Why Apollo Thinks Europe is the Key to Private Credit's Growth

Fundraisings from NorthWall Capital, Arini, Apollo and Pemberton

👋 Hey, Nick here. A big welcome to the new subscribers from Blue Owl, KKR, and CPP Investments. Glad you're here. No commitment fee if you make it to the end. This is the 120th edition of my weekly newsletter. If someone forwarded this to you, you can subscribe here and read my previous articles here.

📕 Reads of the Week

Apollo published its thesis on why Europe could rival the US. You can read my top four takeaways below

Private credit has been the biggest driver of growth for semi-liquid funds over the past three years. Link

PGIM will merge its public and private credit to create a $1 trillion credit platform. Link

BlackRock has been selected to help allocate across public and private markets for Great Gray’s first target-date retirement fund. Great Gray manages over $210 billion in retirement funds. BlackRock believes this model portfolio could add 50 basis points in portfolio returns annually. Compounded over 40 years, this could add as much as 15% more money to a retiree's savings. Link

Median DPI of all asset classes of between 2016 and 2023 vintages. Link

Meta is raising $29 billion to fund the expansion of its AI data centers in the US. It also increased its full-year Capex forecast to between $64 billion and $72 billion. Link

Read Blackstone’s update on infrastructure investing to learn more about this trend. Link.

