“Origination Is the Key to Growth”: How HPS and BlackRock Plan to Win Private Credit

Fundraisings from Partners Group, First Eagle and Patria Investments

👋 Hey, Nick here. A special welcome to the new subscribers from Goldman Sachs, Upper90, and Configure Partners. It’s great to have you. Reach out and say hi. This is the 118th edition of my weekly newsletter. You can read my previous articles here and subscribe here

📕 Reads of the Week

Blackstone plans to invest $500 billion in Europe over the next 10 years. Link

Pimco: “We express caution in areas of corporate private credit where capital formation has outpaced investable opportunities, leading to potential disappointment. Stresses are becoming evident in private equity and private credit and could worsen sharply in a recession.” Link

US LPs pivot to European private credit for stability. Link

Liquidity plans to invest £1.5 billion in the UK over the next five years.Link

JPMorgan and Morgan Stanley are preparing to syndicate a $350m project finance loan for TeraWulf. The transaction will support the construction of a new data centre in Upstate New York. TeraWulf, which focuses on sustainable, zero-carbon bitcoin mining, signed a lease agreement late last year with Core42, an AI infrastructure and digital services firm, for the New York facility. Link

Pitchbook: Private credit funds spent over 23 months fundraising, the longest period recorded since 2008. Link

Months to Close Private Credit Fund

🏦 Partnership of the Week

Carlyle and Citi announced a fintech specialty lending partnership. Citi’s Spread Products Investment in Technologies (SPRINT) team, a venture capital investor in fintech specialty lenders, will help Carlyle originate opportunities. Carlyle’s ABF team has deployed approximately $8 billion since 2021 and has approximately $9 billion in assets under management as of March 31, 2025. More here

📊 “Origination Is the Key to Growth”: How HPS and BlackRock Plan to Win Private Credit

BlackRock hosted its 2025 Investor Day last week (Link). Some of the headlines you might have seen:

BlackRock targets $400 billion in private markets fundraising by 2030

BlackRock plans to grow its revenue from $20 billion to $35 billion by 2030

BlackRock aims to double its share of revenue from private markets & technology from 15% to 30% by 2030 (I.e, $3 billion → $10 billion)

Scott Kapnick presented on BlackRock’s Private Credit strategy. My top takeaways are below, or you can read/watch the full presentation here. (Slide 99 and 2hr 29 mins).

HPS’s Origination Edge

Credit origination remains the key constraint in the market. There isn’t enough bank capital in the world to fund global growth. Private capital must fill that gap. From the beginning, HPS has prioritized differentiated sourcing across sponsor and non-sponsor channels.

Over 60% of what we’ve done is sourced outside the sponsor channel, an underappreciated market with often better returns, albeit requiring more diligence and negotiation.

The combination with BlackRock widens the top of the funnel, allowing HPS to be more selective and scale faster, with stronger risk-adjusted returns.

