Three insights from Pitchbook's H1 2025 Global Private Credit Report

Fundraising from Apollo, General Atlantic and Grays Peak

👋 Hey, Nick here. A big welcome to the new subscribers from GIB Asset Management, Mill Creek, and Human Financial. This is the 133rd edition of my weekly newsletter. If someone forwarded this to you, you can subscribe here, and read my previous articles here.

📕 Reads of the Week

Wealth management is broken. If you want real diversification and you want to participate in 80% of the economy and 80% of the job creation, you now need private markets.

Mark Rowan on the future of retirement and wealth generation. Link

(1) Ares believes Opportunistic Credit is the real winner from the M&A Gridlock

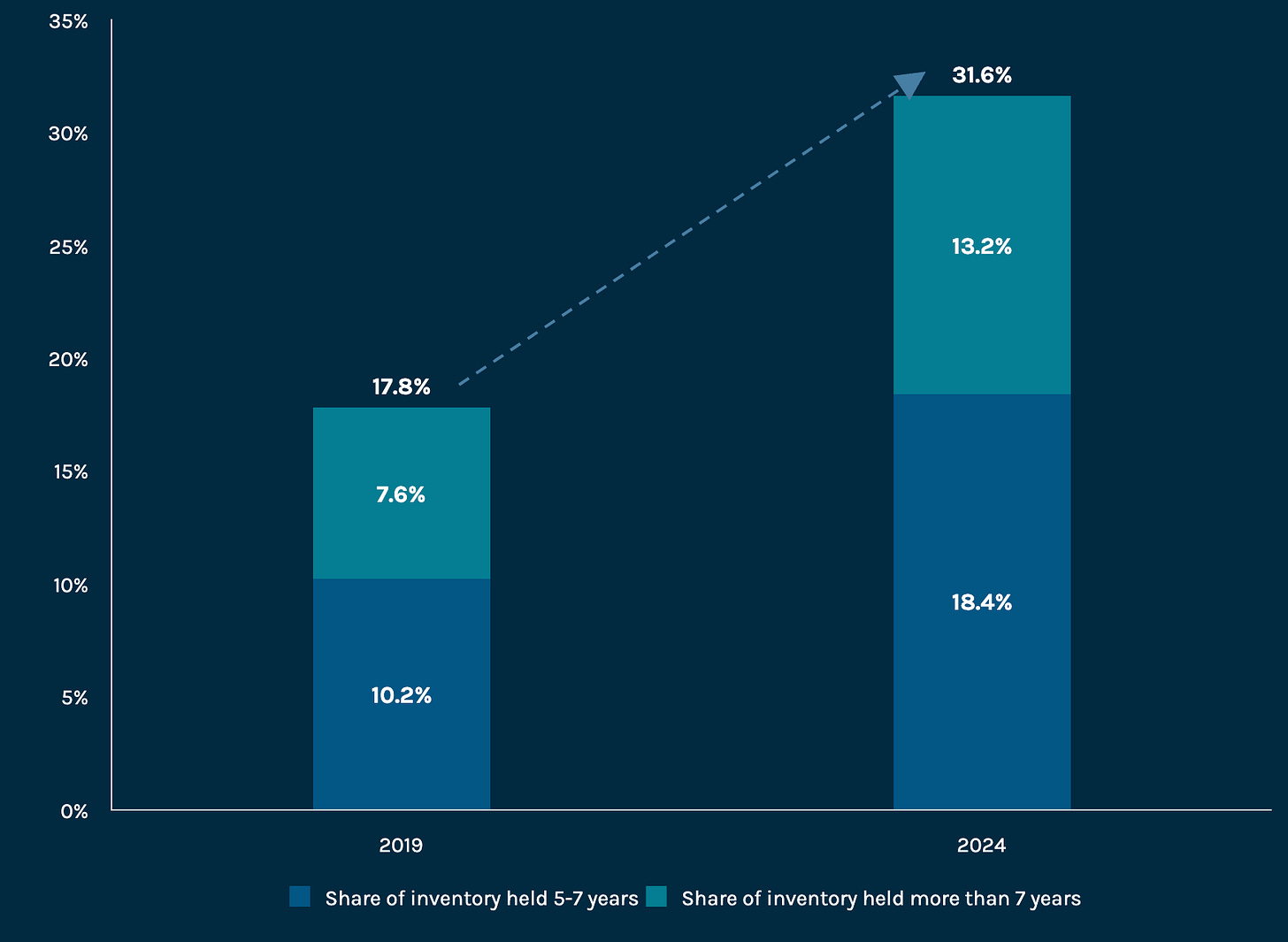

PE Funds have held 1 in 3 U.S. buyouts for at least 5 years

This is nearly double vs. 2019.

