The Evolution of Private Credit in 2026

Perpetual capital, semi-liquid vehicles, and the race for retail

👋 Hey, Nick here. A big welcome to the new subscribers from Saison International, Capital Four, and Golub. This is the 148th edition of my weekly newsletter. If someone forwarded this to you, you can subscribe here and read my previous articles here.

📕 Reads of the Week

“We are trying to avoid overly specialised data centres and data centres that are dedicated or customised for a single player or a single technology, because we don’t know yet which actor or technology will ultimately win the AI race,”

Market Updates

Blackstone on Real Estate’s Next Phase. Blackstone is seeing a dramatic decline in new supply across virtually every sector globally, down 60%+ across major US sectors. This is the #1 reason to be bullish on real estate today: lower supply generally leads to stronger rent growth and higher values.

Coller Capital on credit secondaries continued growth. Coller saw $18-20bn+ in deal volume in 2025. That expansion will likely continue in 2026. Historically, LPs avoided selling credit positions due to steep discounts driven by mismatched cost of capital. Today, dedicated credit secondary funds have reshaped market dynamics. First-lien loan portfolios now trade in the 90s (i.e. approximately 90% of full value) with some clearing at par, making liquidity decisions far less punitive.

👉 [Learn more here]

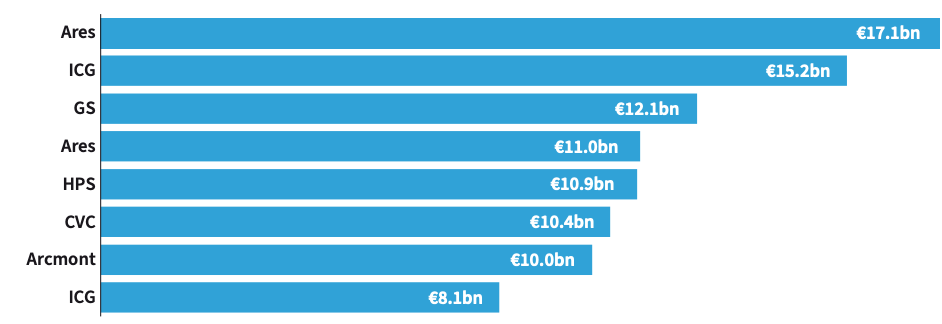

Arcmont on how direct lending took off in Europe.

Largest European direct lending funds in 2025

Fewer private equity portfolio companies filed for bankruptcy protection in the US in 2025 as sponsors opted for out-of-court restructurings to keep distressed businesses out of the spotlight.

👉 [Learn more here]

