Oaktree on Private Equity’s M&A Gridlock

Fundraisings from Apollo, Apera, Escalate Capital, TLG Capital and Ballast Rock

👋 Hey, Nick here. A special welcome to the new subscribers from Dorchester Capital, Oppenheimer, and Moody’s. It’s great to have you. Reach out and say hi. This is the 112th edition of my weekly newsletter. You can read my previous articles here and subscribe here

📕 Reads of the Week

Covenant Lite on private credit secondaries in 2025. Highly recommend. Link

Staying with credit secondaries: Oaktree’s Co-CEO, Robert O’Leary, says that the LPs are taking matters into their own hands to realize liquidity ahead of any economic weakness. Link

Muzinich makes the case for parallel lending alongside banks.

Apollo’s Private Credit Webinar: Watch Jim Vanek, Co-Head of Apollo’s Global Performing Credit, discuss his views on investing in private credit at a time of high volatility. Link

Carlyle is close to finalizing a $464 million bond issuance backed by music royalty rights from a range of artists including Katy Perry, Keith Urban, and Benny Blanc. Link

Apollo, Carlyle, and Ares back first BDC-linked SRT deal. Link

Blue Owl-backed Stack Infrastructure seeks $1.3 billion Asia-Pacific loan. Link

🏦 Partnerships of the Week

It’s easy to see why KKR and Capital Group are teaming up. The FT writes about the fading line between public and private markets. Link

Scottish Widows, a UK-based life insurer, is partnering with BNP Paribas AM to source and originate private credit assets for its new LTAF. Link

Three Insights from Ares’ In the Gaps Webinar

As regular readers will know, In the Gaps is one of my ‘must reads’. The Ares’ Co-Heads also host two webinars a year. One of which was released a couple of weeks ago. Below are my three top takeaways, but if you’re serious about private credit, you should watch the full webinar. Here

The Median age of Homebuyers has climbed to nearly 40

Key Quotes:

Kevin: “A homeowner is about 40 times more worthy from a credit perspective than a renter.”

Kevin: “It’s great to be a consumer from a borrowing perspective, it's getting tougher to be a consumer lender.”

Joel: “We're seeing the aging of America... below replacement rate... most of the world is shrinking faster than the U.S.”

Subprime Auto Credit spreads have compressed significantly

This trend is also happening in CMBs, RMBs, and CLOs.

Joel: “This is a supply/demand mismatch, not a sign of froth.”

Joel: “If I'm insurance with the leverage, I say, ‘you know what? That AAA doesn't work. I'm just not making enough spread.’ Cause everything in this world comes down to Asset Liability arbitrage. And if your liability is more expensive than your assets, clearly you're not going to do that.”

Joel: “We're getting to this point, and I'd say we actually went past it in the fourth quarter, where I've been calling it ‘$20 oil’…And the reason I use $20 oil is just because you can't make money drilling something and at $20 oil doesn't mean you can't go to $20, but you can't stay there for that long because eventually nobody drills probably longer than you'd like.”

Read Ares’ last In the Gaps to learn more about this. Link

Solar Is a Cautionary Tale of Subsidy Risk

Joel: “California represents less than 12% of the population and almost a third of the solar panels… Supply and demand works until somebody puts their thumb on the scale and [California] put their thumb on the scale.”

Keith: “If you're investing in an industry, that is highly regulated or that’s reliant on the government… where with a stroke of a pen could change the economics of that industry you should go in knowing that if those things change, you have to have a good answer for what happens to your economic model. That's what's, I think, part of the story here.”

Watch the full webinar here.

Oaktree on Private Equity’s M&A Gridlock

Yields are up, spreads are tight, and private equity is stuck. Oaktree unpacks the gridlock keeping spreads under pressure. Below are my key takeaways, but you should read the full report here.

Deal Activity has been Muted

It’s no secret that M&A activity has struggled to recapture the heady days of 2021. Though we’ve seen some signs of recovery, predictions for a resurgence in 2025 appear to have been overly ambitious.

