Q4 2025 Alt Manager Earnings: What the Biggest Firms Are Talking About

Key Takeaways from 400 Pages of Earnings Transcripts

👋 Hey, Nick here. A big welcome to the new subscribers from Park Square, Cohen & Company, and Eurazeo. This is the 153rd edition of my weekly newsletter. You can read my previous articles here and subscribe here.

Every quarter, I summarise the 400+ pages of earnings transcripts from the largest managers. I do this for two main reasons:

It helps me understand the consensus views.

It brings to light unfiltered and occasionally provocative opinions.

This is the piece I look forward to writing every quarter. If you take away one useful insight, I’d really appreciate you forwarding this newslettter on.

Start with the software section if you’re short of time.

Only 1% of you will read the whole thing, but if you want to feel insufferably smug, I’d recommend printing this out, blocking 15 minutes in your diary, and giving it a proper read.

I’ve included a breakdown of key topics with links for the rest of you. Skim, skip, or dive in.

📚 Quotes of the Quarter

The four characteristics Ares looks for in software companies

What needs to happen for you to take losses in your software portfolio?

There is an enormous amount of equity cushion below these loans

Whether there is or isn’t an AI bubble is secondary to the question.

This monolithic view people are taking is gonna prove quite misguided

Transcripts can be found here

Provocative Opinions

Tech lending has worked, continues to work. No, We don’t have red flags.

Blue Owl: “A point of fact, we don’t have yellow flags. We actually have largely green flags.

These are loans that are on average 30% of the value of the enterprise at the time of acquisition, with huge equity cushions.

Let’s be fact-based as opposed to headline-driven.

Since November 2022, the advent of ChatGPT as some kind of moment of AI’s arrival, since that time, the portfolio on average has grown revenue 40% and EBITDA 50%.

We’ll bring it much more current because we can all agree that in November 2022, it was doing poems, so maybe it didn’t matter.

But let’s bring it to this quarter. Fourth quarter, the revenue growth was 10%, and the EBITDA growth in those software names was mid-teens. That’s fourth quarter, quarter over quarter.

Stories don’t drive results. Results drive results. And as you can see, we have delivered on every one of our products. An absolutely top-level performance in both total return and in terms of nonaccruals and in terms of loss. Think about what we’ve run at an eight basis point net loss rate. And so these facts do matter.

BDC Redemptions

Ares

95% of all the investors are not looking for liquidity. So typically, what’s driving these redemption queues are a small handful of investors that have to continue to get back in the queue to the extent that they don’t get the liquidity they need. So you do tend to see overinflated numbers coming through the redemption queue as people are trying to get to the front of the line.

Blackstone

On BCRED, we did see this uptick in redemptions, which is not a surprise given all the headlines out there.

I think it is notable that the last two months, despite all of this, we have had $800 million of gross inflows each of the last two months.

On the institutional side, where they are looking at the fundamentals, some of the noise here is not as impactful. Their confidence in what we are doing and their need in many ways is going up.

Apollo

Even though with a small below-the-line redemption in the fourth quarter, net new assets were up every quarter last year, over $5 billion of net inflows.

Blue Owl

Limiting people can also be very negative.

The hard cap is a mechanical hard cap. Unless, you have the added flexibility to accommodate. And I put us in the latter category. We manage our businesses with very low leverage. Manage with a lot of liquidity. I say this with no arrogance. We’re very good at both the liability and asset side.

So there really was no reason to you know, not fulfill an investor’s request for their capital back.

And we see that as actually meeting investor needs. Being an investor-friendly and investor-focused firm, which we think leads to much quicker recoveries in fund flows, and leads to much better performance.

If you have plenty of capital as we did in these vehicles, then we fulfill those requests, that will lead to more wealth growth over time.

BlackRock

Redemptions were 4.1%, which was higher than recent quarters, but in line with the broader industry. Most BDCs posted positive flows.

If you see LTVs rise to 60%, that’s getting to the point where it calls into question the refinanceability of the loan.

