Setting Up Private Credit in 2026: A 2025 Debrief

+ Nick's Fund of the Year

👋 Hey, Nick here. A big welcome to the new subscribers from Fasanara, Franklin Templeton, Axis Group Ventures, and Folk 2 Folk. This is the 149th edition of my weekly newsletter. If someone forwarded this to you, you can subscribe here and read my previous articles here.

Reflecting on 2025

I spent last weekend delivering humanitarian supplies to Ukraine with a few colleagues from work. The three-day drive across Europe gave me plenty of time for reflection. Somewhere between rating lane discipline, sampling half of Germany’s deli counter, and the occasional beer 🍻, I tried to make sense of 2025 and frame my thinking for 2026.

I also picked my Fund of the Year. A strategy that, in my view, best captures what 2025 rewarded and what 2026 will demand.

Private credit is getting the same noise that private equity got 20-plus years ago.

We are living through the ‘mediazation’ of financial markets.

The big questions for private credit are: will increasing competition mean that differentiated returns go down? And, can managers continue to scale at this rate?

KKR thinks that these problems aren’t unique and have been addressed before.

They’ve found that if you go up in size, you build different capabilities, you look at adjacencies, there are lots of different ways to continue to grow.

And, in the grand scheme of the capital markets, the sub-investment grade portion of the $51 trillion U.S. credit pie is small.

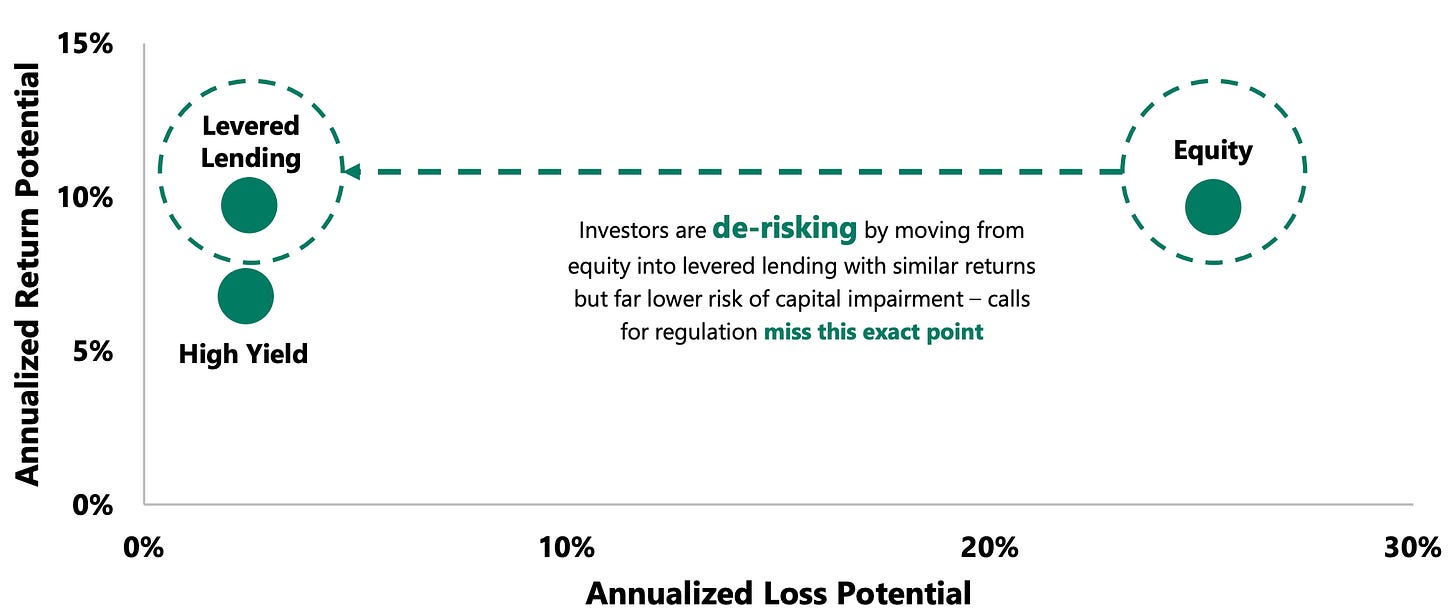

The rotation into private credit is a rotation out of equity.

This is fundamentally what people fail to understand. The rotation into private credit is a rotation out of equity. That is what investors are doing. That is what Apollo observe. They are making a decision to take risk off because they perceive the ability to earn long-run equity returns in first lien debt, top of the capital structure, as an attractive opportunity.”

