The Credit Crunch 05/11/23

Your weekly summary of Private Credit fundraising and news

💰Fundraising news

Ares, a Los Angeles-based alternative investment manager, announced the final closing of its $6.6 billion Pathfinder Fund II. The Fund was oversubscribed and approximately 80 percent larger than the predecessor fund which had total commitments of $3.7 billion. The fund will invest in collateralized pools of assets in overlooked or “misunderstood” sectors, such as shipping containers, supermarkets, and rental units. More here and here

Charlesbank, a US-based investment manager, is targeting $1.25 billion for its Credit Opportunities Fund III. The fund lends to mid-market North American businesses. It typically invests between $50-250 million in companies with enterprise values between $150 million-$3 billion. Charlesbank Credit Opportunity Funds have a net internal rate of return to date of 19%. More here and here

Park Square Capital, a London-based private debt investor, held a first close of ~$940 million for its fifth fund. The fund provides junior debt to European mid-market private companies with an average EBITDA of €175 million. It can also look at secondaries. The fund has a target of ~$1.9 billion and expects to make between 30 to 40 investments. More here

📊 Charts of the Week

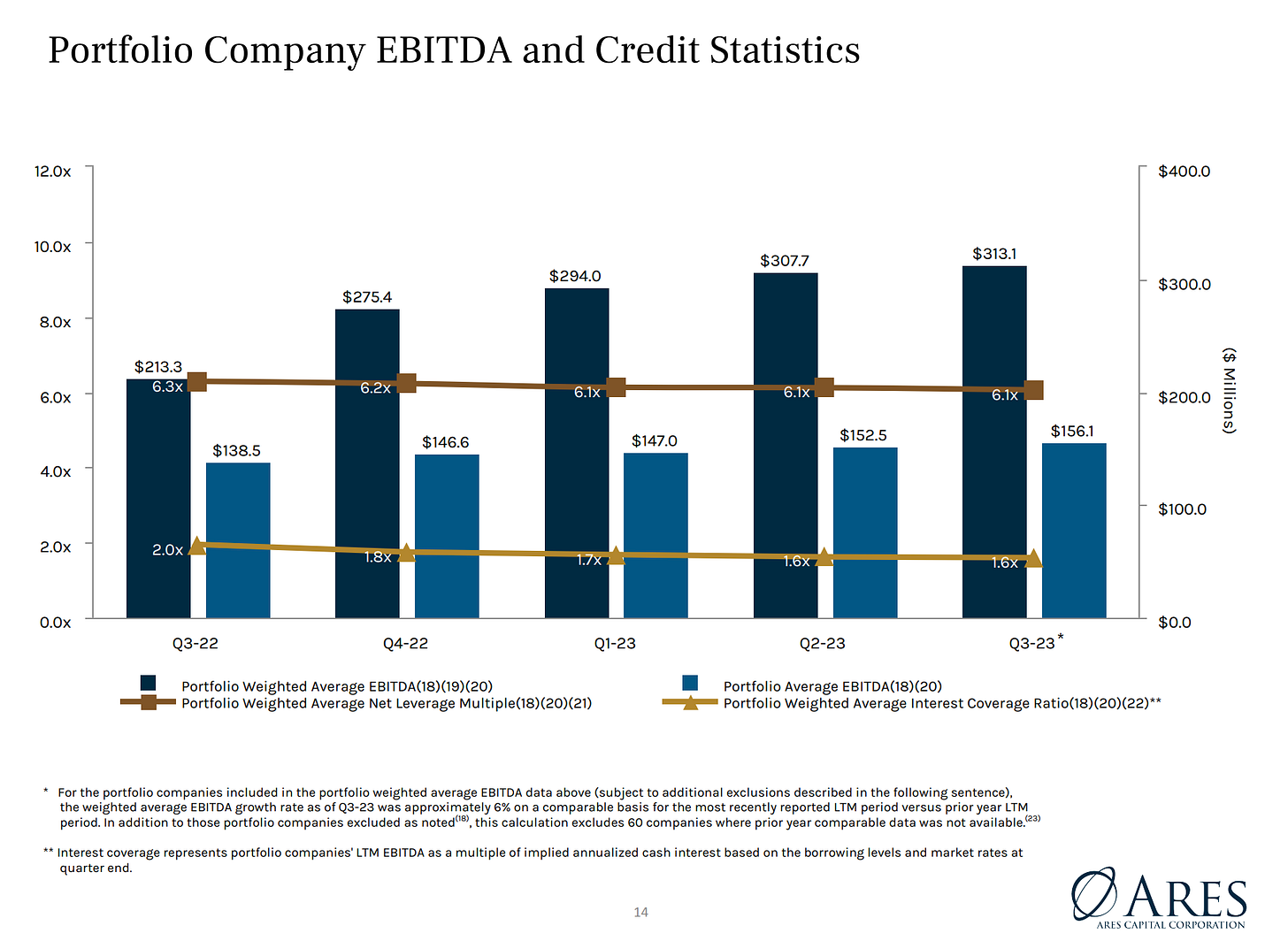

Ares - Interest coverage coming under pressure

After a year and a half of rate hikes, the interest coverage ratios continue to trend down. Ares highlights that its portfolio companies’ interest coverage ratios have fallen 25% over the last year. This is despite the portfolio companies’ weighted average EBITDA increasing by ~$100 million YoY. Link

