The State of Private Credit in Q325

Credit Crunch's Q3 Recap

👋 Hey, Nick here. A big welcome to the new subscribers at Allianz, GIB Asset Management, and Prudential. This is the 135th edition of my weekly newsletter. Each week, I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here.

📊 2025 Fundraising Recap

With Q3 behind us, here are my top insights for the year so far. This recap isn’t exhaustive, but it’s enough to keep you ahead of 99% of your peers.

Key stats 📈

Number of fundraising announcements covered: 69 (Up 18% YoY)

Amount raised: $95 billion (Up 5% YoY)

Number of fund managers covered: 65 (Up 18% YoY)

Number of Countries where funds were based: 14 (Unchanged YoY)

Scroll down to the bottom if you’re here for my Funds of the Quarter.

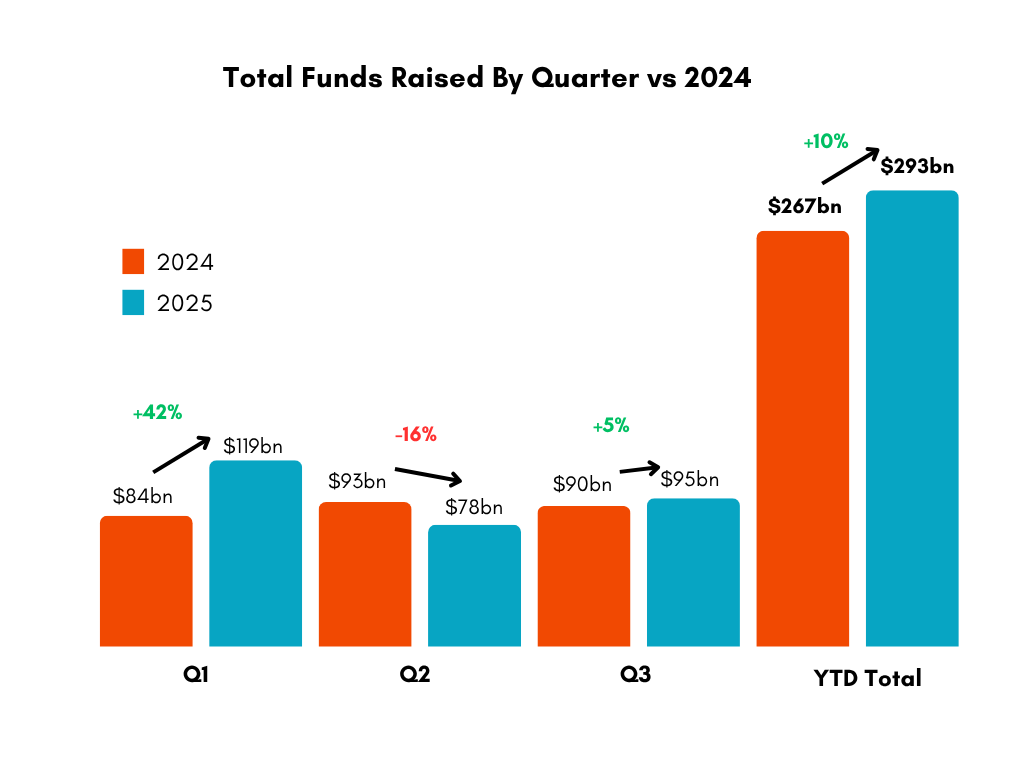

Private Credit Fundraising Returns to Growth

Q3 saw a return to growth, following a weaker Q2.

In total $95 billion was raised, up 5% compared to last year and over 20% higher than Q2.

Private credit fundraising is up 10% YTD, with nearly $300 billion raised this year already.

