The Rise of Credit Secondaries

+ Redefining opportunistic credit with Golub

👋 Hey, Nick here. A big welcome to the new subscribers from HPS, Ares and Point72. This is the 151st edition of my weekly newsletter. If someone forwarded this to you, you can subscribe here and read my previous articles here.

📕 Reads of the Week

Manager Updates

Three Reasons why Jon Gray and Blackstone are “super pumped” about Q4. 🚀

The deal engine is back. M&A volumes ran ~2.5x higher, and the IPO window has reopened.

A massive capex wave is underway. Data centers and energy infrastructure will absorb enormous amounts of long-duration investment.

Alternatives are taking market share. Insurance, pension, and retail demand continue to compound as investors look beyond traditional public markets.

Franklin Templeton is merging its European private credit unit, Alcentra, into Benefit Street Partners. Alcentra will wind down its direct-lending franchise and shift focus to managing existing assets. Alcentra will continue to run structured credit and special situations, all of which will now sit under the BSP banner. Link

The FT’s insight piece into Jeremy Coller. The vegan activist who sold Coller Capital for $3.7 billion. Link

Market Updates

Crescent Capital Direct Lending in the U.S. Middle Market: Stability Amid Uncertainty

Deal flow normalization continues, but quality remains bifurcated.

The best-in-class borrowers, those with strong recurring revenue, cash flow visibility, and defensible market positions, continue to attract competitive terms.

In contrast, second-tier credits are struggling to clear without structural enhancements or pricing concessions.

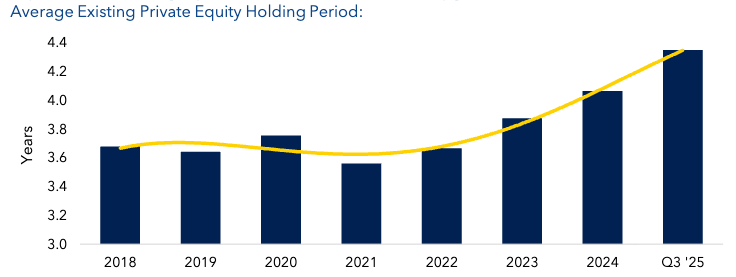

As a consequence, Private Equity firms have increased holding periods (See below)

🎧 The View From Apollo: The Convergence of Private and Public Credit. Link

Antares 2026 Outlook. Link

(Nick Reminder: Interesting BDC Charts to review quarterly)

KKR: Capital Market Assumptions. Link

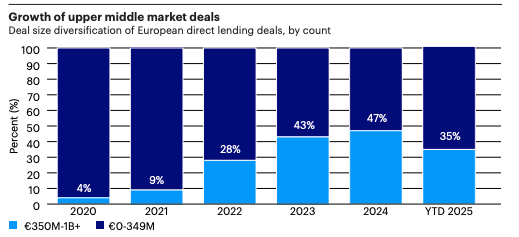

Invesco: The case for the European upper middle market

Not private credit, but worth a mention:

Carlyle: Bubbles as a feature, not a bug. Link

Why Private Equity Is Suddenly Awash With Zombie Firms. Link

Partnership Updates

Citi announced a partnership with Blackstone, Blue Owl, and KKR, to launch evergreen funds for high-net-worth clients in Singapore and Hong Kong. Citigold Private Clients in Asia and the Middle East will gain access to private markets, including equity, credit, infrastructure, and real estate. These alternative asset classes have traditionally been reserved for institutional investors. More here

Wells Fargo and Centerbridge Partners have invested more than $7 billion since their partnership launched less than two years ago. For 2025 specifically, it closed 18 transactions totalling ~$4 billion. More here

The State of Private Credit Secondaries

Credit secondaries have had a busy few weeks:

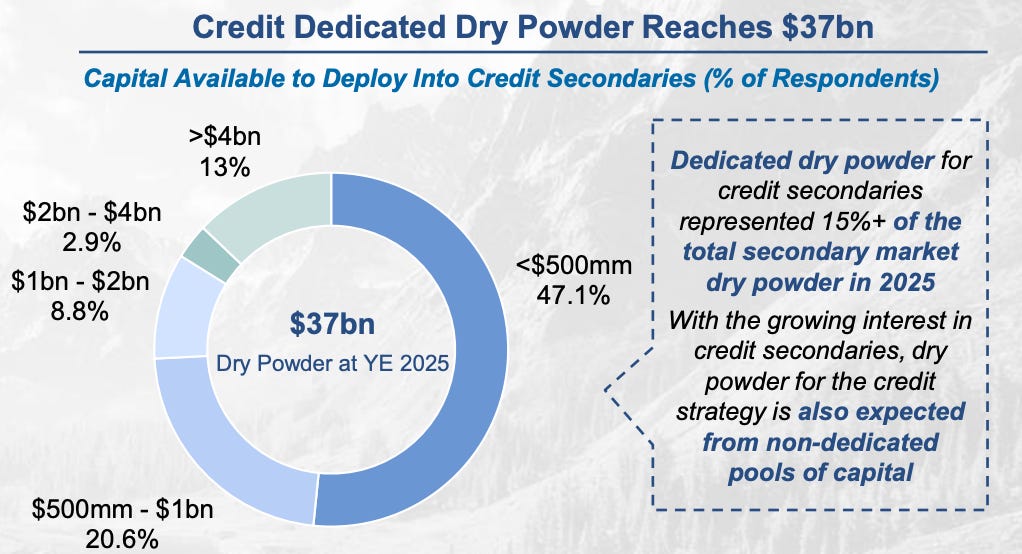

Crescent Capital closed its $3.2 billion private credit continuation vehicle. The transaction was led by Pantheon and is the largest credit continuation vehicle transaction in the private credit secondaries market to date. More here

Ares raised $7.1 billion for its Credit Secondaries fund. ACS is the largest dedicated institutional credit secondaries fund globally based on LP equity commitments. More here

PGIM announced plans to deploy up to $1 billion over the next two years into private credit secondaries.

In light of this, I’ve pulled together the key takeaways from three reports that assess the current state of credit secondaries.

Read the reports below:

👉 Evercore

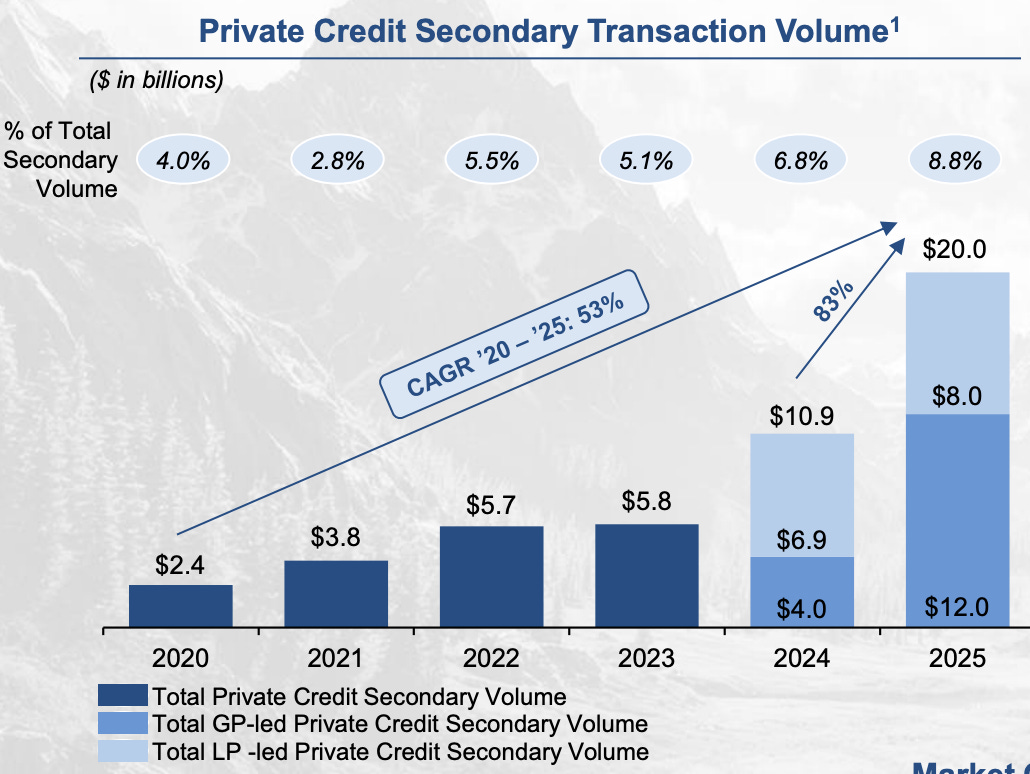

Credit secondaries volume has set new highs every year post 2020

While LP-led transactions have historically dominated, GP-led credit secondaries are taking a larger share as sponsors use secondaries as a repeatable tool for liquidity and portfolio management