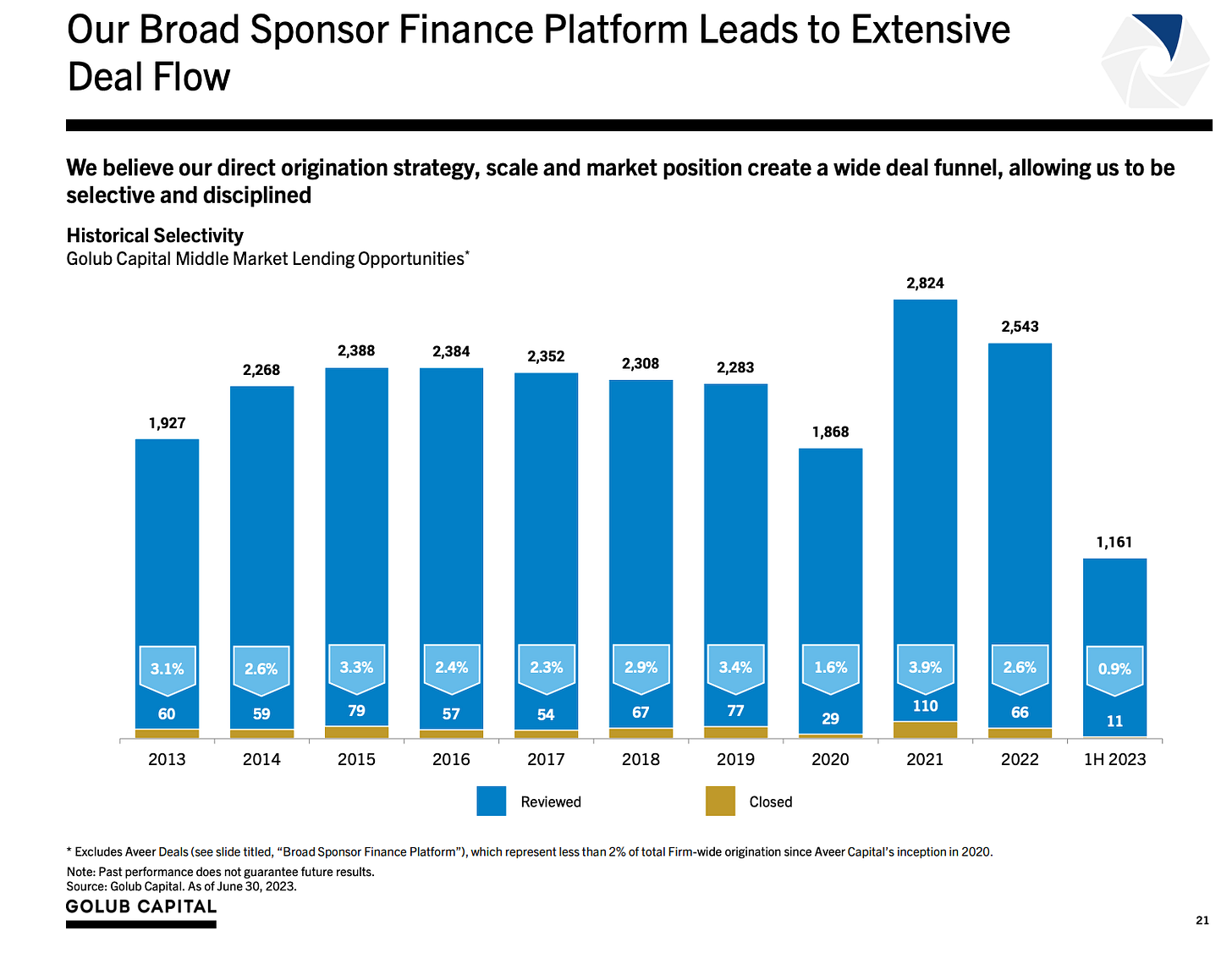

Golub - Slowing down the deals….

Golub’s percentage of deals closed this year is at its lowest level in the last 10 years. It’s also nearly 50% less than during the pandemic.