Brookfield: Why Private Real Estate Lending Is Compelling Now

Fundraisings from Penfund, SKY Leasing, Pimco and TwentyFour Asset Management

👋 Hey, Nick here. A special welcome to the new subscribers from Setpoint, Macquarie, and A&O Shearman. It’s great to have you. Reach out and say hi. This is the 111th edition of my weekly newsletter. You can read my previous articles here and subscribe here

📕 Reads of the Week

You can’t spell defence without “fence” and ESG is sitting on it. Lenders seek ESG flexibility to back Europe’s defence expansion. Link

Apollo and Blackstone are leading a $4 billion facility to support Thoma Bravo’s acquisition of Boeing’s digital aviation unit, Jeppesen. The seven-year unitranche loan consolidates first and second-lien debt into a single structure and is expected to price at 475 basis points over. Link

Blackstone President Jon Gray unpacks why today’s market volatility is unlike past cycles and shares his perspective across key asset classes. Link

TPG and Temasek invest in Cliffwater Link

Cliffwater: No Fee Compression in Private Debt. Link

🎧 Secondaries Investor: What's driving the growth of private credit secondaries? As the secondaries markets grow, LPs may increasingly prefer secondary access. Link

Capital Group, KKR secure SEC approval for two interval funds. Link and Link

🏦 Partnerships of the Week

UBS is in talks with General Atlantic about launching a private credit partnership. Under the partnership, GA Credit will get a first look at loans originated by UBS’s investment bank. It will focus on borrowers in North America and Europe with more than $50 million of EBITDA and loan sizes up to $500 million. More here

Fortress and Mubadala announced a $1 billion partnership focused on credit and special situations co-investment opportunities. The Partnership seeks to deploy $1 billion from Mubadala in a range of Fortress’s existing private credit, asset-based lending, and real estate strategies. Mubadala is already a significant shareholder in Fortress, owning 68% of the business alongside management. More here

Invesco, Barings, and MassMutual announced a new product and distribution partnership agreement for U.S. Wealth channels. MassMutual will initially support this initiative with $650 million. The immediate focus of this partnership will be on private credit solutions for Mass Mutual’s clients, building on Invesco’s and Baring’s private credit capabilities. More here

Nick’s Notes: If there was any doubt about how Barings planned to rebuild after last year’s exodus, it's becoming clear that partnerships are the playbook. This marks their second partnership announcement in just a week. (Last week here)

🌳 Zen Gardens, Private Credit, and Tough-Minded Optimism

I spent the last three days building a Japanese Zen garden. As you would expect, I’m now fully equipped to dispense vague but confident advice.

While raking gravel and overthinking life, I found myself erratically pondering a quote from one of my favorite essays, Personal Renewal by John Gardner:

Optimism is unfashionable today, particularly among intellectuals. Everyone makes fun of it. Someone said “Pessimists got that way by financing optimists.” But I am not pessimistic and I advise you not to be. As the fellow said, “I’d be a pessimist but it would never work.”

I can tell you that for renewal, a tough-minded optimism is best. The future is not shaped by people who don’t really believe in the future. Men and women of vitality have always been prepared to bet their futures, even their lives, on ventures of unknown outcome. If they had all looked before they leaped, we would still be crouched in caves sketching animal pictures on the wall,

There’s no shortage of negative press on private credit.

And yes, downside protection is the cornerstone of our market.

But I’m increasingly frustrated by the giant disconnect between media criticism of private credit and the reality on the ground.

This “gap” is something I want to spend more time understanding, and you should expect a healthy dose of “tough-minded optimism” content going forward. If you have anything worth sharing, then get in touch.

And if you’re doubting my credibility, fair enough. Here’s Jon Gray saying it better. Link

🏘️ Why Private Real Estate Lending Is Compelling Now

In light of the above, Brookfield published a case for why now is the time to invest in real estate. You can read the full report here. Link

While corporate credit shrugged off rate hikes, real estate values took the full punch.

Property values have fallen in tandem with interest rate rises. Multifamily sector property values declined by 20% since late 2022. This creates opportunities to lend against commercial real estate priced below its intrinsic value, providing investors with more income on a derisked basis. It also creates a sizable funding gap as lower real estate values and higher interest rates have reduced debt capacity.

Lower Valuations Offer New Lenders a Cushion Against Losses

Lenders advancing against current property values have a lower dollar basis or exposure against the underlying collateral property.