The M&A Gridlock

Buyers and sellers could not agree on a clearing price for their companies.

With a drastically higher discount rate, the valuations portfolio managers believe their assets are worth have been challenged: potential sellers refuse to compromise while potential buyers aren’t eager to increase their bid.

Because of this deadlock, hold periods have increased, with almost 30% of portfolio companies in 2024 having been held for over seven years.

Over 60% of buyout deal returns in the low-interest-rate era were attributable to broad market multiple expansion and leverage.

With these levers challenged, 2025 was the year of the opportunity fund.

🏆 Nick’s Fund of The Year

If 2025 was the year of the opportunity fund, KSL’s $1.4 billion Tactical Opportunities II (Link) is one of the best examples.

In the lead-up to this post, I had the opportunity to speak with Dan Rohan, Head of KSL Tactical Opportunities. A big thank you to Dan and his team for their time and insights.

I covered over 200 fund announcements in 2026. While Oaktree’s $16 billion Fund XII attracted the headlines, KSL’s fund stood out to me for three reasons.

Three reasons why KSL Tac Opps II is my fund of the year

1) Counter Positioning

“For your performance to diverge from the norm, your expectations – and thus your portfolio – have to diverge from the norm, and you have to be more right than the consensus. Different and better: that’s a pretty good description of second-level thinking.” Howard Marks - It’s Not Easy

KSL invests in travel & leisure with more than three decades and over $25 billion dedicated to this sector exclusively. Generalising against this sector focus will lead you to question how resilient a strategy focused on this could be. However, as I’ve learnt this year, Generalization errors catch the unwary investor too focused on the big picture and not enough on the details.

KSL isn’t a travel generalist.

“KSL has invested exclusively in travel & leisure for over three decades and will continue to do so over the next three. Our thesis is predicated on a prescriptive approach to investing behind a consumer who prioritizes experiential, enduring leisure travel. This consumer tends to be in the top 10% of earners, more resilient across cycles, spends approximately four times as much on travel leisure as the average US consumer and views these experiences as incredibly core to their identity. We map this consumer’s spending patterns and do our best to invest thematically behind the most resilient aspects of their spend.”

Dan Rohan, Partner, Head of KSL Tactical Opportunities

There’s a further tailwind supporting these consumers, and that is the Great Wealth Transfer. Over the next two decades, $100 trillion of wealth will be transferred from boomers to younger generations. For perspective, that’s more than 50 years’ worth of what Americans spend on leisure each year. The beneficiaries of this wealth are more experience-led, and they’re exactly the customers KSL plans to serve.

2) Cornered Resource

“A cornered resource exists when businesses have preferential access to scarce assets (investments, relationships, talent, data and contracts) that others can’t replicate quickly. Rivals can’t realistically copy or obtain it fast enough to neutralize your advantage.” Hamilton Helmer

KSL has made 200 investments in 600 individual assets. This gives them access to:

50,000 employees

30,000 skiable acres

7,000 marinas slips

1,300 resorts

100 FBOs

The data generated from this helps KSL see trends early, make higher-conviction investment decisions, and, importantly, provides a weather barometer when things shift.

Built patiently over 30 years, this platform creates a durable informational and relationship advantage that continues to compound with each new additional investment.

3) Opportunistic Capital

This final point is the most decisive, and it’s why KSL’s Tactical Opportunities Fund II is my fund of the year.

