KKR: Why Speed, Timing, and Structure Matter More Than Ever

Fundraising from Mad Capital, WhiteHorse, LCM Partners, Five Arrows and More...

👋 Hey, Nick here. A big welcome to the new subscribers from Ares, Castlelake, and Legal & General. This is the 132nd edition of my weekly newsletter. If someone forwarded this to you, you can subscribe here and read my previous articles here.

There’s a lot of content this week, so I’ll forgive you for skimming. If you’re limited for time, I’d recommend:

📕 Reads of the Week

(1) HPS: What’s driving private credit’s growth? Link

Allocators increasingly value scale, workout experience, and restructuring expertise

Experienced private credit managers (those with 4+ vintages) captured 86% of fundraising since 2022.

New entrants raised only 4% of fundraising over the same period.

Private credit is no longer reserved for smaller, niche financings, as it was in the earliest stages of its growth.

The average private credit fund size has grown from $627 million in 2020 to $1.05 billion in 2024.

👉 [Read it here]

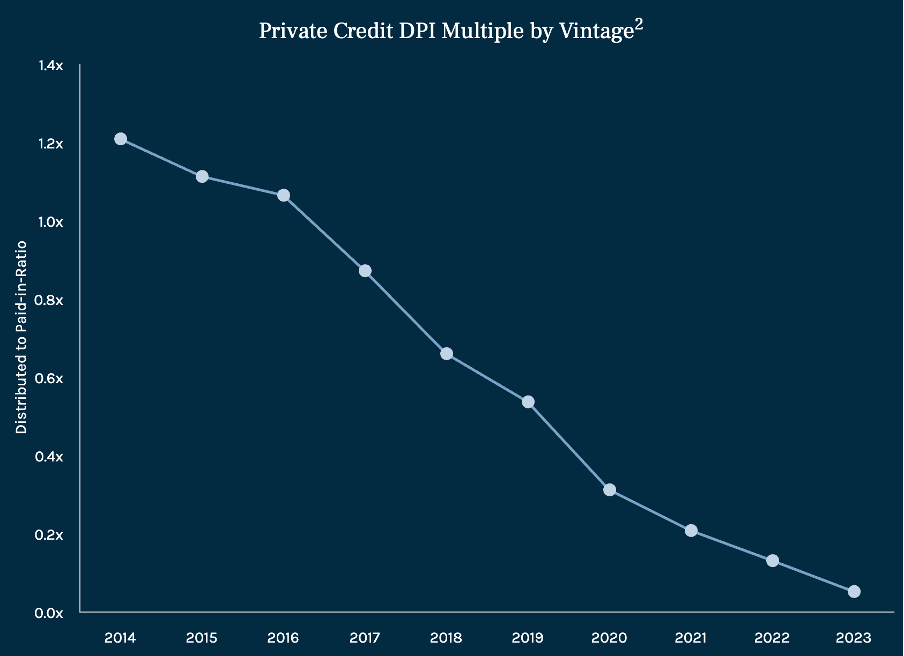

(2) Ares: The Rise of Credit Secondaries - Managers face increasing DPI pressure. Link

(3) Golub Capital Middle Market Report: U.S. Middle Market Earnings and Revenue Prove Resilient in Q2 2025. Link

(4) 🎧 Michael Zawadzki, Chief Investment Officer of Blackstone Credit & Insurance, discusses the current market. Link

Blackstone sees excess spread in private credit… about 200bps in excess of liquid credit.

Data centers are unusually attractive. Lending against fifteen to twenty-year triple net contracts from the highest quality counterparties is a really great place to play.

Blackstone has 2,000 non-investment-grade borrowers, and a default rate of below 50bps. Less than 1% of its income comes from PIK assets.

This summer was the third-highest summer for M&A since 2008… August was the single biggest month for Blackstone’s investment committee…

(5) 📹 Apollo’s Jim Zalter on Private Credit’s Growth in Europe (Link)

From Jim:

“I’ve been in finance for 40 years, and this is the most unique time in Europe.”

European leaders have got the memo about global growth.

The $40 trillion opportunity in private credit is really 80%+ investment-grade, long-duration capital.