In 2025, GP-led activity accelerated materially, representing ~60% of total credit secondaries volume, reflecting increased use of structured solutions to address liquidity, fund optimization, and portfolio repositioning needs

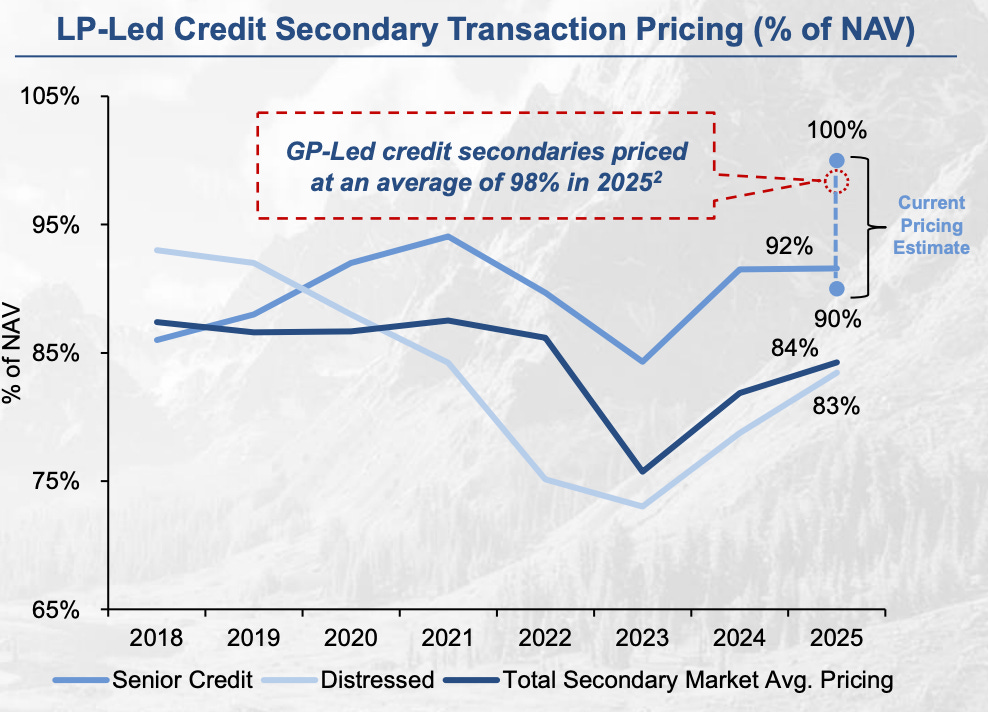

Strong Pricing Into 2026

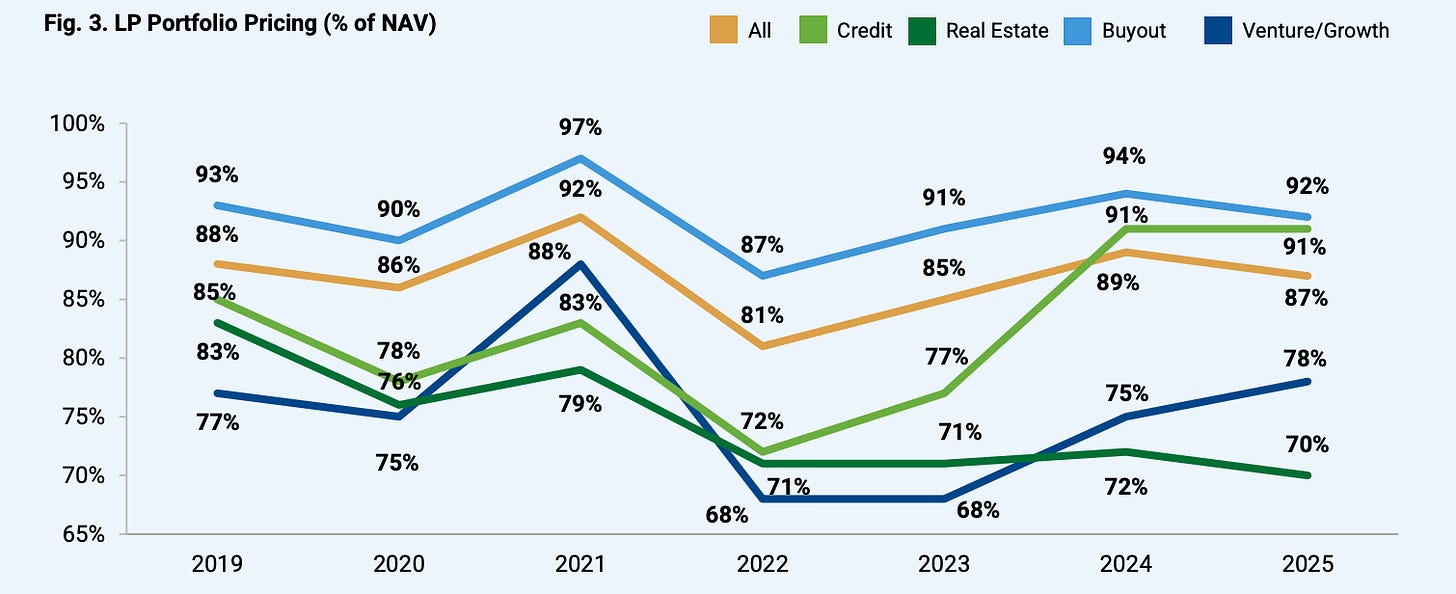

Pricing remained in line with 2024 levels at ~91% of NAV

Credit Pricing Recovery: +1,400 bps Since 2023

Credit has seen meaningful discount improvements since 2022, unlike Venture and Real Estate.

Read the full reports

👉 Evercore

Golub: Redefining opportunistic credit

I’ve previously talked about 2025 being the year of opportunistic credit. Golub’s latest report adds useful clarity on how to think about this opportunity set. Here are my three highlights.

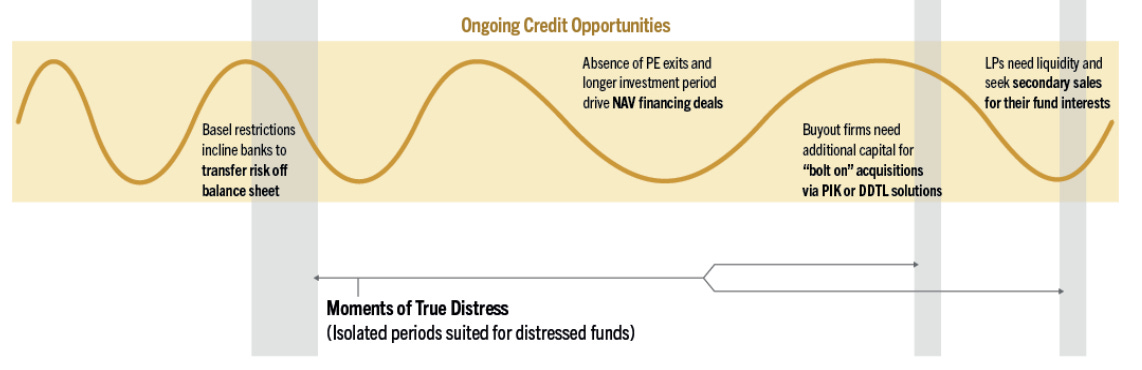

Liquidity mismatches and funding challenges are always occurring

While periods of extreme market dislocation or distress often generate attractive opportunities, such moments are rare, difficult to predict, and typically don’t last very long.

The reality is that liquidity mismatches and funding challenges are always occurring in the credit markets, even during normal conditions.

Recent examples include NAV lending, junior capital solutions, and SRTs.

Longstanding relationships and a deep understanding of each participant’s needs give us an edge.

The best opportunistic credit managers sit at the centre of a diverse ecosystem that includes private fund GPs, portfolio companies, direct lenders, LPs, banks and other trading partners.

Often, the key investment advantage comes not from just analysing the numbers, but from knowing the people and the businesses.

