Three Midyear Themes Private Credit Managers Can’t Ignore

More than $10 billion of fundraising from Macquarie, Pantheon, Chorus, Partners Group and more

👋 Hey, Nick here. A big welcome to the new subscribers from Apollo, Blackrock and LSTA. This is the 123rd edition of my weekly newsletter. If someone forwarded this to you, you can subscribe here and read my previous articles here.

📕 Reads of the Week

BlackRock is acquiring ElmTree Funds, a net-lease real estate investment firm with $7.3 billion in AUM. Link

Covenant Lite: Meta's $29 Billion Bet with Apollo on AI Data Centers. Link

Banks are trading private credit loans. Link

🎧 Building Sixth Street. Link

Ares: How Real Estate Debt Is Redefining Investment Strategy. Link

Apollo buys $1.5 Billion of Investment Grade Loans from SMBC. Link

Elizabeth Warren Is Coming for Private Credit. Read her letter to Moody’s CEO probing inflated ratings, conflicts of interest, understaffed teams, and opaque methods in private credit. Link

JPMorgan: Private credit isn’t inherently dangerous; it’s the execution that matters. With thoughtful structuring, it can deliver strong risk-adjusted returns without systemic issues. Link

EY faces $1 billion lawsuit over its failure to detect fraud that contributed to a Toronto private lender’s collapse. In 2019, the former CIO and other shareholders agreed to sell 50% of Bridging Finances’ equity for $50 million. It was later revealed that the investment was paid using proceeds of a $32 million loan from one of Bridging's credit funds. Link and link

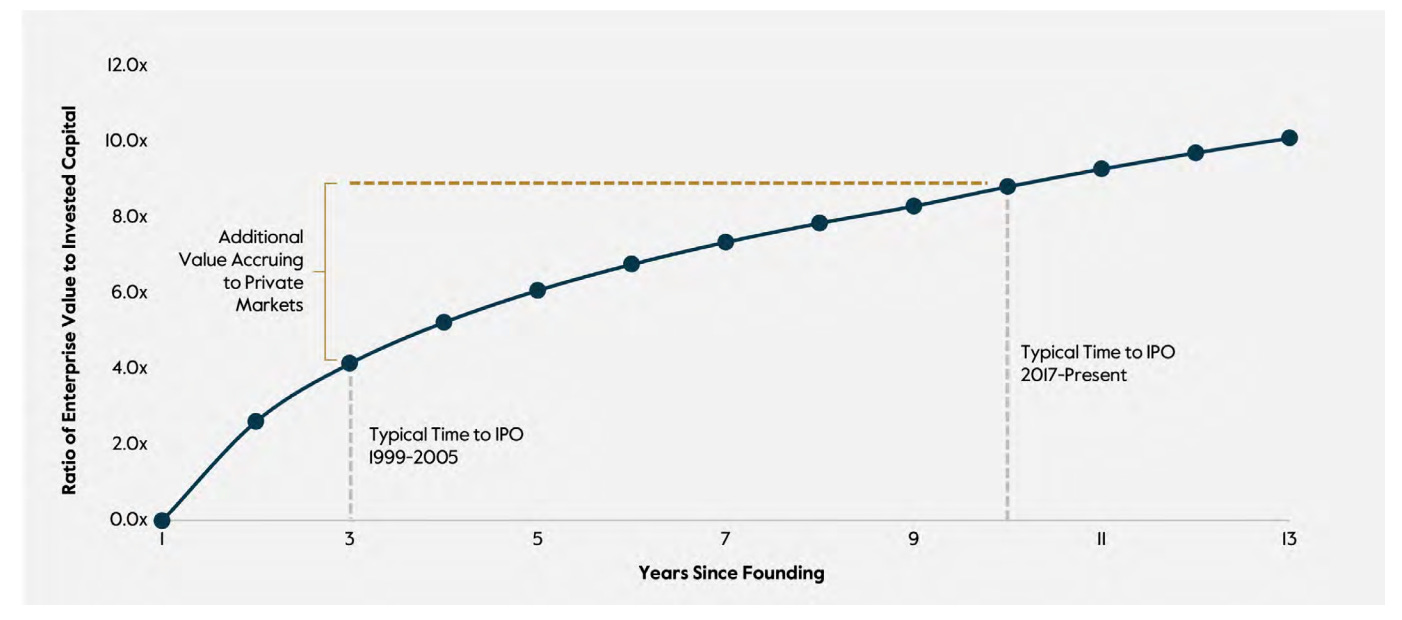

Carlyle’s Case for Private Markets

As more IPO candidates have opted to remain private, the composition of the stock market has shifted radically. The typical public company is now nearly 3x larger (in real terms) and more than 50% older than was the case twenty years ago. In effect, yesterday’s top-performing “growth stocks” have become today’s core private portfolio holdings. As a consequence, a larger share of the value in the first ten years of a company’s life accrues to private rather than public markets. Link