The future of IG private credit is partnerships with banks, no doubt about it. Some banks sit senior or take shorter duration. Companies need 10 to 20-year financing solutions… that’s not typically appropriate for a bank balance sheet.

👉 [Watch it here]

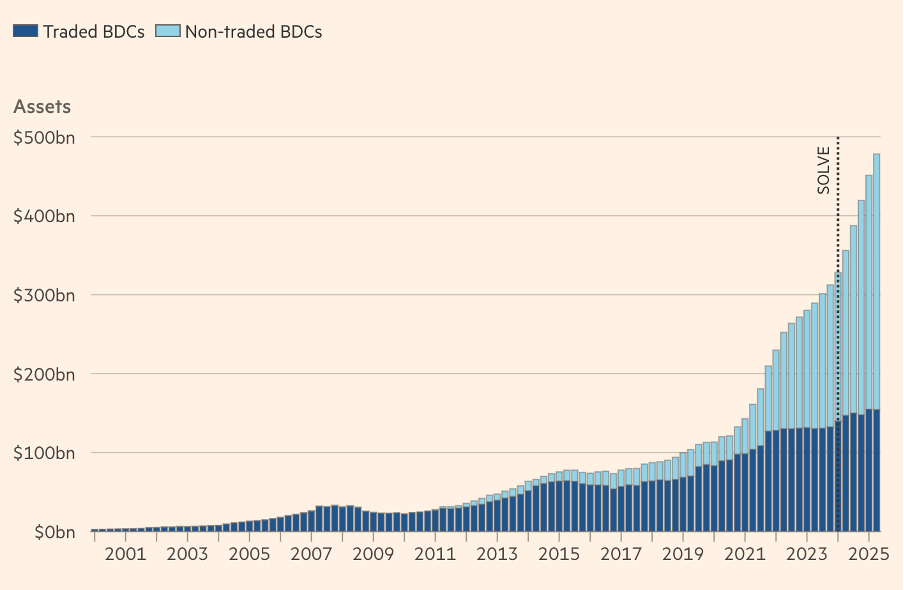

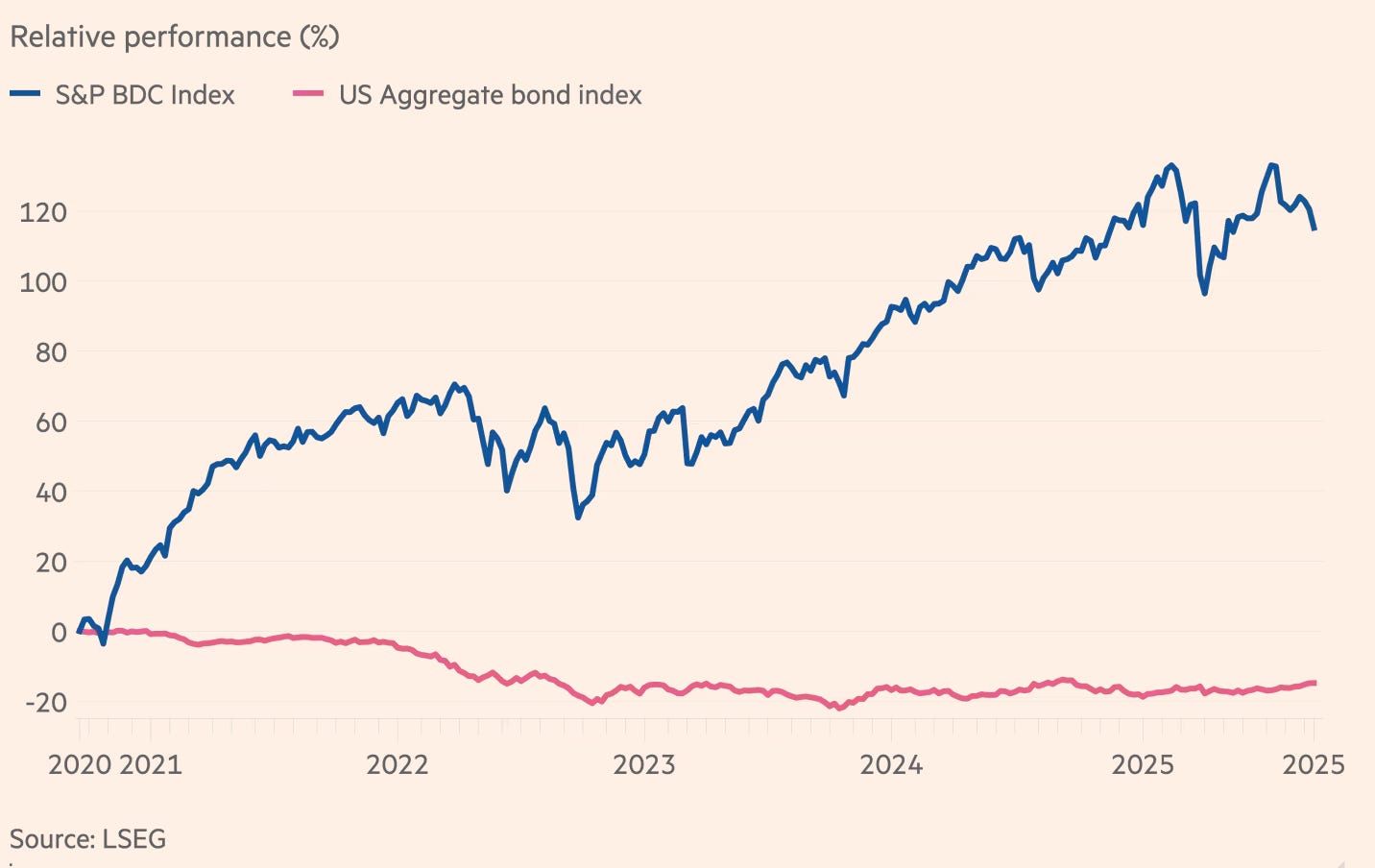

(6) Inside the BDC boom

Unexpectedly and out of character, the FT published a balanced thought piece on BDCs. Below with my highlights. 👉 (Read the article here)

BDCs have grown to $450 billion of AuM

BDC returns have battered the market in recent years

In a “severe adverse scenario” where [BDCs] suffer 16.6% credit losses before revenue (8.3% losses after revenue), they would almost all still be solvent — with all but four BDCs having stressed capital ratios in excess of 15% — far in excess of the average US bank stressed capital ratio of 9.9%