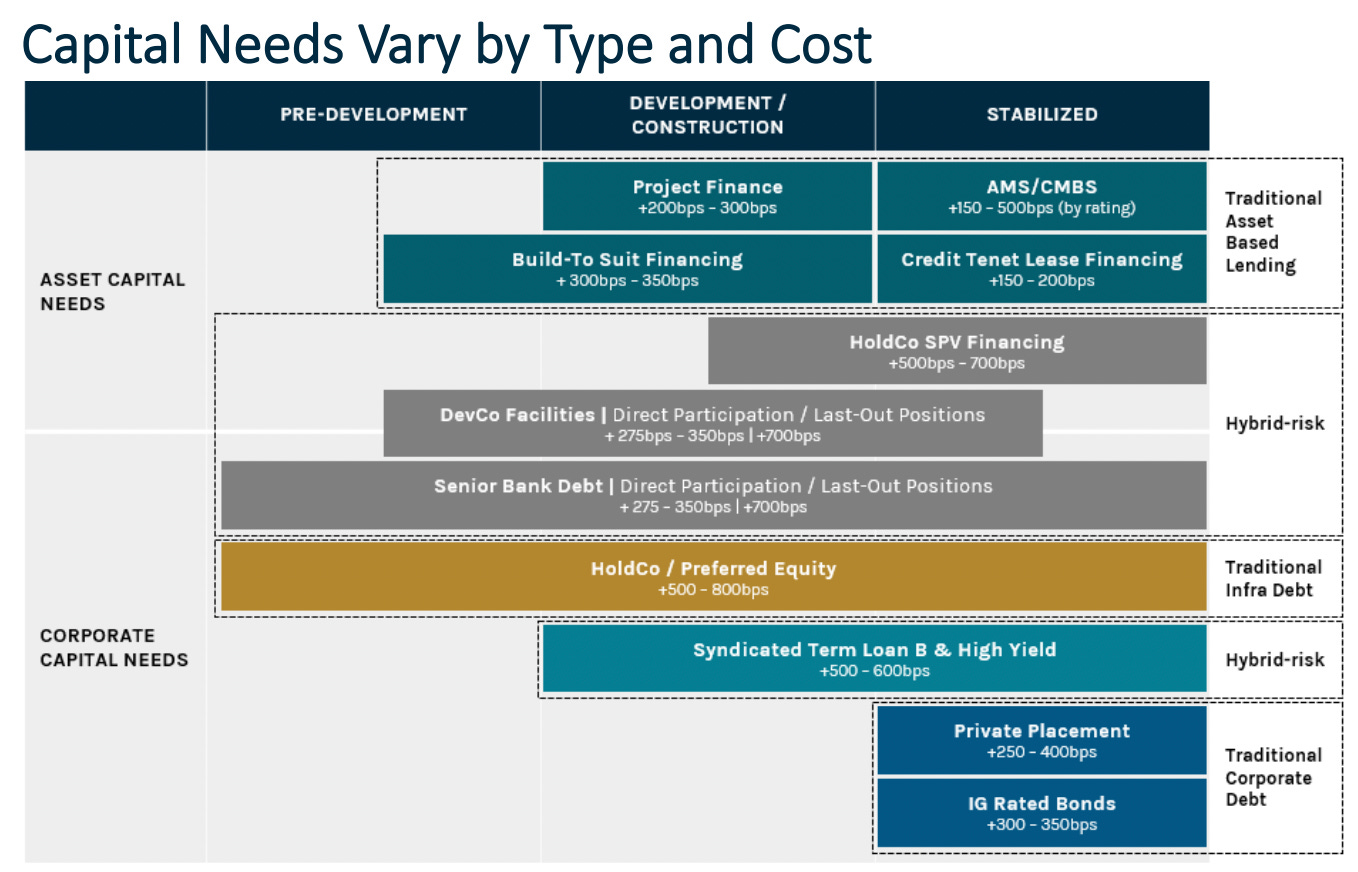

Higher interest rates have created an M&A gridlock. Sponsors and owners don’t want to sell at the current valuations. Despite optimism going into 2026, this trend will continue until either interest rates decline meaningfully or earnings increase meaningfully. This will take more time.

While the market waits for valuations to clear, owners require transitional capital. This could be to merge platforms or to renovate their hotels. Traditional lenders will typically provide the first 40%, but to execute the transition successfully, owners need a partner willing to fund to ~75%.

These opportunities are KSL’s Tac Opps calling card.

“We strive to be a one-stop shop within travel & leisure. It’s immensely powerful to be able to sit across the table from a potential partner and say ‘If we fundamentally believe in your business and your consumer, then we have a solution for you.’ We can buy the business, finance it, or offer just about any type of strategic partnership capital in between.”

Dan Rohan, Partner, Head of KSL Tactical Opportunities

Working alongside owners, KSL structures patient, flexible solutions that “speak for” the entire stack, often blending some level of current pay, PIK, and warrants. The result is an aligned platform, often with KSL providing active operating support alongside the board and management.

It’s important to highlight two additional points about the Tac Opps strategy. Everything else remains unchanged, same consumer focus, same sector focus, simply different places in the caps stack. Secondly, this isn’t predatory capital; this is being a partner to solve an owner’s need.

A few comments on data centers

Generating excess returns in this sector won’t be especially easy

The spectrum of risks will vary from VC-like risk in the earliest stages to re-leasing and technology obsolescence risk in the later stages of these assets. Therein lies the reason to proceed with caution.