Oaktree: “Generally speaking, today, outside of software, when there is an LBO, you’re seeing something like 50%-55% LTV at the max. You’re not seeing 70% or 65% LTV deals generally.

So what would happen, assuming these businesses aren’t burning a terrible amount of cash, and they get to within a reasonable timeframe of maturity, if once the sponsor, calls up the market and says, I want to refinance, and the response is going to be, well, you’re gonna need to put in more equity to kind of make this closer to a 50/50 LTV again.

The sponsors will then have to judge whether it makes sense to do that or not, based on the future sort of risk factors and earnings potential of the business, but also the stage of deployment of the fund that those investments are in.

If a fund cannot call capital, it can’t, then that sponsor can’t support the business.

If the fund is already a winner and has already returned a lot of capital, then it’s more likely to let go those straggler businesses.

And so they’re, the sponsor is less likely to support the business in that event.”

The rotation out of private equity into private credit

Apollo: “Most of the investments that are made into these private BDCs are de-risking for the individual making the investment.

They are not selling their treasury exposure.

They’re selling their equity exposure, and they’re making an intelligent decision that they can earn roughly long-term equity returns in first lien debt versus in equity.

The equity exposure and the pricing of what’s happened in software-related and other-related has been extreme. We’re talking, in some instances, quality companies down 50%-70%.

This is why people are in first lien to begin with.

In private markets, particularly private equity, software had been almost 30% of the market for a decade.

Software is still an amazing business, but you may not like the purchase price at which you entered because you get to now look at the same companies down 50%-70%.

And that’s the public companies. And I have to believe the private marks with leverage will go down equally as much.

Pebbles and Boulders

Apollo: “Much of the conversation in the last several weeks has been about a quick reset of prices in the public equity market and then the impact on non-investment-grade software lending, which has been particularly focused on the non-traded BDCs.

We put out a deck in December, and all the conversation recently has been about the narrow sector, the $2 trillion of private credit.

It’s really not touching the $35 trillion to $40 trillion opportunity in investment-grade private credit. In the last 18 months, short-duration IG vehicle, a strategy that we really started 18 months ago, is up to over $7 billion in assets.

The headlines are focusing on the small pond.

Taking a step back and really understanding how the big boulders are moving, this is the discussion when we talk about non-traded BDCs. That’s about pebbles.

What Marc is talking about is boulders. It’s much more thematic, and it’s really what’s driving our business over the next 5 and 10 years.”