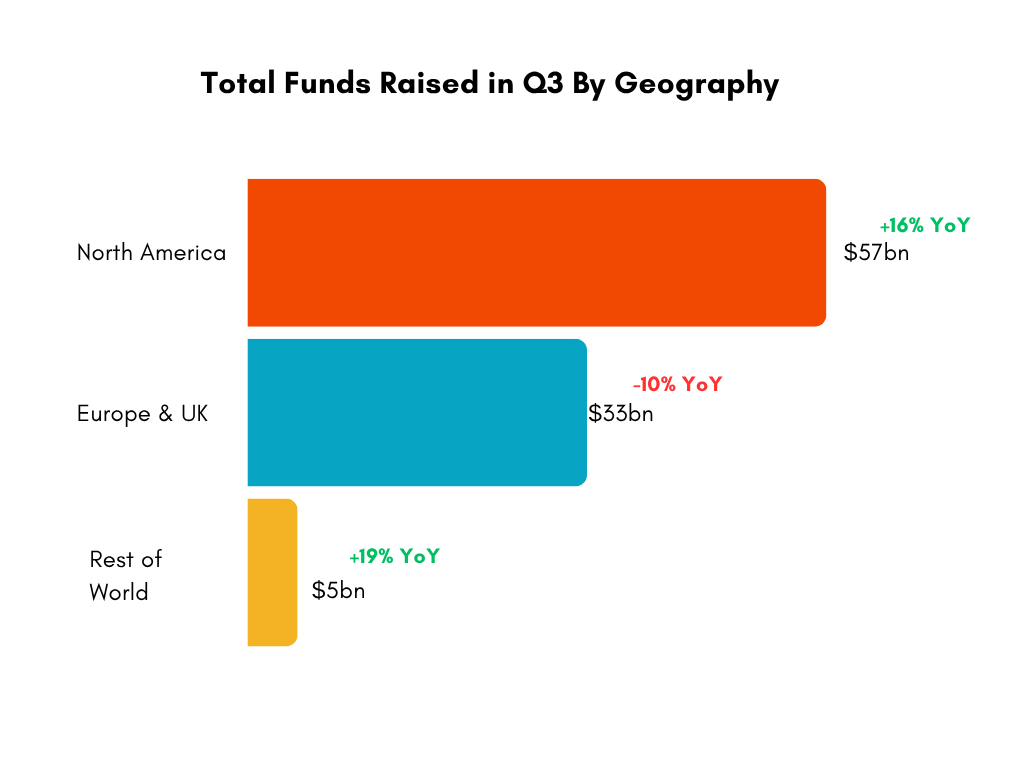

North America Fights Back 🌎

🇺🇸 While American funds grew this quarter, YTD fundraising is still significantly lower compared to last year. The decline was nearly entirely driven by the weak Direct Lending fundraising, which is still less than half of 2024’s number.

See Marblegate’s Whitepaper on the US Middle Market (Link).

European funds continue to benefit from tailwinds, with the median fund nearly 2x the size compared to 2023.

See Brookfield’s and Apollo’s comments on Europe.

📕Nick’s Top Articles of the Quarter

3 Reasons Ares’ Latest In the Gaps Is Required Reading for Your Credit Team

Inside Q2 2025: What the Biggest Alternative Managers Are Talking About

Why Apollo Thinks Europe is the Key to Private Credit’s Growth

Is Direct Lending Overcrowded?

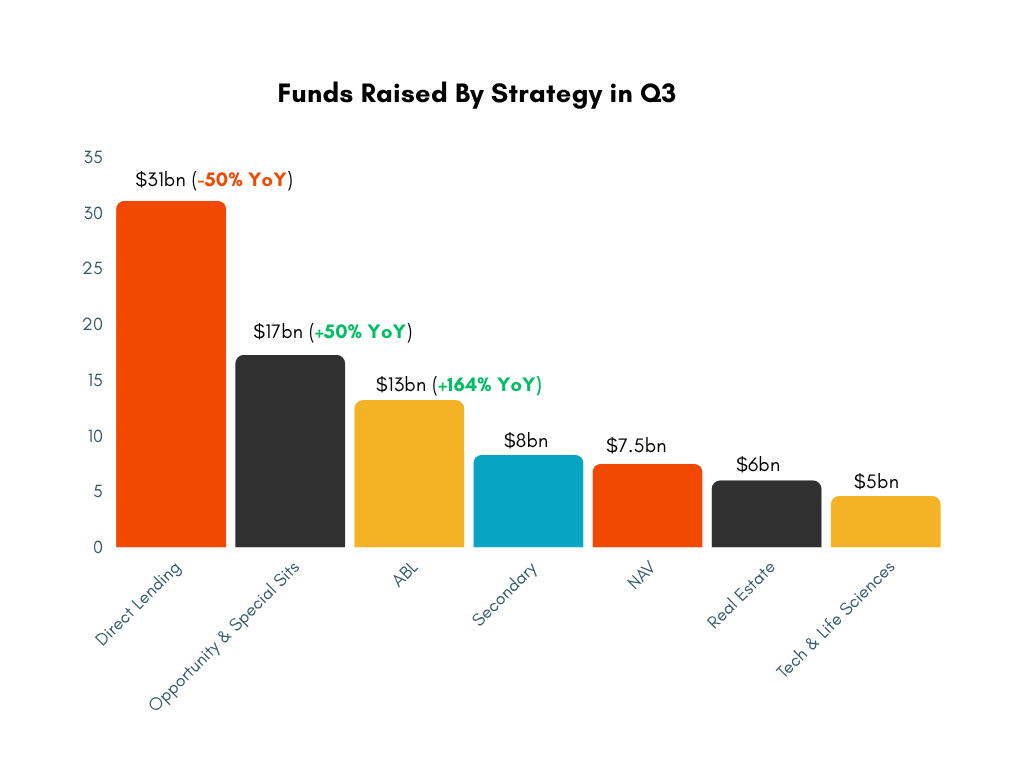

Opportunity fundraising outperformed in Q3.