Traditional, “pure-play” investors may find themselves ill-equipped to underwrite all facets of a hybrid-risk transaction.

Focus on getting leased and repaid. Not on guessing what the world looks like at lease renewal.

There’s a difference between a principal’s mindset and an agent’s mindset.

If you are an agent, you are originating anything to do with AI and data today. You have 100% confidence that you can distribute the risk.

If you have a principal’s mindset and you’re going to own the asset for a long period of time, you look at everything through a different lens.

So, if you now drill into the notion of AI data centers, what are we really talking about? Anywhere we go in the world for heavy users of compute, you ask them, what do they need to move faster? And the answer is always the same, more compute. When are they going to get more compute? No time soon, because there are natural limits. There are energy limits, there are regulatory limits, and there are zoning limits. (And everything else..)

What does that tell you as a credit investor? It tells me that the risk I’m prepared to take is lease-up risk. The risk I’m not prepared to take is renewal risk.

The chart of experts’ projections of energy usage in 2030 is like a child throwing darts. If the experts have no idea of energy use, much less chip use, compute, the impact of quantum, do I really want to, with my credit hat on, take renewal risk? No.

This is now the bifurcation of how you think about AI and data.

And so, let’s make sure we’re looking at this through the right lens. Credit is credit, and the best you can do is get paid back. Therefore, it is not a great place to speculate on renewal. There’s plenty to do without taking renewal risk.

Equity has the volatility of upside and the chance of losing everything. And, yes, you can lose it all, and prices are high, and Marc Rowan think there will be both great fortunes made and lost in the equity of data centers.

The use of leverage in the AI industry shouldn’t be applauded or feared. It all comes down to the proportion of debt in the capital structure; the quality of the assets or cash flows you’re lending against; the borrowers’ alternative sources of liquidity for repayment; and the adequacy of the safety margin obtained by lenders.

We’ll see which lenders maintain discipline in today’s heady environment.

Looking into 2026

Defaults are a normal part of life

The truth is that there are always defaults... Over Howard’s 47 years in the high yield bond market, more than 2% of all bonds by value have defaulted in a typical year, and many more during crises.

If you apply that percentage to the number of sub-investment grade issuers, which runs in the thousands, it shouldn’t come as a surprise if there are a few dozen defaults in a normal year…

The credit spreads people care about so much are there for a reason.

Sub-investment-grade debt entails credit risk

Focus on what could go right

In periods of high volatility, like we are experiencing now, there’s a tendency to focus on what can go wrong.

Even though we’ve already seen a large correction of prices and credit spreads gap out.

It’s actually in these moments that you want to say to yourself, counterintuitively, now that I’ve dropped to here, what could go right?

It’s all about alpha

Direct lending is no longer exotic. While performance across the asset class has been strong over many years, largely supported by accommodative monetary policy, it’s misguided to believe that a rising tide will continue lifting all boats.

One defining feature of the US corporate direct lending market is its fragmentation:

Different sectors,

Different sponsors

Different sizes

Different structures and solutions

The percentage of portfolio holdings that managers have in common remains extremely low. Simply put, not all direct lenders are alike.

As default rates and other signs of stress emerge across this asset class, the impact is anything but uniform across companies and managers.

💰Fundraising News

Ares raised $7.1 billion for its Credit Secondaries fund. The fund will build a portfolio of senior secured private credit loans by investing across LP-led and continuation vehicle transactions in collaboration with leading asset managers. Ares believes that ACS is the largest dedicated institutional credit secondaries fund globally based on LP equity commitments. More here

Oaktree launched its Asset-Backed Income Fund, OABIX, with $400 million in commitments. The evergreen interval fund will provide U.S. individual investors with access to Oaktree’s asset-backed finance. The fund invests across sectors, collateral types, and investment formats. More here

Invesco launched its European Upper Middle Market Income Fund. The evergreen strategy, offered under the ELTIF 2.0 regulation, invests in a portfolio of European upper middle market, senior secured corporate loans. The fund offers a monthly subscription with quarterly redemptions. More here

Jadwa Investment, a Saudi Arabia-based manager, announced a first close of $80 million for its flagship private credit fund. The fund invests across the Gulf Cooperation Council (Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, UAE). More here

Nassau Global Credit, a New York-based manager, launched its $400 million Credit Opportunities strategy. The strategy will invest in performing, opportunistic, and structured credit. More here

This newsletter is for educational and entertainment purposes only. It should not be taken as investment advice.