Private credit on the ropes?

The numbers say otherwise...

👋 Hey, Nick here. A big welcome to the new subscribers from Blue Owl, HPS, and AlphaSights. This is the 134th edition of my weekly newsletter. If someone forwarded this to you, you can subscribe here, and read my previous articles here.

For a market that’s supposedly on the ropes, private credit managers seem remarkably busy raising nearly $20 billion this week. It’s a good reminder to look past the headlines and focus on the insights these managers have that the media overlooks.

If you’re looking for a place to start, see below 👇

📕 Reads of the Week

1) European direct lending is scaling

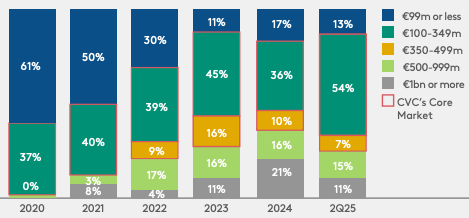

CVC announced a massive European direct lending fund this week. (See below). More impressively, the fund is 60% larger than its predecessor, which only closed in 2022. If you’re trying to understand how CVC is achieving this growth, they’ve shared their case for European direct lending.

European direct lending is up by 44% YoY.

While median spread has compressed to 500bps, private credit still commands a 50-100bp premium to comparable BSL transactions.

Deal sizes have grown meaningfully, and 1 in 3 European deals is above €500 million.

👉 [Read more here]

2) BlackRock on the scale of the private credit opportunity

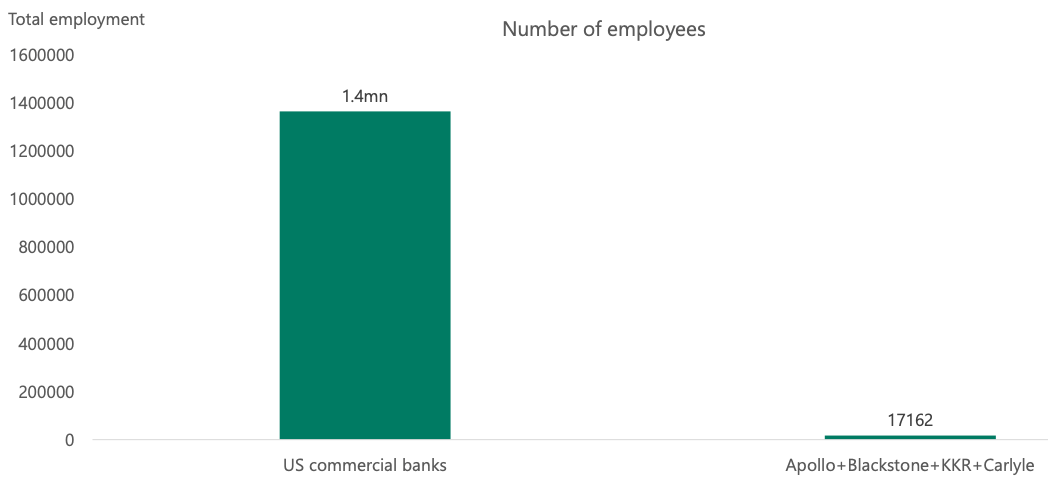

Mark Rowan highlighted last week that:

Wealth management is broken. If you want real diversification and you want to participate in 80% of the economy and 80% of the job creation, you now need private markets.

BlackRock has provided further evidence for Mark’s comment. Below is my favorite graph, but you should read the whole report.

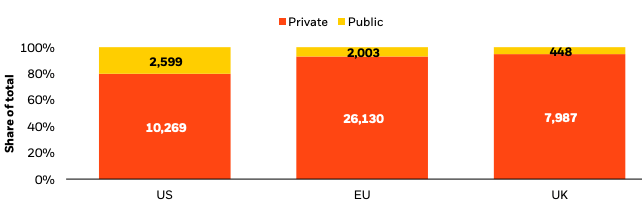

The majority of scaled (>$100m) businesses are private, with over 44,000 businesses across the US, EU, and UK

👉 [Read more here]

3) Private markets are still very small.

Apollo’s Private Market Outlook illustrates one of the clearest pictures of private credit’s growth potential.

👉 [Read more here]

4) The Stage is Set for Opportunistic Credit: Oaktree’s Quarterly Round Up

CCC-rated loans trade at spreads of 1,388 bps, 5.4x wider than BB-rated loans.

The spread reflects a bleak outlook.

Floating-rate debt from pre-2022 deals has doubled in cost.

Median cash flow coverage for CCC-rated loans has dropped below 1x.

CCC issuers can’t invest to grow and will struggle to refinance.

The stage is set to buy deeply discounted debt for many years to come.

👉 [Read more here]

📊 Partnerships of the week

Our market analysis of the 50 largest banks in the United States found 16 partnerships between banks and private credit firms.

How US regional banks are partnering with private credit. Deloitte

Brookfield x Angel Oak

Acquired a majority stake in Angel Oak, a manager specializing in innovative mortgage and consumer products.

Angel Oak has originated more than $32 billion in residential mortgage loans and issued over 65 securitizations over the past decade. More here

Aviva

A UK-based insurer.

Launched a default pension investment strategy that allows clients to invest up to a quarter of their pensions in private markets.

The strategy will invest through a selected group of asset managers, namely Neuberger, StepStone Group, KKR, Invesco, and Apollo. More here

Franklin Templeton

Completed its acquisition of Apera, a pan-European private credit firm with over €5 billion in assets under management.

Founded in 2016, Apera provides senior secured private capital solutions to private equity-backed companies in Western Europe.

With this closing, Franklin Templeton’s global alternative credit AUM grows to over $90 billion. More here

Generali Investments

An Italian investment manager.

Completed its acquisition of MGG Investment Group, a U.S. private direct lending investment firm with over $6.5 billion in AuM. More here

💰Fundraising News

Direct Lending

CVC Credit closed its $12.2 billion European Direct Lending fund IV. The fund lends to sponsored European medium and large companies. Loans are directly sourced through CVC’s sixteen European offices. More here and here

Infrastructure

Brookfield Asset Management held a first close of $4 billion for its fourth infrastructure debt fund. The fund invests in core infrastructure sectors, including the renewable power and data infrastructure sectors. BID III announced a final close of $6 billion in November 2023. More here and here

Incus Capital, a Madrid-based real assets private credit specialist, held a first close of ~$600 million for its fifth European Credit Fund. The fund invests across infrastructure, real estate, and alternative assets. Incus partners directly with small and medium-sized European companies, investing between €10m and €50m per transaction. More here

Special Opportunities

Blue Sage Capital, a Texas-based lower-middle-market firm, announced the final close of $287 million for its Strategic Credit fund. The fund targets lower mid-market companies in Texas, the Southwest, and the Midwest. It focuses on companies in environmental solutions, niche manufacturing, and specialty services sectors. The fund can invest in both debt and equity. More here

Indies Capital Partners, a Singapore-based alternative investment manager, closed its $300 million Special Opportunities IV fund. More here

Impact

M&G Investments, a London-based investment manager, launched a $350 million impact-focused private debt strategy on behalf of Dutch pension fund Pensioenfonds KPN. The Article 9 fund will lend to businesses committed to improving Climate & Biodiversity, Technology, and Responsible Production. More here

This newsletter is for educational or entertainment purposes only. It should not be taken as investment advice.

What? You mean there is no bubble?! But headlines!