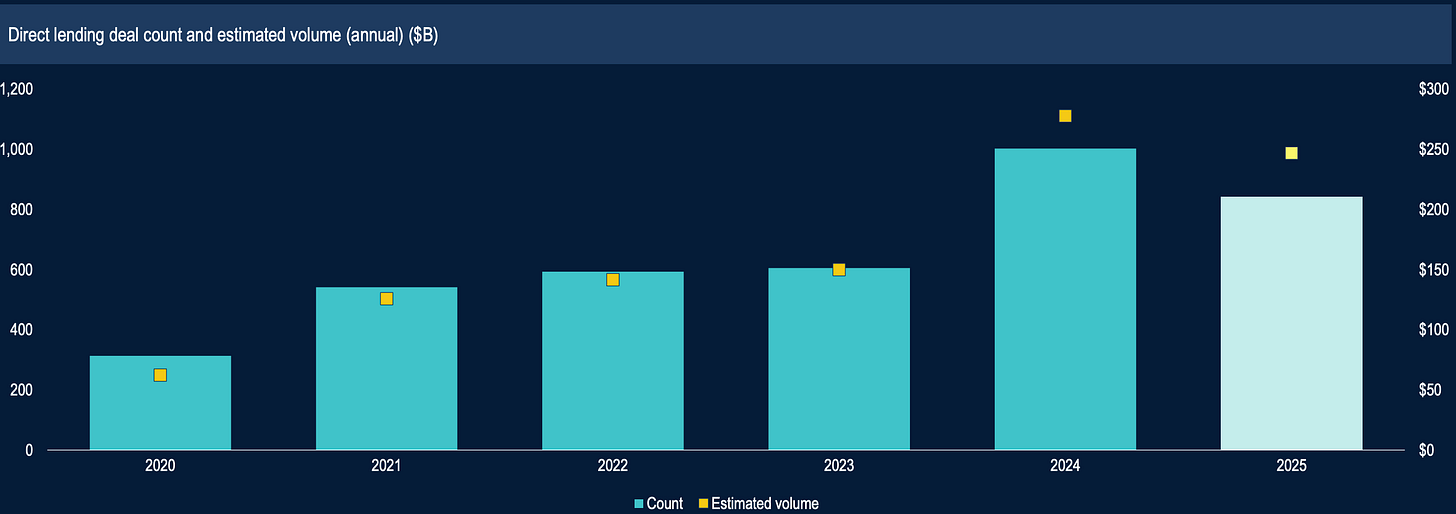

US Private Credit Monitor

Direct lending volume dipped in Q4. Even with November’s mega-deals, Q4 was the weakest quarter of 2025 by volume and deal count.

Despite the drop in lending in 2025 vs 2024, volumes remained historically strong. 2025 ranked as the second-busiest year for direct lenders in at least eight years.

Credit spreads remain compressed but steady. Fourth-quarter spreads held steady, with a median of S+475 unchanged from the third quarter.

👉 [Learn more here]

Manager Updates

What’s Oaktree Reading? 2025 Year-End Book Recommendations

👉 [Learn more here]

Partnership Updates

Blackstone announced an aircraft engine leasing partnership with Willis Lease Finance Corporation, with plans to deploy over $1 billion to acquire both engines and select aircraft. The partnership was made through Blackstone’s Credit & Insurance arm. Link

Ares established a joint venture with Goal Investment Management to acquire a portfolio of consumer loans. The joint venture will target loans in a variety of consumer sectors, including education finance, home improvement, solar loans, and consumer installment debt. Link

Several large private credit lenders have been buying portfolios of consumer loans. Sixth Street agreed to purchase up to $4 billion in consumer loans from Affirm Holdings, while Blue Owl arranged forward flow agreements to buy up to $5 billion in personal loans from SoFi Technologies and another $2.4 billion in consumer loans from Pagaya.

Mubadala and Barings Enter into a $500 Million Global Real Estate Debt Partnership. The new partnership will focus on investing in senior and subordinated real estate loans across real estate asset classes. Link

Guggenheim closed a $250m private debt vehicle backed by LGT Capital Partners. Link

