The Credit Crunch #54

CalPERS is reaping the rewards from Private Credit. Three Insights from Configure Partners. Fundraising from Goldman, Apollo, Vicenda and an Austrialian Manager.

👋 Hey, Nick here. Welcome back to the 54th edition of my weekly newsletter. Each week I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here to get this delivered to your inbox. Scroll to the bottom, if you’re here for the fundraising news. It really makes a difference to me if you share this 🙏.

🥳 CalPERS is reaping the rewards from Private Credit.

I recently wrote a deep dive into CalPERS Private Debt strategy. If you haven’t read it, I’d recommend you read it here.

There have been two interesting developments since I wrote my previous article.

Firstly, CalPERS Private Debt produced a 1-year return of 13.3%. This made Private Debt the second-best performing asset class in the CalPERS portfolio. It even outperformed private equity (Link).

Secondly, you may recall I questioned why CalPERS private debt allocation was so low. Currently, CalPERS has a long-term private credit allocation target of 5%. It appears that someone at Wilshire, CalPERS investment consultant, agrees with me. Wilshire has recently proposed that CalPERS increase its Private Debt allocation to 8% (Link). This increase will unlock an additional $15 billion of capital for new private credit funds.

If this proposal is accepted I owe CalPERS an apology.

CalPERS may be taking private credit more seriously than I originally thought.

📊Charts of the week

Configure Partners published their Q423 Credit Market Update.

Below are three of my favourite insights, but you should also read the full update here. I’d highly recommend it.

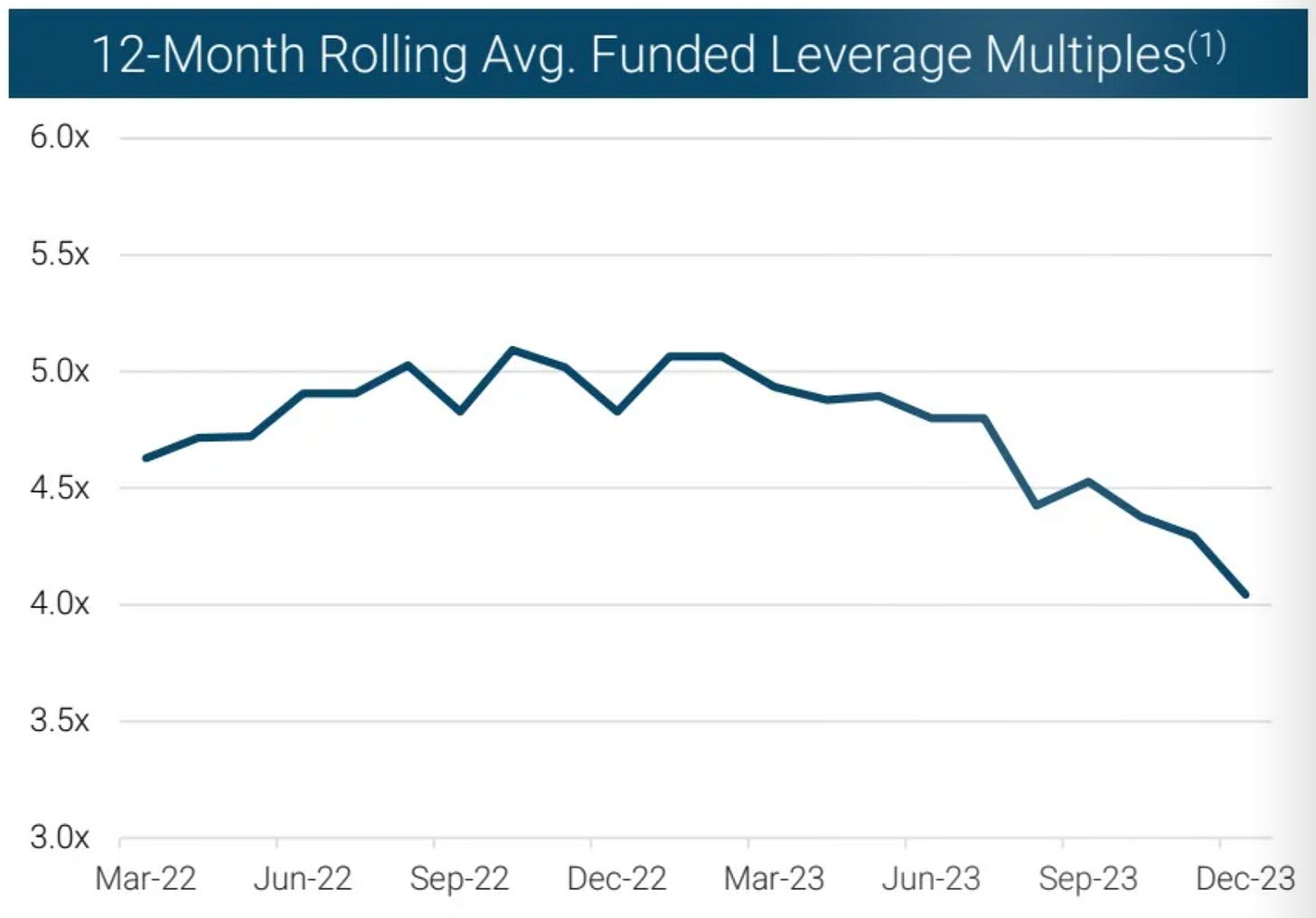

Leverage multiples continue to fall - Average multiples have fallen over 1.0x since the peak in December 2022. Leverage multiples have fallen even further for cyclical industries.