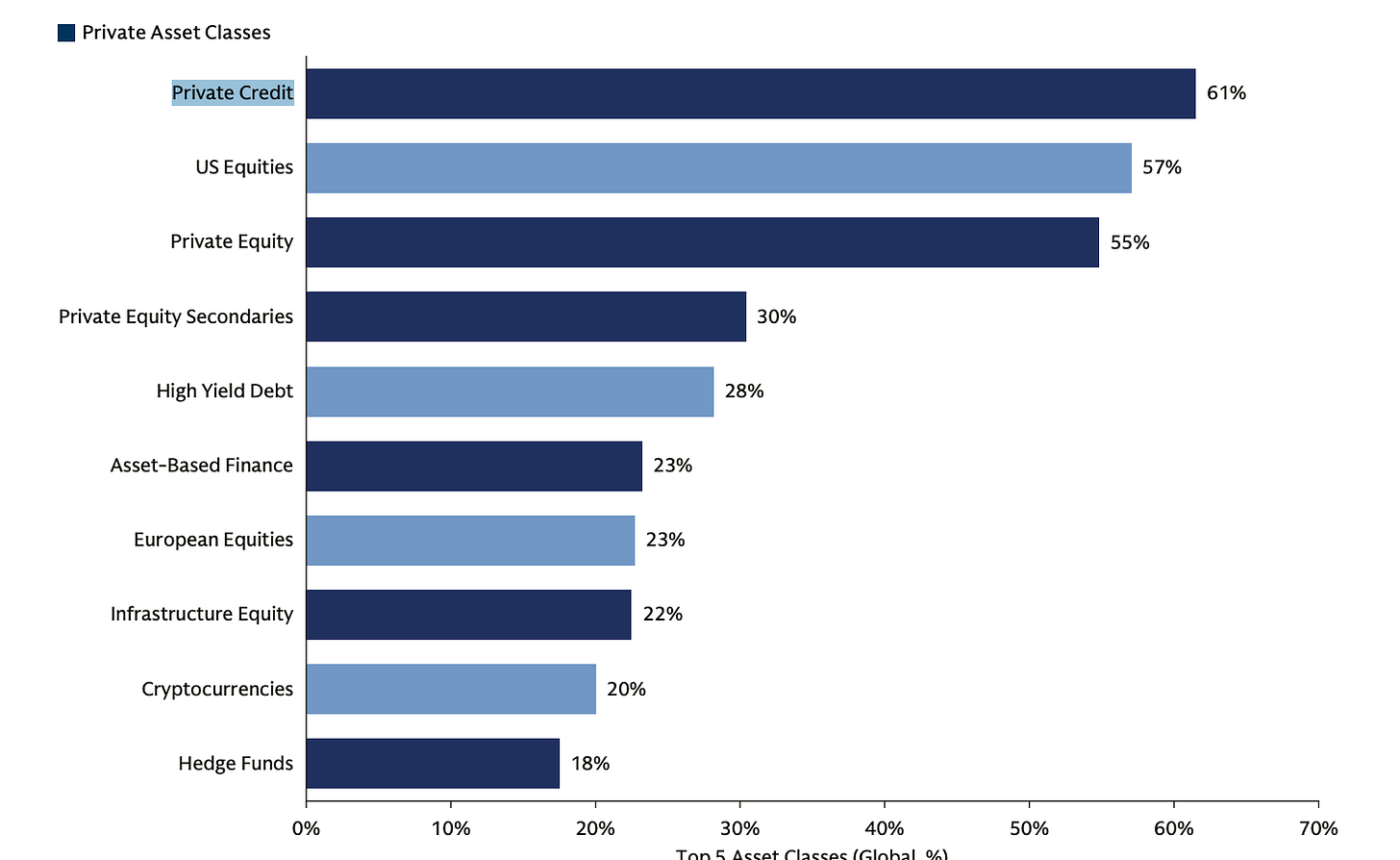

Goldman Sachs Asset Management Global 14th Annual Insurance Survey:

GS surveyed 405 professionals, representing over $14 trillion in assets. Top Insights include:

56% of insurers are looking to increase their Private Credit allocation over the next 12 months.

Most insurers (71%) invest in Private Credit because of high expected returns; however, many (20%) also see benefits in portfolio diversification. A small number of insurers cited the asset class’s ability for potentially high recoveries as well as lower defaults as driving factors.

There is a notable preference for fixed rate investments, with 58% of respondents favoring stability and predictability in returns.

Read the full report here

Insurers expect private credit to have the highest total return in the next 12 months

Read the full report here

🏦 Partnership of the Week

BlackRock and Mubadala have agreed to unwind their Asian private credit partnership. The partnership has deployed only a limited amount of capital and has struggled to find deals that meet its risk-return profile. Link

Bain Capital partnered with Lincoln Financial to launch an evergreen private credit fund. Link

📊 Apollo on Europe’s Private Credit Moment

Apollo’s private credit team published a compelling thesis on why Europe has the potential to rival the US. Below are four of my top takeaways. You can read the full report here.

The European direct lending market trails behind the US

The US pioneered private credit. Yet, over time, Europe has shown a consistent ability not only to catch up but to rival American incumbents. Airbus is now the world’s largest commercial aircraft manufacturer.

As with aviation, Europe’s structural advantages, strong legal protections, institutional credibility, and large addressable markets, create a fertile environment for private credit to flourish.

The evolution is already underway: European direct lending is shifting toward larger, more sophisticated financings. In the two years to 2024, an average of 39% of direct lending transactions in the region exceeded $500 million, up from just 13% in 2020.

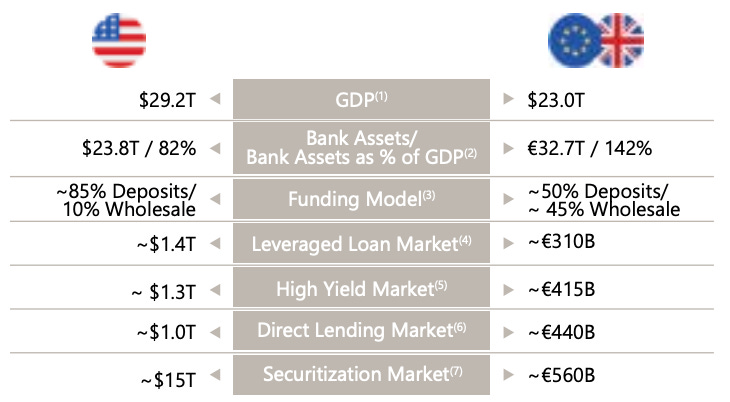

Structural differences between the European and US financial systems

The combined EU and UK economies are approaching the size of the US

Their banking systems hold nearly twice the assets

The region’s high-yield and leveraged loan markets are only one-fourth of the size of their American counterparts