🏦 Partnership of the Week

Man Group, the world’s largest listed hedge fund, announced its acquisition of Bardin Hill, a New York-based private credit manager with approximately $3 billion in AUM. The deal will add opportunistic and performing credit capabilities to Man Group’s existing $40 billion credit business. More here

Fasanara and Alkhabeer Capital Partner to Unlock Fintech Private Credit in Saudi Arabia. More here

📊 Three Midyear Themes Private Credit Managers Can’t Ignore

Nobody knows when M&A will pick up

I was in another discussion yesterday, and I likened this question you're asking me to that old scenario with Charlie Brown trying to kick the football that Lucy's holding. You make a prediction and then you're constantly wrong.

I thought M&A would come back last year. I was wrong.

Beginning of this year, I thought, well, this will be the year; it hasn't.

So I've kind of given up predicting. I think we all need to look at the forces that are building and at some point, you're going to see a pick-up in the M&A cycle. I don't think it's imminent, and, you know, frankly, I'm assuming it's not going to be

Energy is just as important as AI

While most investors are focused on the semiconductor angle of the current AI boom, KKR has been spending more time studying the energy demand surge needed to power these models. The reality is, in many instances, existing infrastructure is insufficient to meet the demand required. Against this backdrop, KKR are bullish on critical energy transmission assets, data centers, and cooling technologies… The market opportunity is significant, as lending in this asset class now approaches $6 trillion today and is projected to surpass $9 trillion, which is multiples the size of High Yield, Levered Loans, and/or Direct Lending.