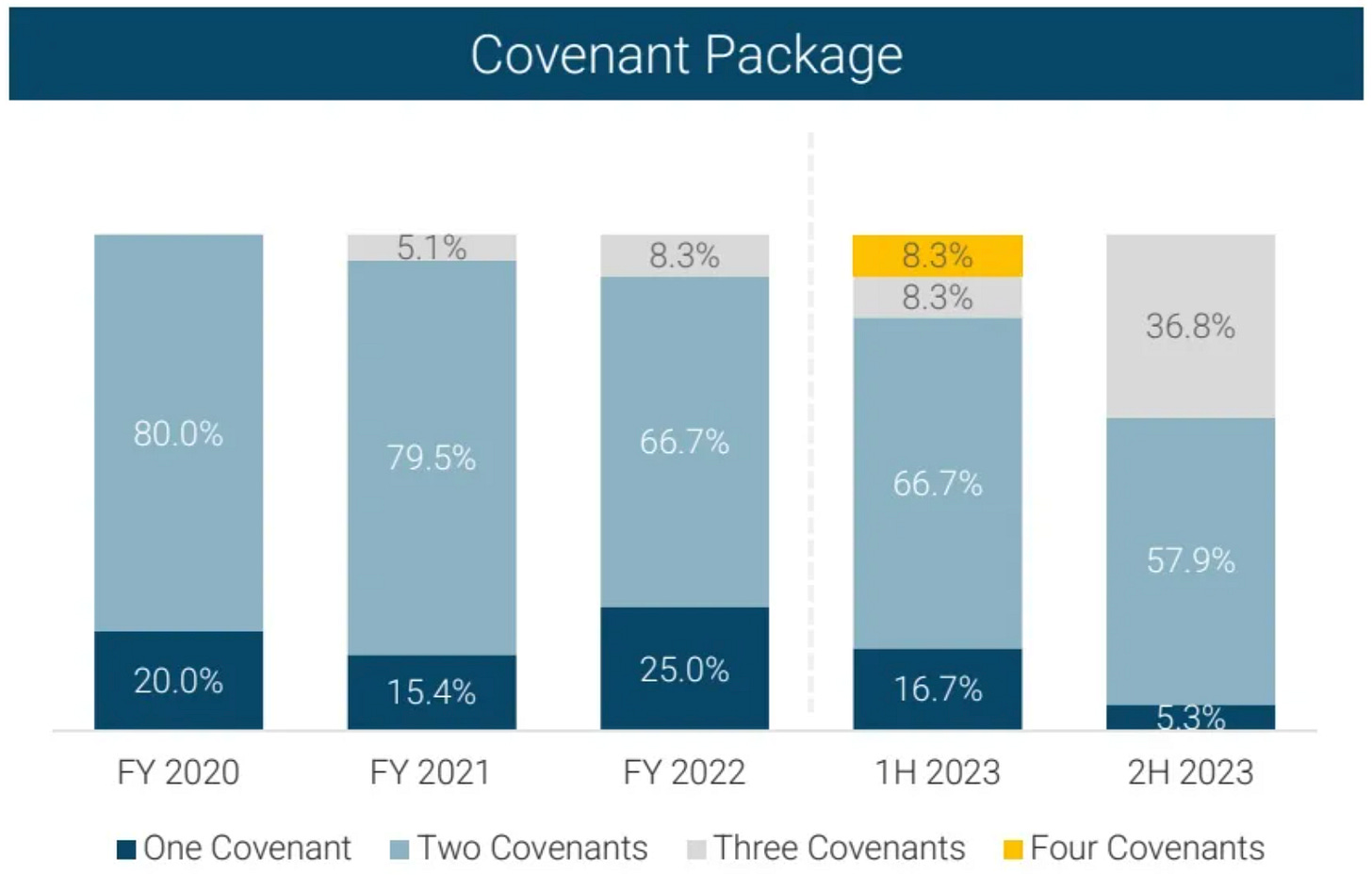

Loans have more covenants than before - Loans with three or more covenants have significantly increased in the last 6 months. These packages were unheard of less than three years ago.

Loan extensions are getting longer - The average loan extension is now 12 months.

💰Fundraising news

Goldman Sachs Asset Management announced a final close of ~$700 million for its Union Bridge Partners I fund. The opportunistic strategy co-invests in high-conviction positions from the portfolios of leading private credit and hedge fund managers. The fund is ~40% deployed and has invested in companies across North America and Europe in diverse sectors including hospitality, fitness centers, software, and music royalties. It will invest in both private and public credit. Union Bridge is part of Goldman's $340 billion External Investing Group.

Apollo launched a private BDC in partnership with Mubadala, Middle Market Apollo Institutional Private Lending. The fund will primarily invest in US middle market companies with less than $75 million in EBITDA. Apollo expects the remaining ~30% of the portfolio will include larger private U.S. and European borrowers with at least $75 million in EBITDA. The fund currently has ~$800 million in assets.

This fund is part of Apollo and Mubadala’s commitment to jointly invest up to ~$2.5 billion over five years.

Vicenda, a Switzerland-based credit manager, launched its ~$270 million Opportunities Fund. The fund lends senior secured loans to small and medium-sized businesses in the DACH region (Germany, Austria, Switzerland). It will invest in ~40 companies, financing between €5 and €25 million per company. Vicenda targets a net IRR of 11 percent. The fund is an Article 8 fund.

Revolution Asset Management, an Australian private credit manager, launched its Private Debt PIE Fund. The fund provides investors exposure to Australian and New Zealand private debt. It invests in senior secured loans, leveraged buyout debt, asset-backed securities, and real estate debt.