Goldman Sachs Sets the Price of Pension Partnerships

Fundraising from Benefit Street Partners, Coller Capital, Peak Rock and Vistara Growth

👋 Hey, Nick here. A big welcome to the new subscribers from Finley, Loomis Sayles and Evercore. This is the 130th edition of my weekly newsletter. If someone forwarded this to you, you can subscribe here and read my previous articles here.

I promised I’d step. So here it is: ABF, pension partnerships, and secondaries. If you only have time for three clicks this week, these are the ones that matter.

📕 Reads of the Week

Deal of the Week

In September last year, the deputy CIO of Castlelake, Isaiah Toback, commented on its sale to Brookfield:

“We feel like we are the dog who caught the bus, but the bus is moving at 40 miles an hour.

If we are going to ride this wave of quickly scaling, we needed to step into a different league.

We needed a partner who was going to open doors and provide multiple different types of capital.” Link

Isaiah’s thesis is already playing out, and this week, Brookfield and Apollo partnered with SMBC Aviation Capital to acquire Air Lease for $7.4 billion. Air Lease owns and manages more than 500 aircraft, with a further 260 on order.

It’s also another illustration of how serious Apollo is about asset-backed finance.

Opinions

Life Lessons from Stephen Schwarzman. Link

Market Commentary

Higher credit quality “is often achieved through creative structuring rather than just using less leverage.” Moody’s warns that pressure to deploy may tempt managers to compromise on underwriting standards. Link

Amundi thinks Private Debt is at a Turning Point: Risks and Opportunities as the Industry Scales Up. Link

