Summer M&A is at its highest level since 2021

Fundraising from Crescent Capital and SeaTown

👋 Hey, Nick here. A big welcome to the new subscribers from Ares, Dorchester Capital, and Howden Capital Markets & Advisory. This is the 129th edition of my weekly newsletter. If someone forwarded this to you, you can subscribe here and read my previous articles here.

I’ve been travelling a fair amount over the last week so unfortunately this week is light on depth and heavy on clicks. Normal service will be resumed when a) easyJet learns to keep to its schedule b) Elon puts wifi on every plane c) we stop pretending that PDFs are readable on iPhones.

📕 Reads of the Week

Market Insights

Jon Gray talks about private assets in retirement plans and why he believes the stage is set for a pickup in dealmaking.

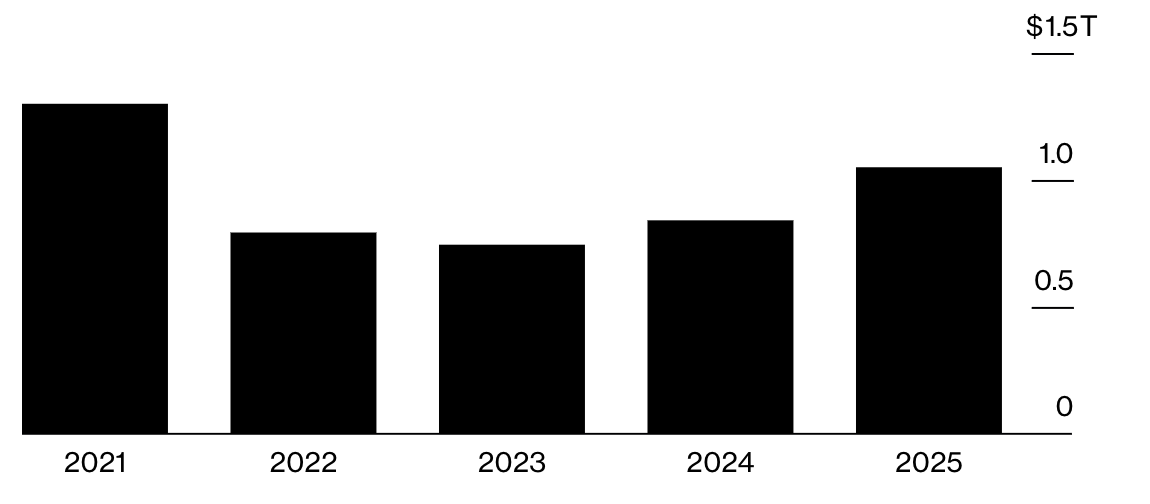

Summer M&A is at its highest level since 2021. Companies have announced $1.1 trillion of transactions since the beginning of June. That’s up 30% from last year.

Note: Data cover June 1 - Aug. 31 periods; 2025 is through Aug. 26

HL’s Summer BDC Monitor: Key Trends from more than 160 BDCs:

The top 10 managers represent 20% of the BDCs by fund count and 64% of the BDCs by total assets.

Leverage is near all time highs.

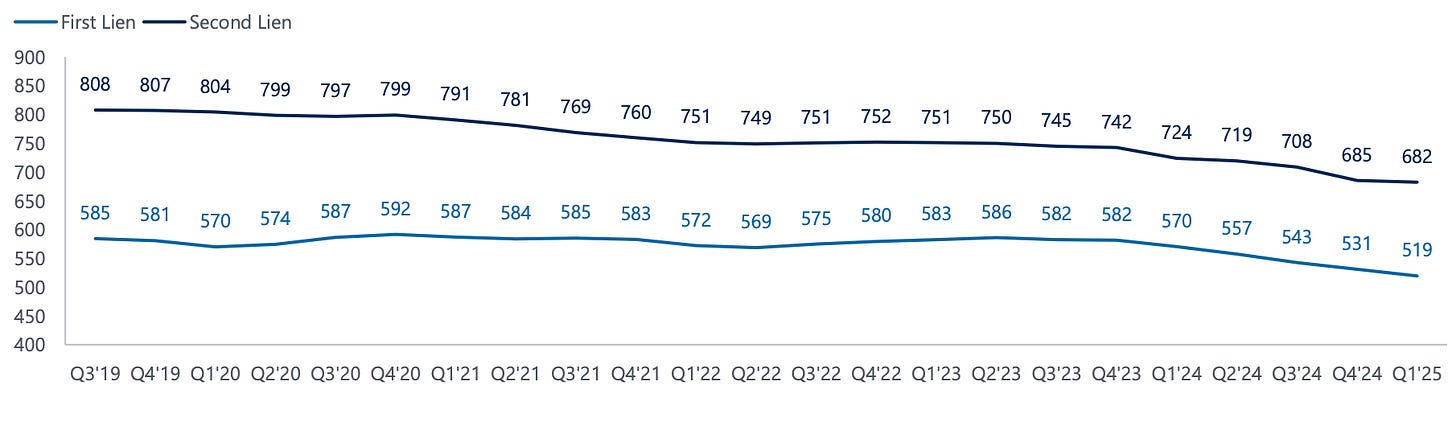

Second Lien Yields and Spreads Are Largely Flat While First Lien Continues to Decline

Also see Apollo’s ABC of BDCs

Deals & Funds

BlackRock pauses Asia private credit fundraising. The $1 billion fund, launched in late 2023, secured less than half of its target before the pause.

