The State of Private Credit in 2026

Credit Crunch's Q4 2025 Summary

👋 Hey, Nick here. A big welcome to the new subscribers at Munich RE, Everest and Octagon. This is the 147th edition of my weekly newsletter. Each week, I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here.

📊 2025 Fundraising Recap

With 2025 behind us, here are my top insights for the year so far. This recap isn’t exhaustive, but it’s enough to keep you ahead of 99% of your peers.

Key stats 📈

Number of fundraising announcements covered: 255 (Up 14% YoY)

Amount raised: $384 billion (Up 4% YoY)

Number of fund managers covered: 208 (Up 19% YoY)

Number of Countries where funds were based: 24 (Unchanged YoY)

Private Credit’s Mixed 2025 Fundraising

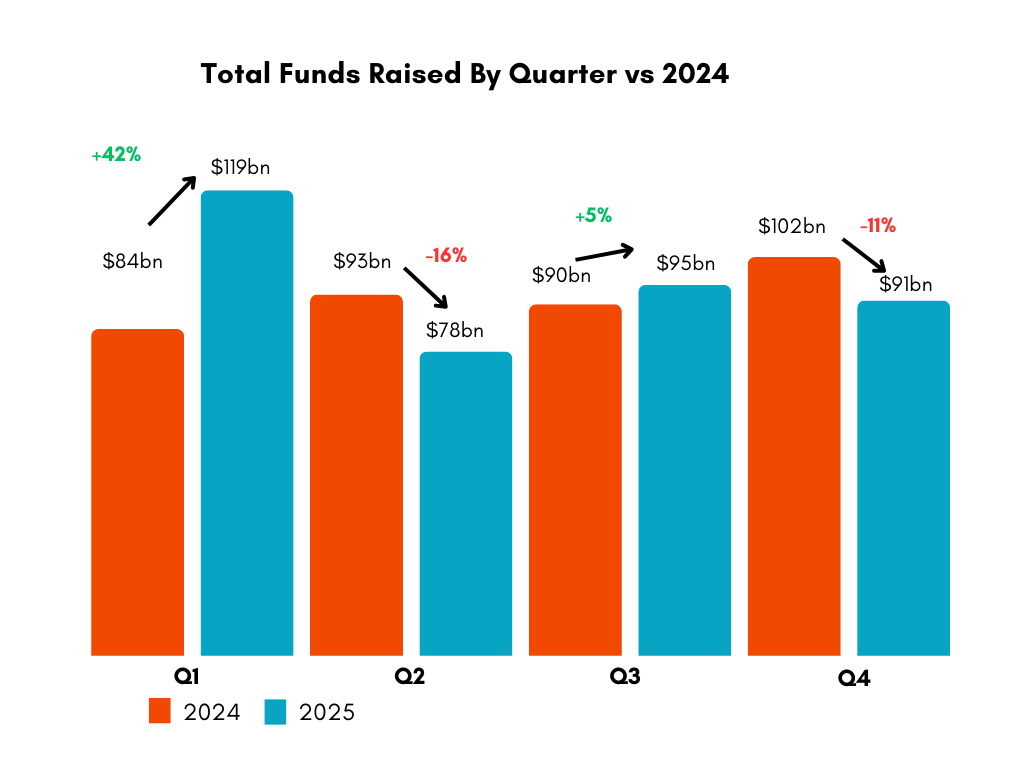

Private credit funds raised $384 billion in 2025, a slight increase compared to 2024.

Last year’s growth was largely driven by a strong Q1 with 33 funds raising more than $1 billion and two funds raising more than $15 billion (See below for the largest funds).

Q2 and Q4 were notably weak.

