What’s Driving KKR’s $42 Billion Real Estate Credit Pipeline?

Fundraisings from Antares, Starwood, Tikehau, TCW and Enko

👋 Hey, Nick here. A special welcome to the new subscribers from Goldman Sachs, Greysteel and Everberg Capital,. It’s great to have you. Reach out and say hi. This is the 117th edition of my weekly newsletter. You can read my previous articles here and subscribe here

📕 Reads of the Week

🎧 Marc Rowan: How Apollo’s Differentiated Strategy Was Built for This Moment. Link

🎧 Oaktree on Private Credit’s Gridlock: “At this point, it feels that liquidity is binary. There’s a very strong bid for high-quality assets and less availability for the less favored sectors and complex businesses”. Link (Transcript here)

Covenant Lite: How Survivorship Bias Skews Private Credit Returns. Link

Bloomberg’s deep dive into Egan-Jones’ questionable ratings. Link

Blue Owl: Investing in the ongoing revolution in life sciences. Link

Q1 2025 Lincoln Private Market Index. Link

Carlyle’s 2025 Credit Outlook

Private credit’s raison d’être is very simple: deliver an annual return premium of roughly 200bps relative to liquid markets without assuming incremental credit risk. And this basic value proposition applies as well to equipment finance and consumer receivables as it does to sponsored M&A. Rather than accept slower growth or a diminished illiquidity premium, look for the private credit industry to grow its footprint in less penetrated sectors eager to explore alternatives to one-sizefits-all public markets.

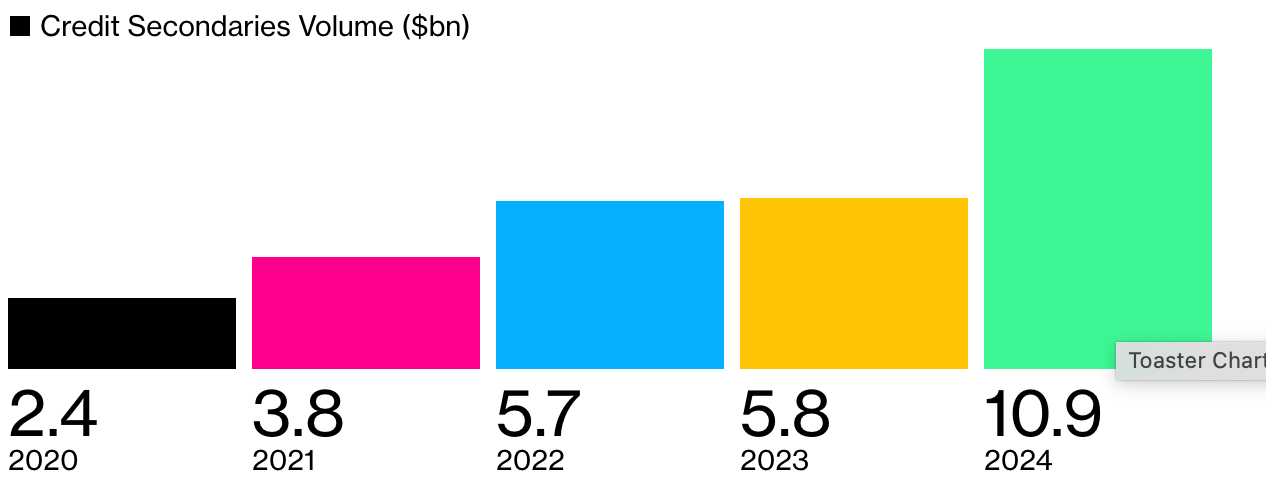

Credit Secondaries Volume More Than Quadrupled Since 2020 Link

Bruce Richards: Handing out private loans to software technology companies is not “intelligent.” Link

🏦 Partnerships of the Week

Allianz is in preliminary discussions to acquire Capital Four, a Copenhagen-based European credit manager. Capital Four manages over €23 billion in assets across various credit strategies, including approximately €8 billion in private credit. More here

Franklin Templeton announced its acquisition of Apera, a pan-European private credit firm with over €5 billion in assets under management. Founded in 2016, Apera provides senior secured private capital solutions to private equity-backed companies in Western Europe. Apera recently closed its third flagship fund family at €2.9 billion. More here

📊 What’s Driving KKR’s $42 Billion Real Estate Credit Pipeline?