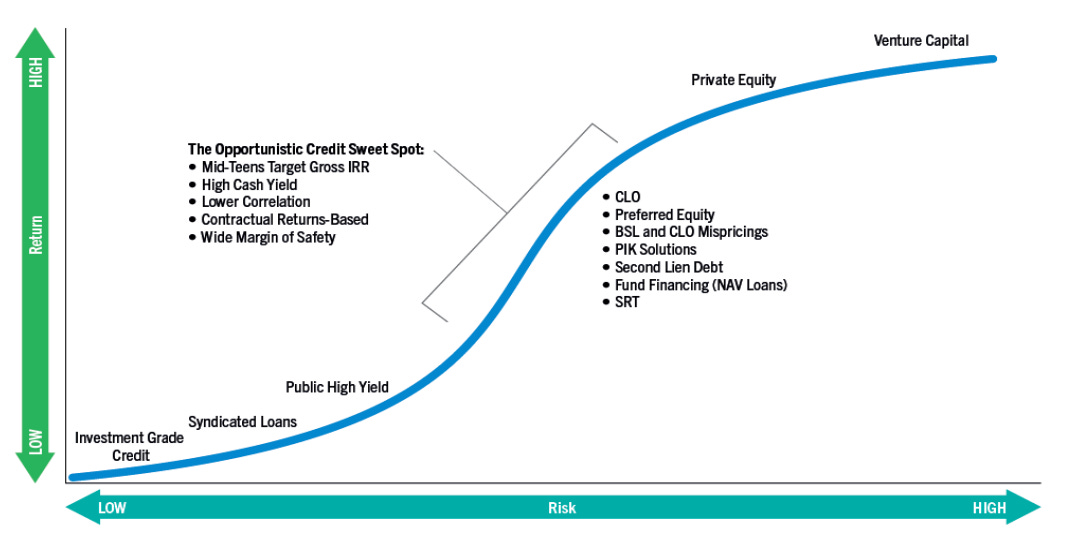

The middle ground has many appealing characteristics,

The “opportunistic” space is a broad and highly diverse zone stretching from senior lending at the top of the capital stack all the way to common equity and warrants at the bottom - and almost everything in between.

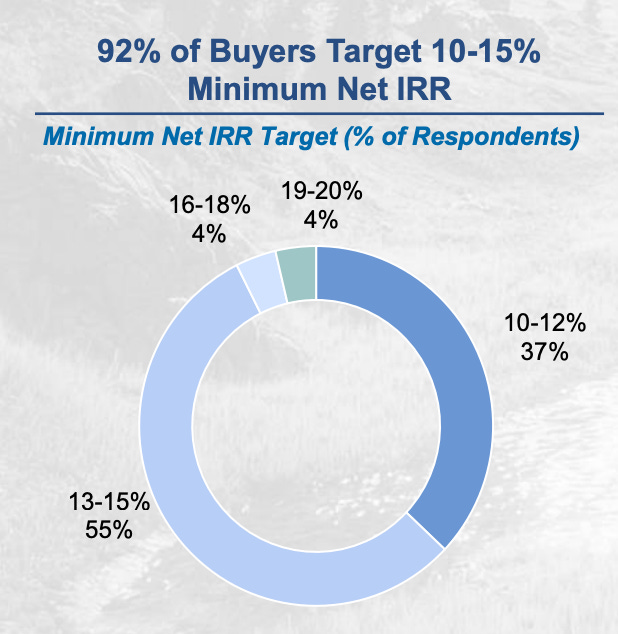

This middle ground has many appealing characteristics, with its performance delivering an attractive blend of equity upside and contractual yield, typically with an internal rate of return (“IRR”) in the mid-teens.

The opportunistic arena rewards agility, relationships and structuring expertise more. The deals we pursue often do not fit neatly into the mandates of traditional private equity or direct lending funds, which is why this strategy offers such value to investors looking to diversify.

The result is a diversified hybrid of credit-oriented investments with a lower correlation to other private market exposures and a comforting margin of safety (thanks to that contractual income component).

💰Fundraising News

Tree Line, a US-based manager, closed its fourth flagship fund with $1.1 billion in total capital commitments. The direct lending fund is focused on lending to US lower-middle-market companies. The firm provides first lien term loans and equity co-investments to companies with between $5 to $30 million of EBITDA in North America in transaction sizes up to $150 million. More here

Investec, a UK-based Alternative Manager, announced a final close of over $700 million for its second private debt fund. The fund will lend senior secured and subordinated debt to private equity and corporate-backed businesses with EBITDA between €3 million and €50 million. The fund’s primary geographic focus is the UK, Ireland, Benelux, and DACH region. More here

Ambienta, a sustainability-focused manager based in Italy, raised more than $600 million for its inaugural private credit fund. The fund is focused on lending to environmentally sustainable mid-market companies in Europe. The fund has already deployed €300 million across 13 portfolio companies, with investments spanning areas such as energy infrastructure, water, and food ingredients. More here

Alantra, a Spanish Alternative manager, launched its second European real estate debt fund, with a target size of €200 million. The fund will finance European mid-market real estate. More here

XSML Capital, a Netherlands-based lender, closed its $142 million African Rivers Fund IV. The fund finances SMEs in African frontier markets with loan sizes between $300,000 to $10 million. Investments to date are concentrated in the DRC (47%), Angola (22%), Uganda (17%), and Zambia (14%), across manufacturing, retail, beverages, food processing, and the pharmaceutical sector. More here

This newsletter is for educational and entertainment purposes only. It should not be taken as investment advice.