Europe is the Key to Growth 🌎

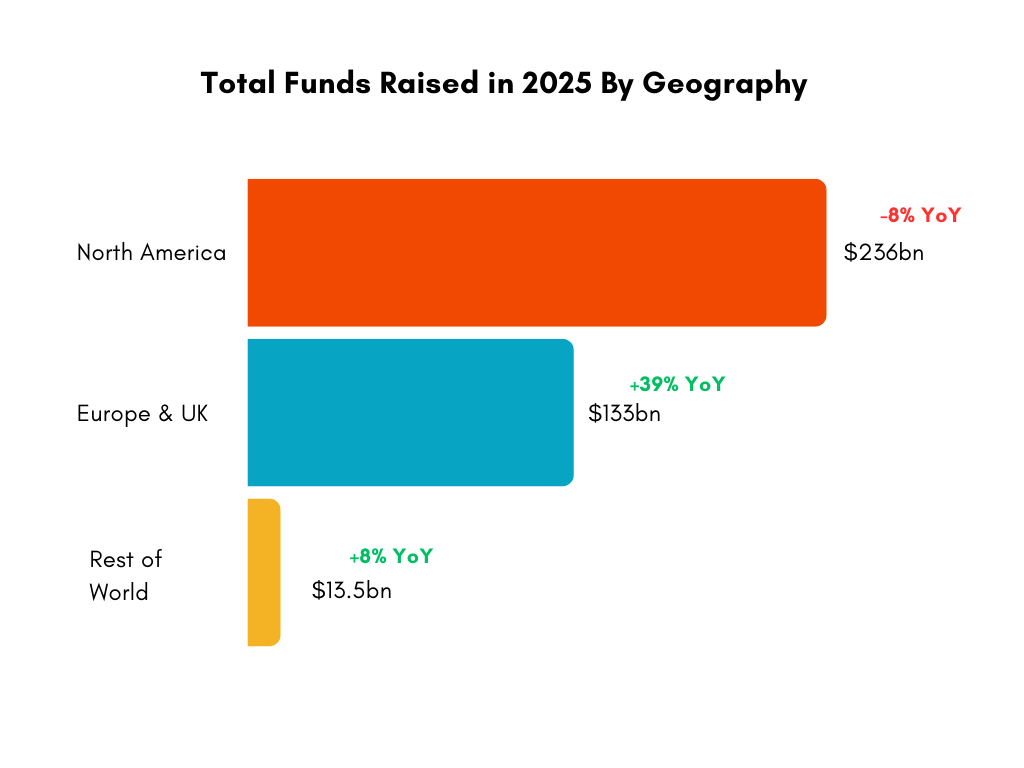

Fundraising in Europe and the UK was the standout for 2025, growing nearly 40% YoY.

The largest managers all got behind this trend:

🇺🇸 North American fundraising declined YoY. The decline was nearly entirely driven by the weak Direct Lending fundraising, which was less than half of 2024’s number.

See Marblegate’s Whitepaper on the US Middle Market (Link).

European funds continue to benefit from tailwinds, with the median fund nearly 2x the size compared to 2023.

See Brookfield’s and Apollo’s comments on Europe.