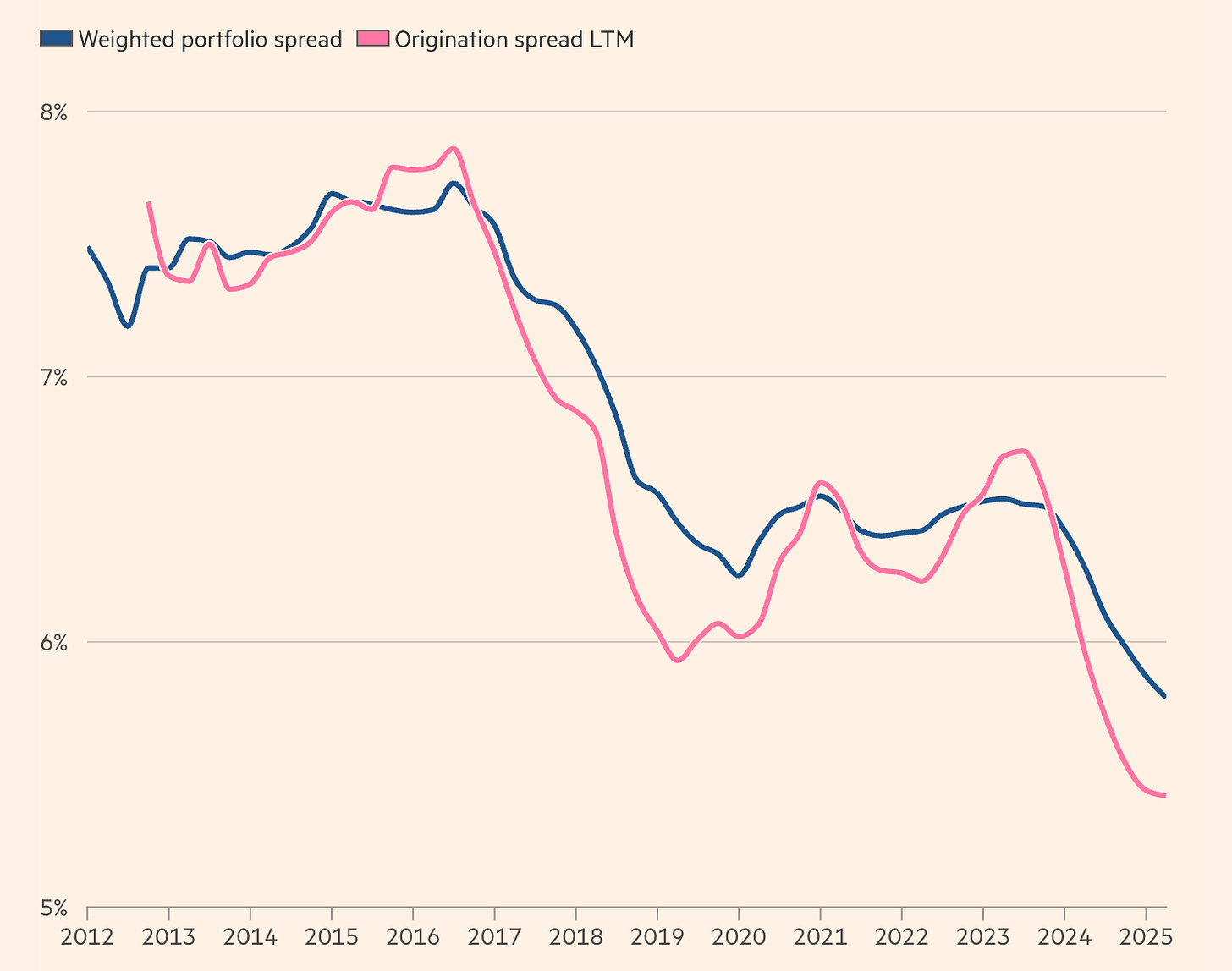

Spreads have fallen fairly sharply

📊 KKR: Why Speed, Timing, and Structure Matter More Than Ever

KKR’s Credit Market Review is filled with top insights, as always. Below are my favorite extracts.