Software

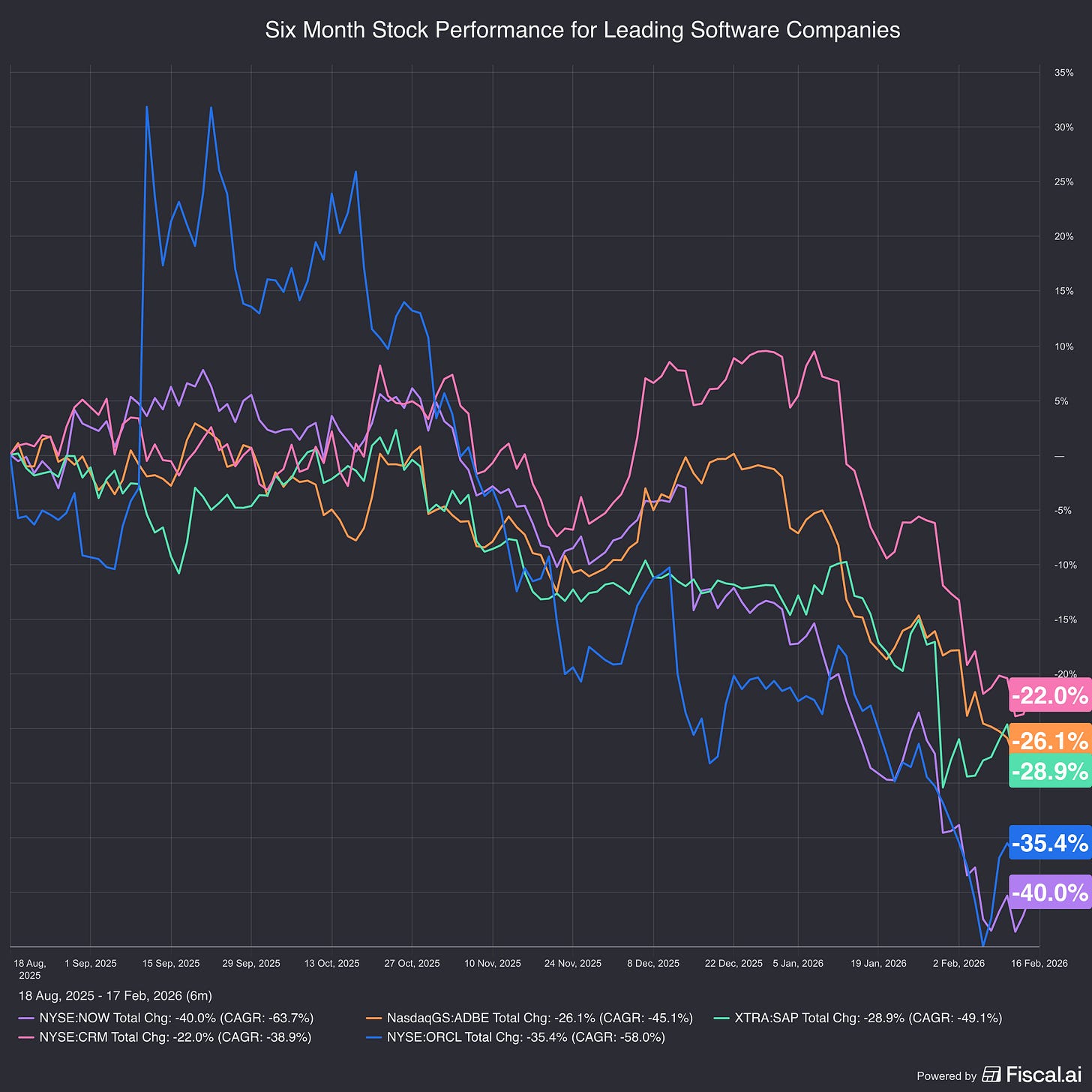

Software has wobbled over the last six months

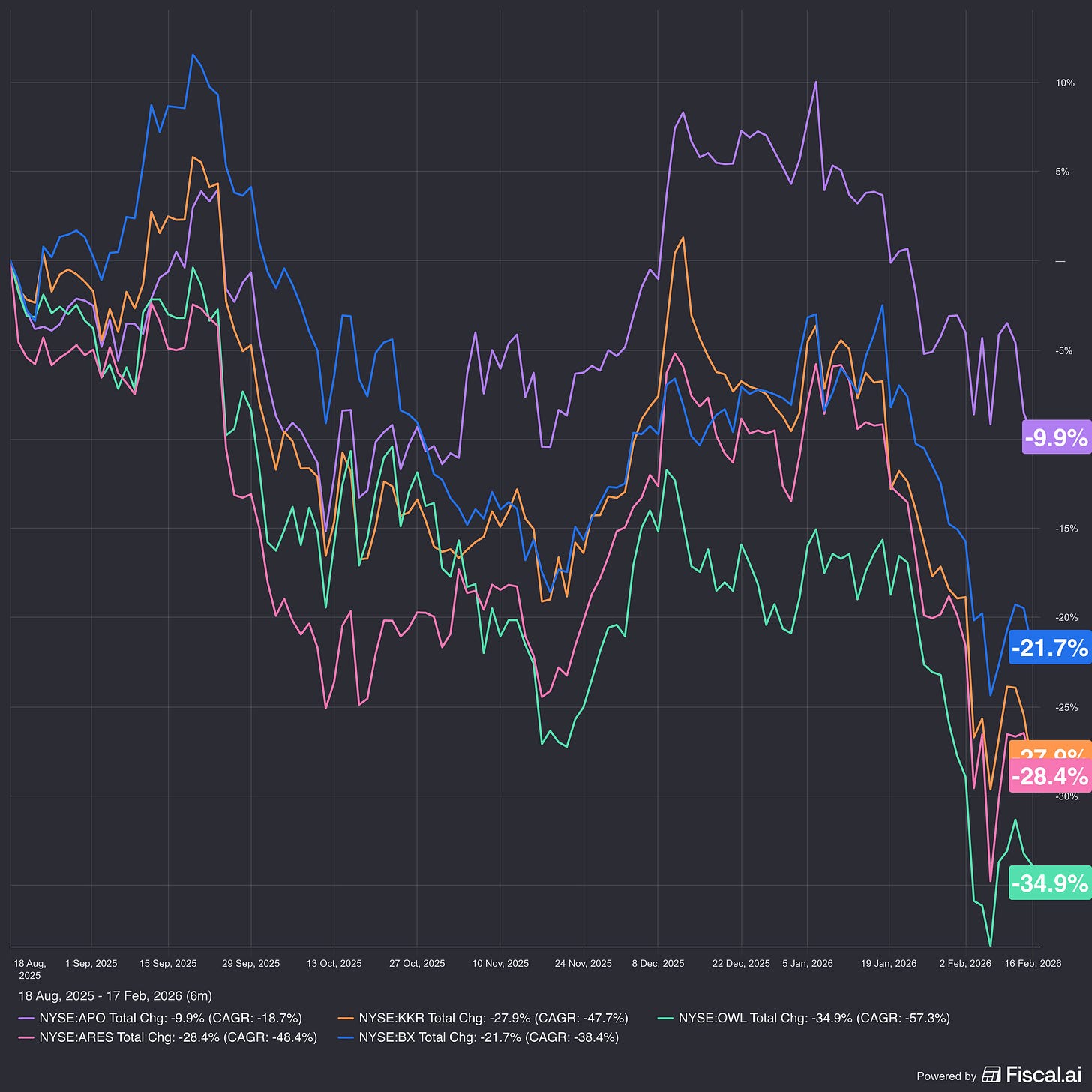

Interestingly, the listed alternative managers have sold off too

That parallel move has sparked a wave of headlines linking the two.

With AI disruption the popular hook…

Here’s how the managers are addressing the narrative

The four characteristics Ares looks for in software companies

We don’t feel any differently this quarter than we did last quarter, despite all the noise in the market. The first thing to remind people is we started investing in the software space about fifteen years ago. From the beginning, the number one risk that we identified in the software space was technology risk, and obsolescence risk.

AI is probably the most disruptive technology risk that we could have imagined. And it absolutely is going to disrupt a lot of software companies, and I don’t want to sugarcoat it. But we still believe strongly that we’ve constructed a portfolio that will remain highly resistant to this risk.

I’ll just outline a few characteristics that we’ve always looked for in our software companies

The first thing is that we primarily look to invest in foundational infrastructure software for complex businesses. This is software that sits at the center of the technology stack and powers all core business systems. It’s the last type of software that a company would look to switch out because all of your downstream systems that feed off the software might also be at risk.

We’re also looking for software companies that collect and own proprietary data. And they collect this data and build this data over many years serving their customers. They use the data as a core part of their value proposition when they deliver the software. We call this a data moat. And it’s important to mention that AI is not a database. AI doesn’t house data.

We also are looking for software companies that serve regulated end markets like healthcare and financial services. There’s lots of these regulated end markets. Where the need for accuracy and auditing of information is really high. And the penalties for lack of compliance can be severe.

So John, you think about it. Jeffrey’s is not going to rip out its core infrastructure software and replace it with an AI-based solution anytime soon, in our opinion.

We’re looking for software companies that have very diverse customer bases. So even if some customers do switch to maybe an AI-generated software solution, others will remain and they create sort of this long tail of cash flow. That will survive and we really do not see quick and binary outcomes that occur when you have this kind of diversified customer base.

What needs to happen for you to take losses in your software portfolio?

Blue Owl: “What needs to happen for you to take losses in your software portfolio?

Over the last three years, the software index is up 23%. We’re all reading about and know what happened in the last year. It’s down 20% now in the last year.