📕Nick’s Top Articles for Q4

Inside Q3 2025: What the Biggest Alternative Managers Are Talking About

3 Reasons Ares’ Latest In the Gaps Is Required Reading for Your Credit Team

A Shift at the Edges: Direct Lending + Opportunity Still Dominated

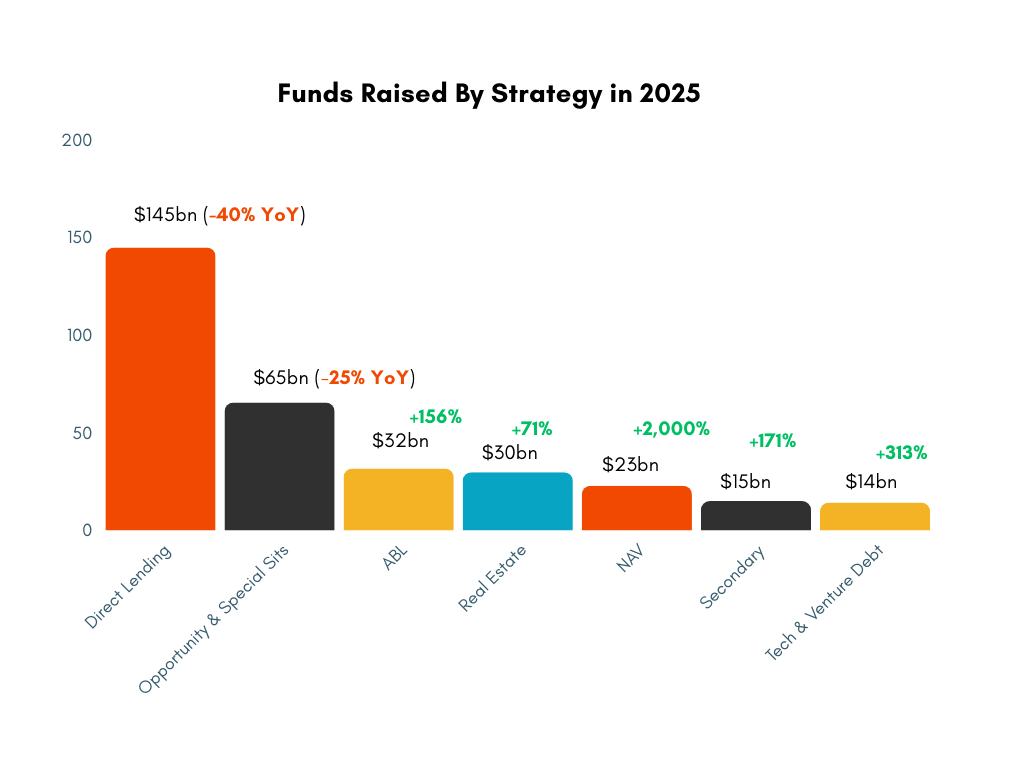

Direct Lending’s YoY fundraising decline is well-documented.

What was unexpected was the fall in fundraising from opportunity funds. This was predominantly driven by the fact that most of the large managers raised large opportunity funds in 2024. The number of opportunity funds raised in 2025 remained unchanged YoY, but these were on average 20% smaller.

The one outlier was Oaktree, which closed its $16 billion Opportunity Fund in February.

2025’s growth was driven by ABL, Real Estate, and NAV financing.

The number of ABL funds in the market grew 3x YoY.

Real estate’s comeback is expected to continue into 2026, with Blackstone’s Real Estate V being the notable outlier.