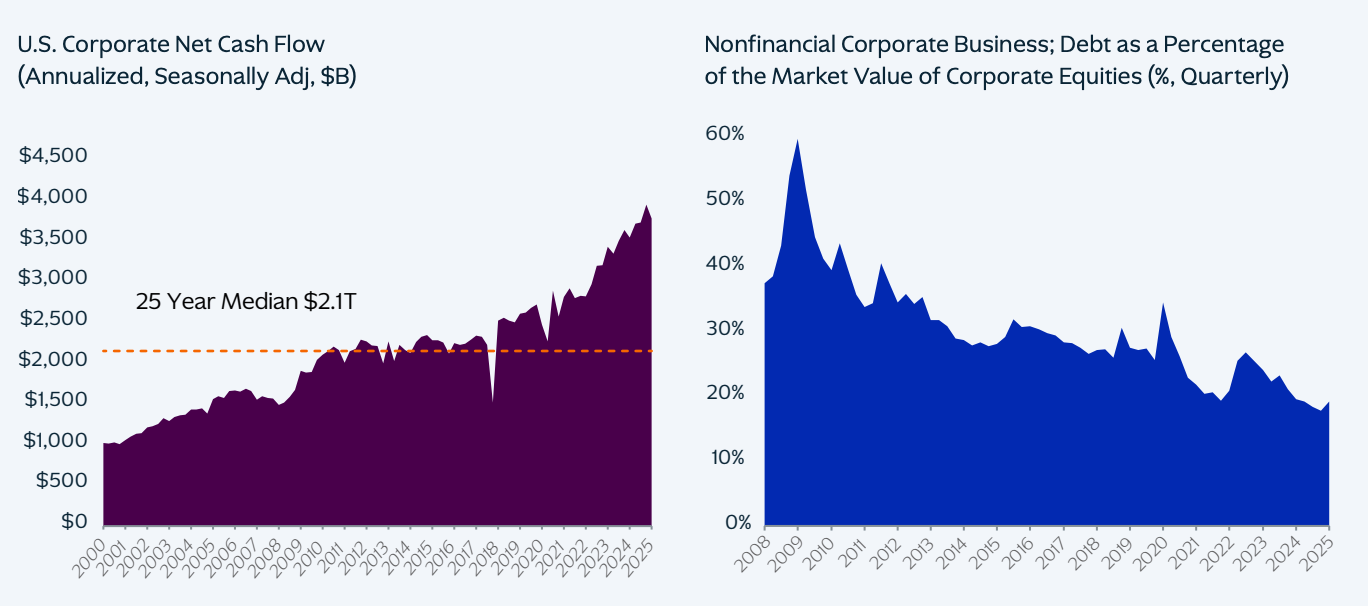

U.S. corporates are generating over $4 trillion in annualized net cash flow

While not all of it sits as cash on the balance sheet, this steady flow of liquidity gives corporates a stronger level of financial flexibility that can be underestimated

Market Returns Remain Highly Concentrated

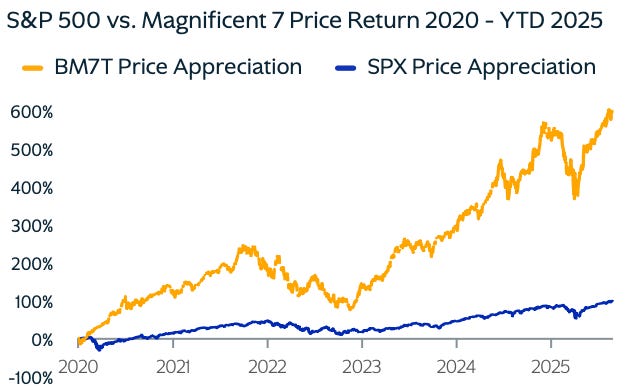

Over the past five years, the S&P 500 has delivered a total return of nearly ~100%.

Strip out the “Magnificent 7”, and the story looks very different.

The remaining 493 stocks returned just ~30% over the same period.

This divergence highlights how concentrated and dispersion-prone markets have become.

In this environment, investors are seeking more than passive exposure. They want alpha, and they are asking management teams and boards:

What are you going to do about it?

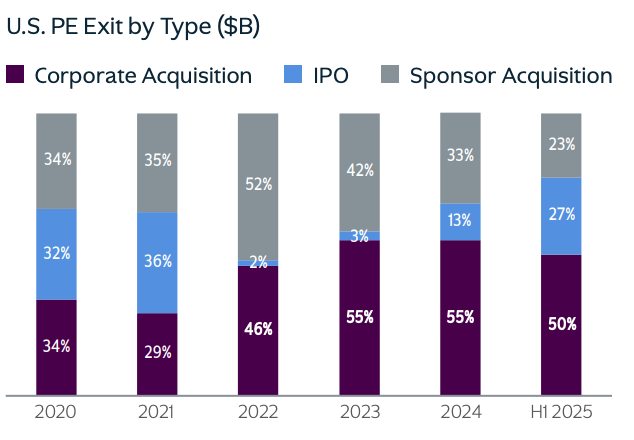

Sponsor Activity Has Become More Dispersed