The Evolution of Private Credit in 2026

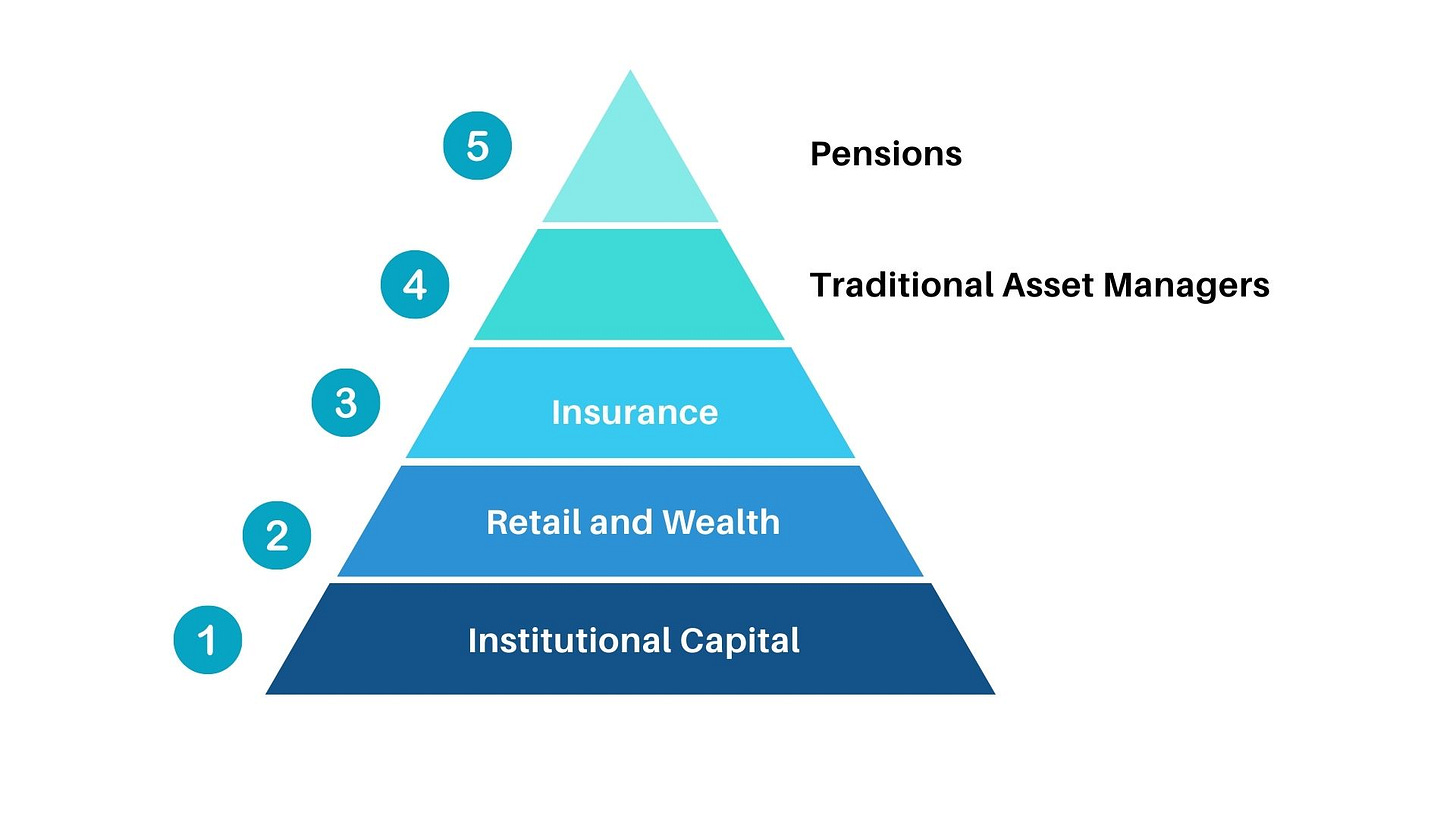

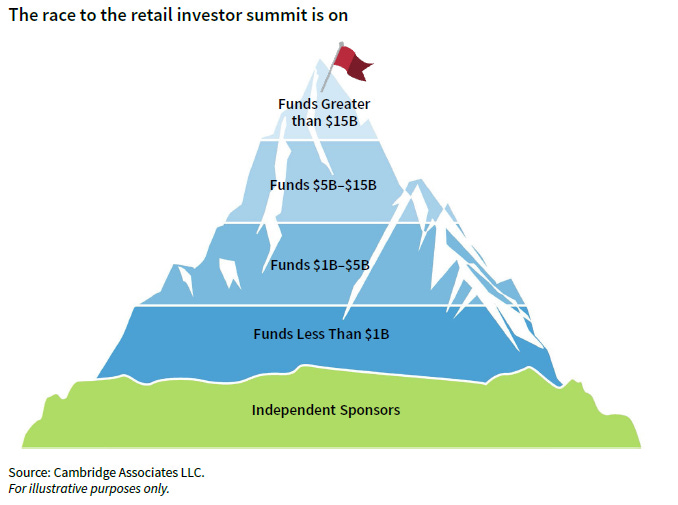

Marc Rowan at Apollo talked about the evolution of private markets at the Goldman Sachs conference last year. If you missed it, I’ve summarised it on the pyramid below.

Institutional capital has been the main source of capital for the last 40 years. As we’ve seen in 2025, this is rapidly changing. Many of the changes and shifts echo the evolution of other investment markets.

The key in 2026 is to begin to adapt to these changes in market structure. I expect to cover many of these changes, and our thinking will collectively evolve.

Below are four shifts already underway in 2026.