The Five Largest Funds Raised a Fifth of the Capital…

The $10B Club is Getting Smaller

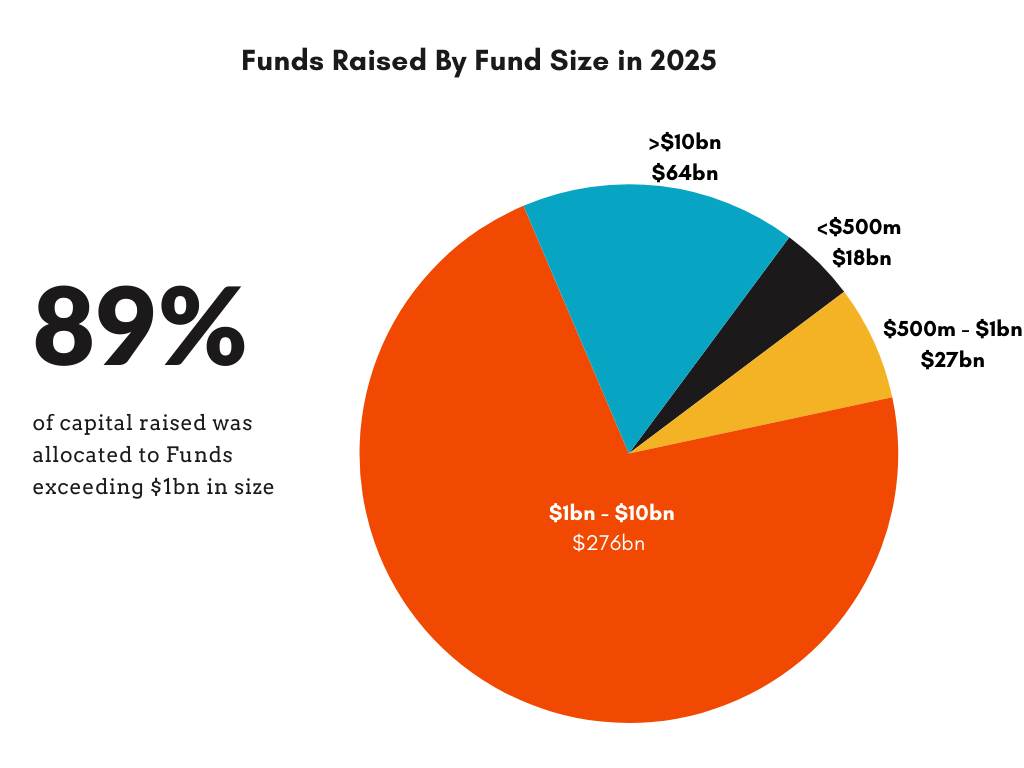

Large funds (>$1 billion) continue to raise the bulk of capital.

Only four funds raised more than $10 billion, half the number raised in 2024.

The average fund size also declined 25% YoY to $1.7 billion.

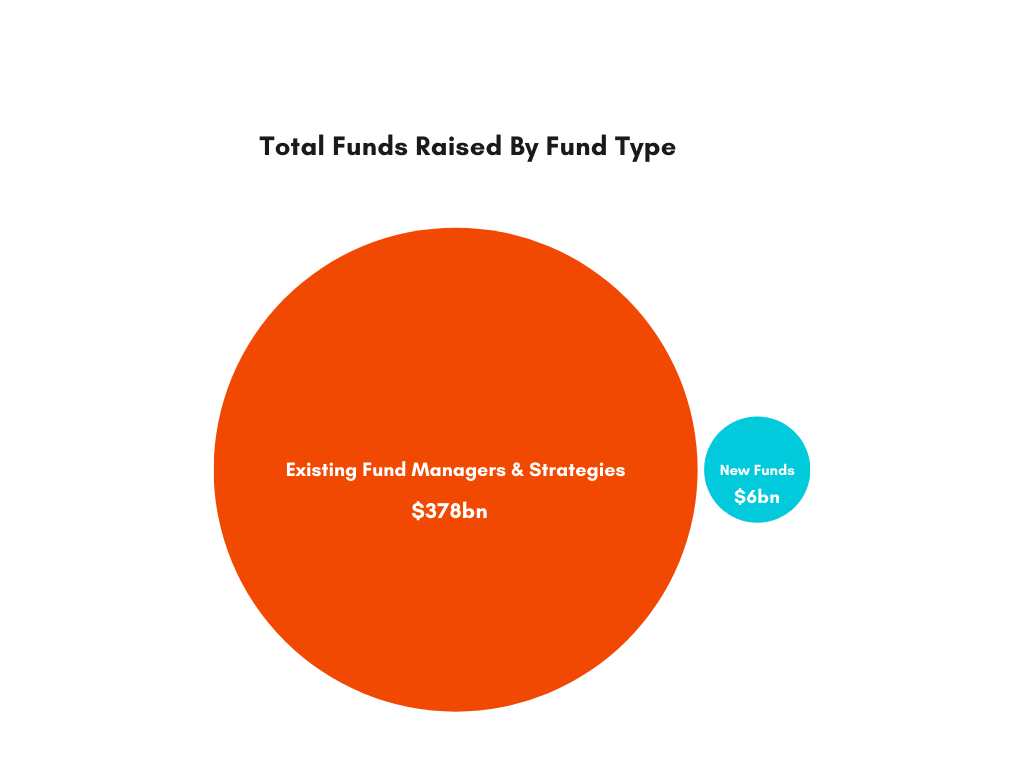

Fundraising Is Dominated by Established Managers

New managers accounted for less than 2% of all fundraising, the lowest on record.

This newsletter is for educational or entertainment purposes only. It should not be taken as investment advice.

Data confirms the trend toward concentration. The fact that new managers accounted for <2% of fundraising is a significant market structure signal. While this provides stability and scale for the incumbents, it also reduces system diversification and potentially innovation in underwriting. In credit, homogeneity in capital sources can sometimes amplify cyclical downturns, as everyone heads for the exit with the same playbook.