But it’s up 23% over the last three years.

So if you think about that as some indicator of the vintage, a lot of big software deals PE firms did, Software equities are up.

We are a first lien lender in almost every instance we talk about software. We are, on average, around 30% loan to value.

So what’s happened objectively in the marketplace is since the vintage of those transactions, equity values on average are up 23%, but pick whatever number you want. We started at 30.

So now let’s answer your question. In order for us to have material losses you have to destroy 70% of the value of every one of these software companies.

We have 400 companies. And, of course, there are losses. Every quarter, we’re gonna have companies that go and get in trouble and companies that get out of trouble. And even trouble doesn’t mean we’ve lost anything. Means they might be struggling. We may have to own them. That’s already built into the calculation. And that’s what with all that said, we’ve been running eight basis points net.

There is an enormous amount of equity cushion below these loans

ARCC: “We are lenders to these companies with maturity dates. We’re sitting at the top of the capital structure. We have all the assets as collateral, including intellectual property. There’s lots of ways that we can look to recover our principal if things do start to get disrupted. And this is just a very different place to be sitting in the capital structure than sitting down in the equity.

If you look at some of the metrics on our software book, they’re extremely healthy. The book itself is also highly diversified. None of which is outsized in any way. These software companies are very large and established business The average EBITDA on our software book is $350 million. That’s above the average in our portfolio. The software book, the LTM EBITDA growth in the software book is growing at a faster rate than the overall average EBITDA on our book. Even through the recent quarter.

The loan to values and this is maybe one of the most important points. The loan to values on our software book our software loan book is 37% on average. That’s below the loan to values on our overall book there is an enormous amount of equity cushion below these loans.

It’s really hard for me to see a scenario where we would find any kind of real dramatic risk or change in our view toward those core enterprise software businesses.

Whether there is or isn’t an AI bubble is secondary to the question.

Blue Owl: “Google is raising its CapEx guidance to $175 billion, up from $93 billion. This is an enormous opportunity. We are in the premier position to be the premier provider of capital solutions to the hyperscalers.

Whether there is or isn’t an AI bubble in valuations is secondary to the question of whether people with some of the largest market caps, best credit ratings in the world are willing to commit to fifteen and twenty-year leases, which they are with us,

This is allowing us to deliver outstanding results for our investors in digital infrastructure, and in triple net lease. Remember our ORAD product as an example delivered an 11% return this past year.

All the headlines and noise aside, facts matter. And we’re delivering those results. We see that continued super cycle as an enormous opportunity. We know how to structure those leases so that they’re ironclad. We have a unique skill to actually build, develop, operate as people want it. We’ve done it with every one of the big hyperscalers in terms of being their partner.”

This monolithic view people are taking is gonna prove quite misguided

Blue Owl: “Software is an enabler. And the best companies are embedded in that position and have data moats and operating environments like health care, financial services with zero tolerance for risk environments.

They’re the adopters of AI. They’re the ones that are then turning around and saying, here, I can offer you an agentic solution to replace some of your human costs. I already have resident in your system and fully integrated into your daily behavior.

We understand the generic parts of software are vulnerable. We’ve studied our portfolios very carefully. We do not see any meaningful exposure to those more susceptible areas.

If you have the right software solutions, you’re gonna benefit from the adoption of AI.

This monolithic view and action people are taking is gonna prove quite misguided, and it’s gonna lead to a miss in significant opportunities. The book is strong. We don’t see meaningful losses. We don’t see deterioration in performance. And last point, the typical duration of a loan remaining in our books, let’s say, a software loan, is a few years. So when you have a business that is still growing double digits, and only a few years left and a 70% equity cushion, all we’re talking about is do we get our money back?

Our software portfolio companies generate significant cash flow and are growing faster than the overall credit portfolio

Ares: “Our software portfolio is highly diversified across many subsectors, with a very small percentage of the portfolio that we deem to have high risk of AI disruption. We lend at lower loans to value on software, which are in the high 30% range, compared to mid-40s LTV on the rest of the portfolio.