Many sellers remain anchored to peak-cycle multiples, while buyers have grown more disciplined on entry price.

That bid-ask tension has cooled sponsor activity and delayed exits, creating an opening for corporates armed with intent, healthy balance sheets, and increasing private-market financing know-how, or at least openness.

Many companies are finding themselves in “prove it” mode, facing pressure not just to tell a value creation story, but to show the steps being taken. This often means exploring divestitures, spinouts, or other creative structures that can unlock value from non-core assets and redirect focus toward margin-accretive growth.

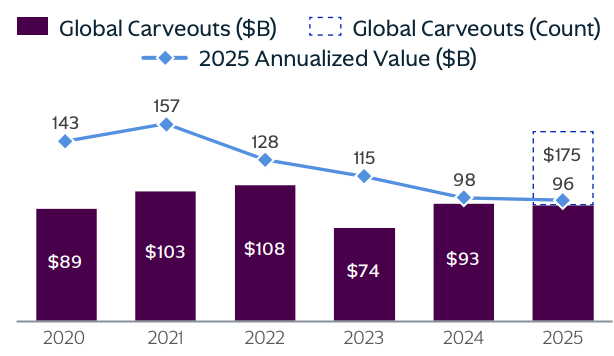

Global Carveout Activity is Rising as Corporates and Sponsors Increasingly Partner to Unlock Value and Accelerate Growth

One of the most consistent areas of opportunity in this environment has been corporate carveouts.