Leading Large-Scale Deals

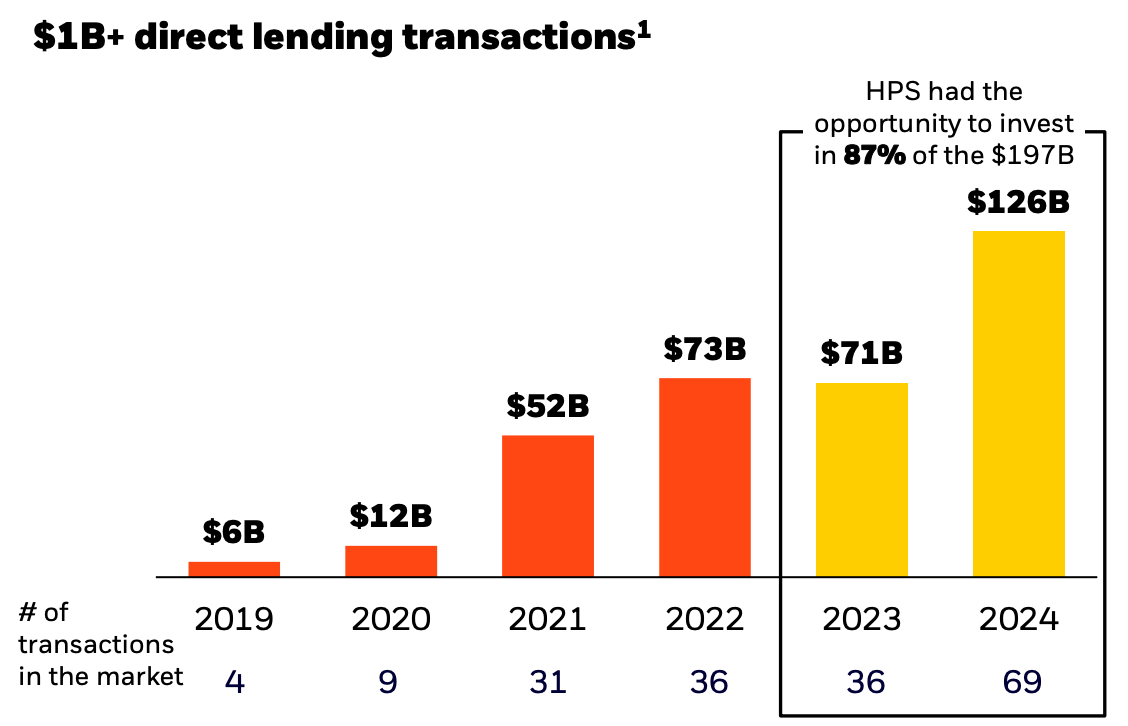

Historically, large deals were done in the broadly syndicated market. That’s changed: private credit has proven it can handle $ 1 B+ transactions. These mega-deals are now a primary driver of non-investment-grade market growth.

There are only a few players who can lead and control such transactions, and HPS is one of them. In the past six years, HPS led more than 25% of the billion-dollar transactions.

Performance Drives Scale

“Performance creates scale, not the other way around.”

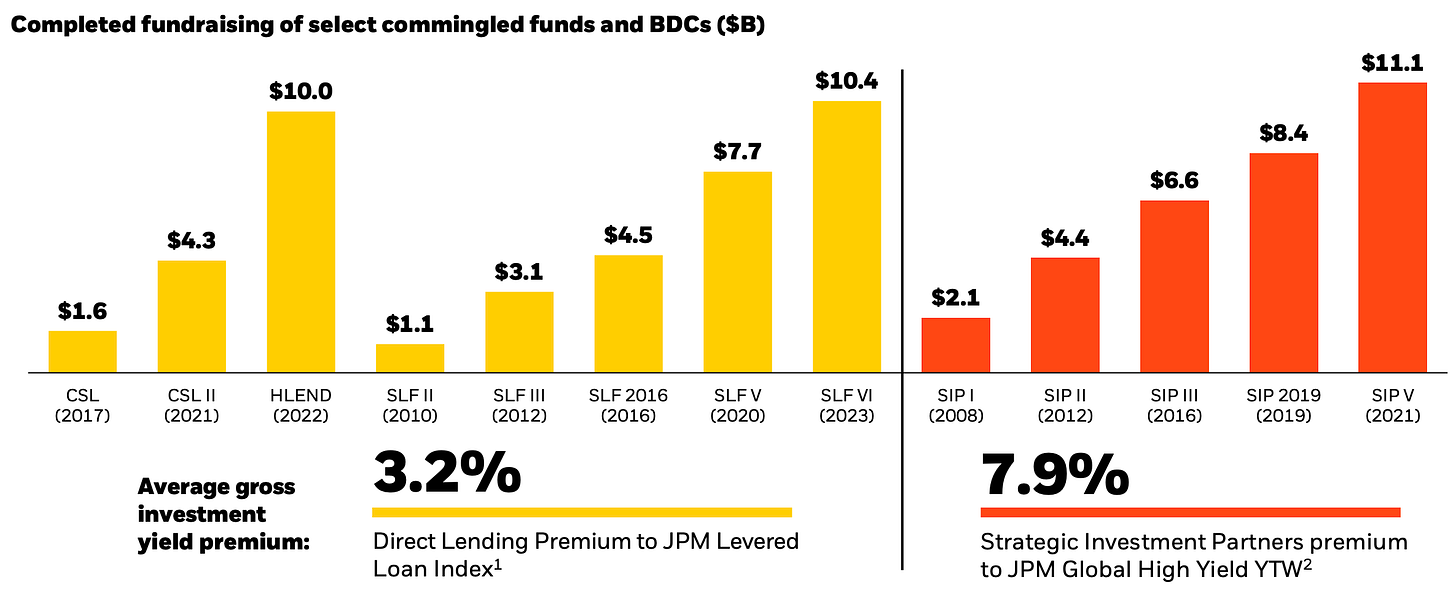

Since inception, HPS strategies have outperformed public benchmarks:

Direct lending: +3.2% over public comps

Junior capital: +7.9% premium

This outperformance has led to strong fundraising, with $10B+ raised for each of its flagship vehicles.