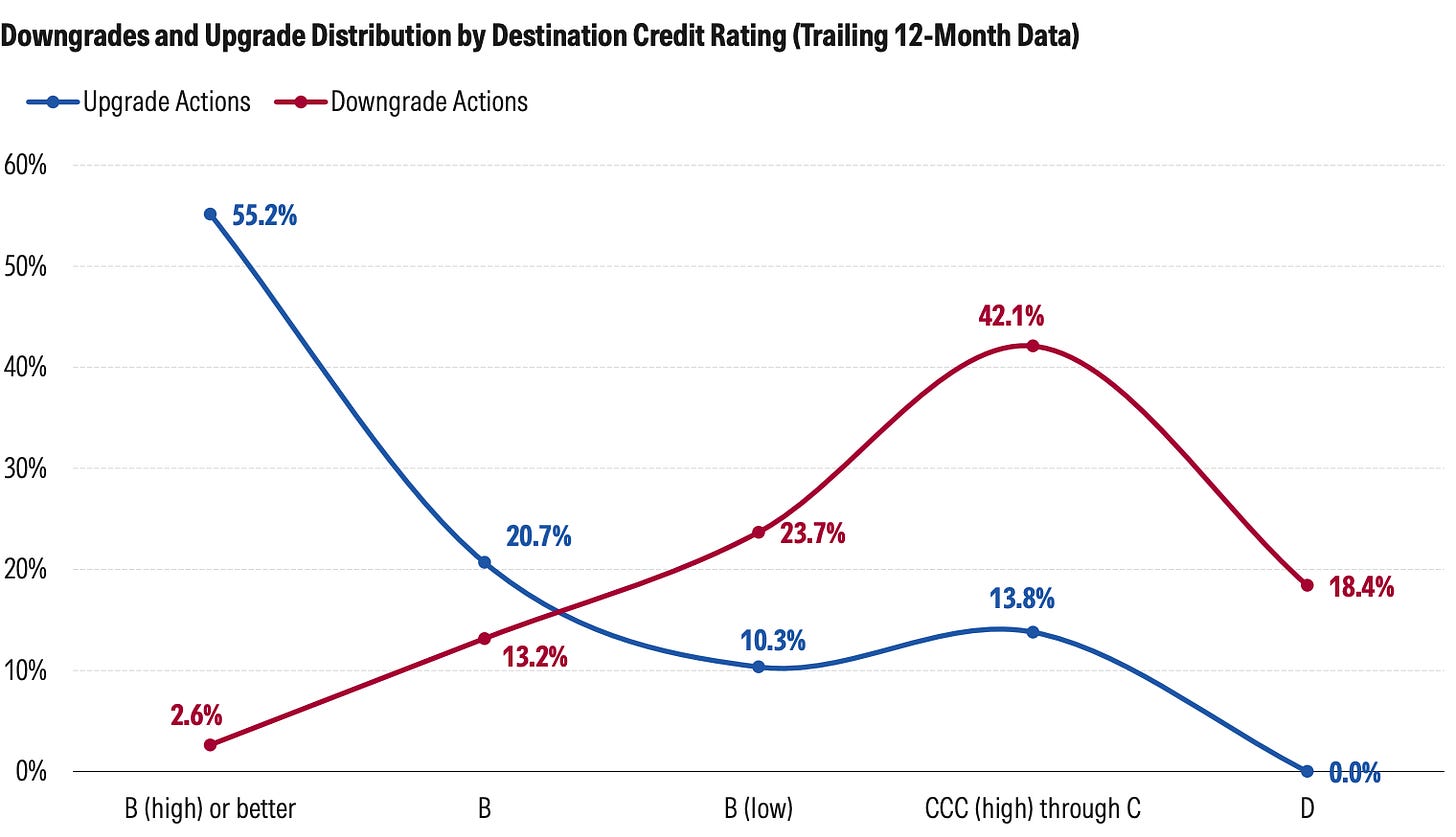

“We are still not seeing any meaningful upward flow from borrowers in the CCC through C group into stronger categories that would indicate fundamental recovery,” DBRS argues that a subset of borrowers continues to face softer operating performance and elevated leverage. Link

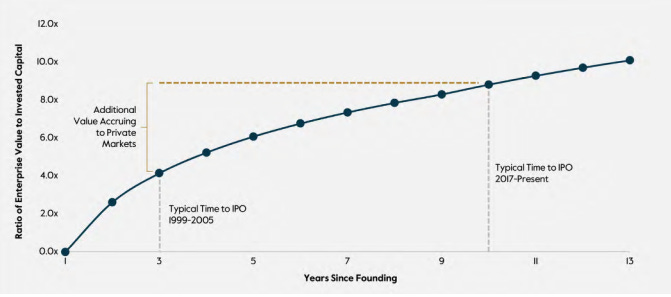

Private Markets Capture 50% More of the Value in the First 10 Years of Promising Companies’ Lifecycle.

The Rise of Private Markets by Carlyle

Announcements

MSCI launched a Private Credit Factor Model to help investors overcome the lack of transparency in the asset class and better assess the long-term risks it presents in their overall portfolios. Powered by data from over 1,500 private capital funds, the model offers institutional investors a consistent, integrated view of risk across public and private markets. More here

Quote of the week

“We recently carried out a survey with 164 mid-market sponsors… [8 out of 10 sponsors] anticipate completing two to three exits from their portfolio in the next year.”

📊Partnerships of the week

Goldman Sachs announced a strategic partnership with T. Rowe Price. The collaboration will enable both firms to offer a range of wealth and retirement products that incorporate access to private markets for individuals, financial advisors, plan sponsors, and plan participants. As part of the collaboration, GS will invest $1 billion. Read more about the partnership here.

I’ve flagged this deal because it’s a clear counterpoint to Brookfield's relaxed take on partnerships during its H1 earnings call:

We feel that this is going to be an opportunity that is created over an extended period of time several years and decades. And none of those partnerships to the best of our knowledge, are exclusive.

However, if Goldman’s $1 billion investment is any benchmark, the cost of accessing pension capital through investment manager partnerships is heating up. The logical outcome is a smaller circle of costly, quasi-exclusive arrangements. Exactly the opposite of Brookfield’s framing.