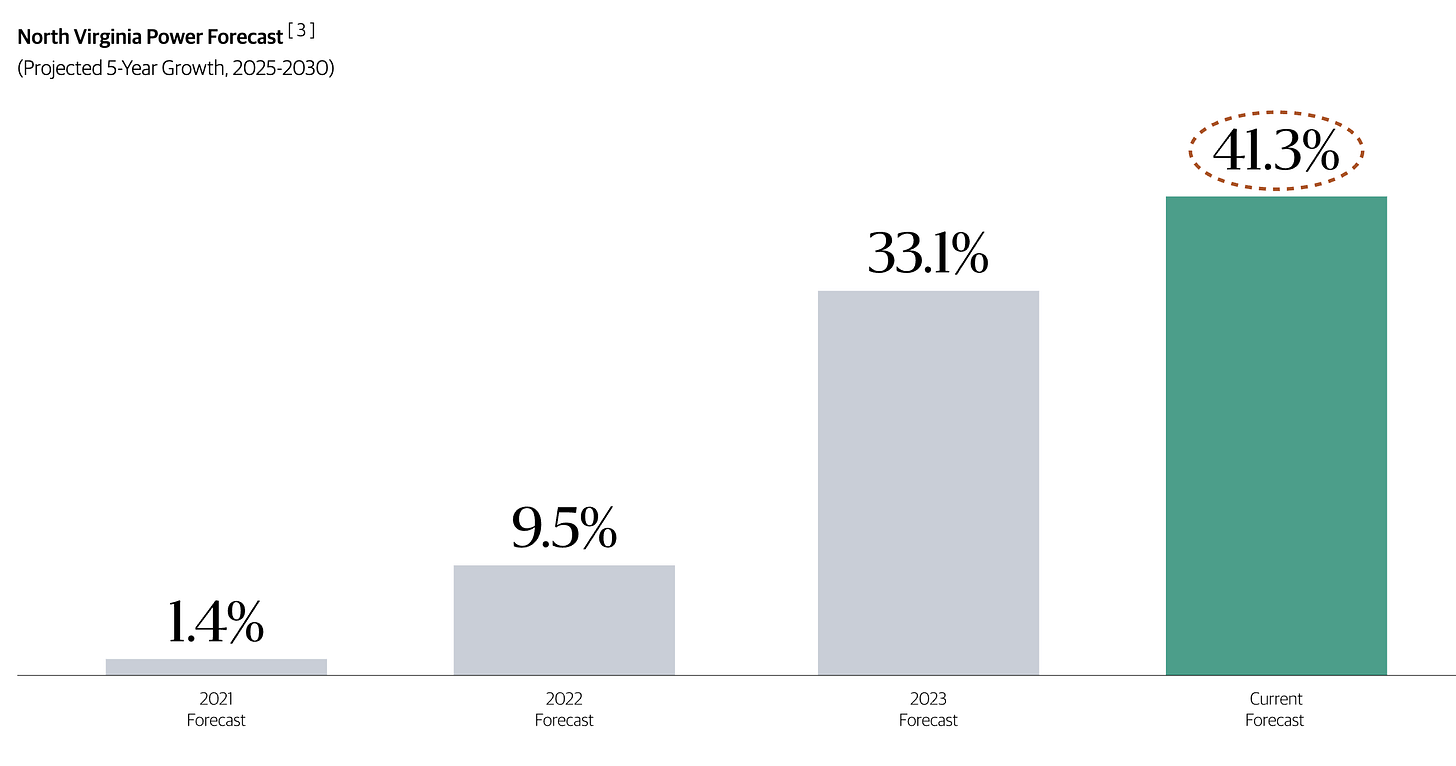

Data Centers Are Rewriting Power Forecasts

The latest power requirement projections for Northern Virginia, the world’s largest data center market, calls for 41% growth between 2025 and 2030, compared to just 1% growth in the 2021 forecast. Blackstone

