The Credit Crunch #46

The rise of “Non Bank Lending”. Fundraising announcements from Arcmont, Benefit Street Partner, BGO, Churchill, Morgan Stanley and Blue Owl

Welcome back to the 46th Credit Crunch.

January finished with nearly $17 billion of fundraising announcements last week.

This January has been particularly great for Business Development Companies with four large BDC raises (Three below).

📊 The rise of “Non Bank Lending”

Morgan Stanley is the latest bank to magnify its focus on private credit, raising ~$100 million for its BDC (See below). The bank also announced plans to increase its private credit portfolio to $50 billion. (Link).

Morgan Stanley isn’t the first bank to do this. We’ve seen similar announcements from Goldman Sachs, JP Morgan, Wells Fargo, Citi, Deutsche, CIBC, BNP Paribas, Societe Generale, and MUFG.

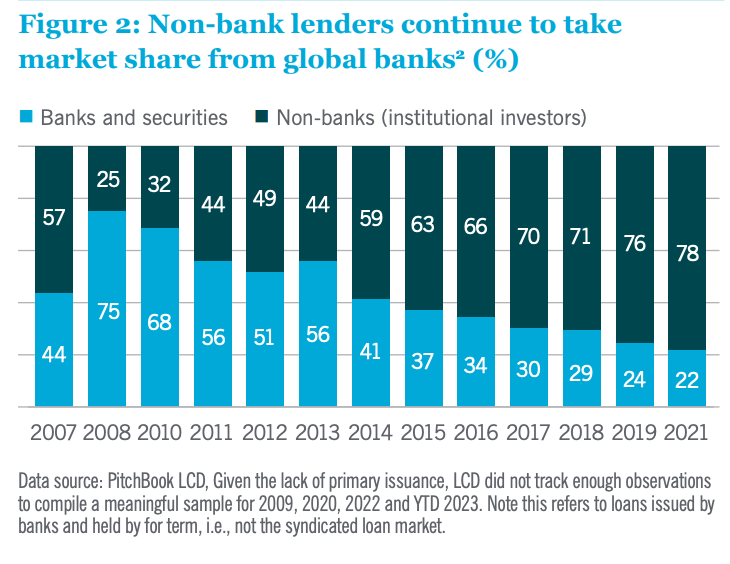

With these facts in mind. Why do we keep seeing slides like this?

The general thesis is that:

Following the global financial crisis, regulators acted to make banking safer. Banks were forced to reduce their lending, and their business clients had to look elsewhere for capital — mainly to alternative asset managers offering private credit.

Excess liquid credit has moved out of the banking system, reducing concentration and risk in the banks, just as the regulations intended. Meanwhile, alternative asset managers are attracting a wide range of investors and spreading risk among them.

Institutional Investor (Link)

We can all agree that private credit has benefitted from this trend over the last 13 years.

The real question is - Will this trend continue?

Many of you (Including Apollo - Link) might now argue:

Private Credit Managers are faster than banks

Private Credit Managers can be more flexible than banks

Private Credit Managers can provide greater certainty of execution

Yet, what happens when Wells Fargo teams up with Centerbridge Partners? (Link) Or when Societe Generale partners with Brookfield Asset Management? (Link) Do these managers suddenly become slower, less flexible, and less decisive?

In my view, these slides don’t provide your LPs with insights. They may actually be diverting attention from the crux of your strategy

So. Rather than trying to forecast what the banks are doing, let's focus on the essentials:

What market is your fund targeting?

What makes this market attractive?

How will you provide LPs with persistent differential returns?

💰Fundraising news

Arcmont Asset Management, a London-based private debt asset manager, announced a final close of $11 billion for its Direct Lending Fund IV. The European-focused fund is targeting a defensive, diversified portfolio of mainly first-lien senior and unitranche loans. It can also invest in second lien and subordinated loans. The fund focuses on sponsored middle market businesses. These companies typically have stable earnings between $10 million to $100 million. Arcmont can also hold equity or warrant positions alongside those loans, providing upside potential through equity participation in select situations. More here and here

Benefit Street Partners, a New York-based alternative asset manager, announced a final close of $4.7 billion for its fifth flagship direct lending vehicle. The fund lends senior secured loans to sponsored and unsponsored North American middle market companies. Benefit Street’s U.S. private debt platform has deployed ~$38 billion since its inception in 2008. More here

BGO, a London-based real estate investment manager, announced a final close of ~$1.5 billion for its Europe Secured Lending Fund III. The fund invests across a range of real estate asset classes, including logistics, multi-family residential, hospitality, retail, and office. It focuses on mid market senior and whole loans and can provide junior debt for appropriate opportunities. Loans typically range from €25 million to €300 million. More here

Churchill, a New York-based asset manager, raised ~$100 million for its Nuveen Churchill Direct Lending Corp. The BDC has a portfolio of ~$1.5 billion across 174 portfolio companies. This generates an average yield of 11.9%. Borrowers have an average EBITDA of $74 million. The portfolio had an average interest coverage of 2.4x and an average net leverage of 4.9x, as of 30 September 2023. The BDC’s average investment is $8.5 million. More here and here

Morgan Stanley, a New York-based bank, raised ~$100 million for its Morgan Stanley Direct Lending Fund. The BDC has a portfolio of ~$2.5 billion across 112 portfolio companies. The BDC typically lends between $10 million and $40 million per company. More here and here

Blue Owl, a New York-based asset manager, raised ~$90 million for its Capital Corporation III BDC. The BDC lends to sponsored US upper middle companies. The BDC has a portfolio of ~$3.6 billion across 146 portfolio companies. This generates an average yield of 11.6%. Borrowers have an average annual revenue of $941 million and EBITDA of $204 million. The portfolio had an average interest coverage of 1.8x and an average LTV of 39%, as of 30 September 2023. Blue Owl typically invests between $20 million and $250 million per transaction. More here and here