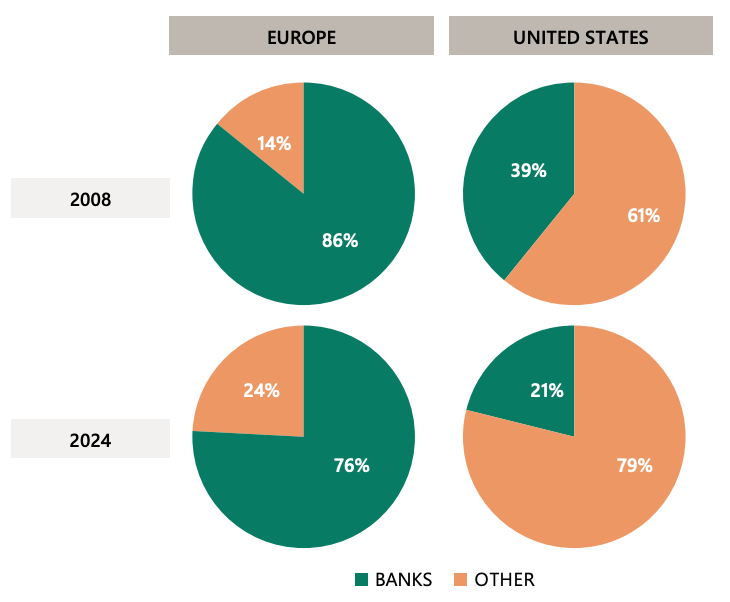

Sources of financing for the corporate sector in Europe versus the US

European corporates remain heavily reliant on banks

With bank assets totaling 142% of GDP in Europe and the UK compared to 82% in the US, there is considerable room for private credit to capture market share

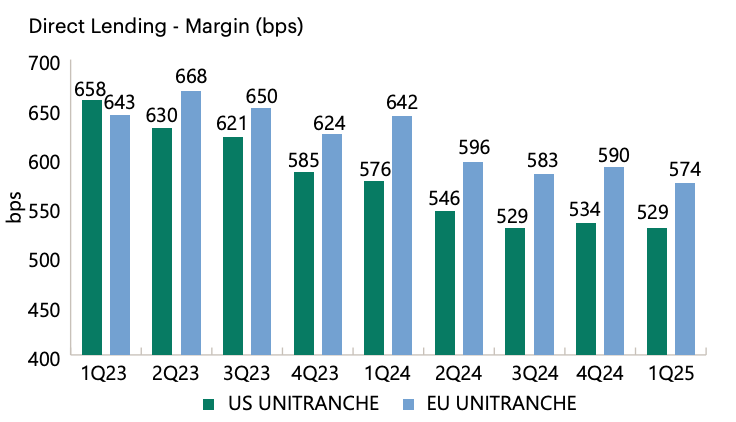

European direct lending deals tend to price at a spread premium to US deals

European direct lending deals tend to price 25 basis points to 50 basis points wider than their US counterparts

Original issue discount’s are often up to one point more than similar US deals

This spread differential stems from structural differences between the two markets, The European market is smaller and more fragmented, with varying regulatory regimes, legal systems, and capital market dynamics across jurisdictions.

Read the full report here

💰Fundraising News

NorthWall Capital, a London-based alternative credit manager, announced the first close of $860 million for its Credit Opportunities Fund. Link

NorthWall Capital, a London-based alternative credit manager, announced the first close of $503 million for its Senior Lending Strategy. The fund targets sponsor-backed and non-sponsored upper mid-market borrowers across Europe. Link

NorthWall Capital, a London-based alternative credit manager, raised ~$300 million for its Asset-Backed Opportunities Strategy. Link

Arini Capital Management, a London-based alternative manager, raised a $200 million anchor investment from BCI for its Direct Lending Fund. The fund is an alliance between Arini and Lazard. It plans to offer a differentiated approach by leveraging Lazard’s corporate advisory network for deal origination and Arini’s credit underwriting experience. BCI could invest an additional $400 million as a co-investor. More here

NorthWall Capital, a London-based alternative credit manager, announced the first close of $169 million for its Legal Assets fund. The fund invests in uncorrelated loans to law firms. Link

Apollo’s Diversified Credit Securitize Fund has surpassed $100 million. Link

Pemberton Asset Management, a London-based private credit manager, launched a new GP financing business in the US aimed at providing growth capital to middle-market and upper-middle-market PE managers. Pemberton’s GP financing platform will target US PE firms with at least $5 billion in assets. The lender offers non-dilutive financing in the form of preferred equity investments and structured loans, typically deploying $50 million to $600 million per transaction. More here

This newsletter is for educational or entertainment purposes only. It should not be taken as investment advice.