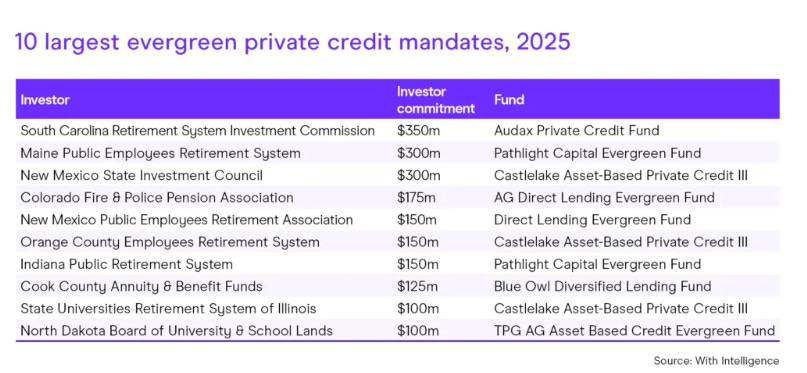

Evergreen funds proliferate as allocators seek perpetual funds

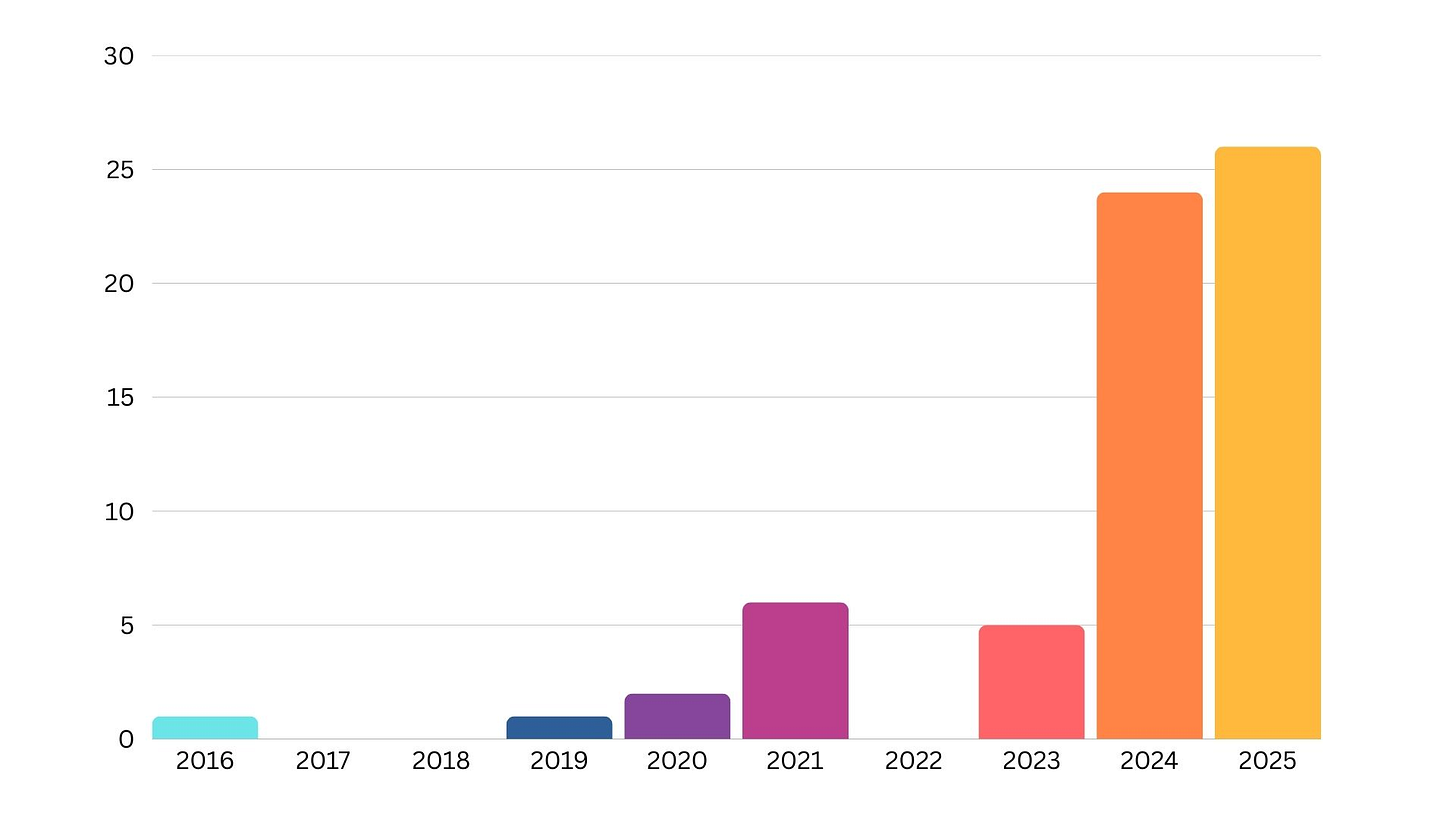

Assets in evergreen private debt funds have surged in recent years.

With Intelligence tracked over 40 commitments to evergreen funds from institutional allocators, totaling over $3 billion. The 10 largest mandates accounted for $1.9 billion.

