must meet strict tests, including on CCC exposure, and must be relatively free of stress to secure economical financing from liability investors. This leads to structurally reduced demand for stressed credits.

Aside from technical pressure (i.e., fewer willing buyers for structural reasons), some credits are trading at elevated spreads because they’re fundamentally troubled. A good portion of CCC-rated credits are genuinely under significant strain: 40% of CCC-rated borrowers have operating cash flow coverage below 1.0x.

Combine these factors, and it’s clear why certain names become pariahs. Encouragingly, part of the problem is that solid yields on performing names mean certain investors don’t need to reach for risk: performing credit investors can construct high-income portfolios without purposefully buying heavily discounted names.

Performing and PIKing

In the private credit world, dispersion is harder to map out. Without a developed secondary market, true price discovery is limited. However, it seems private credit loans are also increasingly bifurcated into fundamentally solid and fundamentally struggling, reinforcing the importance of selectivity.

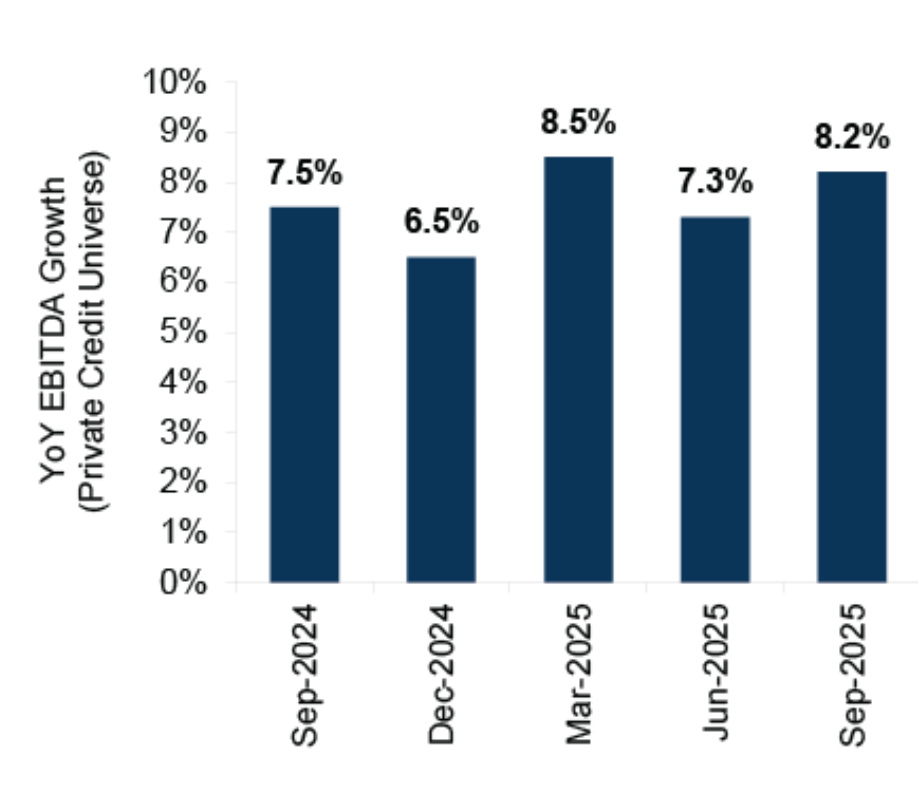

Earnings have been generally strong, with EBITDA growth of over 8% YoY in 3Q2025, and net leverage has trended down over recent quarters.