Today’s Attractive Entry Point also Comes with a Robust Deal Pipeline

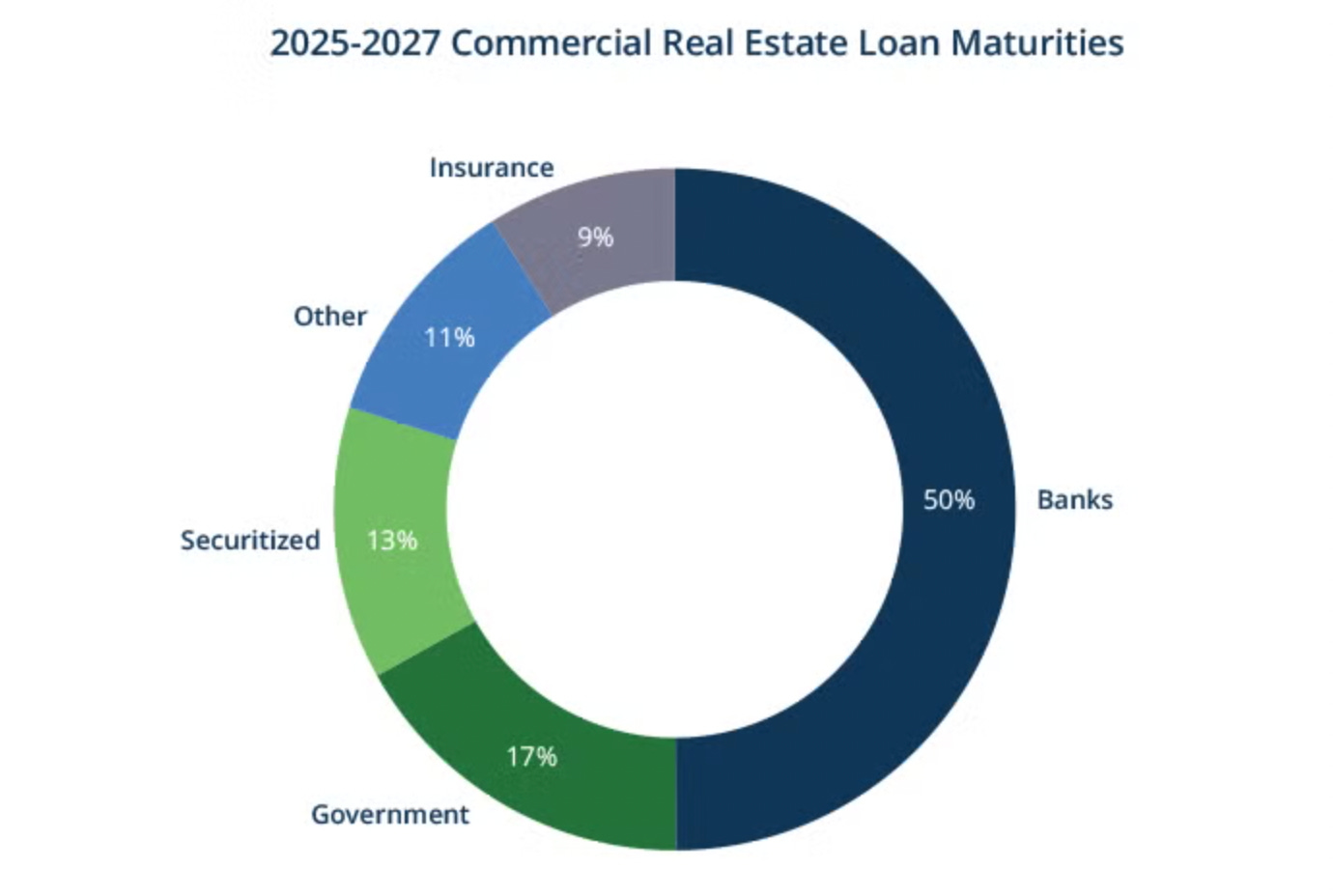

The combination of elevated interest rates and significantly reduced liquidity in the debt capital markets caused many borrowers to struggle to meet their debt service payments over the past two years, resulting in widespread extensions of loan maturities.

The trajectory of CRE maturities has only continued to climb, with peak levels projected for 2027

Brookfield believes $3 trillion in CRE loans are maturing in the next three years. Nearly half of these loans were originated by banks that have since retreated in a meaningful way.

Office is out and multifamily and industrial remain clear favourites for capital.

In the U.S., a severe housing shortage coupled with a sharp increase in mortgage rates is creating a growing class of permanent renters.

Demand also remains strong in logistics. Businesses are holding ~30% higher levels of inventory than they were before the pandemic and the supply picture is positive.

Loan originations in the multifamily and logistics sectors now account for over 70% of all CRE loan originations. Office sector originations represent less than 6%.

Real Estate Debt Has Generated Relatively Consistent Returns

Real estate debt has demonstrated consistent returns across cycles. During recent real estate value corrections, lenders’ positions were largely insulated from loss (outside of the office sector). Ultimately, private real estate credit provides an opportunity to seek consistent risk-adjusted returns while benefiting from the security of an equity cushion at the top of the capital structure.

To find the best return opportunities with minimal downside risks, Brookfield believes managers should use an equity lens to assess the underlying value.

These investors stand to benefit from elevated interest rates, high real estate spreads, and low property values, all of which position the real estate credit investor to receive consistent, strong income yields for less risk than in prior cycles.

Read the full report here

💰Fundraising News

Penfund, a Toronto-based manager, closed its $1.8 billion Prime fund. Penfund specializes in providing junior capital to middle-market companies throughout North America. The Prime fund is their Senior fund, focusing on unitranche and senior term loans. More here

SKY Leasing, a Dublin-based aviation lessor, closed its $1.35 billion Fund VI. SKY primarily finances the sale-leaseback of new and current technology aircraft. To date, SFVI has committed over $600 million of capital to acquire a fleet of 62 aircraft. More here

Pimco is launching its European Diversified Private Credit Fund after securing informal approval from regulators in Luxembourg. The fund will focus on European asset-based credit and will be accessible to European high-net-worth individuals. More here

TwentyFour Asset Management, a London-based asset manager, launched a new asset-backed finance fund. The fund will invest primarily in a range of consumer and corporate asset portfolios across Europe through acquisition, partnerships, or structured exposures. TwentyFour manages £21.7 billion of assets under management. More here

This newsletter is for educational or entertainment purposes only. It should not be taken as investment advice.