The five largest listed private markets fund managers – Apollo, Ares, Blackstone, Carlyle and KKR – now manage a combined $1.5 trillion in perpetual capital: around 40% of their combined AuM. If the CAGR seen since 2021 continues, these firms will manage almost $5 trillion in permanent capital by the end of the decade.

👉 [Learn more here]

UK LTAFs gain momentum as DC pensions target private markets

The LTAF is a UK-regulated vehicle for long-term assets. The UK regulator approved this framework in 2023 to encourage UK Defined Contributions pensions to invest into private market assets.

There are now more than 25 Long-Term Asset Funds (LTAFs) on the market.

BlackRock is the largest private credit manager with an LTAF, with many managers, including Ares, Apollo, and Blackstone, yet to launch.

👉 [Learn more here]

ELTIF 2.0 leads to a surge in new approvals

The world’s largest asset managers increasingly see the private wealth market as the key driver of their future AuM growth. KKR, for example, plans to raise as much as 50% of its capital from high-net-worth clients.

If ’40 Act funds continue to attract capital at the rates seen since 2022, these funds will surpass $1 trillion in combined AuM by 2028, with nontraded BDCs alone set to reach this milestone by 2030.

Across the Atlantic, the implementation of the “ELTIF 2.0” regime – which broadened the list of eligible assets for European Long Term Investment Funds (ELTIFs) – has led to a surge in new approvals for private credit ELTIFs. European semi-liquid funds now manage over €20 billion. While lagging the US by some distance, this will increase in 2026.

👉 [Learn more here]

The Bifurcation of Retail

The rise of the individual investor is accelerating the market bifurcation. The largest asset managers, namely those who have expanded, acquired, or partnered to offer a range of private market investment options, are best positioned to capture the flag in the race for retail capital. These managers will amass the lion’s share of aggregate investor capital. As a consequence, their role in a private investment portfolio will likely change as they manage multiples more capital than the rest of the market. Institutional investors and sophisticated families will need to rethink the megas’ role in portfolios.

👉 [Learn more here]

💰Fundraising News

Direct Lending

Monroe Capital, a Chicago-based private credit manager, announced a final close of $6.1 billion for its 2025 Monroe Capital Private Credit Fund V. The fund will focus on providing senior secured loans to sponsored and non-sponsored, lower middle-market U.S. companies with approximately $35 million or less in EBITDA. More here

Macquarie Asset Management is raising a $1 billion US direct lending fund. The Australian firm held a first close in November and is targeting a second close of $400 million to $500 million in mid-2026. The fund will primarily extend senior secured loans to private equity-backed companies in the US, but can allocate to Europe, the UK, and Australia. It will focus on companies with $25 million to $75 million in EBITDA. More here

Opportunities

Benefit Street Partners raised $10 billion for its BSP Real Estate Opportunistic Debt Fund II. The fund lends senior and junior commercial real estate debt investments across major U.S. markets, with a particular emphasis on the multifamily sector. More here

KKR has closed its second Asia-focused private credit fund at $2.5 billion. The Asia Credit Opportunities Fund II focuses on investing in credit opportunities across Asia. The fund is reportedly targeting returns in the low to mid-teens. KKR has been expanding its private credit footprint in Asia, including hiring its first Japan-based credit specialist last year and completing transactions in Australia and India. More here

RRJ Capital, a Singapore-based private equity manager, has completed a first close of $1.1 billion for its first private credit fund. The RRJ Structured Hybrid Opportunity Fund targets a net internal rate of return of about 16%. Founded in 2011 by former Goldman Sachs banker Richard Ong, RRJ plans to deploy capital across Southeast Asia, Australia, Hong Kong, and India, completing about six deals per year. More here

ABL

Davidson Kempner, a New York-based manager, announced a final close of $1.1 billion for its second asset-backed private credit fund, Income Fund II. The Fund invests across structured residential, corporate, specialty finance, and hard asset-backed loans. The fund has a global mandate and invests using teams in the U.S., Europe, and Asia. More here

Impact

Creation Investments Capital, a Chicago-based impact investor, announced a final close of $46 million for its Impact Credit Fund II. The fund lends senior, secured loans to investment-grade rated institutions that are exclusively focused on underserved populations in emerging markets, with a current geographic emphasis on India. These portfolio companies provide responsible access to credit for micro and small businesses, affordable housing, electric vehicles, and smallholder farms and agriculture in peri-urban and rural India. More here

This newsletter is for educational and entertainment purposes only. It should not be taken as investment advice.