Our software portfolio companies generate significant cash flow, with EBITDA margins over 40%, average EBITDA over $350 million, and a growth rate that is faster than the overall credit portfolio over the past year.

Consensus

Deployment

KKR

We’ve also continued to lean into the opportunity within credit, deploying $44 billion in total over 2025. That’s up 14% compared to 2024.

Carlyle

Direct lending had a record quarter of originations. Our performance continues to be strong, with realized losses across the portfolio running at an average of just 10 basis points per year over the past decade.

Ares

After a slower first half, our U.S. and European direct lending deployment also increased sharply year-over-year, with investments into more than 240 different portfolio companies. Together, these two strategies represented just over half of our deployment for the year.

Apollo

If you look at the $305 billion last year, $245 billion was North America, $40 billion Europe, $15 million-$20 billion in Asia.

We’re taking this strategy global. When you think about why we were just in Japan, when you think about the Industrial Renaissance and that part of the globe, Asia Pac, along with how we’re focused on Europe, the answer to your question, big picture, is we’re going to take a very successful strategy of integrating origination to every aspect of our business.

We certainly have shown an ability to originate scale, but it’s really growth with intention. So I want to make sure that we’re not overemphasizing the growth in this point. We have a ton of robust yield, robust spread, and that’s what we’re trying to do.

Brookfield

Our objective is to deploy more than $100 billion of capital across the full AI infrastructure value chain, from land and power to data centers and compute capacity,

Fundraising

Ares

Our record, $113 billion in total fundraising for the year, was capped off by a record $36 billion in the fourth quarter. It's noteworthy that we surpassed our previous record by such a wide margin without our two largest private credit campaign funds in the market.

KKR

We come off a year where we had record capital raising, almost $130 billion, and we’re on our way to meaningfully exceed our $300 billion-plus fundraising target that we set out from 2024 to 2026. We feel really good about the trajectory on management fees.

Apollo

Of the $100 billion of organic inflows into asset management during the year, approximately 75% went to credit-oriented strategies and 25% to equity-oriented strategies.

Secondaries

Ares

Our secondaries group was a standout performer, with $12.9 billion raised and an increase in AUM of 45%. We ended the year with our secondaries business having nearly doubled in size since we acquired Landmark in mid-2021.

KKR

We have evaluated most of the secondary asset managers that have traded over the last decade. For a variety of reasons, we did not pursue any of those opportunities. However, we knew that when we found that right partner, the partner who could give us conviction that we could build a leading secondaries and solutions franchise, that we would be all in. We are confident that we have found that in Arctos.

Brookfield

In terms of secondaries, it is a space we track very closely. It’s growing rapidly. It’s a segment of the market where our expertise would be very clearly differentiating, and it would add an additional service that we could offer to our clients.

If we were going to do something, secondaries is probably near the top of the list, and we would focus on a platform that we thought would grow significantly as part of the broader Brookfield ecosystem.

Blackstone

Our secondaries platform saw a record year of deployment in 2025, and we see strong growth ahead fueled by the ongoing expansion of private markets.

Carlyle

AlpInvest has returned over $10 billion to our investors and invested a record $14 billion, highlighting both the breadth of the market opportunity and the scale at which the platform is operating.

We closed our largest ever secondary strategy at $20 billion, continuing to grow our co-investment platform and expanding our portfolio finance strategie

Blackstone’s True North

Blackstone

The reason we have grown so much over forty years is because we have not lost sight of True North, which is delivering returns for our customers.

I know everyone’s always like, oh, larger is worse.

I think in this environment, having more scale and more data is a meaningful moat.

We raised $71 billion of inflows in a quarter, $239 billion in a year. In what has still been a pretty tough environment, real estate lagging, the M&A and IPO markets not quite open yet.

The ability to write these very large checks allows us, in our minds and in the numbers, to outperform.

Partnerships

Apollo

What we see is a number of the leading investors in the world moving to this notion of total portfolio approach. Total portfolio approach essentially opens up the debt and equity buckets of these institutions to private assets in competition for what has historically been 100% market share for public assets.