(2) City of Jacksonville Employees’ Retirement System is expected to commit $280 million to private credit over the next 5 years. The pension fund is expected to grow its private credit allocation from 4% to 7%. RVK carried pacing analysis here

(3) Blackstone reprices its Squarespace deal. The debt was split across two tranches, with banks taking the senior tranche and the junior tranche split between Blackstone, Blue Owl, and Ares. The private credit loan is priced at 4% over the base rate, while the bank debt is priced at 2% over. Link

(4) “With a portfolio yielding 9 to 10 percent and meaningful equity behind us, we like the risk-return opportunity”. Why AustralianSuper invests in private credit. Link

(5) Lenders have come up with an interesting new concept whereby sponsors agree to put their shares in a trust. In return, sponsors are given 12 to 18 months to turn things around at the struggling company. The trust then becomes subject to clearly stipulated milestones such as selling the business by a certain period, selling part of the business for a specific minimum price, or achieving a particular revenue or EBITDA target. If the milestones are missed, the trust gets activated, and the trustee will then sell the shares for the benefit of the lenders. More here

(6) A thriving secondary market relies on a large and stable primary market, as only a small fraction of primary assets will ultimately trade on the secondary market. Around 1% of private debt’s primary market transitions to the secondary market each year. Tikehau is purchasing private credit portfolios at a discount to NAV of more than 15%. Link

📊 Partnerships of the week

Franklin Templeton formed a partnership with Copenhagen Infrastructure Partners, DigitalBridge, and Actis. The partnership will provide Franklin Templeton’s wealth clients access to institutional-quality private infrastructure investments. More here

Blue Owl and Qatar Investment Authority formed a digital infrastructure platform. The platform will finance leading hyperscalers’ data centers. QIA will initially contribute more than $3 billion of data center assets. More here

Victory Park Capital announced a strategic partnership with US life and health insurer, CNO Financial. CNO will acquire a minority interest in VPC as part of the transaction. CNO will also provide a minimum of $600 million in capital commitments to new and existing VPC investment strategies. More here

📊 Pitchbook H1 2025 Global Private Credit

Pitchbook published its H1 report, below are my favorite extracts.