Rithm Capital is acquiring Crestline Management, an alternative investment manager with approximately $17 billion in AUM. The acquisition will meaningfully expand Rithm’s capabilities across direct lending, fund liquidity solutions, insurance and reinsurance. Read more here

Nuveen Private Capital is partnering with Hunter Point Capital and Temasek. HPC and Temasek are making minority investments in Nuveen Private Capital and Temasek will provide long-term capital commitments to the platform’s new and existing strategies. More here

📊Charts of the week

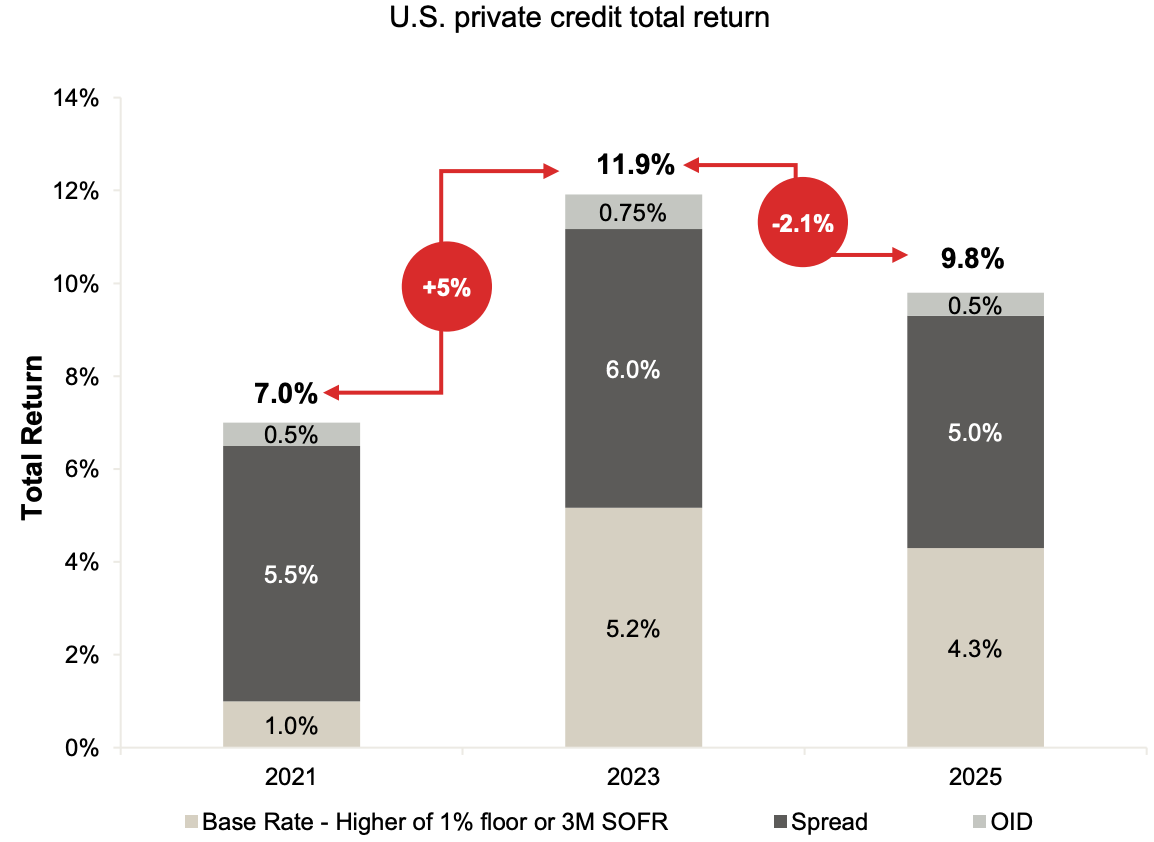

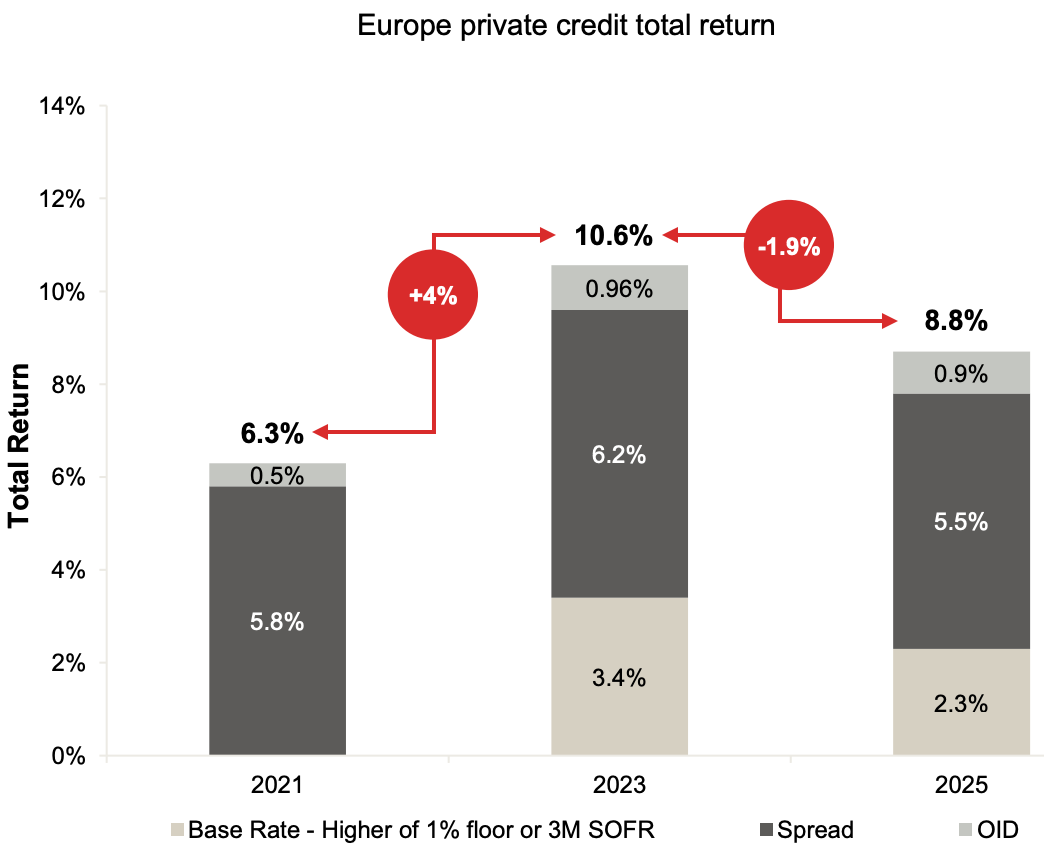

All-in yields in private credit remain attractive across the U.S. and Europe

Partners Group: Private Markets Chartbook – Q3 2025 Link

While base rates in the U.S. have declined from their peak, the spread has seen more significant declines.

In Europe, spreads have seen more moderate declines, but the base rate has declined slightly more.

Over the last 12 months, most downgrade activity moved borrowers toward the B(low) or weaker categories.

DBRS: Private Credit Rating Actions Chartbook. Link

“We are still not seeing any meaningful upward flow from borrowers in the CCC (high) through C group into stronger categories that would indicate fundamental recovery”