You saw the announcement with Schroders this morning which I expect to grow into a multibillion-dollar partnership. And PRIV, our ETF with State Street, now approaches $700 million in size and, more importantly, it's among the top performers of investment-grade ETFs everywhere.

Again, proving that private can be both liquid and illiquid, in this case, private investment-grade being fully liquid.

Apollo

We need to adapt our business to the ways traditional asset managers work.

Moving your business to daily NAV is a big deal for our industry. We are in the process of moving, particularly our high-grade credit business to daily NAV.

That is an unlock. Providing liquidity in markets, which many in our industry have spoken against, is an unlock for traditional asset managers.

I think traditional asset managers could be the single largest opportunity. I expect them to be among the largest buyers. Some of that will be in the existing mutual fund complexes and ETF complexes. Some of that will be through new products. And some of that will be through 401(k).

BlackRock

We think that private credit and building great public-private portfolios is a very important growth vector within private markets

We have over 20 conversations right now where we’re working on high-grade SMAs with leading insurers and building private high-grade portfolios.

We’d hope to start seeing deployments pull through the second half of 2026, and we’re really focused on three things with them.

The first is delivering better outcomes for our insurance clients by working with them to migrate something on order of 10% of their existing public fixed income assets into private high-grade. So think of a $700 billion base migrating to $70 billion on order of that in private high-grade.

The second is expanding high-grade mandates, meaning new assets and winning new assets with clients away from our existing book.

And the third is also pursuing strategic partnerships, minority investments to increase the pool of insurance assets managed here at BlackRock. It is a highly interactive day-to-day thing. So being able effectively to blend turnkey full-service capabilities for insurance companies, that’s a key competitive advantage for BlackRock.

Integrating public fixed income, private credit, Aladdin, accounting, middle office services makes working with BlackRock a performance enhancer, a scale enabler. So there’s no doubt that this space has become more competitive, especially in private high-grade. But I think our experience is that insurance companies want a full-service partner and that we’re well-positioned to play that role given our track record in public fixed income technology and world-class capabilities in private credit.

Blackstone

On the insurance side, the fact that investment-grade credit is at 71 basis points, which is the tightest level since 1998.

The fact that we can bring our insurance clients an extra 180 basis points, which is what we did in 2025, obviously motivates them in this area.

The key remains, can we deliver a durable premium to what you can get in liquid credit?

401(k)s

Apollo

On the 401(k) specifically, the big volumes in 401(k), in my opinion, are not going to come until there is rulemaking or at least guidance that will give more clarity to the executive order that has come down.

Having said that, if I had to give you my email inbox, the amount of activity taking place in defined contribution in all its quadrants is just off the charts.

Every conference, every industry get-together is literally just overwhelmed with a discussion of private assets, and for very good reasons. The addition of private assets to a portfolio, given the length of time these employees will be in these plans, are 50%-100% better outcomes.

The other interesting piece of this is the opening of 401(k) to guaranteed income, particularly guaranteed lifetime income. We moved as a world for something that was really good for employees. We moved from defined benefit. Employees loved it. Guaranteed lifetime income. Companies hated it.

We then moved to a world of defined contribution where all of the risk was essentially on the employee and not on the company. Been great for companies but not so good for employees.

Most employees have not made a proactive investment decision within their 401(k) ever. They are guided by the alternatives provided by the trustees of that plan. I believe the world we’re heading to is more of a hybrid world. where we will end up with something that looks more closely to defined benefit but will not be provided by the employers. It will be provided by the marketplace. Right now, we’re in the baby steps phase where every day we’re making progress. It will be north of $1 billion this year.

Portfolio

Ares

LTVs are near historical lows in the 40% range. Interest coverage continues to strengthen, and quarter-to-quarter non-accruing loan trends are generally flat, while remaining well below historical average levels.

As an example, in our U.S. direct lending strategy, portfolio company EBITDA growth was in the low double digits for the last 12 months, and net realized loss rates were essentially zero on a net basis, which is in line with our 20-year average of 1 basis point in annual losses.

