The Credit Crunch #47

Four Insights into Private Credit Fund Sizes. Fundraising from Charlesbank, TCW, Phoenix Merchant Partners and Ambienta.

Welcome to the 47th Credit Crunch.

How big should a private credit fund be?

After analyzing 183 private credit funds, I still can’t be sure.

I can however tell you:

Successful fund managers should exceed $1 billion of AUM by their Fund IV

US Funds raise more than European Funds

Managers with over $50 billion of AUM have a distinct advantage

Enjoy.

🤓 Benchmarking Private Credit Fund Sizes

How big should your next private credit fund be?

In 2023, a typical manager raised a first fund of ~$400m

Successful funds typically grew between 30-80% per new generation.

After four funds a successful manager should expect a fund of more than $1 billion.

Note, that this excludes managers with more than $50 billion of AUM. More on them below.

Does it matter who raises the funds?

I write about two types of managers:

Credit-only managers. Examples include Calmwater Capital, Deerpath , Vistara Growth

Asset managers with multiple strategies e.g. Hayfin, Charlesbank, Sixth Street

Filtering the data by these categories, it’s easy to see a difference in fund size.

Credit-only managers typically raise smaller funds. This gap narrows the more funds they raise.

Two potential explanations:

Asset Managers have existing LPs from their other strategies. These LPs provide them an advantage when launching their new credit fund

Existing Asset Managers have higher operating costs. They require larger new funds to justify launching a credit strategy

Does Geography impact fund size?

North American funds accounted for over 60% of fundraising last year (Link)

Like their food (Link), North American funds were bigger than European funds. This was particularly noticeable when comparing first and second funds.

Two potential explanations for this difference

US managers have a larger pool of LP capital. This gives them a distinct advantage earlier on. European managers have to develop a compelling track record before raising US capital

North American private credit market is larger. North American funds need to be larger to lend in this market.

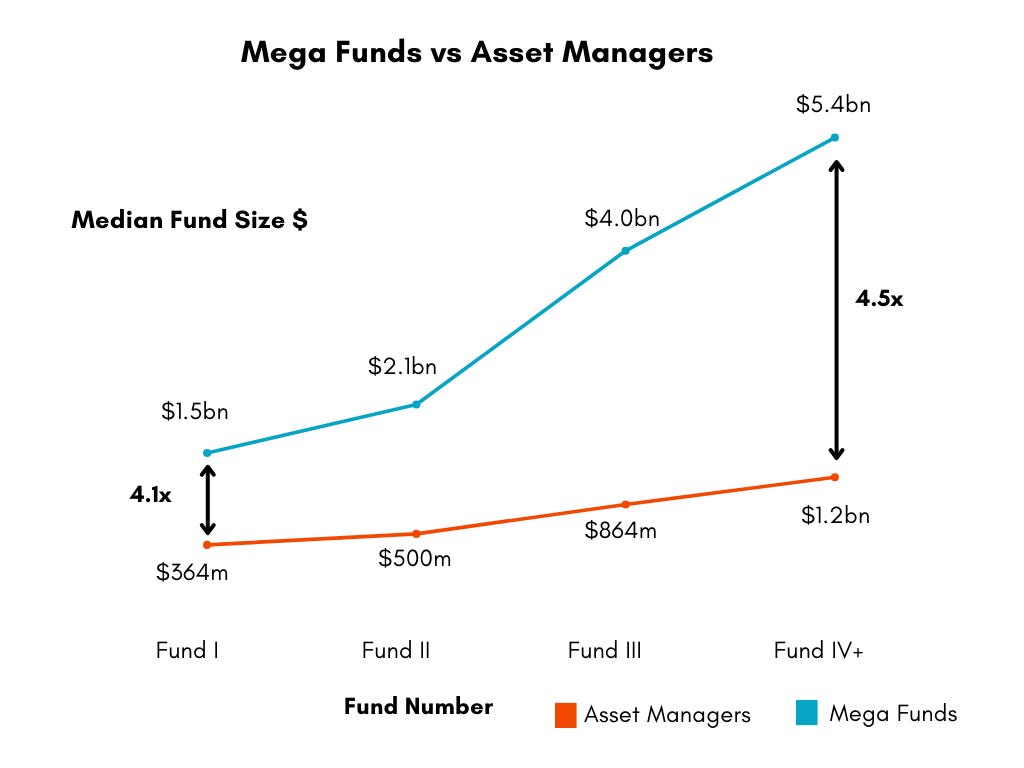

Do mega funds have an advantage?

Managers with over $50 billion of AUM have a distinct advantage. This holds true throughout every generation.

The gap consistently stays between 4-4.5x vs other managers.

Thanks for reading. If you’ve enjoyed this subscribe. If you’re here for the fundraising news then scroll down.

💰Fundraising news

Charlesbank, a US-based investment manager, closed its $1.5 billion Credit Opportunities Fund III. The fund lends to North American mid-market businesses. It typically invests between $50-250 million in companies with enterprise values between $150 million-$3 billion. Charlesbank’s core sectors include business and financial services, consumer, healthcare, industrial, and technology. The team has invested over $4 billion in capital, since the inception of the Credit Opportunities strategy. More here

TCW, a Los Angeles-based investment manager, launched its $1 billion Asset-Backed Finance (“ABF”) business. TCW focuses on four asset categories: consumer finance, real estate, hard assets, and financial assets. It offers investment-grade and mezzanine asset-backed finance. The IG team can invest up to $500 million per transaction with a typical investment ranging from $50 million to $250 million. The Mezzanine team can invest up to $250 million per transaction with a typical investment ranging from $25 million to $150 million. More here and here

Phoenix Merchant Partners, a New York-based investment manager, raised $900 million for its new private credit platform. The fund lends to unsponsored North American mid-market companies. It will focus on companies in the industrials, telecom, health care, and energy transition sectors, with EBITDA between $20 million and $100 million. More here

Ambienta, an Italy-based asset manager, announced a first close for its ~$540 million Sustainable Credit Opportunities Fund. The fund lends to European mid-market companies whose products or services use resources more efficiently or reduce pollution. Ambienta has a dedicated team of engineers who assess and improve the ESG profile of portfolio companies’ value chains. The fund is an Article 9 fund. More here.