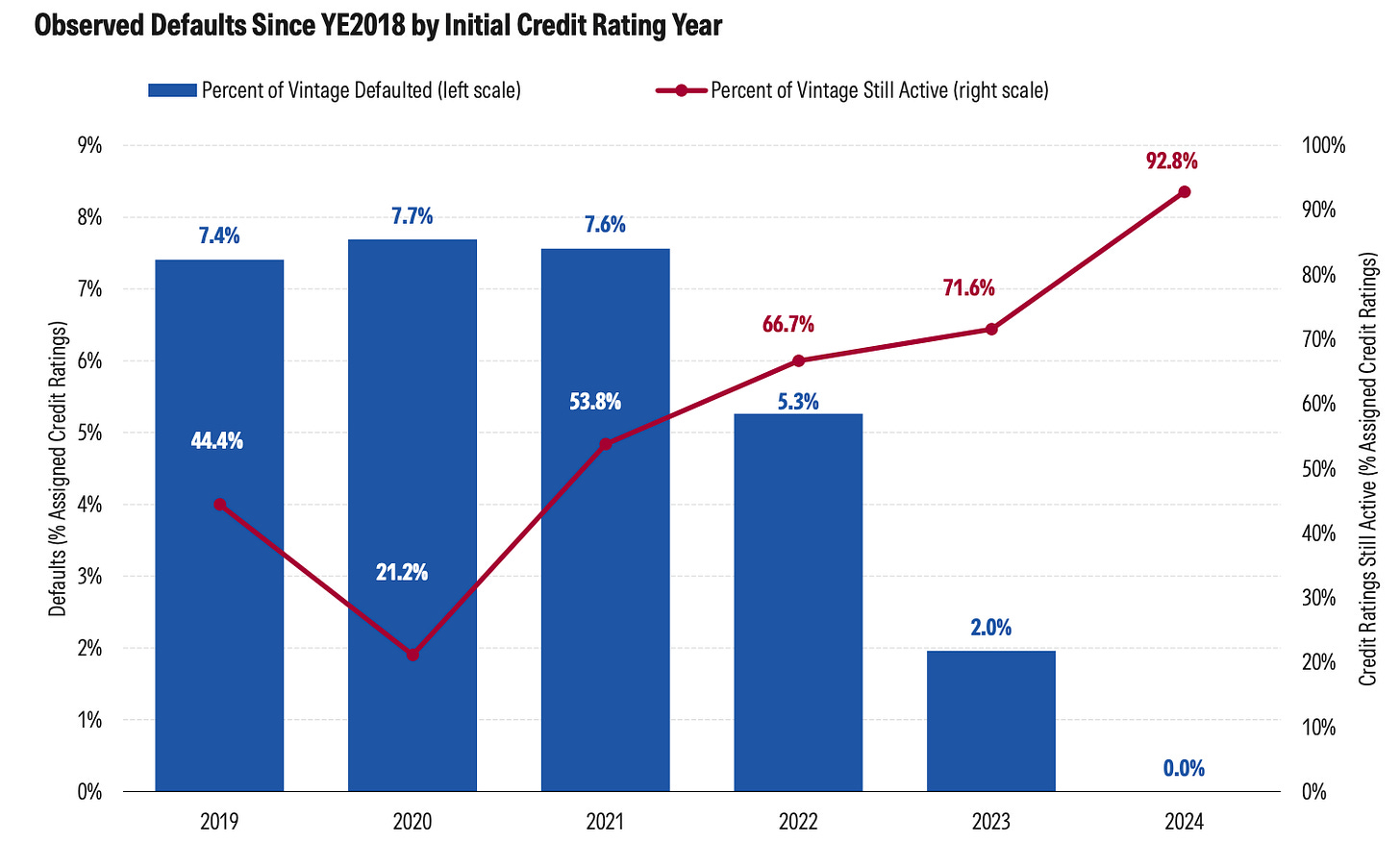

Pre-2022 Vintages Have Been Hit More Heavily by Defaults

To date, most of the defaults DBRS recorded have been by the 2020 and 2019 credit rating vintages.

💰Fundraising News

Benefit Street Partners and Coller Capital announced the closing of a $2.3 billion private credit continuation vehicle, BSP Debt Fund IV. The fund will acquire a portfolio of loans from BSP’s 2016 vintage direct lending fund. The continuation vehicle structure allows BSP to extend the life of its fourth flagship private credit vintage. More here

With three huge deals in the last three months, Coller Capital is solidifying its position as the leader in secondaries. See its $6.8 bn Credit Opportunities Fund here and its $3bn partnership with Twin Brook here

Peak Rock Capital, a Texas-based private investment firm, closed its $500 million Capital Credit Fund III. The fund primarily lends to family and founder-owned middle market businesses in North America and Europe. It targets loan sizes ranging from $10 million to $100 million. More here

Vistara Growth, a Canadian Venture debt lender, has raised $265 million for its fifth Technology Growth Fund. The fund lends to software & technology-enabled services businesses in North America. It typically lends between $10 million and $30 million per company. Vistara expects a final close on September 30, 2025. More here

EAAA Alternatives, an India-based alternative manager, raised $510 million for its first special situations fund. Bloomberg has more here

This newsletter is for educational or entertainment purposes only. It should not be taken as investment advice.

These smaller rating agencies, like DBRS, benefit disproportionately from private credit. When they talk about credit quality, I wonder whether I should take it with a giant grain of salt or trust them because they’re closer to the action. I am leaning towards salt though...