Apollo

When you look at our software PIK exposure, negligible.

When you look at our software ARR exposure, negligible.

When you look at our pre-2021/2022 software exposure, negligible.

Blackstone

There will be losses in non-investment grade credit. The key, of course, is your portfolio healthy?

Last year, we actually saw high single-digit growth in the EBITDA of our borrowers. The loan-to-values are sub 45%, and rates are coming down. So the credit metrics are healthy. The key remains, can we deliver a durable premium to what you can get in liquid credit? And that we feel very confident in terms of, you know, sort of outlook.

Blue Owl

Weighted average LTVs remain in the high thirties across direct lending, and in the low thirties, specifically in our tech lending portfolios. On average, underlying revenue and EBITDA growth across our portfolios was in the high single digits.

IG Private Credit

Blackstone

We now manage $130 billion of IG private credit, up 30% year over year.

Why is investment-grade private credit growing so quickly? Two main reasons:

First, corporate investment-grade bond spreads are at their tightest level since 1998. We have been seeing insurers and now some pensions and sovereign wealth funds looking to earn materially higher spreads at the same or lower risk level.

Second, the build-out of AI infrastructure requires a massive amount of private debt capital for the construction of fabs, energy supply, and data centers.

Real Estate

Blackstone

We see a number of positive signs which point to a better year ahead.

These include the sharp decline in construction starts, which have fallen to the lowest level in more than twelve years in the US, in both logistics and multifamily, our two largest sectors in real estate.

Continued growth in debt availability and declines in the cost of debt, a pickup in transaction activity, and now an improvement in logistics demand with our US platform reporting record leasing activity in Q4.

Brookfield

Across the highest quality office in global gateway cities, there is very low to no new supply coming on market. New supply is not expected for you know in large scale anytime soon, and yet tenant demand continues to grow.

The number of tenants we’re actively engaged with, who have very large requirements for high-quality space. We you know we signed two of the largest leases in downtown last year.

You look in London, one of the tightest markets globally now, setting record rents with each lease we sign in the city. Tenant demand in Canary Wharf, the strongest we’ve seen. So those are the underlying drivers for the growth in the NOI in office. Now, as we move those tenants in and we vacate space, it takes time to come through the numbers, but the underlying momentum and the valuation appreciation is coming through the numbers.

Defaults

Blackstone

We think some of the headlines highlight isolated stress points rather than painting the full picture. We generally see stable credit conditions across the portfolios that we’re managing,

Context is critical. Like defaults and losses in the non-IG direct lending to corporates have been abnormally low for years, following low rates. Default rates in the broader leveraged loan market are averaging slightly below the long-term average at 3%. And in economic slowdowns, like default rates rose to 4-5%, the all-time peak in the GFC hit 15% on an issuer-weighted basis, and so direct lending defaults are rising, but they remain in historical ranges, so I think we see this period, as do many of the other firms, as a period of expected catch-up following a long period of very low defaults.

When we look through the universe of BDC loans, the $400 billion across 20,000 loans sitting in the valuation databases, we see non-accruals that are inside the historical average. We see PIK as a percentage of total interest income in line with historical norms, recovery rates that are in line with historical norms.

Spreads

Oaktree

While large cap activity accelerated in the December quarter, middle market volumes were still below historical averages. Since the Fed rate cut in September, we have seen greater price discipline in the market and believe that spreads in private credit have now bottomed out at SOFR +450-475 basis points.

Oaktree

Direct lending transactions continue to offer an approximate 150 basis point spread premium relative to broadly syndicated loans with similar credit quality.

PIK interest remains prevalent in direct lending transactions, underscoring sponsors’ preference for flexible capital structures.

We continue to stay extremely disciplined in our use of PIK. In the first quarter, PIK, as a percentage of adjusted total investment income, was 6.3%, which is below the public BDC industry average.

Thanks again for reading. Let me know if you find these posts useful or how I can improve it for next quarter.

Share this with your Investor Relations Colleagues.

This newsletter is for education or entertainment purposes only. It should not be taken as investment advice.

These Quarterly summary calls are great!