Earnings Have Been Strong…

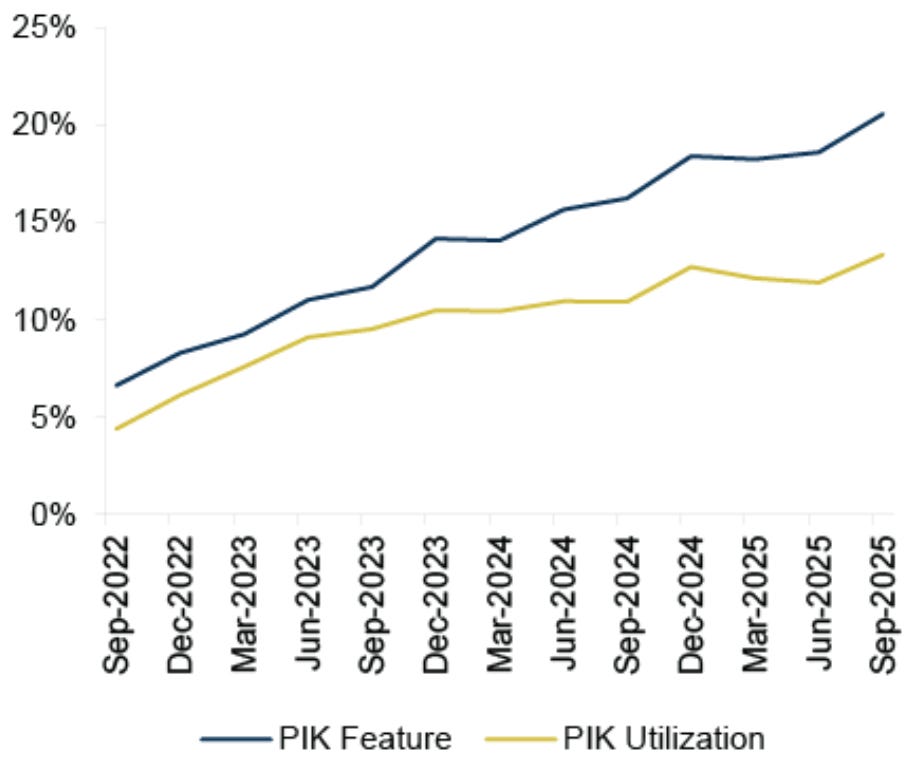

Default rates also remain very low, but there’s some stress under the surface, manifesting most evidently in the form of a reliance on payment-in-kind (PIK) interest as opposed to cash payment.

Roughly 20% of private loans have PIK optionality and over half have ended up taking the option.

But the good news is the instances where PIK emerges after the origination of a deal due to borrower stress remain relatively limited, representing around 4-5% of private loans.

But PIK Reliance Presents a Concern

What Next?

A dispersed market requires a nuanced management approach, rewarding both prudent risk control and intrepid opportunism. Relying on index averages won’t be enough, as the performance of assets within the same universe drift apart.

Part of the conundrum, as always, will be delineating between assets that are:

(a) unreasonably discounted due to psychological aversion and

(b) appropriately discounted because they’re fundamentally flawed.

💰Fundraising News

Eurazeo, a Paris-based manager, closed its $570 million private debt continuation vehicle supported by Pantheon. The vehicle will purchase of a portfolio of performing European senior credit assets originating from Eurazeo’s legacy private debt platforms. This acquisition will also be supported with leverage. As part of the structure, Eurazeo will continue to manage the assets, ensuring continuity in portfolio monitoring and strong stakeholder alignment, while Pantheon will provide additional capital, giving Eurazeo new lending capacity to support European middle market companies. More here

Power Sustainable, a Canadian alternative manager, closed its $1 billion infrastructure credit fund. The manager lends across the infrastructure sectors, including energy and decarbonization, transportation and logistics, digital, social, utilities, and recycling. More here

LBP AM, a European alternative manager, closed its $600 million Infrastructure Debt Climate Impact Fund. All investments are directed towards low-carbon or decarbonising infrastructure that contributes to climate change mitigation. More here

Ruya Partners, an Abu Dhabi-based boutique private credit firm, is raising $400 million for its latest fund. The fund will focus on middle market lending in Saudi Arabia and the UAE. More here

This newsletter is for educational and entertainment purposes only. It should not be taken as investment advice.

The JP Morgan report link is broken!