KKR thinks today’s market environment makes this vintage of real estate credit particularly attractive. Below are three drivers of its record pipeline. You can read the full report here.

KKR isn’t the only manager getting excited about real estate. You may remember Brookfield posted a similar report a few months ago. Here

Demand for real estate lending is robust.

Borrowers who took out loans when interest rates were low in the pandemic years are still facing maturities in a higher-rate environment on properties that have lost value. These owners have a pressing need to either sell or refinance.

KKR has a real estate pipeline of $42 billion

KKR’s global lending pipeline has hit a high-water mark twice so far this year. This has largely been driven by a combination of a heavy wave of refinancing and an increase in transaction activity.

KKR believes that lenders that have solid relationships with borrowers, access to scaled and varied capital, and a strong reputation should have plenty of opportunities going forward, even if the economy slows.

KKR pipeline’s maturity wall

Real estate credit provides attractive income

Muted construction activity, less competition, and resetting of rents should create a favorable supply/demand dynamic.

While spreads have tightened from their widest levels, KKR believes that these factors should keep spreads elevated.

KKR is focusing on the segments in which it has the most conviction, including multifamily and industrial properties, looking for high-quality borrowers, and being mindful of leverage.

KKR has set a high bar for lending in cyclical sectors such as hospitality, as well as in markets that are exposed to global trade. Port cities that process cargo from China, for example...

CMBS Yields are Over 300bps Higher than High Yield Corporates

Property values have reset materially over the past few years, providing attractive entry points to buyers and lenders

KKR Real Estate Credit typically lends at 60%-70% LTVs. The “value” portion of LTV has declined materially over the past few years as real estate, unlike most other asset classes, has re-priced in response to rising interest rates.

Most real estate is currently trading at or below replacement cost. Prices are starting to recover, but real estate credit investors can still take advantage of defensive entry points.

KKR thinks the limited supply of many types of properties compared to the demand for them should support asset values going forward. Construction pipelines were already down materially when tariffs hit due to sharp increases in the cost of financing, as well as labor and materials in both Europe and the United States. In Europe, strict planning regimes have also thwarted new construction. Constraints on new buildings should benefit existing assets, particularly in sectors and markets with high demand.

Real Estate Valuations Remain Significantly Below Historical Valuations

Read the full report here.

💰Fundraising News

Antares Capital, a Chicago-based private credit manager, closed its $1.2 billion Private Credit Continuation Vehicle. The continuation vehicle was established to purchase assets and limited partner interests from two comingled private credit funds comprising over 100 underlying first lien, floating rate loans originated and managed by Antares. The vehicle provided existing investors with an attractive liquidity option while offering new investors exposure to quality Antares-originated private credit assets. The transaction was led by Ares Credit Secondaries funds, along with a commitment from Antares. More here

Starwood Capital, a Miami-based investment manager, announced it has raised $2.9 billion for its latest private credit-focused vehicles: Starwood Real Estate Debt Strategies U.S., Starwood European Real Estate Debt Finance II, and Starwood Australian Real Estate Debt Finance Trust I. Starwood has completed over $100 billion of lending transactions since 2010. More here

Tikehau, a Paris-based asset manager, launched its first ELTIF 2.0 semi-liquid private debt fund. The fund provides private investors with exposure to European mid-market credit. It will co-invest alongside Tikehau Capital's institutional credit vehicles, which have invested nearly €70 million of their own balance sheet in the vehicle. It will be open to subscriptions on a permanent basis and will publish its net asset value every month, with the option of monthly subscriptions and quarterly redemptions. More here

TCW, a Los Angeles-based manager, launched the TCW Private Asset Income Fund (TPAY), a private asset-backed finance interval fund. TPAY launches with over $450 million in commitments, including an anchor commitment from Apollo S3 Credit Solutions. TPAY focuses on private lending opportunities that power the real economy. More here

Enko Capital, an African-focused asset manager, raised $25 million for its first private credit fund. The fund will invest in a portfolio of USD-denominated senior secured and unsecured debt to mid-sized corporates in sub-Saharan Africa, excluding South Africa. It has a target fund size of $150 million. The raise was anchored by the IFC. More here

This newsletter is for educational or entertainment purposes only. It should not be taken as investment advice.