Private Credit H1 24: Key Takeaways

Fundraising from Pemberton, Polestar, Impact Bridge and Marathon Asset Management

👋 Hey, Nick here. A special welcome to the new subscribers at Oxane Partners. As a reminder, Golub is the leading subscriber of The Credit Crunch 🥳 Share this with your colleagues to knock Golub off the top spot.

If you’re new, this is the 69th edition of my weekly newsletter. Each week I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here. Scroll to the bottom, if you’re here for the fundraising news.

📊H1 Fundraising Recap

With the first half of 2024 behind us, I thought it would be useful to provide some analysis of the current fundraising environment.

This analysis is based on data from the 106 fundraises. I’ve tried my hardest to capture every fundraise and wasted many evening hours scrolling through Google News.

This data is not a complete list and unfortunately, I’m not privileged enough to own a Preqin account. (If anyone at Preqin wants to give me a trial account then I’d be eternally grateful.)

Despite this, I believe the data is directionally accurate and provides some useful insights.

Fundraising by Geography

US private credit funds continue to raise the most capital, with 40 funds raising $127 billion in 2024.

Total fundraising in the US was four times that of any other country. The next closest country was the UK, where 14 funds raised $28 billion.

On top of having the most funds, the US funds have typically been the largest. On average, US private credit funds were 50% larger than any other country.

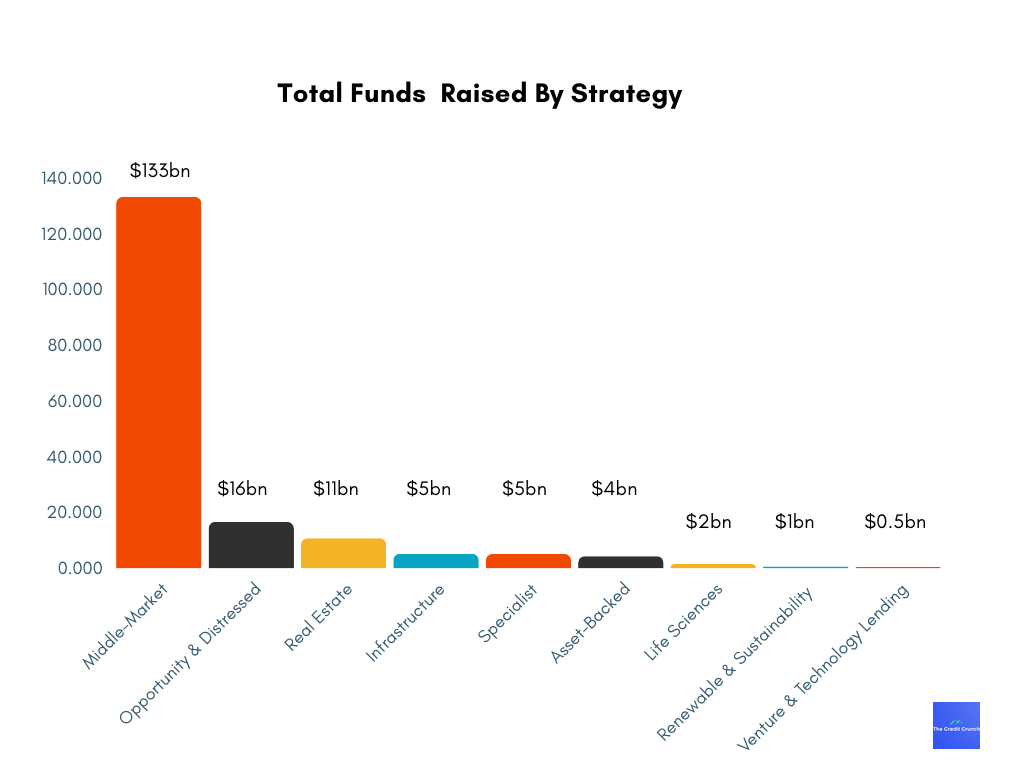

Fundraising by Strategy

Similar to previous years, Middle-market funds were the largest winners, with 63 funds raising $133 billion.

Middle-market fund sizes ranged from $90 million to a colossal $22 billion (Great work Ares). Ares’ fund significantly skewed the average fund size up to $1.7 billion. A median fund size of $1 billion is more representative.

Distressed and “Opportunity” funds continue to be notable recipients of capital in 2024. Blackstone’s Capital Opportunities V was the clear outlier in this category raising $10 billion.

What fund sizes raised the most money?

The majority of capital went to funds with over $1 billion of AUM, with 41 funds raising $162 billion. This concentration has increased over 2 percentage points compared to 2023. These funds had an average fund size of $4 billion.

The remaining funds accounted for less than 10% of the total capital raised. These funds had an average fund size of $423 million (9x less than with over $1 billion of AUM).

Can new funds and strategies raise money in this environment?

Most of the private credit capital went to Existing Fund Managers. More specifically managers who have more than $50 billion of AUM.

I should caveat that “New” includes new strategies launched by existing asset managers

If you exclude existing asset managers, less than 1% of all capital went to new credit managers.

💰Fundraising news

Pemberton, a London-based credit manager, announced a first close of $1 billion for its NAV Strategic Financing strategy. The fund is anchored by the Abu Dhabi Investment Authority (ADIA). The strategy will provide GPs with capital for increased fund commitments, succession planning, and accretive portfolio investments such as bolt-on acquisitions. More here

Polestar Capital, a Dutch-based impact investor, announced further funding to its $260 million Circular Debt Fund. Polestar lends to sustainable technology companies building first-of-a-kind commercial production facilities. This phase is usually too innovative for banks and too capital-intensive for venture capital. The fund will finance 20 to 30 companies. Example projects include waste reduction, recycling, and replacing fossil fuels. More here

Impact Bridge Asset Management, a Spanish impact investor, launched its ~$50 million Impact Direct Debt fund. The fund finances social and environmental impact companies in developing countries. The fund focuses primarily on sub-Saharan Africa and Latin America and on opportunities that address five impact themes, access to basic services, climate change mitigation and adaptation, women’s empowerment, decent job creation, and financial inclusion. More here

Marathon Asset Management, a New York-based credit investment manager, launched a private credit joint venture with Webster Financial Corporation, the holding company for Webster Bank. The JV will finance sponsor-backed middle market companies. More here

This newsletter is for education or entertainment purposes only. It should not be taken as investment advice.