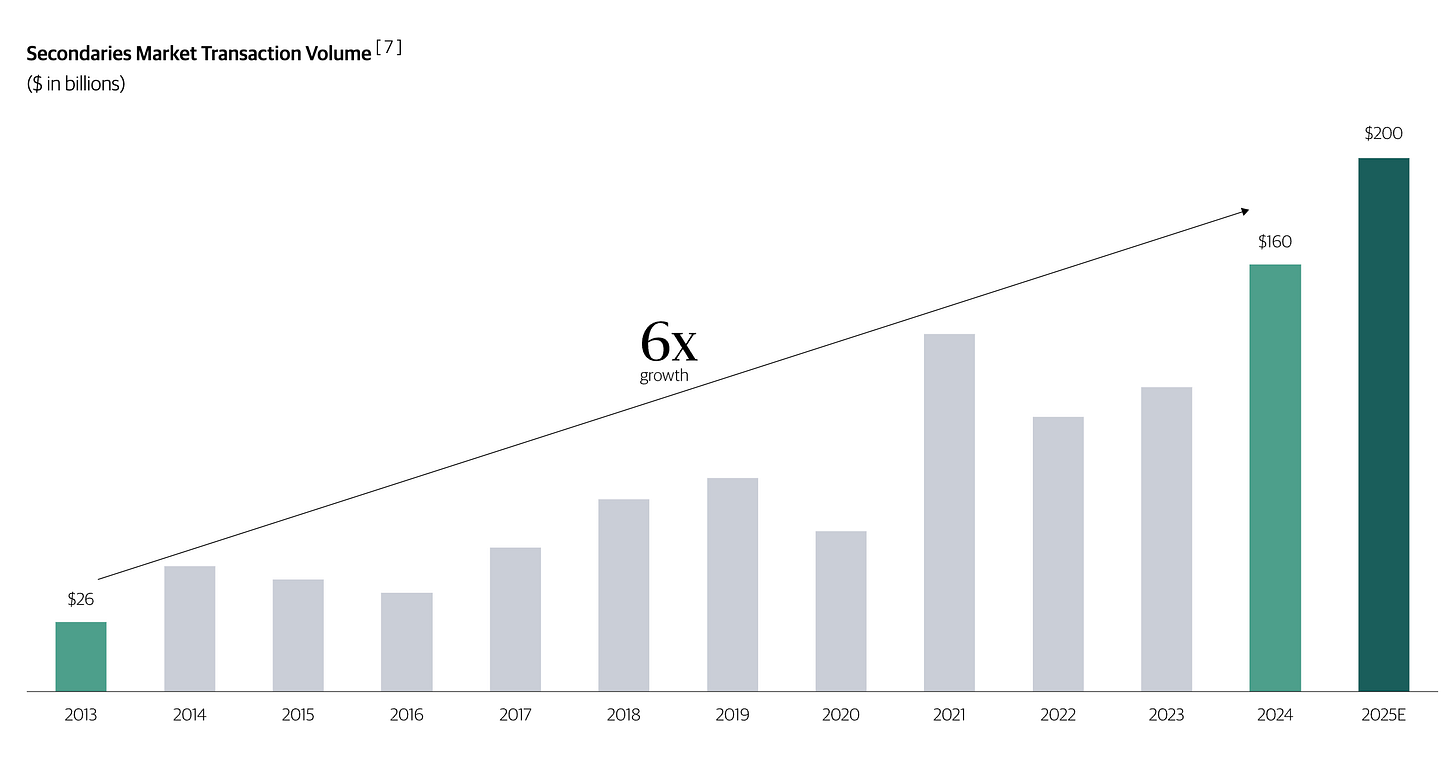

The Rise of Secondaries

Capital committed to primary private equity funds has grown more than threefold since 2009, from $300 billion to roughly $1.0 trillion.

In contrast, the secondaries market has grown more than sevenfold since 2013, from $28 billion in 2013 to over $200 billion expected in 2025.

Even with this growth, the secondary market still represents only ~1.5% of global alternative assets, highlighting the substantial runway ahead.

With IPO and M&A activity still subdued, secondaries are playing a critical role in providing liquidity to long-dated private investments.The current environment reflects a buyers’ market, characterized by a large and growing source of supply with an annual turnover of ~1% and approximately 1.1 years of secondary dry powder overhang. Secondaries have emerged as a structural solution, offering both buyers and sellers flexibility in a historically illiquid asset class. With strong secular tailwinds in place, we believe the opportunity in secondaries is only accelerating.

💰Fundraising News

Chorus Capital, a London-based alternative credit manager specialized in bank risk-sharing transactions, raised $2.5 billion for its Capital Credit Fund V. The Fund invests in portfolios of investment-grade corporate loans from leading European and North American banks through risk-sharing transactions. More here

Pantheon announced a final close of $2.2 billion for its Credit Opportunities III. PCO III is a core offering within Pantheon’s integrated private credit secondaries platform. Investments span over 10 GPs and more than 1,000 underlying loans, with ~80–100% allocated to secondary purchases and up to 20% for co-investments. It focuses on North America, with 20–40% exposure to Europe and up to 10% in Asia and other regions. The fund targets net IRRs of 15–20% over an eight-year term. More here and here

Macquarie Asset Management announced a final close of $1.4 billion for its European Infrastructure Debt Fund. The fund has a portfolio of 24 European infrastructure debt investments and is over 80% deployed. These investments span across renewables – solar and wind; digital - fibre and data centres; transportation and adjacent assets - roads, rail, ferries, motorway service. The fund was primarily launched to provide insurance companies a pooled fund vehicle to invest in high-quality infrastructure debt assets. More here

Partners Group, a Switzerland-based manager, announced a first close of over $1.2 billion for its latest European direct lending program. The program targets senior direct lending to companies across Europe. It focuses on core mid-market companies that have EBITDA predominantly in the EUR 20 million to EUR 50 million range. Link

Apollo has been awarded the mandate to manage Singapore’s $1 billion Private Credit Growth Fund, a government-led initiative designed to provide non-dilutive financing to high-growth local enterprises. Launched by the Ministry of Trade and Industry and Enterprise Singapore in March, the Private Credit Growth Fund is part of a broader national strategy to establish Singapore as a hub for private debt in Asia. More here

Blue Owl announced a final close of $850 million for a private offering of an alternative credit fund. More here

Sabal, a California-based real estate investment manager, announced the final closings of two funds with total commitments of $720 million. Sabal Strategic Opportunities Fund II invests across strategies that include purchases of non-performing loans, asset acquisitions from motivated and distressed sellers, originations of rescue financings, and homebuilder finance. SIH Debt Opportunities Fund II focuses on senior secured, performing commercial real estate loans secured by multifamily properties located across 46 states and the District of Columbia. More here

SAB Invest, a Saudi Arabia-based investment manager, launched its $270 million announced Multi-Strategy Private Investment Fund I. The fund will invest in private credit opportunities across Saudi Arabia, the GCC, and the MENA region. SAB Invest expects the fund to deliver an annual return of 12%-13%. More here

Prefequity, a London-based private credit firm, raised $20 million from the British Business Bank. The fund will invest alongside Prefequity Credit Opportunities II, which is expected to have a final close of £150 million. Prefequity targets non-sponsored companies with EBITDA of £2-10m. It typically invests between £5 million and £25 million per company. More here

This newsletter is for educational or entertainment purposes only. It should not be taken as investment advice.