Coller’s $7 billion fund was the clear outlier.

ABL has grown rapidly.

Ares suggested, at this point, everybody and their cat is raising an ABL fund.

The Five Largest Funds Raised a Third of the Capital…

Goldman Sachs’ $6 billion Evergreen European Private Credit Strategy.

H.I.G. WhiteHorse’s $5.9 billion Middle Market Lending Fund IV.

The $10B Club is Getting Smaller

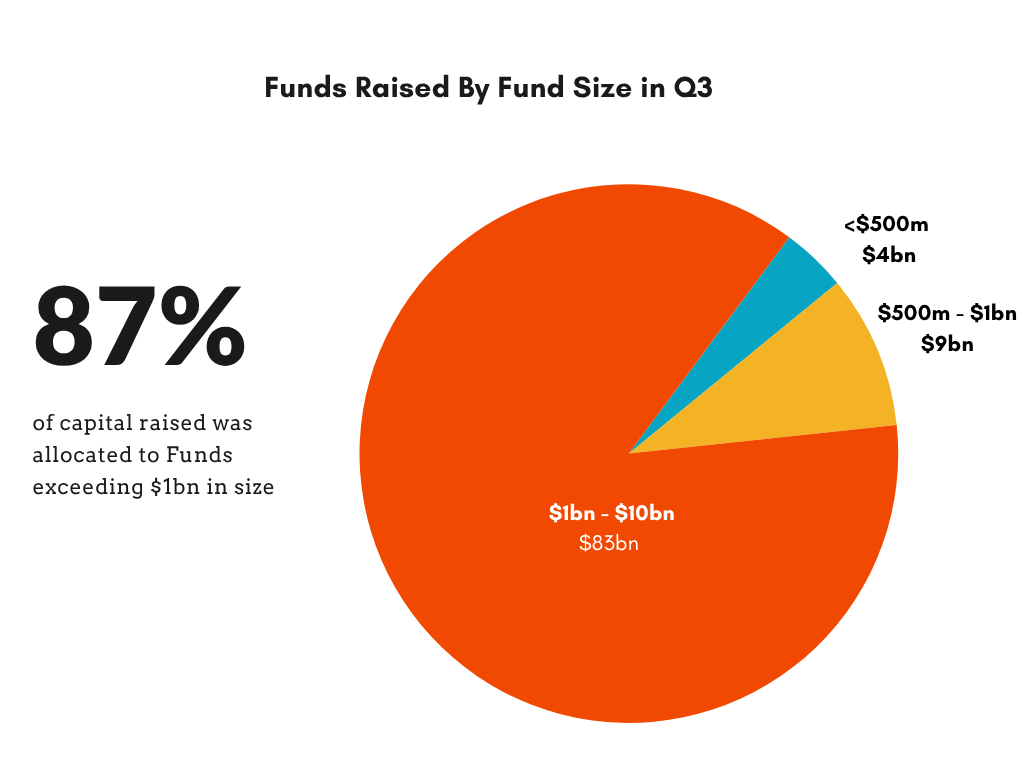

Large funds (>$1 billion) raised the bulk of capital.

For the first time in 12 quarters, no fund raised more than >$10 billion.

The average fund size also declined 20% YoY to $1.5 billion.

🏆 Nick’s Funds of the Quarter

Proof that private credit is more than senior and “special sits.”

🚜 Mad Capital’s $78.4 million Agriculture Fund

Mad Capital is a Colorado-based agriculture lender. The second fund will finance U.S. farmers to help them adopt regenerative organic practices while boosting long-term profitability.

💻 Claret Capital’s Second Close of its European Growth IV Fund.

I may be biased, but I’m incredibly proud of this one. We announced the second close of Claret Capital’s fourth fund. The close takes our AUM to over $1 billion, reinforcing our position as a leader within the European technology and life science growth lending.

🛫 Castlelake’s $1.8 billion aviation lending entity, Merit AirFinance.

Proof that Castlelake’s thesis for being acquired is panning out.

We feel like we are the dog who caught the bus, but the bus is moving at 40 miles an hour.

If we are going to ride this wave of quickly scaling, we needed to step into a different league.

We needed a partner who was going to open doors and provide multiple different types of capital.

Isaiah Toback, Partner, Deputy Co-Chief Investment Officer, Castlelake

This newsletter is for educational or entertainment purposes only. It should not be taken as investment advice.

I gotta check all your quarterly recaps going back. This is awesome!