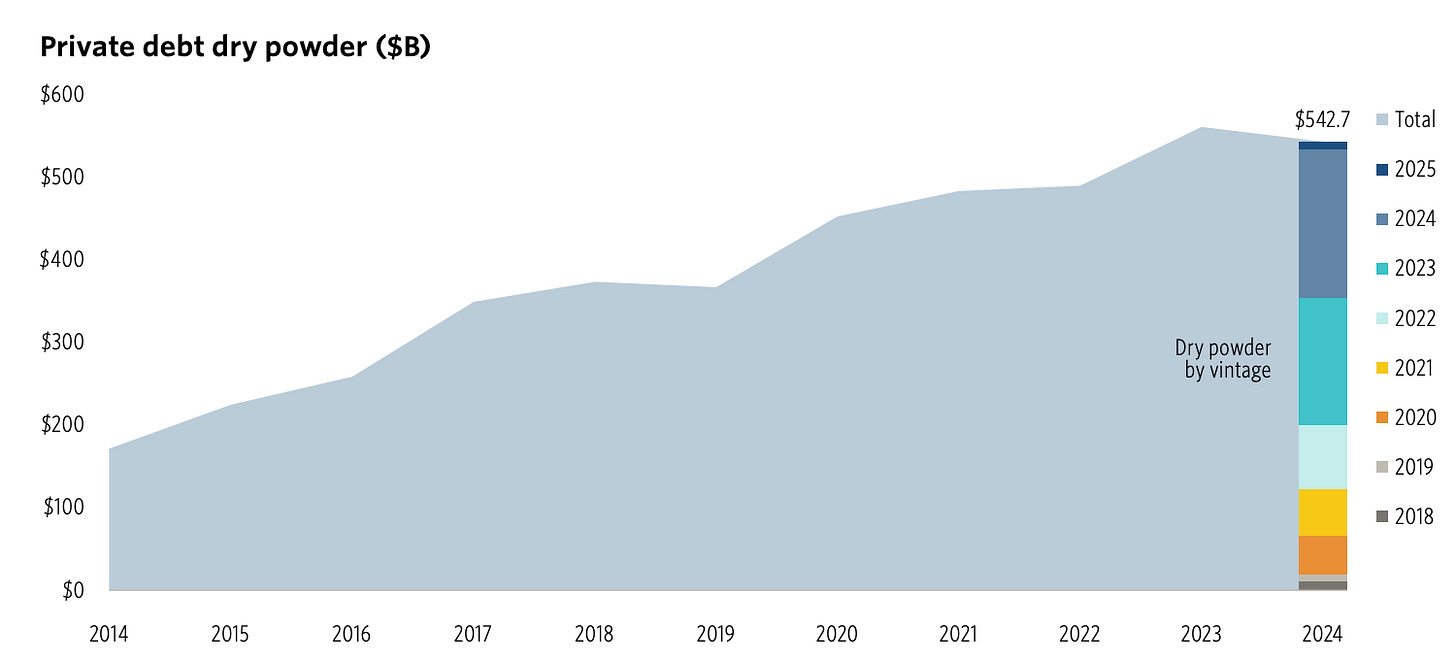

Private Credit Dry Powder falls for the first time since 2018.

While this figure is still the second-highest dry powder figure of all time, it’s a good sign that the capital raised over the last four years are being put to work.

Dry powder’s share of AUM fell to 29.3%, slightly below each of the last two years.

