Oaktree warns about the LME Wave

Fundraising from Ares, Fortress, Colesco, Trifecta Capital, GCI and Locust Point Capital.

👋 Hey, Nick here. A special welcome to the new subscribers from Kirkland, Deutsche Bank, and KKR. It’s great to have you. Reach out and say hi. This is the 99th edition of my weekly newsletter. Each week, I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here.

📕 Reads of the week

Net Interest: Financing the AI Boom. Link

Apollo: Investors can earn a premium for lending in the private markets. Link

Ares is looking to grow its business in India. Link Recall Blackstone’s Spotlight on India

Wells Fargo and Centerbridge’s partnership has arranged $2.8 billion in deals since its formation. Link

Carlyle and Ares Credit announced an €800 million preferred equity investment in Your.World, a leading European provider of web hosting and managed IT services. Link

Pitchbook’s Q3 24 Lending League Tables Link

Aviva Investor’s Private Market Study Link

Goldman Sachs, CEO David Solomon on the Rise of Private Credit. Link and Transcript

🏦 Insurance Partnerships of the Week

Shares of Brighthouse Financial rose more than 20% last week after the FT reported that the life insurer was working on a sale process with Goldman Sachs and Wells Fargo.

Brighthouse is one of America's largest life insurance and annuity companies with over 2 million customers.

Its $120bn investment portfolio makes it one of the few life insurance companies with sufficient scale to appeal to alternative asset managers such as Apollo, KKR, Sixth Street, Brookfield and BlackRock Link

Read more here

🌊 Oaktree: The LME Wave

Oaktree's quarterly credit update is filled with great content. My highlight is its insights on the LME wave. Summary below - read the full report here

If the onset and acceleration of the LME wave could be explained in just two charts, the two below would be highly effective.

Most Senior Loans Now Lack Meaningful Covenants

Base Rates Have Significantly Increased

Documentation standards deteriorated rapidly during the ZIRP era as lenders compromised on protections in favor of deployment.

Fundamentally, this permits the potential for asymmetrical outcomes for lenders invested in the same instrument, a factor that partly explains the oft-used term ‘‘creditor-on-creditor violence.’’

If loose documentation formed the groundwork for the LME wave, the most significant catalyst that pushed borrowers to exploit them was the historic increase in interest rates in 2022.

While most companies demonstrated resilience to the increased interest burden, a meaningful cohort of challenged borrowers may need additional debt or equity to run their businesses.

For this stressed subset of borrowers, conducting an LME presents the opportunity to secure new liquidity and/or cut their existing debt burden. This may also help avoid –or at least delay – a formal bankruptcy process.

Given the cost, time, and loss of equity associated with an in-court restructuring, an LME is increasingly the preferred option.

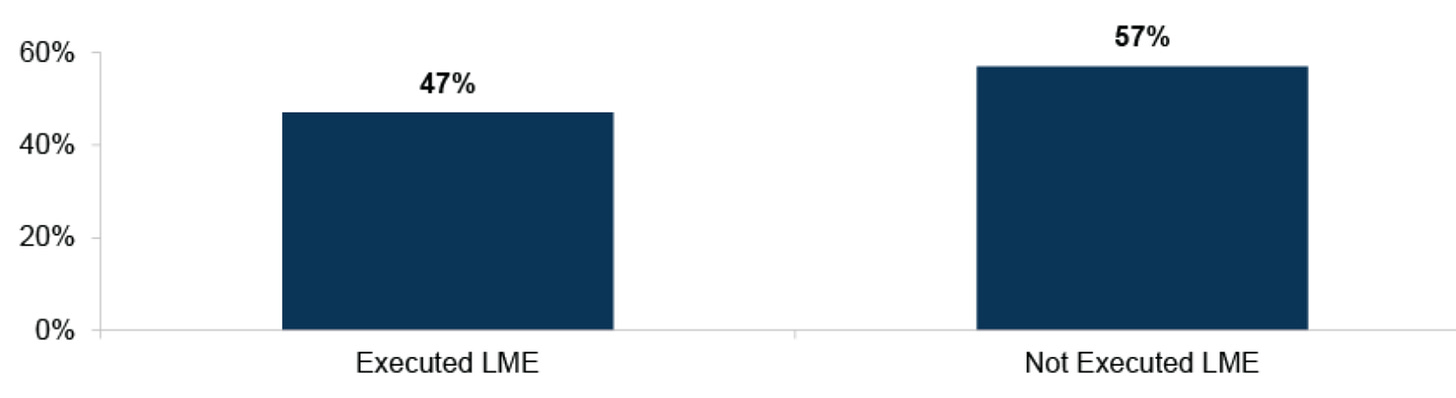

LMEs Represent Over Half of All Defaults

For sponsors, even if LMEs may only delay the eventual day of reckoning, they can provide additional runway to drive improvement in their portfolio companies without the need to contribute more equity, and without the need to crystallize a loss.

Since LMEs only impact a borrower’s balance sheet and don’t affect its business operations, there is a significant risk that despite the transaction the company will eventually need to file for bankruptcy. If a bankruptcy filing does occur post-LME, the negative impact on lender recoveries can be substantial.

Recovery Rates Are Lower for Post-LME Issuers

Oaktree believes the biggest determiner of recoveries in bankruptcy for lenders may be their participation (or lack thereof) in an LME.

Read the full report if you’d like to learn more about protecting against LMEs.

💰Fundraising News

Ares has raised over $2.25 billion for its European Strategic Income Fund. The open-ended fund is marketed to high-net-worth individuals in Europe and Asia. Senior secured floating-rate loans to European mid-market companies form the core of the portfolio and as of December 2024, the fund had invested in 230 portfolio companies. More here

Fortress is raising $1 billion for its latest litigation finance fund, Fortress Legal Assets Fund II. The vehicle targets ~16% net returns and would be more than double the size of the prior fund that closed in 2021. Fortress is already a leader in the sector, with $6.8 billion in commitments. It has backed law firms behind some of history’s biggest mass tort suits, such as the Roundup cases against Bayer AG and talcum powder litigation against Johnson & Johnson. More here

Read CovenantLite’s Introduction to Litigation Finance. Link

Colesco, a Netherlands-based lender, raised ~$830 million for its first fund. The fund finances European mid-market businesses that contribute to a more sustainable society. It focuses on three core themes: Sustainable Food, Energy Transition, and Inclusive Society. Colesco targets businesses with EBITDA of between €10 to €100 million and lends between €50 to €250 million per transaction. The fund recently financed the buyout of Dunlop Protective Footwear. More here

Trifecta Capital, an India-based Venture debt fund, announced a first close of ~$260 million for its fourth fund. The fund lends to fast-growing Indian technology startups. These companies are typically revenue-generating and have raised their Series A or B investment rounds. More here

Global Credit Investments, an Australian credit provider, launched its $60 million Real Estate Credit Fund. The fund focuses on Australian real estate, lending to a range of property types, including residential, industrial, retail, commercial, hospitality, and agricultural properties. Its loan facilities typically range between AUD$10 to $50 million. More here

Locust Point Capital, a New Jersey-based real estate lender, raised $30 million from LAFPP for its third private credit fund. The fund invests in lower mid-market senior housing and care assets. It typically lends between $6 to $14 million per transaction More here and here

ELTIF and LTAF launches from Axa Investment Managers, LBP AM European Private Markets, Partners Group.

This newsletter is for education or entertainment purposes only. It should not be taken as investment advice.