Growth in Insurance Allocations

This is one of the largest, most immediate opportunities. Insurance companies are leading the shift from public fixed income to private credit, and HPS believes it’s ideally positioned.

BlackRock manages $ 700 B+ in insurance AUM. HPS manages $60B. If HPS convert even 10% of that at a modest spread, it becomes highly impactful.

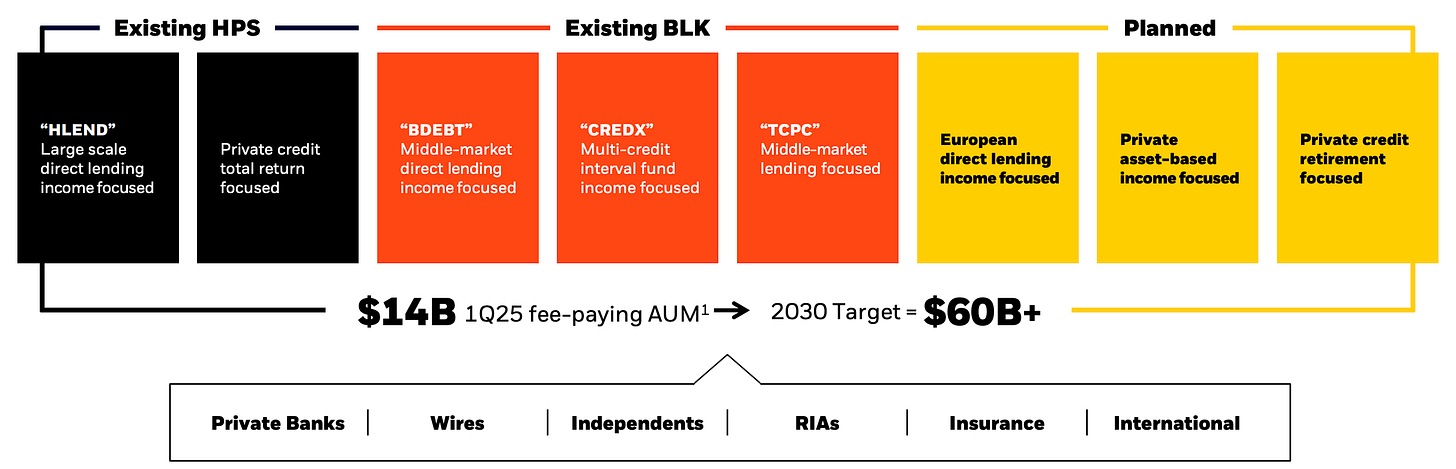

Growth in the Wealth Channel

We’re combining HPS’s and BlackRock’s wealth platforms. Together, we’re positioned to grow from $144B to $160B+ in wealth AUM through scaling existing vehicles and launching new ones.

Origination is at the heart of it all

There’s too much capital chasing too few assets… We’ve built HPS without a large Wall Street wallet… Now, with Black Rock, we're part of Wall Street, one of Wall Street's biggest counterparties, and one of the world's largest equity owners. That is going to supercharge the origination engine and lead the better outcomes, and it's going to allow this leadership team here to have a lot of fun providing service to our clients and our investors.

💰Fundraising News

Partners Group, a Switzerland-based manager, announced its evergreen fund has now raised $2.3 billion, making it one of the largest Luxembourg-domiciled private credit evergreen funds. The fund is open to institutional and private wealth investors and invests globally using Partners Group’s private credit platform. Its portfolio is currently comprised of over 140 primarily senior secured direct loans. The Fund is unlevered and returned 9% net last year and around 8% annualised over the last five years. More here

First Eagle Investments, a New York-based investment manager, launched its Real Estate Debt Fund managed by Napier Park Global Capital. The Fund invests across private and public real estate debt markets with a focus on investment opportunities in residential real estate. It is structured as a closed-end interval fund. More here

Patria Investments, a Cayman Islands-based alternative manager, has raised $314 million for its Latin America funds. About 80% of Patria’s Latin America-dedicated fund has been focused on direct lending. More here

This newsletter is for educational or entertainment purposes only. It should not be taken as investment advice.