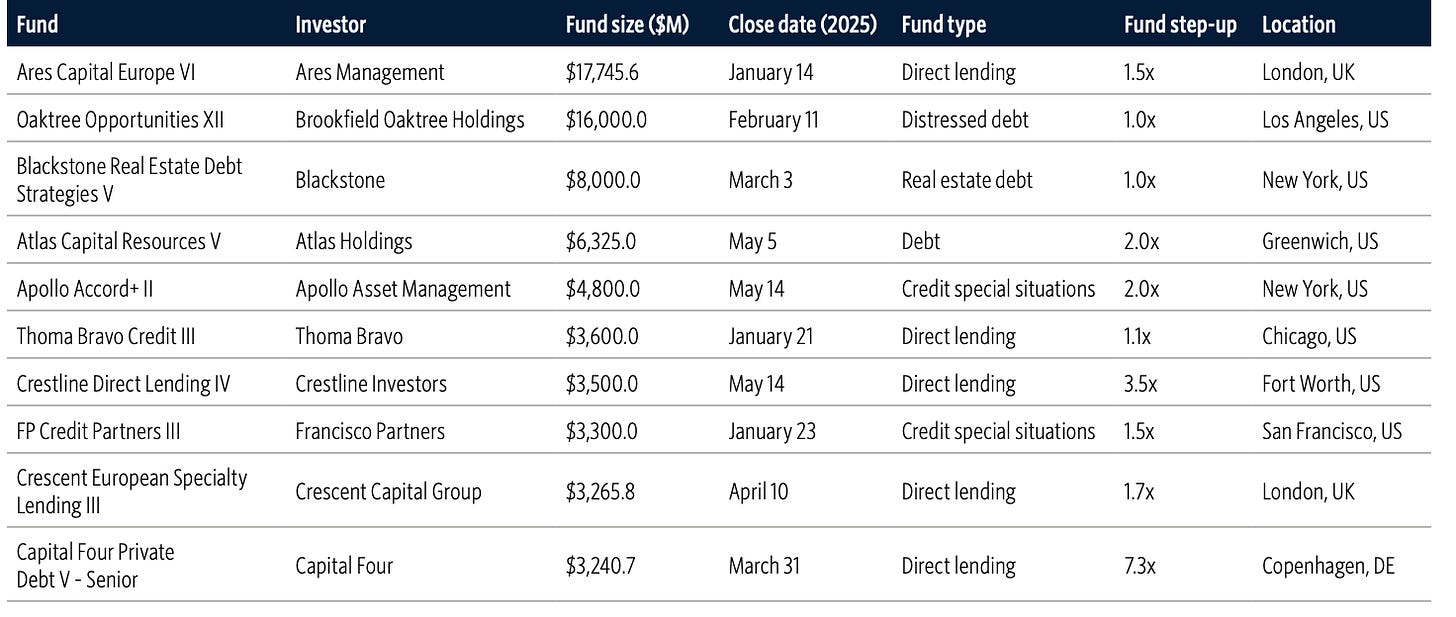

Largest Private Credit Funds Closed in H1

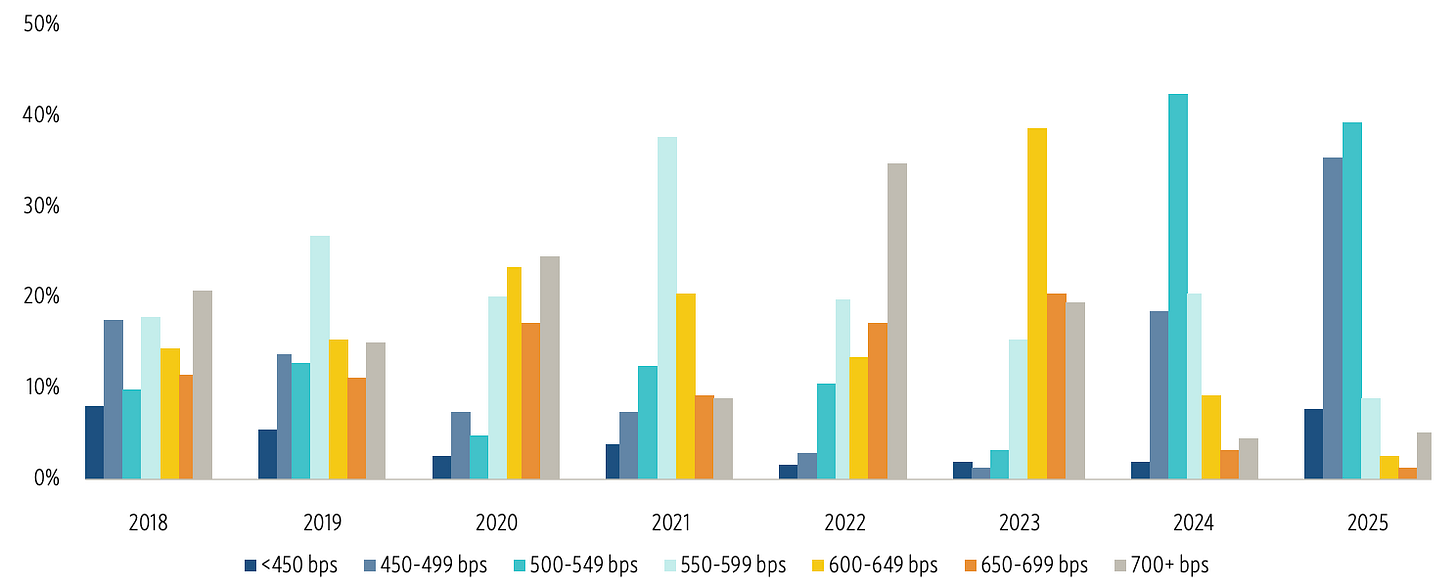

2025 Spread Compression

Spread tightening has been a recurring theme across BDC earnings calls

Churchill Asset Management CEO Ken Kencel noted that spreads have stabilized in the 450-to-475-basis-point range but could compress by another 25 basis points in the near term.

Supporting this trend, LCD data shows that 43% of LBO financings by direct lenders this year have priced below SOFR+500. More than double the share in 2024.

💰Fundraising News

Apollo launched two credit ELTIFs:

Apollo European Private Credit. An ELTIF that invests primarily in senior secured direct lending to large-cap and upper middle-market European companies

Apollo Global Diversified Credit. An ELTIF with a global, multi-asset credit strategy that invests across private credit sectors, including direct lending and asset-backed finance.

General Atlantic Credit announced a $2.1 billion first close for its latest opportunistic credit fund, Atlantic Park Strategic Capital Fund III. GA Credit has managed to distribute cash back to its investors at a much quicker rate than most of its peers. The first fund, a 2020 vintage, has already achieved a 0.9x DPI. That compares with a median distribution of about 0.42x for equivalent funds tracked by PitchBook. More here

Grays Peak Capital, a New York-based investment manager, launched its second defense-focused private credit fund. The fund aims to deploy $500 million annually in government and military middle-market companies, joint ventures, and value-add opportunities. It will focus on short-duration, senior secured lending to government contractors and mission-critical counterparties. More here

This newsletter is for educational or entertainment purposes only. It should not be taken as investment advice.