🥃 Wineries and Whiskey Makers Tap Private Credit for Financing. As an example, InvestBev Credit has committed up to $50 million to enable Lofted Spirits’ clients to borrow against their aging barrel inventory.

Blackstone Credit & Insurance announced an upsize of its $1 billion senior secured facility with Aligned Data Centers. The financing will support the development of its planned 5+ GW of future capacity across the Americas.

🐎 Apollo pushes deeper into sports lending. The firm has extended £40 million to Joorabchian’s Sports Invest Holdings, secured against assets including racehorses and stables.

Private credit pay in 2025: better bonuses than banking

Opinions

🎧 Huw van Steenis and Net Income talk about private credit. “Private Credit is Ozempic for the Banking Industry, it helps you slim down your balance sheets.”

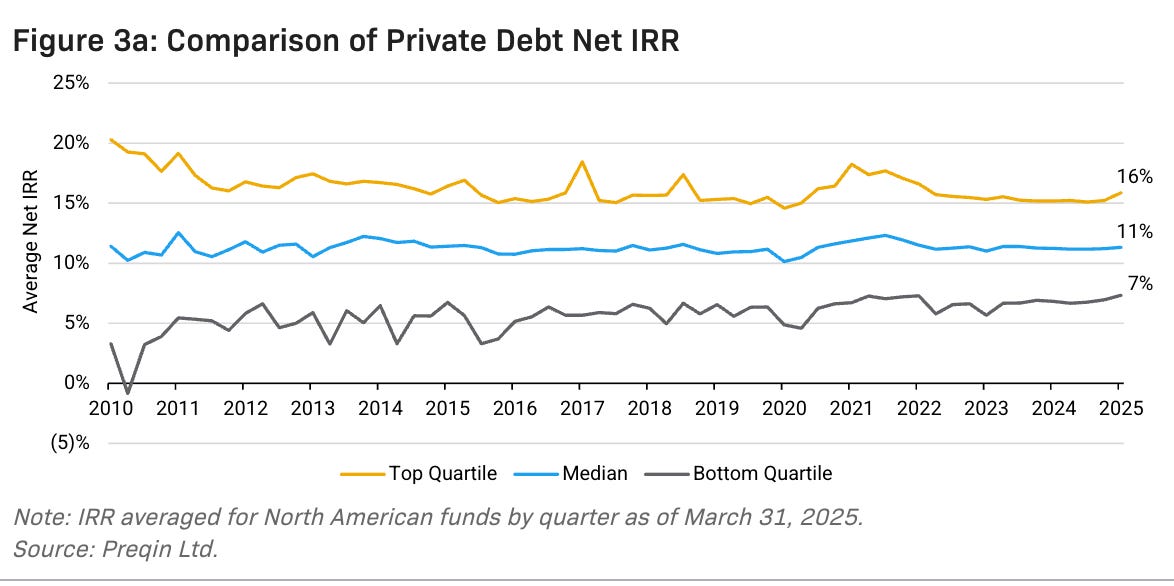

KBRA assesses the risks of investing defined contribution plans in private credit. The difference between the top and bottom-quartile funds can be material.

📊Charts of the week

Configure Partners published its Q224 Credit Market Update.

Below are two of my favorite insights, but you should also read the full update here. I’d highly recommend it.

Loans Issued with a PIK Option

Proposals issued with a PIK option declined notably.

Junior capital remains characterized as selective deployment and competitive pricing, mirroring the senior environment.

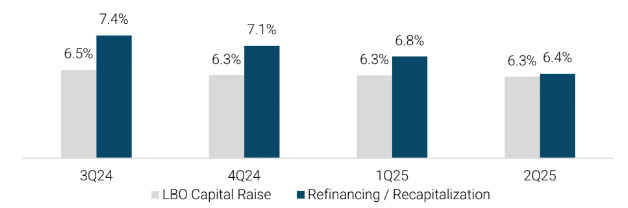

LTM Spread by Engagement Type

The spread gap between LBO raises and refinancing transactions has largely dissapeared.

Read the full update here.

💰Fundraising News

Crescent Capital, a Los Angeles-based alt manager, is raising $3 billion for a new credit continuation vehicle that would roll assets out of its 2017-vintage Crescent Mezzanine Partners VII fund.

SeaTown, a Singapore-based alternative manager, held a first close of $612 million for its third private credit vehicle. The fund lends to corporates in the Asia-Pacific region and targets mid-teens returns.

This newsletter is for educational or entertainment purposes only. It should not be taken as investment advice.

Great roundup Nick, especially the BDC leverage data from HL. The fact that leverage is near all time highs while first lien spreads continue to decline is exactly the kind of squeeze that firms like Ares Management are navigating right now. What's intersting about Ares is they're one of the few managers with significant scale across both the BDC side (ARCC being one of the largest) and the direct origination platform, which means they can see both the supply and demand dynamics in real time. The PIK option data from Configure is particularly relevnt because Ares has been pretty disciplined about avoiding high PIK structures compared to some competitors. The summer M&A pickup to $1.1T is encouaging for deployment, but I think the real test is whether these deals are getting financed at sustainable spreads or if lenders are chasing volume. Ares' advantage has always been their sourcing relationships and ability to stay patient when pricing gets irrational. Good stuff as always.

Really sharp roundup, Nick - the $1.1T summer M&A stat and BDC leverage trend caught my eye. TCLM (Trade Credit & Liquidity Management) puts out content on credit, liquidity, and working capital from the corporate finance side, which could add another layer to the market insights you’re already sharing here.

(It’s free)- https://tradecredit.substack.com/subscribe