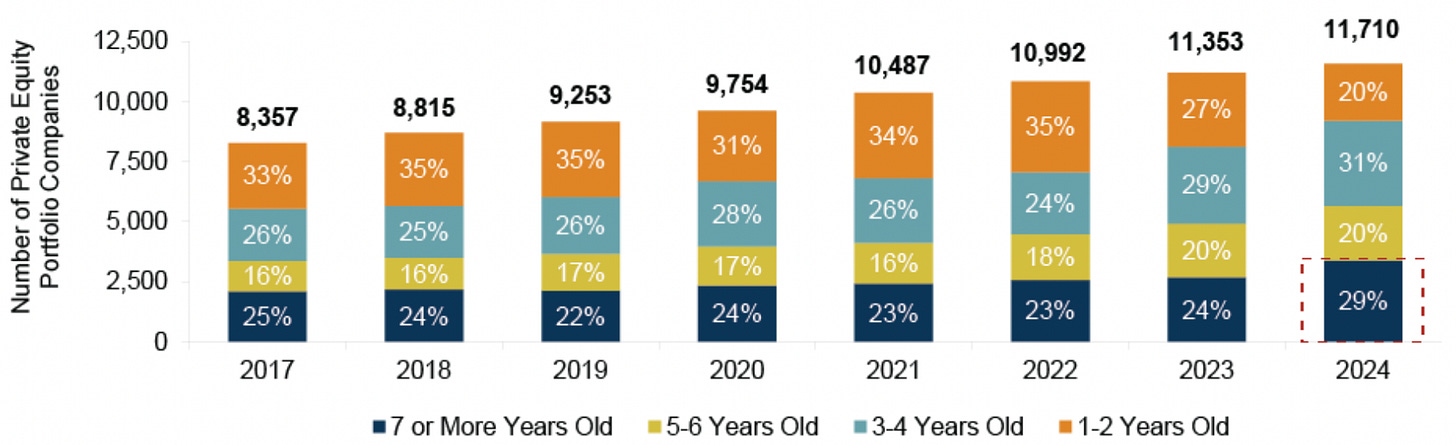

Portfolio Companies are Being Held for Longer

Higher interest rates impact the salability of private equity portfolio companies. With a drastically higher discount rate than that between 2009-21, the valuations portfolio managers believe their holdings are worth have been challenged: potential sellers refuse to compromise while potential buyers aren’t eager to increase their bid. Because of this deadlock, hold periods have increased, with almost 30% of portfolio companies in 2024 having been held for over seven years.

What’s led to this impasse? Prospective sellers purchased companies at a much lower cost of capital than potential buyers now face to fund purchases of the same assets, leading to a mismatch. Notably, over 60% of buyout deal returns in the low-interest-rate era were attributable to broad market multiple expansion and leverage. With these levers challenged, a private equity manager may need to sell to a buyer with a lower cost of funding to achieve their desired exit multiple: a situation that might not be forthcoming.

Limited New Supply has Constrained Loan Market Growth

With hold periods increasing for portfolio companies, the leveraged credit markets have mostly seen supply in the form of refinancings, rather than debt issued to fund acquisitions: refinancings have constituted over 85% of supply in the loan market so far this year. Transactions that effectively just extend the maturities of existing debt don’t directly increase market size, leaving investors fighting over the same amount of paper. In the three years ending in March 2025, the U.S. loan market grew by a total of just 6.1%. Meanwhile, the prospect of high single-digit coupons has enticed income-seeking investors

The supply/demand balance is tilted toward demand

While supply has been limited, demand for credit has been strong; for exactly the same reason! After being stuck with mediocre yields for over a decade, credit investors have jumped at the chance to buy high yield bonds and senior loans at a roughly 8% yield, and, of course, an even greater yield in private credit. Demand for high yield bond and senior loan mutual funds was strong in 2024 while particularly remarkable has been the record levels of CLO creation, which has turbocharged demand for senior loans. means the supply/demand balance is also tilted toward demand.

Credit Yields Are Being Driven By Base Rates

When supply is low but demand and rates are high, we have the situation we’ve been experiencing over the last few years: unexciting credit spreads but attractive yields. Even with the recent increase in spreads, over half of the yield on high yield bonds is currently coming from rates compared to only 25% on average since 2010. Happily for investors, elevated rates are bumping the yield on high-yield bonds to around 100 bps above the average level since 2010.

Read the full report here

💰Fundraising News

Apollo announced $8.5 billion in total commitments for its Accord+ strategy. The opportunistic strategy focuses on high-conviction investments across the credit spectrum. It invests across the capital structure, across both private corporate credit and asset-backed finance, as well as secondary opportunities. More here

Apollo announced the final close of $5.4 billion for its flagship secondaries funds. The funds will provide a range of financing and liquidity solutions, including secondary investments, net asset value (NAV) loans, GP lending, and GP staking. More here

Apera, a London-based asset manager, announced a final close of $3.2 billion for its Private Debt Fund III. The fund lends senior secured loans to lower mid-market companies in Western Europe. It typically lends between €15 million and €100 million per company. The fund is more than twice the size of its predecessor. More here

Escalate Capital Partners, an Austin-based manager, closed its $350 million Capital V fund. Escalate focuses on venture and growth capital-backed companies in technology, software, services, and healthcare. It typically lends between $5 million and $30 million per company. More here

TLG Capital, a London-based emerging markets manager, announced the first close of $75 million for its Africa Growth Impact Fund II. The fund will partner with African banks to support SMEs facing stress with their existing loan options. It will finance businesses across sectors, including manufacturing, healthcare, agriculture, and telecoms. More here

Ballast Rock, a Charleston, South Carolina-based investment manager, launched its first Real Estate Private Credit Fund. The fund will lend to small to medium-scale real estate and solar projects and is targeting a final close of $50 million. It will focus on senior secured debt with the potential for some equity upside and will target loan sizes of $5 million or less. More here

BFS Marine Finance raised ~$30 million from the British Business Bank. The fund will help smaller marine businesses acquire newer vessels to expand or upgrade their existing fleets. Qualifying assets include coastal ships trading in UK and European waters, general purpose workboats, windfarm service craft, survey vessels, charter boats, and passenger ferries. More here

This newsletter is for educational or entertainment purposes only. It should not be taken as investment advice.