These deals are about more than price or cheap leverage. They represent the new playbook for both sponsors and strategics alike who increasingly are seeking operational transformation, digital enablement, and platform expansion.

💰Fundraising News

🚜 Mad Capital’s $78.4 million Agriculture Fund

I started the Credit Crunch to explore every corner of private credit. While most weeks are dominated by a handful of managers, every so often, I’ll stumble on a manager that reminds me private credit can be more than direct lending + ABF. This week’s fund in focus is one of those.

Big ❤️ to Mad Capital.

Mad Capital, a Colorado-based agriculture lender, announced a final close of $78.4 million for its Perennial Fund II.

The fund provides U.S. farmers with tailored transition finance to help them adopt regenerative organic practices while boosting long-term profitability.

☀️ Why?

Industrial agriculture is one of the leading drivers of climate change, soil degradation, and biodiversity loss. Regenerative organic farmers work with natural systems to reverse this damage, creating ecologically resilient farms and healthier food systems.

🐴 What?

Mad Capital’s second private credit fund will provide regenerative organic farmers with flexible loans to cover a spectrum of capital needs, from transition financing to soil health investments, market development, and enterprise diversification.

Mad Capital has already partnered with 17 farmers and ranchers managing over 126,260 acres to deploy over $25 million in loans in PFII.

Investors include: The Rockefeller Foundation, The Schmidt Family Foundation, and New Mexico Finance Authority.

What’s next?

Conceptualization of Fund III is already underway, with the leading concept being a semi-liquid, evergreen fund designed to scale into a vehicle exceeding $500 million to attract institutional investors seeking impact forward and uncorrelated yield.

If you’re an LP and want to learn more. Get in touch (Link) and tell them Nick sent you. You can also learn more here

💰Main Fundraising News

H.I.G. WhiteHorse, the direct lending affiliate of H.I.G. Capital, closed its $5.9 billion Middle Market Lending Fund IV. The fund lends senior secured loans across the U.S. middle market. Fund IV focuses on originating senior secured loans to both sponsor and non-sponsor borrowers with EBITDA generally between $30 and $100 million. More here

LCM Partners, a London-based private credit manager, announced a first close of €3.8 billion for its flagship Credit Opportunities 5 strategy. Brookfield committed an additional €600 million to the COPS strategy, bringing Brookfield's total commitment to COPS to €1.2 billion. More here

Five Arrows, the alternative assets arm of Rothschild, announced a final close of €2.4 billion for its fourth Direct Lending strategy, Five Arrows Debt Partners IV. The fund lends to both sponsored and non-sponsored European and North American mid-market companies. It can invest across the capital structure, ranging from senior-secured unitranche loans to junior instruments such as second lien, mezzanine and PIK facilities, as well as preferred equity structures. The Fund is already more than 50% committed to 19 transactions. More here

Blue Owl secured $850 million for its first alternative credit interval fund. The ABF fund will invest across credit assets, including financial and hard assets. It intends to provide monthly distributions and quarterly liquidity via repurchase offers. More here

Sienna, a Luxembourg-based investment manager, raised ~$320 million for its defence private credit fund. The fund is dedicated to SMEs and mid-caps operating in the European defense sector. The fund will finance 30 to 40 companies. The inflows will be deployed in Europe by the French private credit management team, leveraging the expertise of the Italian management team of the Sienna IM group. More here

TLG Capital, an Africa-focused fund, plans to raise $200 million for its Africa Growth Impact Fund II. The fund will provide financing in partnership with African banks to support up to 20 SMEs that face stress with their existing loan options. More here and here

Nextalia, an Italian asset manager, is launching a $300 million private credit fund. The fund will focus on corporate direct lending, real estate financing, and fund finance. More here

This newsletter is for educational or entertainment purposes only. It should not be taken as investment advice.

I LOLed when I read your intro to FTs piece on BDC!:) I was surprised too - usually the skies are falling